Get the free Ct-990t

Get, Create, Make and Sign ct-990t

How to edit ct-990t online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-990t

How to fill out ct-990t

Who needs ct-990t?

A comprehensive guide to the ct-990t form for tax-exempt organizations in Connecticut

Understanding the ct-990t Form

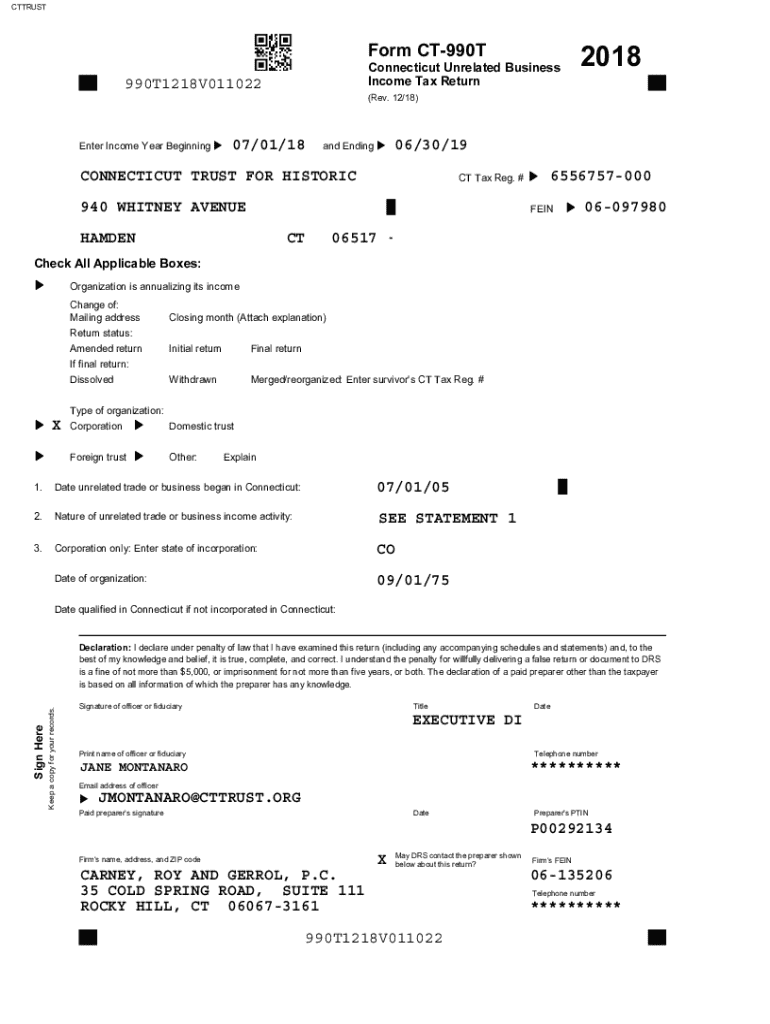

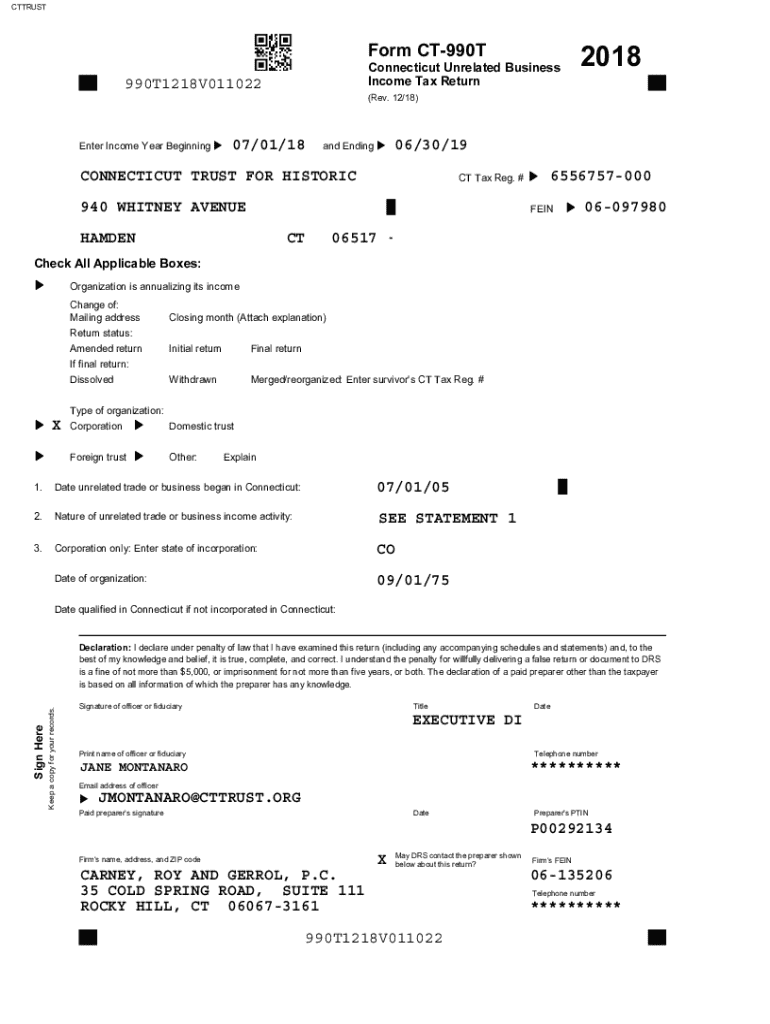

The ct-990t form is a vital document for tax-exempt organizations in Connecticut. This form serves as a means for these organizations to report unrelated business income to the state. The primary purpose of the ct-990t is to ensure that organizations, which normally enjoy tax-free status, remain compliant with state laws when engaging in activities that may generate taxable income.

The importance of the ct-990t form cannot be overstated. For tax-exempt organizations, failing to file this form or inaccurately reporting information could lead to financial penalties, loss of tax-exempt status, and negative repercussions for their operations. This makes an understanding of this form crucial for any organization that aims to maintain its tax-exempt status while engaging in other revenue-generating activities.

Who needs to file the ct-990t form?

The eligibility to file the ct-990t form primarily concerns organizations that are classified as tax-exempt under IRS regulations and engage in unrelated business activities. Common organizations required to file include charities, educational institutions, and religious entities that generate income from sources not directly related to their mission.

Preparing to complete the ct-990t form

Before embarking on completing the ct-990t form, it’s crucial to gather all necessary information and documents. This foundational step ensures you have all pertinent details at your fingertips, allowing for a smooth completion process. Key documents to prepare include your organization’s financial statements, the previous year’s tax returns, and any relevant information about unrelated business activities.

Understanding the overall structure of the ct-990t form is equally important. The form is typically divided into sections that require specific information about your organization’s financial activities. Familiarizing yourself with the terms and codes used throughout the document can significantly streamline the completion process, reducing the likelihood of errors.

Step-by-step instructions for filling out the ct-990t form

Filling out the ct-990t form can be broken down into a few clear sections, each requiring specific information.

Section 1: Basic information

The first section asks for your organization’s identification details. It's essential to provide accurate information such as the organization’s legal name, address, and Employer Identification Number (EIN). Double-checking these details can prevent processing issues.

Section 2: Financial information

Next, you’ll need to report your organization’s income and expenditures. This includes detailing any unrelated business income. Remember, accurately reflecting unrelated business activities is crucial because these revenues may be subject to state income tax.

Section 3: Additional schedules

