Get the free Critical Illness Claim Form

Get, Create, Make and Sign critical illness claim form

How to edit critical illness claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness claim form

How to fill out critical illness claim form

Who needs critical illness claim form?

Critical Illness Claim Form: A Comprehensive How-to Guide

Understanding critical illness claims

A critical illness claim provides financial support to policyholders who are diagnosed with severe medical conditions outlined in their insurance policy. These claims are crucial as they help alleviate the financial strain associated with treatment, providing a safety net during some of life's most challenging moments. Commonly covered conditions include heart attacks, strokes, certain cancers, and organ transplants, among others.

The importance of understanding this claim cannot be overstated, particularly in a world where unexpected health events can disrupt employment and lead to substantial medical expenses. A timely claim can mitigate the financial impact of these conditions, allowing patients to focus on recovery rather than worrying about bills.

Preparing to file a critical illness claim

Before you initiate a claim, it is essential to gather all necessary documentation. Required materials typically include your insurance policy details, medical records reflecting your diagnosis, and any additional forms that your insurance provider may require. Ensuring that all documents are accurate and complete will facilitate a smoother claims process and reduce the likelihood of delays.

Furthermore, familiarize yourself with your policy's terms, particularly regarding exclusions and the definitions of critical illnesses. Understanding these nuances can prevent potential claim denials and ensure that your submission aligns with the insurer's criteria.

