Get the free Certificate of Error Application

Get, Create, Make and Sign certificate of error application

How to edit certificate of error application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of error application

How to fill out certificate of error application

Who needs certificate of error application?

Navigating the Certificate of Error Application Form: A Comprehensive Guide

Understanding the certificate of error

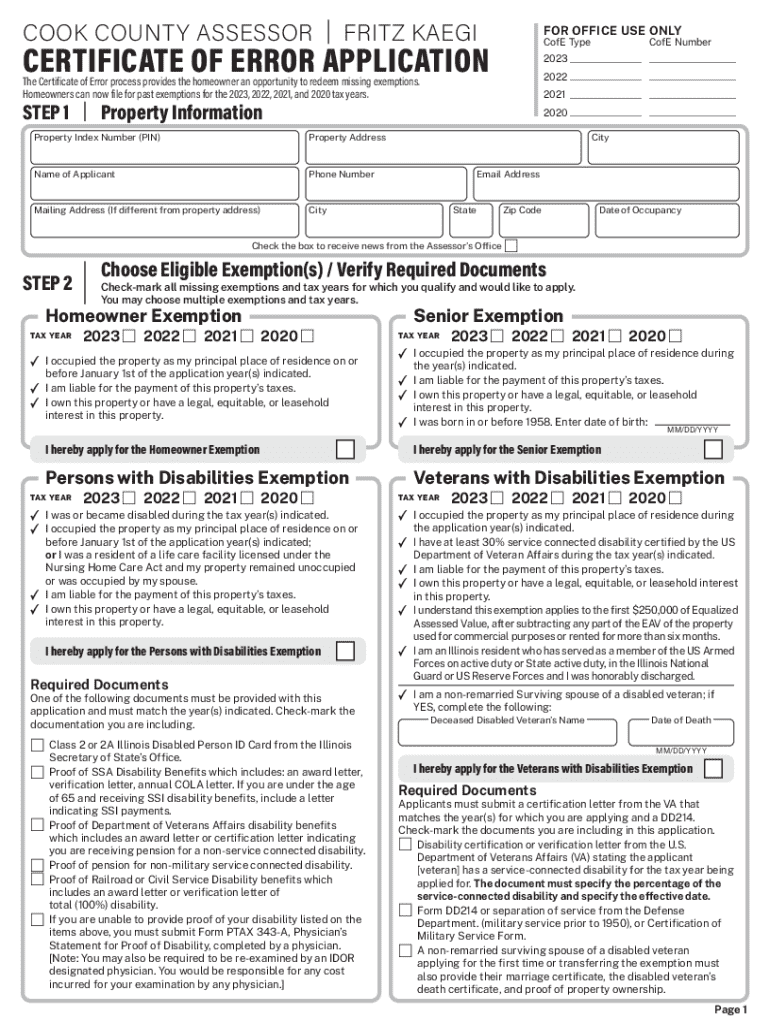

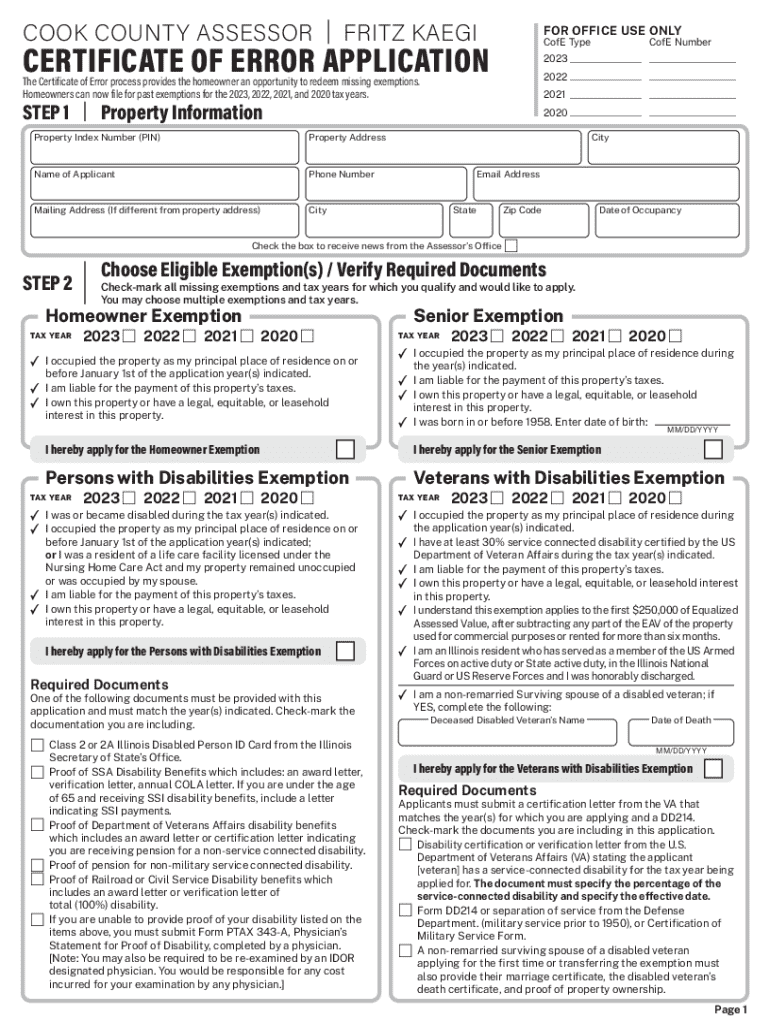

A Certificate of Error is an official document that verifies the presence of an error in property assessments, taxation records, or other public records. This certificate facilitates corrections that can significantly affect property taxes owed or refund entitlements. The importance of filing a Certificate of Error cannot be overstated, as it provides taxpayers an avenue to correct inaccuracies, ensuring they are only liable for the correct tax amounts based on factual assessments.

Common scenarios necessitating a Certificate of Error application include incorrect property descriptions, assessment errors, and failure to apply exemptions that should have been granted, such as a homestead exemption. Understanding these circumstances helps ensure you are well-armed with information to correct any discrepancies.

Eligibility for filing a certificate of error

Eligibility to file a Certificate of Error varies by jurisdiction but generally includes property owners or authorized representatives. To qualify for submission, applicants must demonstrate their relationship to the property in question and identify the specific error in documentation or assessment. Some of the types of errors eligible for correction include tax computation errors, incorrect property classifications, and clerical mistakes.

It is also critical for applicants to understand the deadlines and rules set by their local assessor's office regarding the types of errors accepted for correction and the necessary grounds for the filing. Each jurisdiction has unique criteria that can dictate the success of your application, making it vital to familiarize yourself with these specific requirements.

Required documentation for application

Filing a Certificate of Error requires a collection of specific documentation to support your claim. These documents typically include proof of eligibility, such as ownership records, prior tax statements, and substantial evidence supporting the existence of an error. Below is a list of common necessary documents:

Gathering documentation can be expedited by ensuring you have electronic copies saved on your device or in cloud storage, making access easy when completing the application.

Step-by-step guide to completing the Certificate of Error application form

To navigate the Certificate of Error application process seamlessly, follow these steps:

Methods to submit the Certificate of Error application

Submitting your Certificate of Error application can be done through various methods, with the most common options being online submission, mailing, or in-person delivery. Using pdfFiller can streamline the online process effectively.

What to expect after submission

Once your Certificate of Error application is submitted, it is essential to have realistic expectations. Applications typically undergo a review process conducted by the Assessor’s Office, which can take several weeks. During this period, you may receive communications concerning your application’s status or requests for additional information.

