Get the free Chapter 667 - Foreclosures

Get, Create, Make and Sign chapter 667 - foreclosures

Editing chapter 667 - foreclosures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 667 - foreclosures

How to fill out chapter 667 - foreclosures

Who needs chapter 667 - foreclosures?

Understanding Chapter 667 - Foreclosures Form: A How-To Guide

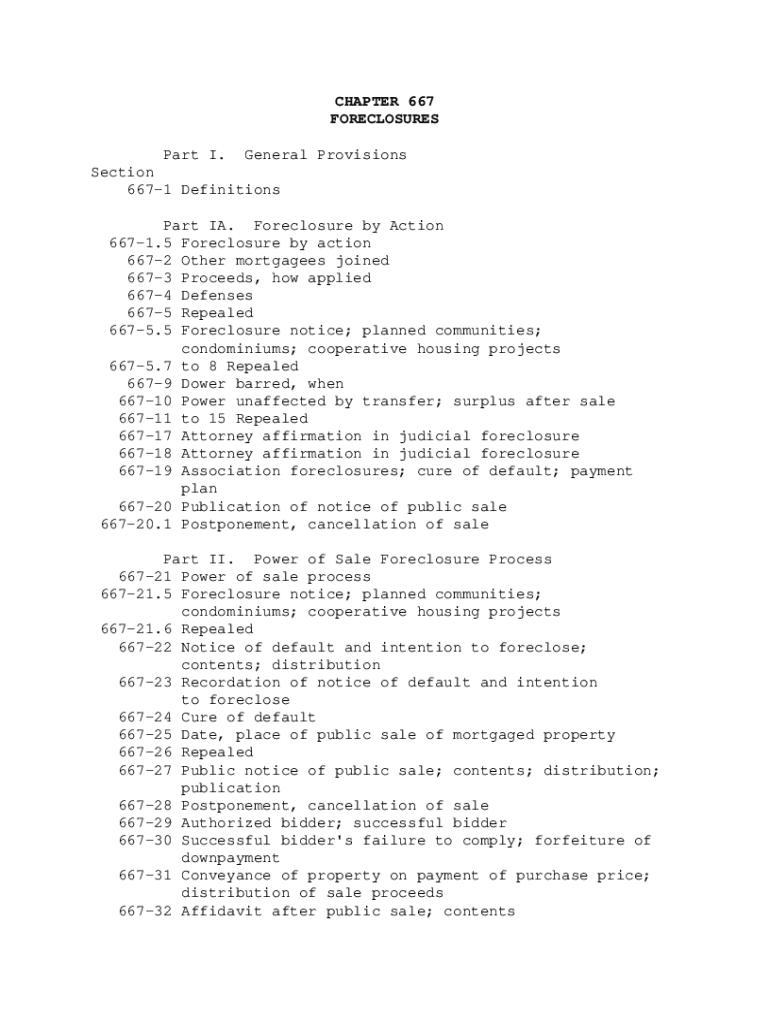

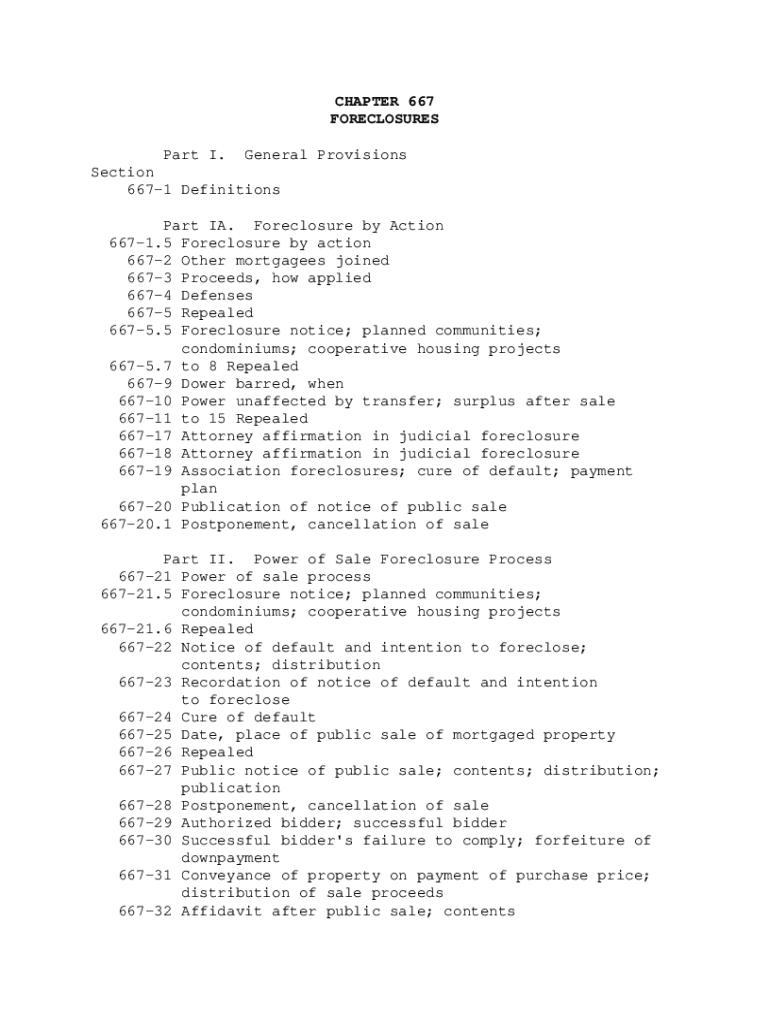

Understanding Chapter 667: A Comprehensive Overview

Foreclosure represents the legal process through which a lender recovers the balance of a loan from a borrower who has defaulted on their mortgage payments. Chapter 667 plays a crucial role in providing the legal framework governing foreclosures, and an understanding of this chapter is vital for both homeowners and lenders alike. A comprehensive grasp of chapter 667 is particularly important because it outlines the rights and obligations of all parties involved in the foreclosure process.

There are two primary types of foreclosures outlined within Chapter 667: judicial and non-judicial. Judicial foreclosures require court involvement, wherein the lender must file a lawsuit against the borrower to initiate the process. Conversely, non-judicial foreclosures enable lenders to pursue foreclosure without court intervention, following specific state statutes.

Key components of the Chapter 667 Foreclosures Form

The Chapter 667 Foreclosures Form comprises essential information that must be meticulously provided to ensure compliance and effective processing. The form requires various details, including property specifics, debtor information (such as the borrower's name and contact details), and creditor information (including the lender's name and address). Each item is critical, as inaccuracies can lead to processing delays or legal complications.

Furthermore, filers must be aware of the associated filing fee and the accepted payment methods. Different jurisdictions may impose varying fees. By understanding these financial aspects, parties can avoid unnecessary delays. Lastly, the importance of completing the form accurately cannot be overstated; errors can have significant ramifications in legal proceedings.

Detailed instructions for completing the Foreclosures Form

Completing the Chapter 667 Foreclosures Form requires attention to detail and organizational skills. Begin by gathering all necessary documentation, including the original loan agreement, evidence of default, and any prior communication regarding the mortgage. This foundational step simplifies the form-filling process.

Next, fill in property and owner information, ensuring that the names and addresses are accurate; common mistakes here include typos in names or addresses. Input financial information meticulously, as discrepancies may raise legal issues. It's essential to review all legal language and clauses within the document to ensure full understanding before signing.

After completing the form, it's crucial to edit and finalize the document carefully. This includes proofreading to catch typographical errors or omissions. Proper signing and submission of the form also hold significance; verify requirements for signatures, including potential witnesses or notarization.

