Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

Editing campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Understanding Campaign Finance Receipts and Form: A Comprehensive Guide

Understanding campaign finance receipts

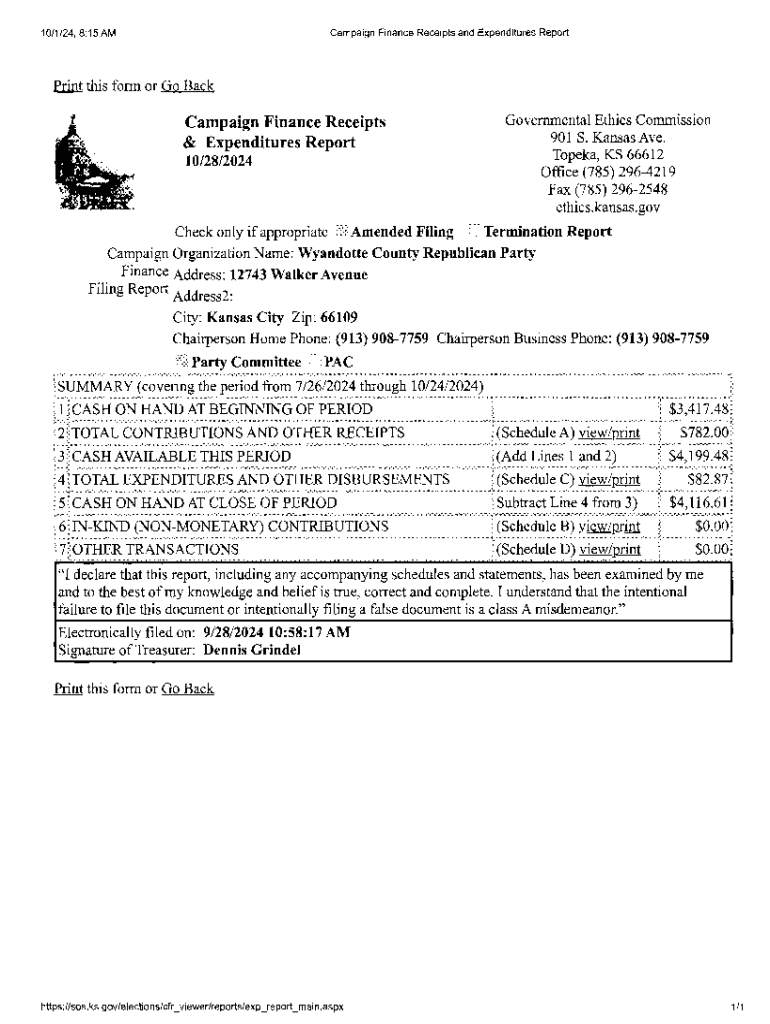

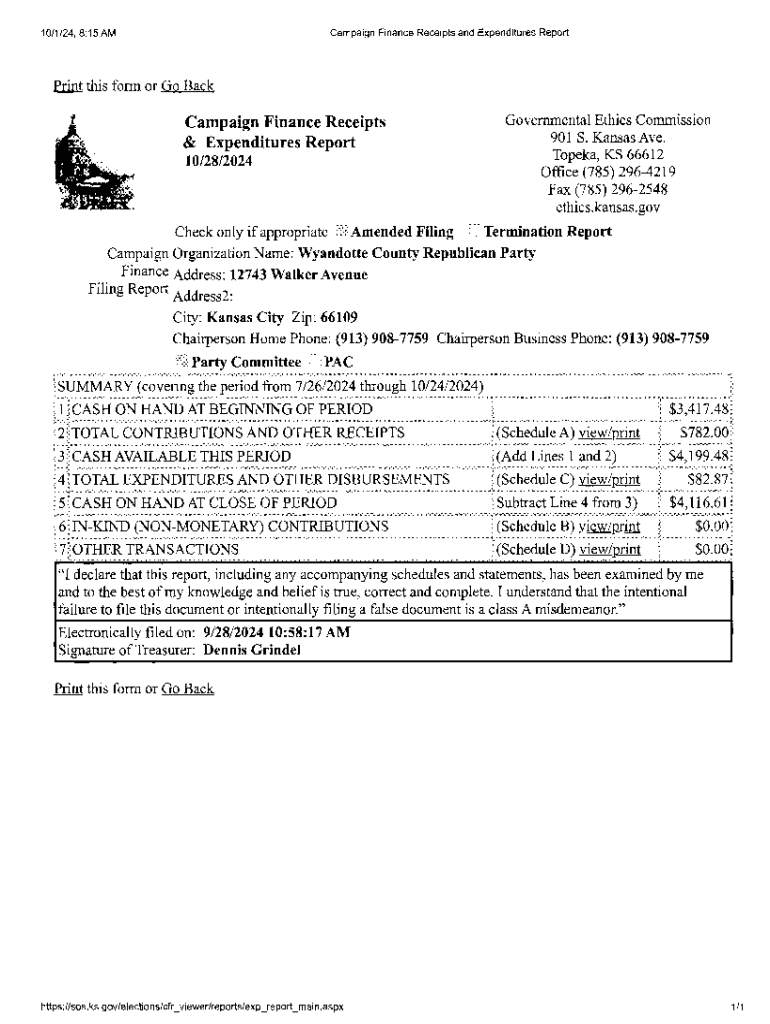

Campaign finance receipts play a fundamental role in the political landscape, reflecting transparency and accountability in political fundraising. A campaign finance receipt is a document that records the funds received by a political candidate, party, or committee. These receipts are crucial for ensuring that all financial contributions are documented in compliance with legal standards.

