Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

A Comprehensive Guide to Credit Application Forms

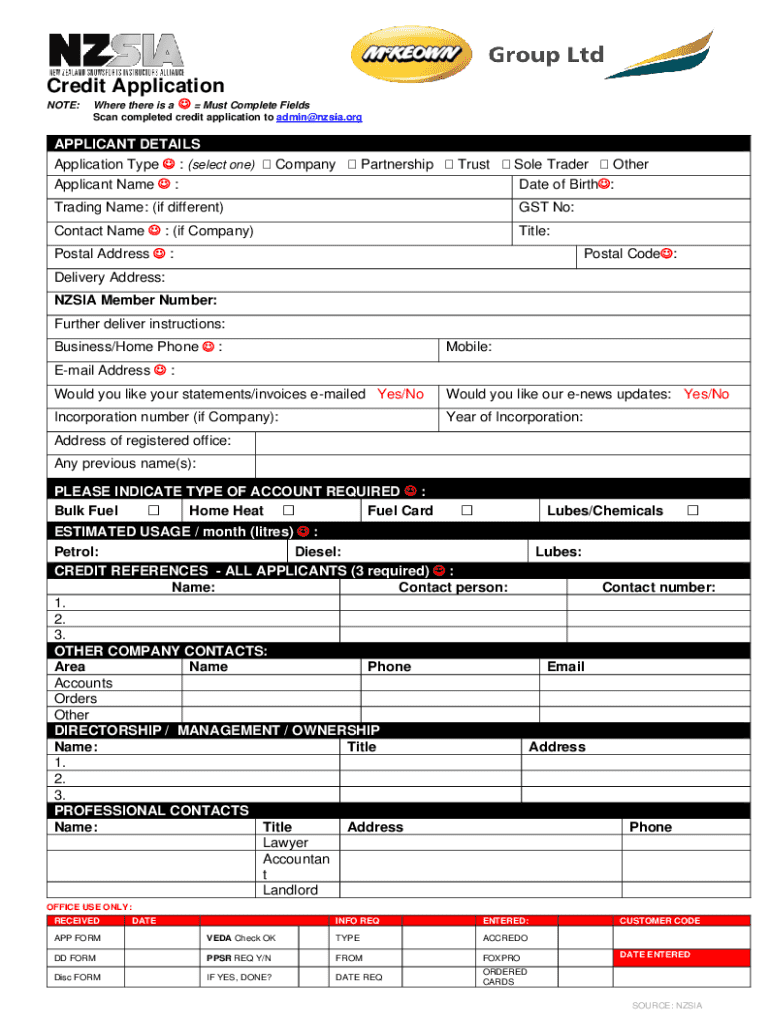

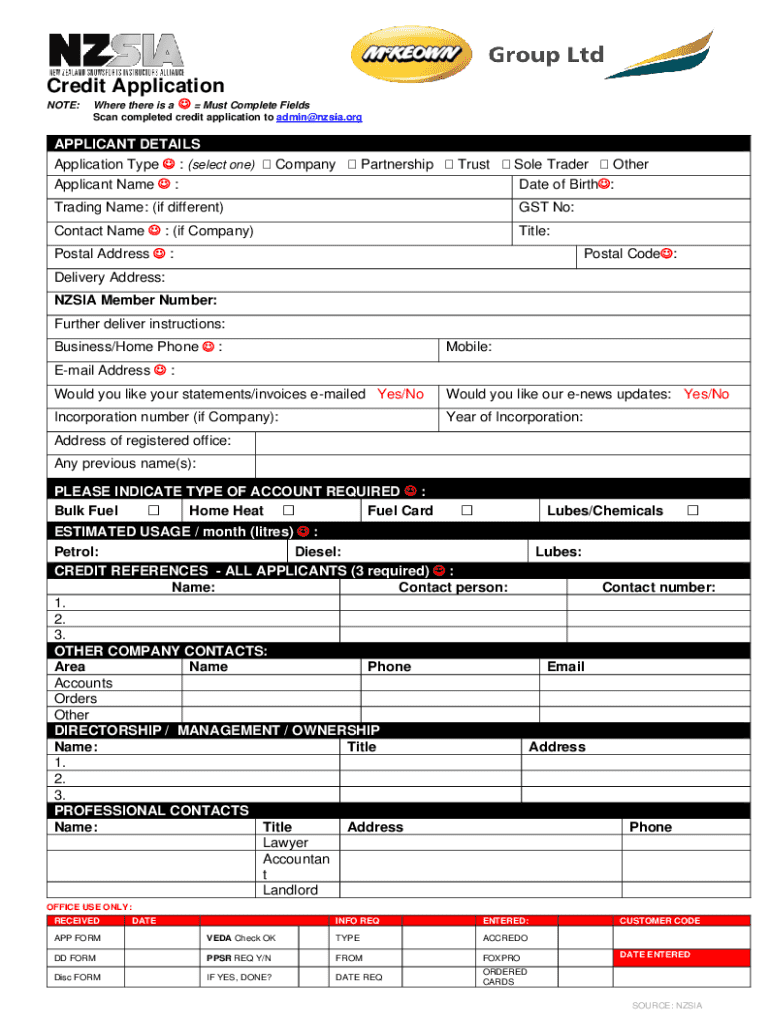

Understanding the credit application form

A credit application form is a crucial document that individuals and businesses complete when seeking credit from lenders, banks, or financial institutions. The primary purpose of this form is to provide the lender with essential information to evaluate the applicant's creditworthiness and financial stability. By thoroughly filling out the credit application form, applicants can facilitate a smoother approval process.

