Get the free Crs Self Certification Form

Get, Create, Make and Sign crs self certification form

Editing crs self certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self certification form

How to fill out crs self certification form

Who needs crs self certification form?

CRS Self Certification Form – A Comprehensive How-To Guide

Understanding the CRS Self Certification Form

The CRS Self Certification Form is a critical document utilized in the Common Reporting Standard (CRS) framework established by the Organisation for Economic Co-operation and Development (OECD). Its primary purpose is to help financial institutions gather information about their account holders' tax residency. This form is crucial for ensuring compliance with international tax regulations, allowing countries to automatically exchange tax information.

Self certification holds significant importance in compliance practices, especially in the context of combating tax evasion. By requiring individuals to certify their tax residency status, governments can ensure that their citizens are reporting income accurately across borders. Certain situations may necessitate the completion of this form, including opening a new bank account, investment account, or any financial product that involves cross-border transactions.

Key components of the CRS Self Certification Form

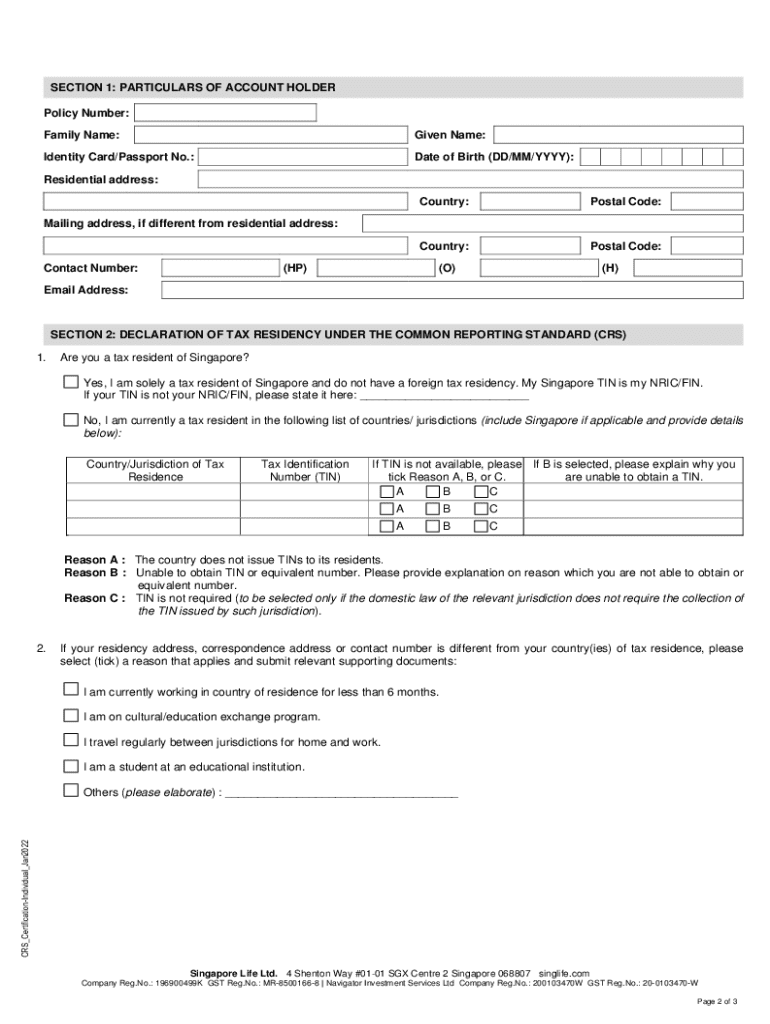

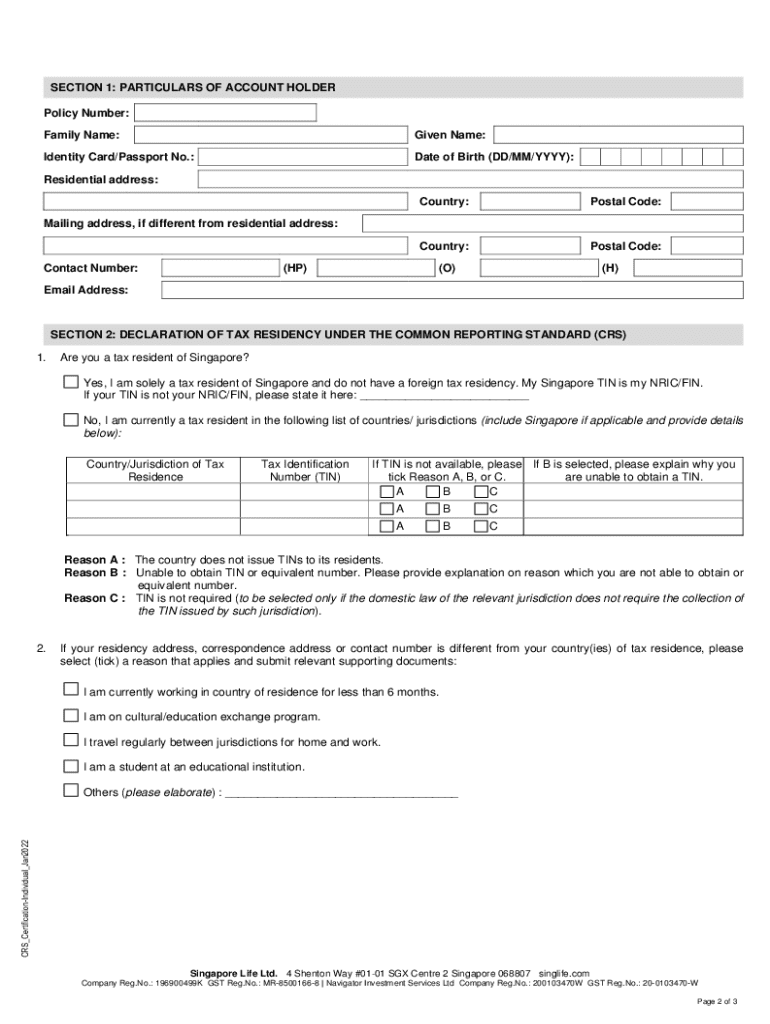

The CRS Self Certification Form consists of several key components that individuals must understand when filling it out. First and foremost are the personal information requirements. These typically include the individual's full name, residential address, date of birth, and tax identification number. Collecting accurate data is essential for the form’s validity and helps financial institutions meet their compliance obligations.

Another crucial component is the declaration sections, which focus on tax residency declaration. Individuals need to provide details about their tax residency status, which may involve indicating whether they are residents of one or more jurisdictions. Moreover, supporting documentation may be requested for verification purposes; individuals should prepare documents such as tax returns or proof of residence as needed.

Step-by-step instructions on filling out the CRS Self Certification Form

Filling out the CRS Self Certification Form can seem daunting, but breaking it down into simple steps makes the process manageable. The first step is gathering the necessary personal information and supporting documents. Having these ready will streamline the process and enhance accuracy.

Step two involves completing the form fields. Focus on filling out each section methodically, ensuring details are accurate and consistent. In step three, review the information to spot any common mistakes, such as typos or missing information — double-checking can save time in the submission process. Finally, sign and date the form; accurate signatures are vital as they confirm the authenticity of the information provided.

Editing and customizing the CRS Self Certification Form

Once the form is filled out, reviewing it for accuracy is crucial. Utilizing tools like pdfFiller allows users to edit the CRS Self Certification Form seamlessly. The editing tools include options for adding text, marking sections, or even signing electronically. To make changes, simply upload the PDF into the editing platform and follow the prompts to customize as needed.

Best practices for ensuring form accuracy involve validating all information before submission. It’s essential to cross-reference the details provided with supporting documents to confirm consistency. This precaution dramatically reduces the likelihood of rejections or requests for additional information from financial institutions.

Submitting the CRS Self Certification Form

Once completed, the CRS Self Certification Form needs to be submitted. There are various submission methods available. Individuals can send the form via email or physical mail, depending on the requirements of the financial institution. It is vital to check specific submission instructions provided, as they can vary.

