Get the free Chapter 110 - TAXATIONCode of OrdinancesMustang, OK

Get, Create, Make and Sign chapter 110 - taxationcode

Editing chapter 110 - taxationcode online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 110 - taxationcode

How to fill out chapter 110 - taxationcode

Who needs chapter 110 - taxationcode?

Chapter 110 - Taxation Code Form: A Comprehensive How-to Guide

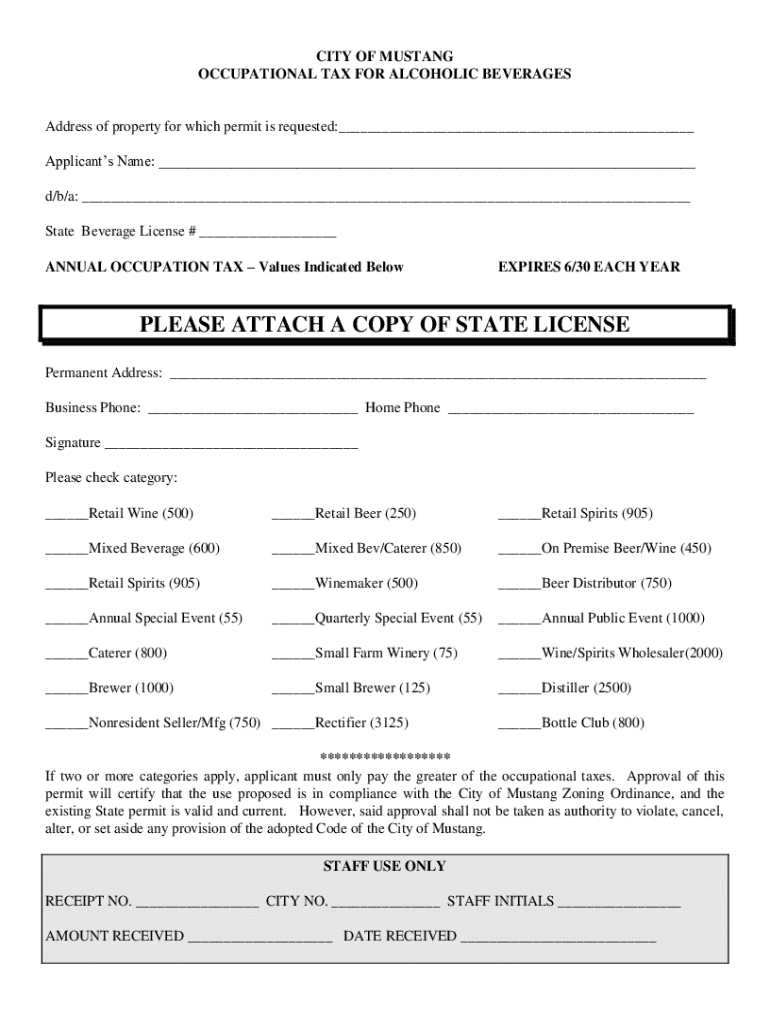

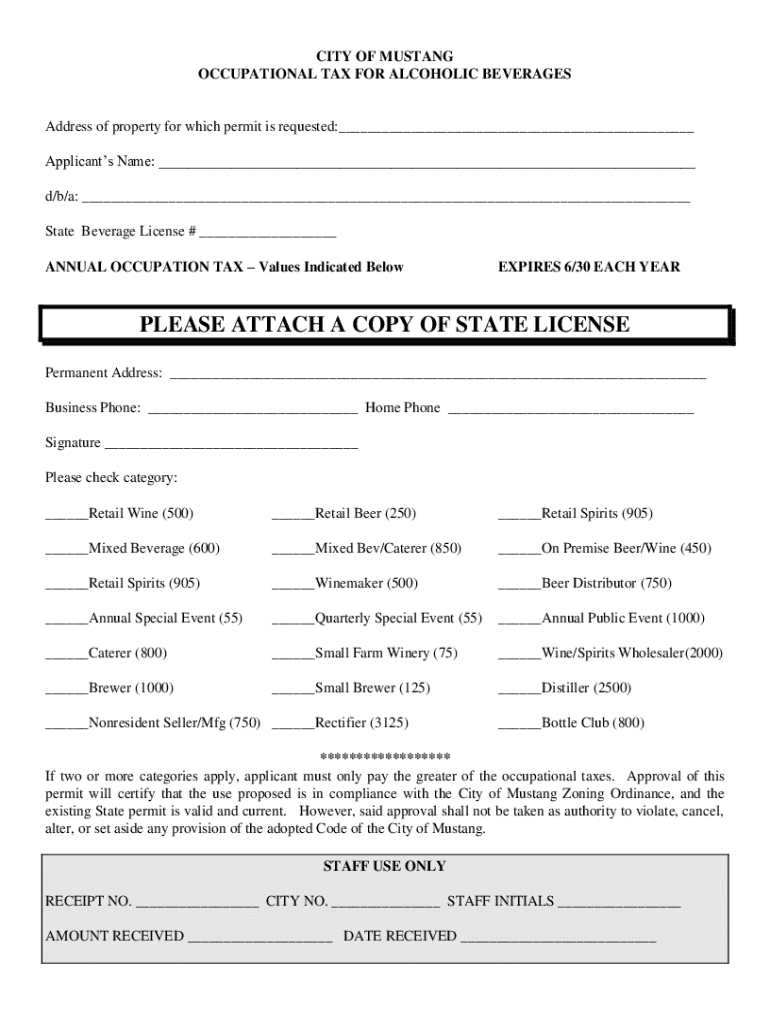

Overview of Chapter 110: Understanding the Taxation Code Form

Chapter 110 of the Taxation Code Form serves as a crucial document in managing your tax obligations. It is specifically designed to provide a detailed account of your taxable income, deductions, and tax owed. Completing this form correctly is paramount, as inaccuracies can lead to penalties or delays in processing your tax returns.

