Get the free Chapter 13 Case Summary

Get, Create, Make and Sign chapter 13 case summary

Editing chapter 13 case summary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 13 case summary

How to fill out chapter 13 case summary

Who needs chapter 13 case summary?

Understanding the Chapter 13 Case Summary Form: A Comprehensive Guide

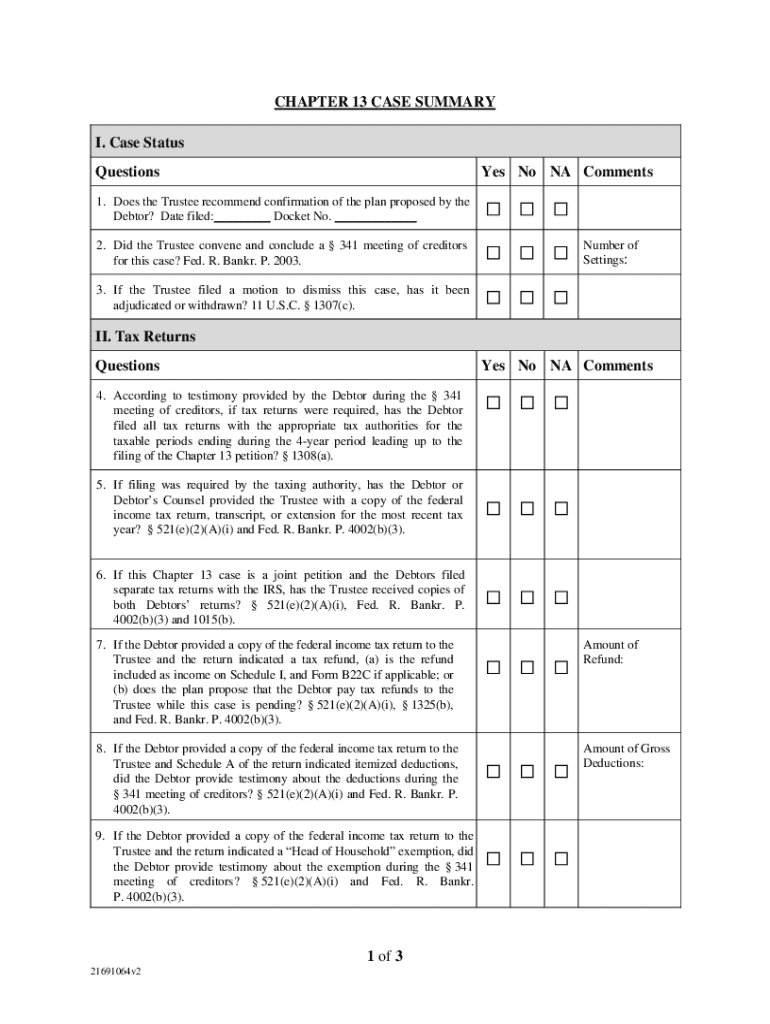

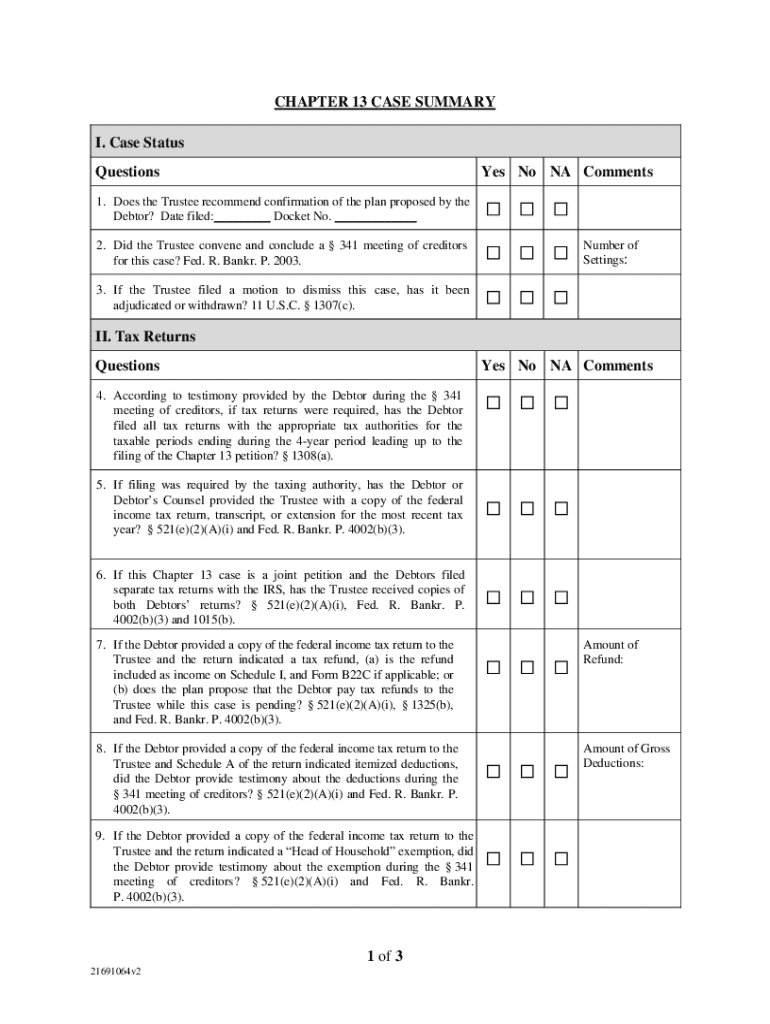

Overview of the Chapter 13 Case Summary Form

The Chapter 13 Case Summary Form is a critical document in the bankruptcy process, serving as a detailed summary of an individual's financial status and repayment plan. This form is specifically designed for individuals seeking relief under Chapter 13 of the Bankruptcy Code, allowing them to reorganize their debts and create a manageable payment plan over three to five years. The form plays an essential role in facilitating discussions with creditors and ensuring compliance with bankruptcy court requirements.

By meticulously detailing personal financial information, including income, expenses, and the amounts owed to creditors, the form establishes a clear plan for both the debtor and the bankruptcy court. Without this form, a debtor’s case might face unnecessary complications or delays, emphasizing its importance in the overall bankruptcy process.

Who needs the Chapter 13 Case Summary Form?

Individuals considering Chapter 13 bankruptcy form the primary demographic for the Chapter 13 Case Summary Form. Typically, these users are those facing insurmountable debts but retain a steady income and wish to avoid the liquidation of assets associated with Chapter 7 bankruptcy. Common scenarios where this form becomes essential include circumstances relating to mortgage arrears, medical bills, and unsecured debts.