Tools to simplify the Foreclosures Form management

Utilizing cloud-based solutions like pdfFiller can significantly enhance your experience in managing the Chapter 667 Foreclosures Form. The platform's key advantages include the ability to edit and eSign documents seamlessly, providing a more efficient method of completing the necessary forms without the inconvenience of printing or scanning.

Collaboration features allow multiple stakeholders to work on the document simultaneously, further streamlining the process. Additionally, robust document management tools enable users to track changes and versions, ensuring that all revisions are accounted for. This not only saves time but also reduces the risk of errors due to miscommunication.

Navigating the legal landscape of Foreclosures

Understanding the legal landscape surrounding foreclosures is crucial for anyone involved in the process. Chapter 667 lays out many pertinent laws and provisions; however, it's equally important to consider relevant federal and state regulations that may influence how foreclosures operate. For example, the effects of recent legislative changes like Act 48 can shift the landscape significantly by streamlining or complicating foreclosure proceedings.

Moreover, remaining updated with legal changes is paramount for all parties. Resources such as local legal aid organizations and online news outlets can help keep individuals informed about any alterations in the foreclosure process, ensuring compliance and protection of rights.

Frequently Asked Questions (FAQs)

Various concerns may arise when dealing with foreclosures. One common question is, 'What should I do if I can’t pay my mortgage?' It's imperative to contact your lender immediately to discuss possible solutions such as loan modification, forbearance, or even selling the property. Additionally, many individuals wonder, 'Can my foreclosure be prevented?' In some cases, options like negotiation and legal aid can provide pathways to avoid foreclosure.

Simply stated, the role of courts is significant in many foreclosure cases, particularly in judicial processes. Legal aid organizations can assist individuals in navigating complex legal aspects, ensuring that their rights are protected and understood. Lastly, being aware of the timeframes involved in foreclosure procedures can be crucial for those facing potential foreclosure.

Exploring additional resources

A variety of agencies and organizations are dedicated to assisting individuals facing foreclosure. Legal aid services can provide vital support, particularly for those who cannot afford an attorney. Housing counseling agencies also play critical roles in guiding homeowners through the complexities of foreclosure prevention and resolution.

In addition to these support systems, numerous online resources and tools facilitate the understanding and management of foreclosures. Community groups and support networks prove invaluable, allowing affected individuals to share experiences and solutions, creating a network of knowledge and support.

Case Studies: Real-Life Scenarios

Understanding how others have navigated the foreclosure process can offer invaluable insights. For instance, in Case Study 1, a homeowner undergoing judicial foreclosure faced an uphill battle against a lender's aggressive tactics. Through diligent research and legal counsel, they were able to negotiate a loan modification, significantly reducing their monthly payments and ultimately averting foreclosure.

In Case Study 2, a property owner opted for a non-judicial foreclosure due to non-payment and ignorance of their financial resources. Lack of awareness led to an expedited process without options for contest. Their experience highlights the need for understanding one’s rights and seeking assistance before it escalates. Lessons learned from both scenarios emphasize the importance of being proactive and informed.

Expert insights & best practices

Managing foreclosure processes effectively requires not only knowledge but also strategic planning. Proven strategies include maintaining open lines of communication with lenders, understanding potential alternatives to foreclosure, and seeking legal counsel as soon as financial difficulties arise.

Interviews with real estate law professionals reveal that staying informed on legal changes, utilizing technology like pdfFiller for document management, and participating in homeowner workshops can significantly enhance one's ability to navigate foreclosure challenges. Collaboration with legal teams also ensures decisions are made knowledgeably and effectively, optimizing outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find chapter 667 - foreclosures?

How do I edit chapter 667 - foreclosures in Chrome?

Can I create an electronic signature for the chapter 667 - foreclosures in Chrome?

What is chapter 667 - foreclosures?

Who is required to file chapter 667 - foreclosures?

How to fill out chapter 667 - foreclosures?

What is the purpose of chapter 667 - foreclosures?

What information must be reported on chapter 667 - foreclosures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.