Get the free Cash Reserve Overdraft Line of Credit Application

Get, Create, Make and Sign cash reserve overdraft line

How to edit cash reserve overdraft line online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash reserve overdraft line

How to fill out cash reserve overdraft line

Who needs cash reserve overdraft line?

Comprehensive Guide to Cash Reserve Overdraft Line Form

Understanding cash reserve overdraft lines

A cash reserve overdraft line is a financial tool provided by banks that allows account holders to withdraw more money than they currently have in their checking accounts, up to a predetermined limit. This service serves as a safety net for unexpected expenses or temporary cash flow issues, allowing individuals and businesses to maintain stability without the need for a traditional loan.

Maintaining a cash reserve is crucial for both personal and business finances, offering flexibility in managing day-to-day operations. It can prevent the inconvenience of declined transactions and help manage financial emergencies effectively.

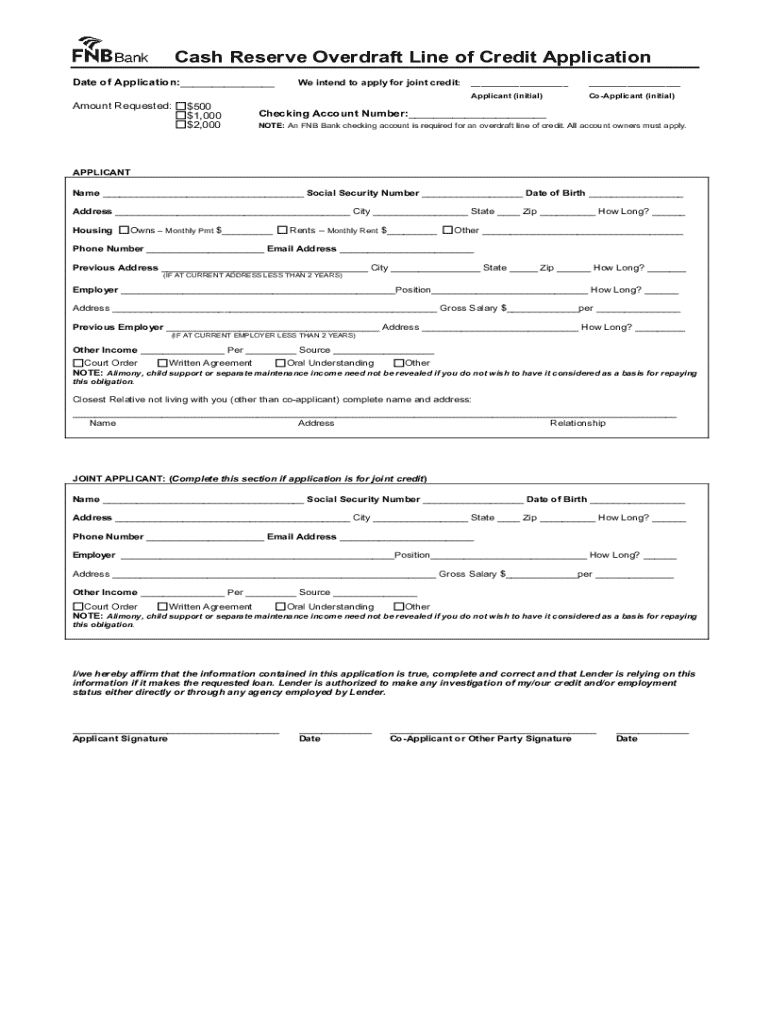

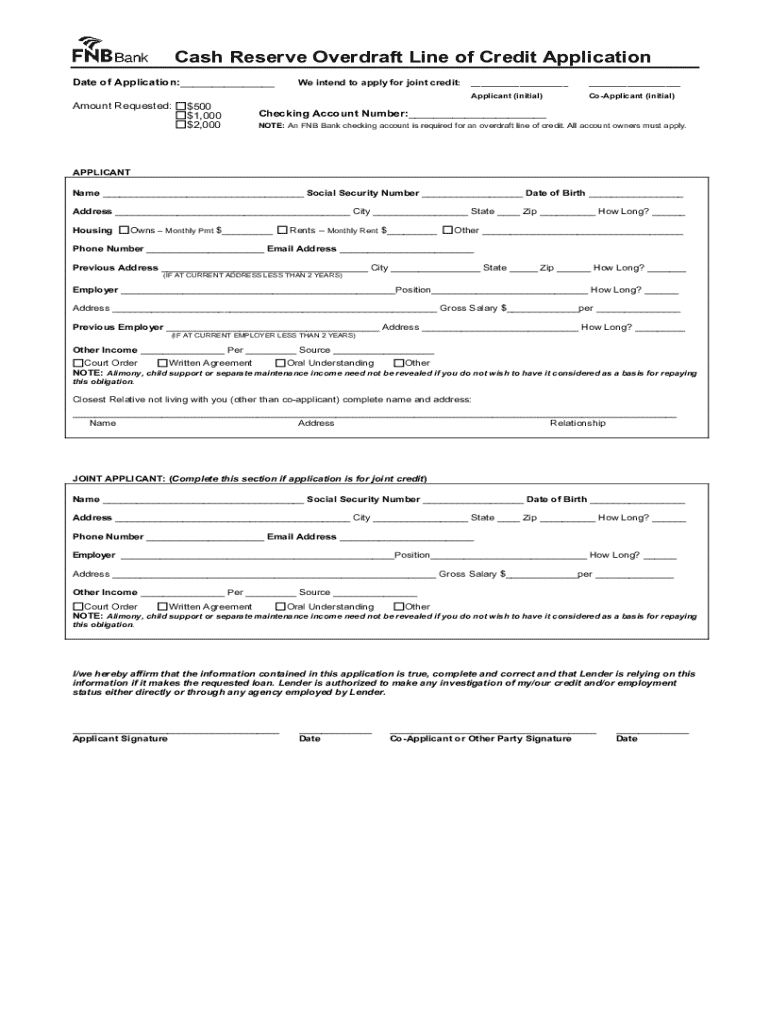

Overview of the cash reserve overdraft line form

The cash reserve overdraft line form is an essential document for anyone looking to apply for this financial service. Its primary purpose is to collect necessary information from the applicant, allowing banks to assess eligibility and determine the terms of the overdraft line.

This form streamlines the application process by providing a clear structure for financial information. Depending on the bank's policies, there are personal and business options available, with variations in terms, limits, and conditions tailored to different client needs.

Step-by-step guide to filling out the cash reserve overdraft line form

Filling out the cash reserve overdraft line form may seem daunting, but it’s a straightforward process. The form requires specific personal and financial information that will aid the bank in evaluating your application.

Mandatory sections typically include personal identification details, financial information, and proof of income documentation. Being thorough and precise will facilitate a smoother approval process.