Furthermore, legal and financial professionals also utilize the Chapter 13 Case Summary Form in their practices. Attorneys representing clients in bankruptcy court and financial advisors assisting individuals through the bankruptcy process rely on this form to ensure that all important financial details are comprehensively documented. The collaboration allows for a smoother navigation of the complexities involved in debt repayment strategies and creditor negotiations.

Key features of the Chapter 13 Case Summary Form

The Chapter 13 Case Summary Form boasts a variety of sections, each designed to capture critical information needed for effective case processing. The major sections typically include personal information about the debtor, detailed financial disclosures, and case specifics, such as payment plans and creditor information. Each segment is tailored to interact with other relevant bankruptcy forms, ensuring a holistic view of the debtor’s financial situation.

When completing the form, it is essential to avoid common mistakes, such as inaccurate calculations, missing signatures, or omitting important financial details. These errors can lead to complications in the bankruptcy process, making it paramount to review the form thoroughly before submission.

Step-by-step guide to filling out the Chapter 13 Case Summary Form

Before beginning to fill out the Chapter 13 Case Summary Form, preparation is key. Potential filers should gather necessary documents, including pay stubs, tax returns, and statements from creditors to have all pertinent information at hand. Understanding the basics of Chapter 13 bankruptcy and how it operates will also assist in accurately completing the form.

As you fill out each section, begin with the personal information, ensuring that all contact details are correct. Next, proceed to the financial information section, where you must disclose all sources of income and monthly expenses. Lastly, fill out the case details section, detailing your proposed payment plan. Highlighting this crucial information helps creditors and the bankruptcy court understand your repayment capabilities.