Accurate completion of Chapter 110 is not just a ritual; it has real implications. This form influences your financial standing, eligibility for tax credits, and fulfillment of state and federal tax responsibilities. Understanding key terminologies such as 'taxable income,' 'deductions,' and 'credits' is essential for effective filling.

Preparing to fill out Chapter 110

Before diving into the filling process of Chapter 110, gathering all necessary documents is vital. Typically, you will need W-2 forms from your employer, 1099 forms for miscellaneous income, and any relevant receipts for deductible expenses. Ensuring you have these documents on hand streamlines the preparation process and fosters accuracy.

Understanding both local and state tax regulations is equally important. Each jurisdiction may have unique requirements or nuances regarding tax filings. Inaccuracies can carry legal implications, such as fines and audits, making the careful interpretation of regulations imperative. Familiarize yourself with your local tax laws to avoid oversight.

Step-by-step guide to filling out Chapter 110

Filling out Chapter 110 requires careful attention to detail, with each section serving a unique purpose. Begin with your personal information, ensuring accuracy in name, address, and Social Security number. Mistakes in these fields can cause significant delays.

Next, report your income sources. Identify all streams of income, including wages, dividends, and interests. Make sure to include any income derived from self-employment, as these figures will affect your overall tax calculations.

Following income reporting, address any eligible deductions and credits. This section can significantly reduce your tax liability, so ensure you meet the eligibility criteria and document these deductions adequately. Finally, calculate your tax liability. Familiarize yourself with current tax rates, as they fluctuate annually. Mistakes in this section can lead to underpayment or overpayment of taxes.

The final step involves a thorough review of your completed form before submission. Check for any potential errors and ensure compliance with state-specific guidelines. Utilizing a tool like pdfFiller can aid in this process, providing an interactive platform for final checks.

Tools and resources for completing Chapter 110

pdfFiller offers various interactive tools that simplify the completion of Chapter 110. Users can utilize features for editing and customizing the form, ensuring everything is tailored to their specific financial situation. This includes convenient options for electronically signing the document, facilitating a smooth submission process.

Furthermore, accessing help and support is crucial. pdfFiller provides customer service options, tutorial videos, and community support forums. Engaging with these resources ensures you have the insights and assistance necessary to navigate potential challenges during the filling process.

Common questions and answers about Chapter 110

As users prepare to complete Chapter 110, frequently asked questions often arise. One of the most pressing inquiries is, ‘What do I do if I make a mistake?’ It’s essential to know that mistakes can be corrected by filing an amended return. This ensures that you stay compliant with tax regulations while rectifying errors.

Another common question is regarding the amendment of submissions. Should you realize an error post-filing, you can amend your return within a specific time frame. Processing times for such amendments can vary, so keeping tabs on your submissions is prudent to ensure a swift resolution.

Additional considerations and best practices

Organizing your records is one of the best practices you can adopt while navigating Chapter 110. Maintaining a well-structured document management system ensures that all supporting documentation is readily accessible at tax time. Consider incorporating pdfFiller for document storage, which offers a cloud-based solution for managing files securely.

Staying updated on taxation changes is equally critical. Consider subscribing to tax advisory services or joining forums that provide regular updates on new regulations. Utilizing current forms and understanding the latest provisions in tax law can prevent compliance issues and improve your tax filing experience.

Real-life scenarios and case studies

Engaging with the Chapter 110 filing process can be daunting without context. Reviewing real-life scenarios provides insight into typical filing situations. For instance, many individuals exhibit uncertainty when reporting freelance income due to varying 1099 forms. Being familiar with these forms and knowing how to categorize this income accurately is imperative.

Additionally, testimonials from pdfFiller users often reveal how the platform's features enhance ease of use. Many users highlight the convenience of editing options and the ability to engage with support services when necessary. Learning from others’ experiences can guide you towards making informed decisions during your own filing process.

Conclusion of Taxation Code Form Insights

In summary, navigating Chapter 110 - Taxation Code Form requires attention to detail, understanding of tax regulations, and effective organization of documentation. The insights gathered can significantly ease the filing process while ensuring compliance with local laws. Utilizing tools like pdfFiller can not only streamline your workflow but also enhance the accuracy and efficiency of your submissions.

Embrace these practices and tools to empower yourself in managing your tax obligations effortlessly. With conscientious preparation and the right resources, completing Chapter 110 can transform from a daunting task into a manageable and even rewarding experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit chapter 110 - taxationcode from Google Drive?

How do I make edits in chapter 110 - taxationcode without leaving Chrome?

Can I sign the chapter 110 - taxationcode electronically in Chrome?

What is chapter 110 - taxationcode?

Who is required to file chapter 110 - taxationcode?

How to fill out chapter 110 - taxationcode?

What is the purpose of chapter 110 - taxationcode?

What information must be reported on chapter 110 - taxationcode?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.