Get the free Central Kyc Registry | Kyc Application Form | Individual

Get, Create, Make and Sign central kyc registry kyc

Editing central kyc registry kyc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out central kyc registry kyc

How to fill out central kyc registry kyc

Who needs central kyc registry kyc?

Central KYC Registry KYC Form: A Comprehensive Guide

Understanding the Central KYC Registry

The Central KYC Registry is a centralized database established to streamline the Know Your Customer (KYC) process. It was created by the Reserve Bank of India (RBI) with the intention of simplifying the procedures financial institutions must follow to verify the identity of their clients. This registry holds KYC information securely and provides it to member banks and financial institutions, making the onboarding process faster and more efficient.

The importance of KYC in financial systems cannot be overstated. It acts as a crucial safeguard against identity theft, money laundering, and fraud. By standardizing the KYC process, the Central KYC Registry allows for better regulatory compliance and ensures that financial institutions can effectively manage their risks.

Overview of KYC compliance

KYC, or Know Your Customer, presents a fundamental aspect of compliance within the financial services industry. It is a regulatory requirement that obligates institutions to verify the identity of their clients to prevent illegal activities such as money laundering and fraud. KYC compliance comprises several key components, including customer identification procedures, determining the risk profile of customers, and ongoing monitoring of transactions.

The role of KYC in preventing fraud is crucial. By ensuring that institutions are aware of who their customers are, banks can effectively mitigate risks and prevent financial crimes. A comprehensive KYC process can save institutions from significant reputational and financial damage that could arise from unscrupulous activities.

