Get the free Crs Self Certification Form

Get, Create, Make and Sign crs self certification form

Editing crs self certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self certification form

How to fill out crs self certification form

Who needs crs self certification form?

Understanding the CRS Self Certification Form: Your Complete Guide

Understanding the CRS Self Certification Form

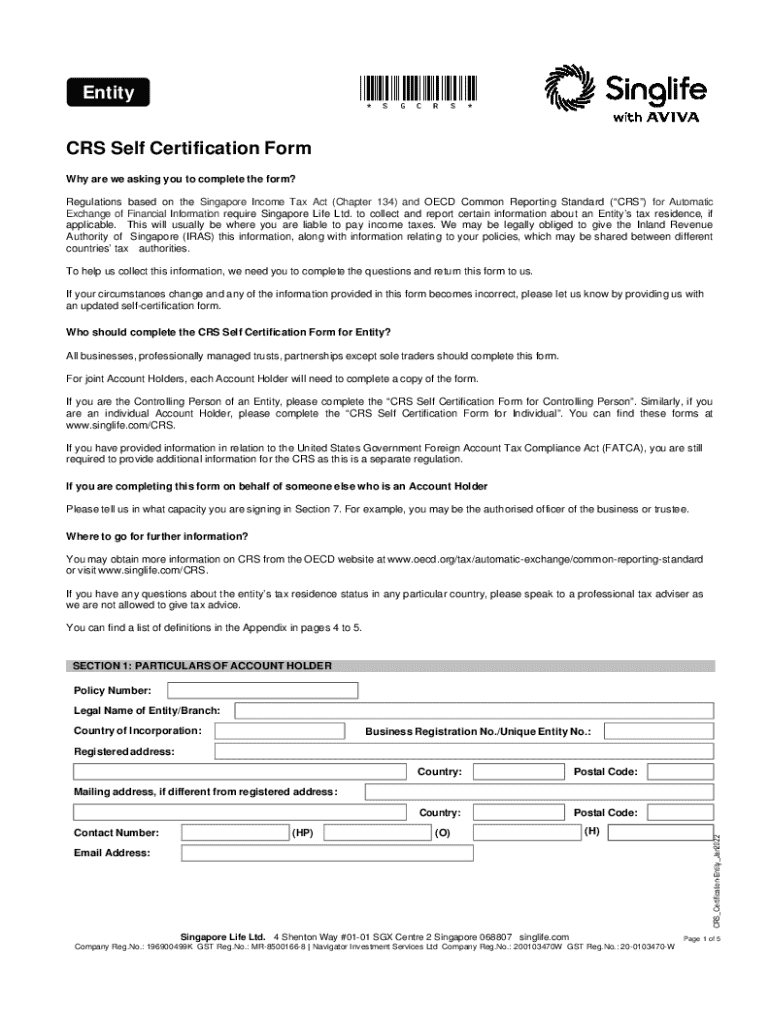

The CRS Self Certification Form is a pivotal document for individuals and entities as it ensures compliance with the Common Reporting Standards (CRS) set forth by the OECD. This standard aims to combat tax evasion and subsequent loss of revenue for governments across the globe by facilitating the exchange of financial account information between jurisdictions.

The CRS mandates that financial institutions collect information about the tax residency of their clients via the CRS Self Certification Form. The completion of this form signifies a self-disclosure of tax information, which plays a crucial role in the international effort to promote tax compliance and transparency.

Why is the CRS Self Certification Form important?

Completing the CRS Self Certification Form is not just a matter of compliance; it holds significant implications for both individuals and organizations. For individuals, failing to provide accurate information could lead to potential penalties and a higher likelihood of scrutiny by tax authorities. Organizations risk facing sanctions and damage to their reputations if they mishandle the collection and reporting of their clients' information.

Key components of the CRS Self Certification Form

The CRS Self Certification Form is composed of several key components that collect essential information about the taxpayer. Primarily, this form requires personal identification details, including your full name, date of birth, and address. It's vital to provide accurate and up-to-date information as discrepancies could affect the validity of the form.