Completing a comprehensive credit application form is vital for several reasons. First, it helps establish transparency between the lender and the borrower, promoting trust and accountability. Second, a well-prepared application can significantly improve the chances of approval, as lenders require detailed insights into the applicant's financial background to make informed decisions.

Key components of a credit application form

A credit application form typically comprises several key components that provide lenders with a complete picture of the applicant's financial standing. The first section involves personal information, including the applicant's name, address, and contact information, which establishes the identity of the applicant.

Additionally, providing a Social Security Number (SSN) is essential. This number allows lenders to perform background checks and review credit history. The employment and income verification section highlights the applicant's work history, including their current job, length of employment, and any other sources of income, such as bonuses or part-time work.

Types of credit application forms

Credit application forms come in various types, each tailored for specific purposes. Business credit application forms are utilized by companies seeking funding to manage cash flow, purchase inventory, or invest in growth opportunities. These forms often require detailed financial records and projections to assess the business's viability.

Consumer credit application forms, on the other hand, are designed for individual borrowers looking to secure personal loans, credit cards, or mortgages. Additionally, some financial products have specialized credit application forms, such as those for auto loans or home equity lines of credit, which may require further documentation and specific declarations.

Step-by-step guide to filling out a credit application form

Filling out a credit application form may seem daunting, but following a structured approach can simplify the process. Begin by gathering all necessary documents, including proof of identity, employment verification, and financial statements. This preparation ensures that you have all the information readily available, minimizing errors and omissions.

When filling out the personal information section, be precise with your details, ensuring accuracy in your name, address, and contact information. Follow this with an accurate depiction of your employment history, detailing your job title, employer's name, and duration of employment. Your income details should include gross salary, bonuses, and any additional income sources. Disclose all financial obligations, such as outstanding debts and monthly expenses, to provide a realistic view of your financial landscape.

Common mistakes to avoid

Completing a credit application form is a critical step, and several common mistakes can compromise your approval chances. One prevalent issue is submitting incomplete information. Lenders need detailed insights to evaluate your application, and missing key details can lead to delays or outright denials.

Another significant error is misrepresenting financial data. It may be tempting to inflate income figures or downplay debts, but lenders can verify your financial history. Transparency and honesty are crucial. Additionally, applicants often overlook the importance of reading the terms and conditions associated with the application, leading to unexpected consequences in the future.

Tips for a successful credit application

To enhance your chances of approval for credit applications, present accurate financial data. Lenders appreciate honesty; thus, ensure your application reflects your true financial standing. Include clear contact information to avoid misunderstandings, and make it easy for the lender to reach you with questions.

Highlighting a positive credit history is another actionable tip. Provide documentation or references that showcase your responsible credit management, such as on-time payments and low debt-to-income ratios. This approach can help differentiate your application from others.

The credit application review process

Once you submit your credit application form, it undergoes a review process where lenders assess the information provided. Typically, you can expect either a decision or a request for more information within a few days to a few weeks, depending on the lender and the type of credit being sought.

However, there are several reasons why applications may be denied. Common factors include poor credit history, high debt-to-income ratio, or discrepancies within the application. Understanding these factors can prepare you for possible outcomes and help you improve your application in the future.

Tools for managing and tracking your credit application

Utilizing tools to manage your credit application process can streamline your experience significantly. pdfFiller offers an intuitive platform to fill out and store credit application forms securely. Using this tool, individuals and teams can edit PDFs, eSign documents, and manage files effectively.

Moreover, pdfFiller’s features allow for collaboration, enabling multiple team members to work on a single application form in real time. This function facilitates proper communication and ensures all relevant information is included, reducing the risk of errors.

FAQs about credit application forms

When considering a credit application, applicants often have many questions. One common query is about the duration of processing time. Most credit applications are processed within a few business days; however, complex applications may take longer. If your application is denied, it's crucial to understand why and assess whether waiting or applying again would be more beneficial in the long run.

Another important concern is the safety and security of online credit applications. Most reputable financial institutions utilize encryption and secure networks to protect personal information, but it’s always wise to verify the platform's security measures before submitting sensitive data.

Best practices for organizing and storing your credit applications

Proper organization and storage of your credit application forms can save time and reduce stress. Digitally archiving your forms allows for easy access, and you can use pdfFiller's features to maintain organized and up-to-date documents. Creating a secure filing system—whether digital or physical—ensures that sensitive information is protected while remaining easy to retrieve when needed.

Regularly updating financial documents, such as income statements and assets lists, ensures that your applications remain accurate and relevant. Keeping a tidy record of applications submitted, including dates and outcomes, can also provide valuable insights for future credit endeavors.

Resources for further assistance

For those looking to deepen their understanding of credit management, there are numerous educational materials available online. Accessing guides and articles related to credit and finance can equip you with knowledge to make informed decisions. Additionally, consulting financial experts can provide personalized guidance tailored to your situation.

Utilizing tools like pdfFiller can enhance your document management experience, offering interactive tools to assist you with your credit applications. By leveraging these resources, borrowers can navigate the credit landscape with greater confidence.

Related articles and tools

Understanding the broader financial landscape is essential for solid credit management. Articles exploring different types of financing available can provide insights into making informed decisions about borrowing. Additionally, gaining a comprehensive understanding of credit scores and their impact on loan approvals is vital in today’s financial environment.

Furthermore, strategies on improving your chances of approval in future applications can set you on the right path for financial success. By proactively managing your credit and applying for loans wisely, you set the stage for favorable credit opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application in Gmail?

Where do I find credit application?

How do I make changes in credit application?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.