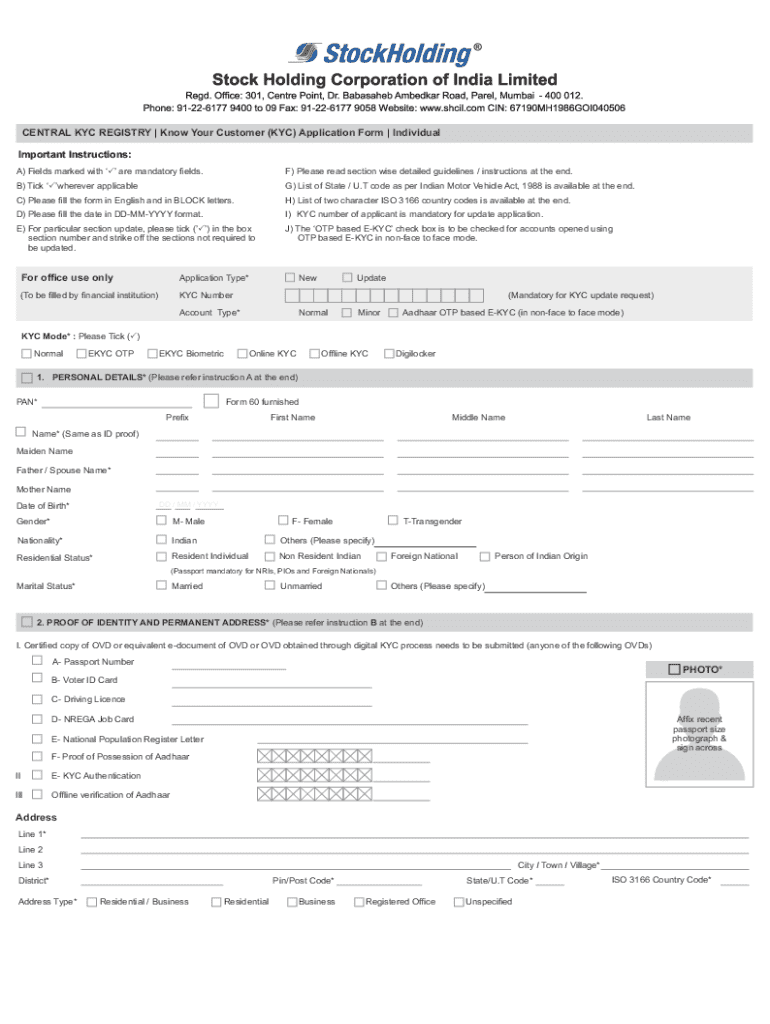

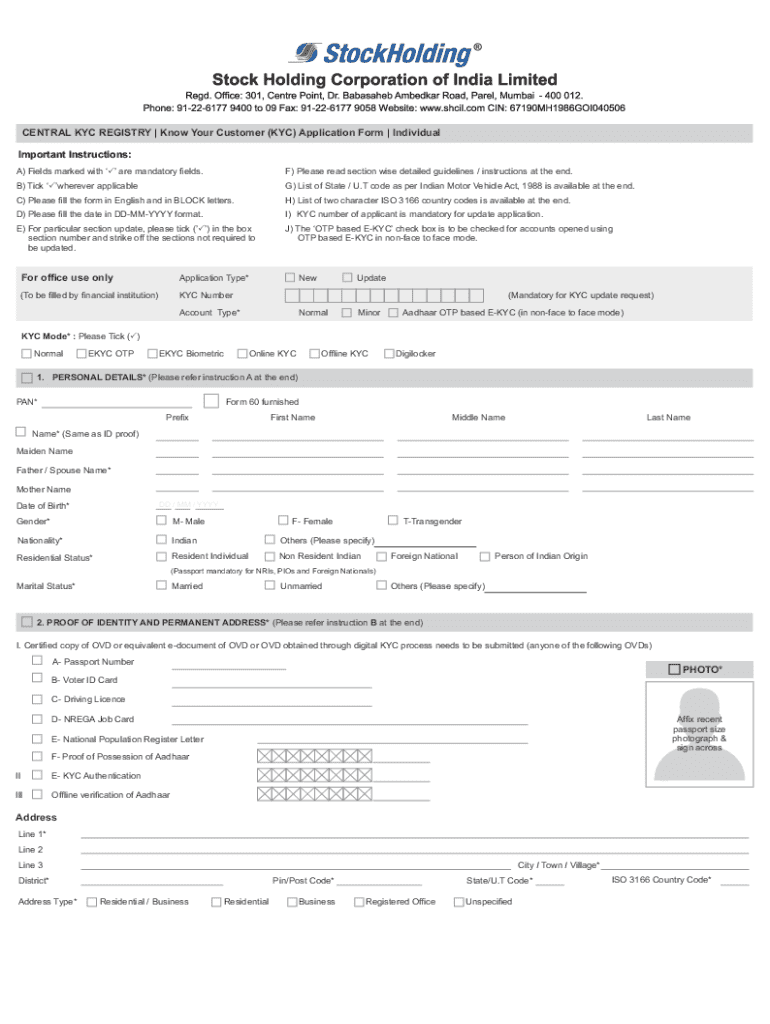

Specifics of the Central KYC Registry KYC Form

The Central KYC Registry KYC form is the official document required to register your KYC details. This form is structured to capture essential personal information that is necessary for identity verification. The KYC form includes mandatory fields such as name, address, date of birth, and identification numbers.

In addition to mandatory fields, there is space for optional information, which may help banks to better understand your financial profile and needs. Identification documents required typically include government-issued IDs, proof of address, and relevant financial documents.

How to fill the Central KYC Registry KYC form step-by-step

Filling out the Central KYC Registry KYC form is a straightforward online process. Here’s a step-by-step guide to help you navigate it smoothly:

Editing and updating your KYC information

It is vital to keep your KYC information current to reflect any changes in your personal circumstances. This includes changes such as moving to a new address, changing your name, or alterations in your financial status. Keeping your KYC details updated helps prevent any discrepancies that could lead to legal or financial consequences.

To make changes to your existing KYC details, access the Central KYC Registry portal. Follow the instructions to make necessary updates, and be sure to upload any new documents that support your changes. Common scenarios that necessitate updates include marriage (name change), relocation (address change), or changes in identification numbers.

eSigning and collaboration features in pdfFiller

pdfFiller enhances the KYC filling experience by integrating eSigning capabilities directly into the platform. This feature allows you to sign your KYC form digitally, making the process quicker and more efficient. Moreover, collaboration tools available on pdfFiller enable users to share documents easily with stakeholders or financial institutions, facilitating smoother communication during the KYC process.

The benefits of using a cloud-based platform like pdfFiller extend to KYC management as well. Users can store their submitted KYC forms and related documents securely, access them from anywhere, and ensure their documents are well-organized.

Troubleshooting common KYC form issues

Filling out the KYC form can sometimes lead to mistakes that result in submission rejections. Common errors include incomplete sections, incorrect document uploads, or not meeting the format requirements. To avoid these pitfalls, double-check each entry against your documentation and adhere strictly to guidelines.

If your submission is rejected, it’s crucial to understand the reason. The Central KYC Registry usually provides feedback on what needs to be corrected. Use the available resources online or contact customer support for assistance to ensure your next submission is successful.

Managing your KYC documents with pdfFiller

pdfFiller offers robust tools for managing your KYC documentation. You can securely store KYC documents in the cloud, ensuring they are easily accessible whenever needed. This feature provides peace of mind, knowing that your important documents are not at risk of loss or damage.

Moreover, pdfFiller enables users to organize and categorize their KYC documents efficiently. This means you can quickly retrieve files when required and share your KYC information without hassle with financial institutions or auditors.

FAQs about the Central KYC Registry and its process

It is common for users to have questions regarding the Central KYC Registry and its processes. To assist, we have compiled a list of frequently asked questions to guide each user through their KYC journey.

Additional tips for a smooth KYC experience

For a seamless KYC experience, it’s beneficial to maintain regular updates to your personal information. Ensure complete accuracy while filling out forms and keep a close eye on any communication from the financial institutions regarding your KYC status.

Staying informed about KYC regulations is crucial. Regularly review updates from your financial institutions and regulatory bodies to ensure compliance and adapt promptly to any changes in policies.

Conclusion: Streamlining your KYC process with pdfFiller

In conclusion, the Central KYC Registry KYC form serves as a pivotal element in the compliance process for financial institutions and their customers. By utilizing pdfFiller, users can benefit from improved efficiencies, such as easier form management, eSigning, and document storage solutions.

Embracing digital tools like pdfFiller empowers individuals and businesses to proactively manage their KYC compliance, ensuring a smoother, efficient, and more secure experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my central kyc registry kyc in Gmail?

Can I sign the central kyc registry kyc electronically in Chrome?

Can I edit central kyc registry kyc on an iOS device?

What is central kyc registry kyc?

Who is required to file central kyc registry kyc?

How to fill out central kyc registry kyc?

What is the purpose of central kyc registry kyc?

What information must be reported on central kyc registry kyc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.