In addition to personal identification, individuals must disclose their tax residency status. This involves identifying whether they are a tax resident of any country and if applicable, reporting additional countries where they may be liable for taxes.

Types of entities that require CRS Self Certification

Both individuals and organizations are required to fill out the CRS Self Certification Form. For individuals, the responsibility lies solely with the taxpayer to disclose their residency status. On the other hand, businesses and organizations must collect CRS Self Certifications from their account holders as part of their compliance obligations.

Filling out the CRS Self Certification Form

Completing the CRS Self Certification Form correctly is crucial for compliance. Start by gathering all necessary documentation that verifies your identity and tax residency status. Section by section, you'll need to provide details such as your name, residential address, and the country in which you are deemed a tax resident.

Common mistakes to avoid when filling out the form

Filling out the CRS Self Certification Form can seem straightforward, but there are common pitfalls that many individuals encounter. One frequent error is providing outdated or incorrect personal information. Ensure to double-check for any discrepancies in your name or address.

Another mistake is failing to identify all applicable tax jurisdiction. If you have dual residency or have been a resident in multiple countries, make sure to outline all relevant jurisdictions. Lastly, neglecting to sign the document can render it invalid, so don’t overlook this critical step.

Digital tools for efficient form management

In the age of digitalization, managing forms like the CRS Self Certification has become significantly more manageable with tools like pdfFiller. This platform allows users to edit PDFs directly in the cloud, providing a seamless experience for filling in details and correcting errors.

One of the standout features of pdfFiller is its eSigning capability. You can easily sign the CRS Self Certification Form electronically, promoting a faster and more efficient submission process. Furthermore, collaborative features enable teams to share and work on documents together, ensuring all necessary minds contribute to compliance efforts.

Frequently asked questions about the CRS Self Certification Form

The CRS Self Certification Form often raises many questions among users. One of the most common inquiries is regarding who needs to submit it. Essentially, anyone with a tax residency outside their country of financial institutions must complete the form. This includes expatriates, international students, and global business professionals.

After submission, the form is typically reviewed by the relevant financial institution. If further clarity or additional information is requested, the institution will reach out to the individual or organization in question.

Managing your CRS Self Certification Form with pdfFiller

Once your CRS Self Certification Form is completed, securely managing this important document is crucial. pdfFiller allows users to save and store their forms in the cloud, providing easy access and peace of mind with encryption features that safeguard sensitive information.

Additionally, tracking changes and prior versions becomes simple with pdfFiller's version control features. You can easily look back at past submissions or updates to your CRS Self Certification Form, allowing you to ensure all information remains compliant and accurate over time.

Tips for staying compliant with CRS regulations

Staying compliant with CRS regulations is essential for avoiding penalties and ensuring proper tax transparency. Regular updates on tax law changes or modifications to the CRS standards are vital. Subscribe to trusted tax advisory news sources that can alert you to relevant updates affecting your jurisdiction.

Moreover, establishing best practices for document management can streamline your compliance efforts. This includes the regular updating of documents, maintaining accurate records, and creating reminders for re-certification if you anticipate changes in residency status.

Conclusion of the overview of CRS Self Certification

The CRS Self Certification Form represents a foundational element of today's global tax compliance landscape. Utilizing tools like pdfFiller not only enhances the process of completing this crucial document but also streamlines the overall management of your forms. Being informed about the implications, process, and management of the CRS Self Certification Form is paramount for both individuals and organizations.

In summary, understanding the significance of the CRS Self Certification Form, avoiding common pitfalls, and leveraging digital tools can empower users in a complex regulatory environment. This proactive approach ensures smoother compliance and fosters a sense of organization in managing international tax responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit crs self certification form from Google Drive?

How do I make changes in crs self certification form?

How do I edit crs self certification form in Chrome?

What is crs self certification form?

Who is required to file crs self certification form?

How to fill out crs self certification form?

What is the purpose of crs self certification form?

What information must be reported on crs self certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.