Utilizing tools like pdfFiller can also enhance accuracy. Features such as automatic error checking can validate information, prompting users to correct any inconsistencies before submission.

Editing and customizing the Chapter 13 Case Summary Form

Once the Chapter 13 Case Summary Form is completed, it might need adjustments. Utilizing pdfFiller’s editing tools allows users to customize sections of the form to suit their specific needs. This includes features for adding or removing sections, which can be particularly useful for cases where unique financial situations arise.

While making edits, it is crucial to ensure compliance with legal standards. This means that all essential details must remain intact and accurate. Suggestions for maintaining document integrity include regular reviews of the form, keeping abreast of any changes in bankruptcy laws, and ensuring all necessary fields are filled out before submission.

Signing the Chapter 13 Case Summary Form

Understanding eSignature requirements is vital in the bankruptcy filing process. Electronic signatures are legally valid and can expedite the filing of the Chapter 13 Case Summary Form. Best practices for electronic signing include ensuring that the platform used, like pdfFiller, complies with legal standards for eSignatures to avoid any issues related to validity.

Collaborating with legal counsel can also be beneficial during the signing process. pdfFiller facilitates effective sharing and collaboration, allowing debtors to work closely with their attorney to ensure that the form is completed accurately before submission. This cooperation can mitigate the risk of issues arising later in the bankruptcy process.

Managing your Chapter 13 Case Summary Form with pdfFiller

After submitting the Chapter 13 Case Summary Form, managing the document becomes essential. pdfFiller offers numerous storage and organization capabilities that allow users to access their forms from anywhere. Users can categorize their documents, making it easier to locate specific forms when needed.

Furthermore, tracking changes and maintaining a history of modifications can be invaluable for monitoring the progression of a bankruptcy case. pdfFiller’s version control features allow users to revert to previous versions if needed, ensuring that every detail of the Chapter 13 Case Summary Form is accounted for throughout the bankruptcy process.

Frequently asked questions about the Chapter 13 Case Summary Form

When navigating the complexities of the Chapter 13 Case Summary Form, many questions often arise. Common issues include understanding what constitutes adequate financial disclosure, clarifying the role of the trustee, and knowing what happens after submission to the bankruptcy court. Ensuring that all forms are filled out correctly before filing can prevent legal complications.

Additionally, there may be confusions regarding the timelines for case processing and the specific details that need to be shared. It’s imperative to address these concerns proactively, often with legal counsel, to clarify any misunderstandings and maintain a smooth filing process.

Real-life scenarios and use cases

Studying real-life scenarios can provide valuable insight into the Chapter 13 Case Summary Form's effectiveness. Successful filings often illustrate how accurately completed forms streamline the bankruptcy process, thus leading debtors to secure the relief they require. For instance, several case studies have shown that users who provided meticulous financial records in their forms had smoother interactions with bankruptcy courts and creditors.

Conversely, lessons learned from common challenges often highlight the importance of detail. Mistakes made in the Chapter 13 Case Summary Form, such as underestimating monthly payments or failing to include certain creditors, can lead to complications that may elongate the bankruptcy process or even result in dismissal of a case. Learning from these examples can help future filers navigate the process more effectively.

Advanced tips for navigating Chapter 13 bankruptcy

Consultation with experienced bankruptcy attorneys can provide invaluable insight during the Chapter 13 process. These professionals can offer guidance on the nuances of bankruptcy law, ensuring compliance and prudent financial management overlooked by those less experienced with the legal system. Specifically, knowing when to seek professional help can make a significant difference in the outcome of one's bankruptcy case.

Moreover, leveraging technology can yield efficiencies unmatched by traditional processes. pdfFiller's integration into the bankruptcy workflow allows users to create, edit, and submit forms seamlessly, saving time and reducing stress. Utilizing modern document management tools not only simplifies the filing process but also ensures that users remain organized and informed throughout their Chapter 13 journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the chapter 13 case summary in Chrome?

How do I fill out the chapter 13 case summary form on my smartphone?

How do I fill out chapter 13 case summary on an Android device?

What is chapter 13 case summary?

Who is required to file chapter 13 case summary?

How to fill out chapter 13 case summary?

What is the purpose of chapter 13 case summary?

What information must be reported on chapter 13 case summary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.