Depending on your organization’s activities, you may need to attach additional schedules to provide further details. Common schedules required often depend on the type of unrelated business activities engaged in.

Common mistakes to avoid

Filing the ct-990t form can seem straightforward, but common pitfalls can lead to significant issues. One prevalent mistake is misreporting unrelated business income. It's vital to have explicit documentation supporting income claims to avoid disputes. Additionally, late submissions are another frequent error. Missing deadlines can lead to penalties or even complications with your tax-exempt status.

Editing and collaborating on the ct-990t form

Using pdfFiller can be a game-changer when it comes to preparing your ct-990t form. The platform offers a myriad of editing tools that allow for easy adjustments and reviews. The real-time collaboration features enable teams to work on the document simultaneously, boosting efficiency.

Signing the ct-990t form

When you’re ready to submit your ct-990t form, consider utilizing electronic signatures. This method not only speeds up the process but also has legal standing. pdfFiller makes it easy to sign electronically, ensuring your document is both legally binding and complies with state regulations.

Submitting the ct-990t form

The next step is submission. Organizations have the option to submit the ct-990t form online through the Connecticut Department of Revenue Services or via traditional mail. Each method has its specific guidelines that need to be followed carefully to ensure successful processing.

Frequently asked questions about the ct-990t form

Many organizations have questions after submitting the ct-990t form. If you find yourself denied tax-exempt status, timely communication with the Department is crucial to understand your standing. On the other hand, if mistakes occur post-submission, amendments may be necessary. Knowing how to correct errors is a key part of the filing process.

Resources for further assistance

Connecting with the Connecticut Department of Revenue Services can provide additional guidance for navigating the complexities of the ct-990t form. Moreover, professional services may offer tailored support, ensuring compliance and accuracy in filing.

Additional tools and resources

pdfFiller offers various interactive tools, including templates tailored for nonprofit organizations. These resources act as an excellent starting point, simplifying the process of generating accurate documentation. Furthermore, educational materials like webinars and workshops provided through pdfFiller can enhance your understanding of tax compliance specifically for nonprofits.

Educational resources for nonprofits

Engagement in community forums or support groups can also foster learning and sharing of experiences among organizations tackling similar issues. The collaborative spirit can provide insights into best practices and innovative ways to ensure compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct-990t online?

Can I sign the ct-990t electronically in Chrome?

How do I edit ct-990t on an iOS device?

What is ct-990t?

Who is required to file ct-990t?

How to fill out ct-990t?

What is the purpose of ct-990t?

What information must be reported on ct-990t?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.