The importance of campaign finance receipts is underscored by various legal requirements. Most jurisdictions mandate that candidates report all receipts periodically, adhering to laws established by both federal and state regulations. For instance, in the United States, the Federal Election Commission (FEC) oversees the reporting of receipts for federal candidates, while state laws may impose additional obligations.

Transparency and accountability are critical components of campaign finance, fostering trust within the electorate. When voters can see where campaign funding comes from and how it is spent, they are more likely to trust and engage with the electoral process. This perception can significantly influence voter behavior and overall election outcomes.

Key components of a campaign finance receipt

To ensure clarity and compliance when filling out campaign finance receipts, certain essential information must be captured. Each receipt should effectively capture the date of the transaction, the total amount received, and the source of the funds. This information not only aids organizations in accounting but also serves legal and regulatory purposes.

Different types of receipts exist within campaign finance, each reflecting specific funding channels. These include contributions from individuals, which typically represent personal donations, and donations from organizations, including businesses or non-profits. Additionally, in-kind contributions, like the provision of services or goods rather than monetary donations, play a significant role and must be accurately recorded.

Having a comprehensive understanding of these components assures compliance with reporting regulations and helps campaigns maintain a reliable track of their funding.

Navigating the campaign finance form

Filling out the campaign finance form is a crucial task for any campaign team, comprising specific sections that must be completed accurately. Various forms exist by state and federal levels, with commonly used forms like the OCF Form 16a serving as templates for organizations to report their financial activities.

Typically, the campaign finance form divides into multiple sections, which include:

Careful attention to detail is required when filling out these forms. Common mistakes include omitting contributor details or misreporting amounts. By double-checking entries and using resources for verification, campaigns can avoid compliance issues that may arise from incorrect submissions.

Interactive tools for managing campaign finance receipts

Leveraging technology can significantly enhance the efficiency and accuracy of managing campaign finance receipts. pdfFiller offers advanced document creation features, allowing users to edit and customize finance forms effortlessly. With a library of templates, users can quickly adapt forms to meet their specific organizational needs.

The e-signature capabilities of pdfFiller ensure that forms are valid and compliant. Furthermore, pdfFiller's collaborative features enable team members to work together seamlessly. This includes:

Utilizing such tools not only improves accuracy but also streamlines the workflow for completing campaign finance receipts.

Best practices for managing campaign finance receipts

Organizing and storing campaign finance receipts is essential for effective management and compliance. Campaign teams should choose between digital and physical record-keeping methods, although digital solutions often provide advantages such as ease of access and enhanced security. Regardless of the method chosen, tracking dates and categorizing receipts is critical.

Monitoring and evaluating fundraising efforts also plays a pivotal role in campaign management. Establishing automated reporting alerts can help teams stay on top of their financial status. Additionally, utilizing analytics tools to gain insights into donor behavior and funding trends empowers campaigns to make informed decisions that align with their goals.

Common queries and troubleshooting tips

Understanding common issues related to campaign finance receipts is essential for smooth operation. For instance, what should a campaign do if a receipt is missing? Candidates must have protocols in place for such situations, which may include attempting to contact the donor for a reissuance.

Another frequent concern involves handling refunds and returns. Campaign teams should maintain clear records of such adjustments to avoid discrepancies in reports. Furthermore, navigating submission errors can be frustrating; to mitigate this, campaigns are encouraged to consult state or federal election offices when faced with technical issues.

Conclusion and next steps

Familiarizing yourself with the nuances of campaign finance receipts and forms is vital for ensuring compliance and operational efficiency. By harnessing pdfFiller, campaigns can optimize document creation, editing, and management to streamline their fundraising efforts.

The key points discussed in this guide should serve as a foundation for managing financial documentation effectively, aiding campaigns in their pursuit of transparency and accountability.

Legal advice and compliance

While this guide provides a comprehensive overview of campaign finance receipts and forms, it is crucial to seek professional guidance when necessary. Campaigns should consult legal or financial experts to navigate complex scenarios, especially when questioning compliance with local regulations and laws.

Understanding when to involve an attorney can make a difference in overcoming regulatory hurdles, ensuring that all financial activities align with the legal framework governing campaign funding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit campaign finance receipts and on a smartphone?

Can I edit campaign finance receipts and on an Android device?

How do I complete campaign finance receipts and on an Android device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.