Knowing the general timeline and common procedures can relieve anxiety while awaiting approval. Each jurisdiction may have different timelines, with some reporting decisions within 30 days while others might take longer, especially during peak filing periods.

Tracking your application status

Tracking the status of your Certificate of Error application is crucial for staying informed about its progress. Many jurisdictions have online tracking systems that you can utilize. Additionally, you can directly reach out to the Assessor’s Office via phone or email to get updates, ensuring you have all the details needed.

After approval: Next steps and refund process

Upon approval of your Certificate of Error application, several important next steps follow. You should expect a formal notification from the Assessor's Office indicating the approval and necessary adjustments to your tax status. After your application is processed, be prepared for refund checks from the Treasurer's Office for any overpayments on property taxes.

The timeline for processing refunds can vary, typically ranging from a few weeks to a couple of months. Understanding the implications of an approved Certificate of Error is vital, as these changes may also impact your future tax assessments and potential appeals.

Common issues and solutions

Filing a Certificate of Error can sometimes lead to concerns or issues, particularly if an application is denied. Common errors include incomplete forms or lack of adequate supporting evidence. To address these problems, it's crucial to double-check all application elements and ensure that all documents are included and accurately represented.

Frequently asked questions (FAQs)

While the Certificate of Error application process can appear daunting, there are frequently asked questions that can clarify common concerns. General queries often revolve around eligibility, document requirements, and processing times. Familiarizing yourself with these FAQs not only eases the application journey but also maximizes your chances of submitting a successful application.

Utilizing pdfFiller for an enhanced application experience

Choosing pdfFiller enhances your Certificate of Error application experience through its user-friendly platform for document management and editing. The service simplifies form development, allowing users to fill, eSign, and collaborate on files conveniently from anywhere without hassle.

With pdfFiller, you can expedite the e-signing process effortlessly. The platform also provides collaborative features suitable for teams, making it an ideal choice for businesses or groups managing multiple applications.

Conclusion

Filing a Certificate of Error application can be a straightforward process with the right information and resources. By following this comprehensive guide, utilizing online tools like pdfFiller, and understanding the eligibility and required documents, you can navigate your way through the administrative maze effortlessly. Making accurate filings not only ensures your interests as a property taxpayer but also reinforces the integrity of property assessment systems.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in certificate of error application?

How do I edit certificate of error application in Chrome?

How do I fill out certificate of error application on an Android device?

What is certificate of error application?

Who is required to file certificate of error application?

How to fill out certificate of error application?

What is the purpose of certificate of error application?

What information must be reported on certificate of error application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.