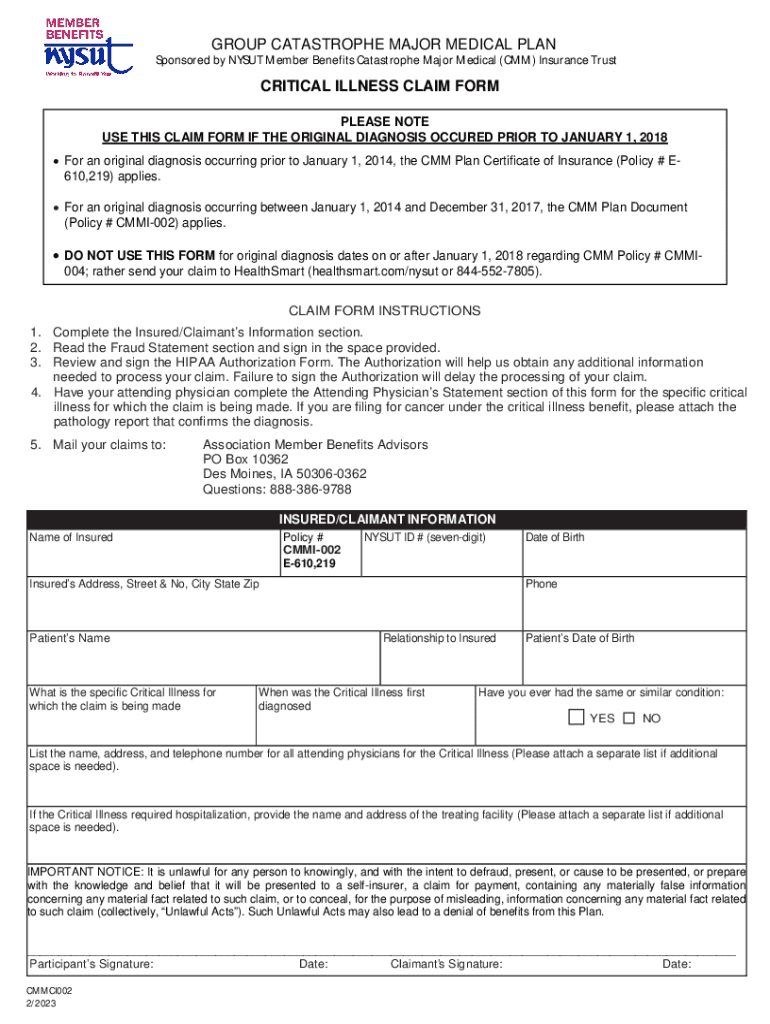

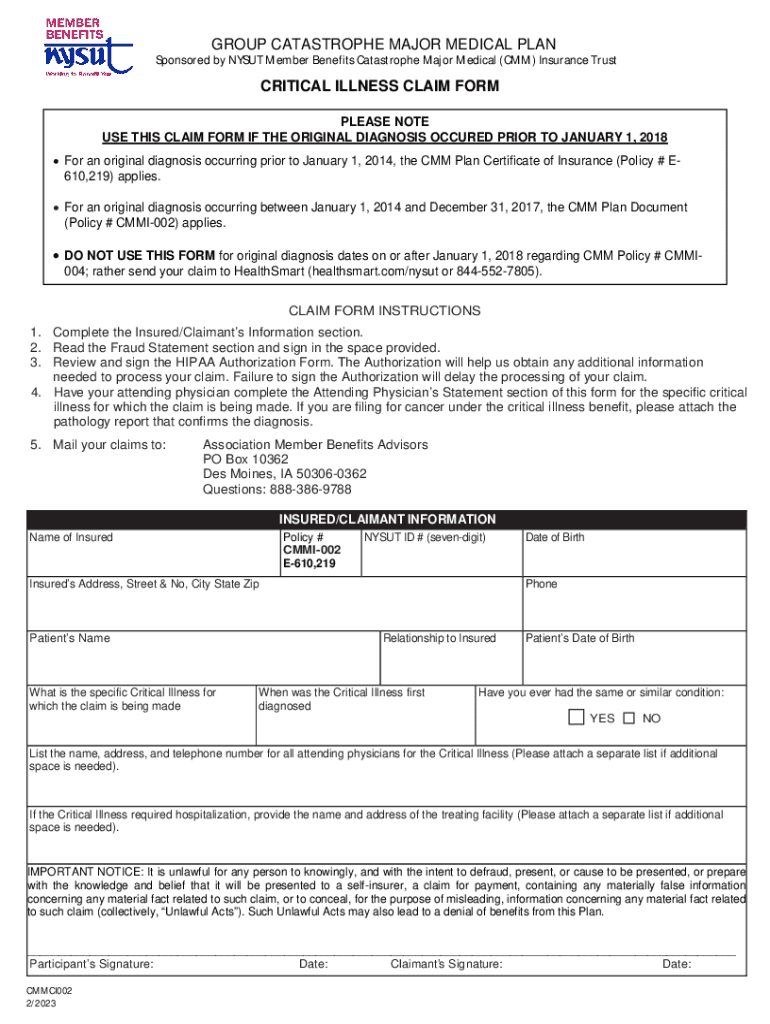

The critical illness claim form: a step-by-step guide

The critical illness claim form is an essential part of the process. First, locate the official claim form specific to your insurance provider; you can often find this on pdfFiller's website, where it can easily be downloaded and filled out electronically. Ensure that you're using the most current version of the form to avoid complications during submission.

With your form completed, you'll have several submission options. Many insurers allow claims to be submitted online through their portals, via email, or even through physical mail. Be mindful of submission deadlines to ensure timely processing of your claim.

After submission: what to expect

Once you've submitted your critical illness claim form, it typically undergoes a review process that can last several weeks. Understanding the typical processing timeframe can ease any anxiety you may feel waiting for approval. Insurers may take anywhere from a few weeks to several months to process a claim, depending on the complexity and additional investigations.

In cases where claims are denied, knowing how to navigate the appeals process is crucial. Common reasons for denial include insufficient medical documentation or claims being submitted for conditions not covered under the policy. If your claim is denied, you can appeal this decision by providing additional evidence or clarification on your diagnosis.

Tools for managing your critical illness claim

Managing the critical illness claim process can be simplified by utilizing interactive tools available on pdfFiller. You can easily edit, customize, and eSign your claim form directly on the site, ensuring it meets all requirements without the hassle of printing and scanning physical documents. This level of convenience is crucial for time-sensitive claims.

Collaborating with your healthcare provider is also vital. Work closely with them to ensure accurate and comprehensive information is included in your medical documents. Efficient communication can prevent unnecessary delays; thus, establishing a good rapport with your medical team can smooth the claims process.

Additional considerations for critical illness claims

Filing a critical illness claim is not just about receiving benefits; it may also have tax implications. Generally, payouts from critical illness insurance are not considered taxable income, but understanding your tax situation is important. Always consult a tax professional to manage potential liabilities associated with large sums of money received as benefits.

Additionally, many organizations offer support services for individuals navigating health challenges. Leverage these resources for guidance, emotional support, or financial advice to help you manage the stresses brought on by a critical illness.

Key guidelines for a successful claim experience

Successful critical illness claims hinge on careful execution. Approach the process methodically, ensuring accuracy in every detail provided in your claim form. Establish a checklist of items necessary for submission, and double-check for completeness before sending off your application.

Staying organized is equally important. Keep detailed records of all submitted claims, correspondence with your insurer, and any documents you’ve provided. Good documentation practices ensure that you can easily manage follow-ups or inquiries about your claim status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in critical illness claim form?

How do I edit critical illness claim form in Chrome?

Can I create an electronic signature for the critical illness claim form in Chrome?

What is critical illness claim form?

Who is required to file critical illness claim form?

How to fill out critical illness claim form?

What is the purpose of critical illness claim form?

What information must be reported on critical illness claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.