Timing is also important; understanding submission deadlines is essential to ensure compliance. Generally, institutions set deadlines aligned with specific reporting periods. For processing, the completed form should be sent to the designated department within the institution, which may be the compliance or account services team.

Tracking your CRS Self Certification Form submission

After submission, tracking the CRS Self Certification Form is vital to confirm that it has been received and processed. Utilizing tracking features through platforms like pdfFiller allows users to monitor their submissions easily. This capability adds reassurance and helps identify any issues after submission.

In cases where confirmation is not received, it’s prudent to proactively follow up with the institution. This ensures that the form is not lost in transit and confirms the institution has all needed information on hand.

Frequently asked questions (FAQs) about the CRS Self Certification Form

As with many compliance-related documents, questions are common. Some frequently asked questions include clarifications regarding tax residency status: What determines tax residency? How does income from foreign investments affect certification? Addressing such queries not only aids individuals in completing their forms accurately but also empowers them with knowledge about their tax obligations.

Additionally, concerns may arise regarding form updates or changes in regulations. Staying informed through financial institutions or tax professionals is advisable, ensuring that individuals always use the most compliant and current versions of the CRS Self Certification Form.

Troubleshooting common issues with the CRS Self Certification Form

Despite careful completion, issues can occur with any form submission. Common problems include rejections due to incorrect data or incomplete forms. In such cases, individuals should review the feedback received, address specific questions or highlighted errors, and promptly resubmit. This can reduce frustration and speed up the resolution process.

Another challenge may involve requests for additional information. To address this efficiently, maintain organized records of submitted documents and be prepared to provide supplementary proof of residency or income sources that support the original submission.

Advantages of using pdfFiller for your CRS Self Certification Form

pdfFiller offers numerous advantages for users preparing the CRS Self Certification Form. One significant benefit is the cloud-based document management system, which allows for seamless access from any device, eliminating the need for physical documents and the hassles of traditional paperwork.

Additionally, collaboration features enable real-time team efforts, making it easier for groups to manage forms and documents together. The platform also prioritizes security, ensuring that sensitive information is fully protected through eSignatures and robust document security features, giving users peace of mind while submitting their forms.

Conclusion: Mastering the CRS Self Certification process

Mastering the CRS Self Certification Form involves understanding its purpose and accurately completing the requirements set forth by financial institutions. By effectively utilizing platforms like pdfFiller, individuals and teams can streamline their document management, ensuring compliance with tax regulations without added stress.

Recapping key takeaways, be diligent in providing accurate information, utilize editing and submission tools effectively, track your submissions, and be responsive to any follow-up requests. Through these practices, individuals can navigate the CRS Self Certification process with confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my crs self certification form directly from Gmail?

How can I send crs self certification form to be eSigned by others?

How can I get crs self certification form?

What is crs self certification form?

Who is required to file crs self certification form?

How to fill out crs self certification form?

What is the purpose of crs self certification form?

What information must be reported on crs self certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.