Ensure you provide accurate information in each section and consult with bank representatives if you have questions. This diligence can prevent delays or miscommunication.

Editing and managing the cash reserve overdraft line form

Using pdfFiller's editing tools can significantly enhance your experience when managing the cash reserve overdraft line form. Features such as highlighting and commenting allow users to pinpoint critical information or clarify sections that may require further attention.

Moreover, maintaining clarity and accuracy in documentation can lead to quicker processing times by the bank. It’s beneficial to store all your financial documents in a cloud storage solution for easy access and organization.

Signing and submitting your cash reserve overdraft line form

Once your form is completed and reviewed, the next step is to sign it. Digital signing options through pdfFiller offer a convenient way to provide your signature without the need for printing.

Legal considerations are important; make sure to follow your bank’s guidelines on e-signatures as they vary across institutions. After signing, you can submit your application online, usually through your bank's website or directly via the pdfFiller platform.

Common questions about cash reserve overdraft lines

When applying for a cash reserve overdraft line, applicants frequently have questions about eligibility criteria. Banks generally review factors such as credit history, current debts, and income to determine qualification.

Alongside eligibility, understanding the associated fees is crucial; overdraft lines might have monthly fees or interest rates that apply on any drawn amount. Managing your overdraft responsibly is essential to prevent excessive fees.

Interactive tools for effective financial management

To manage finances effectively while utilizing a cash reserve overdraft line, tools like budgeting apps and financial calculators can be invaluable. PDFfiller offers features that assist users in tracking expenses and budgeting effectively, ensuring better financial management.

Utilizing financial calculators can also provide insights into how much you need regarding overdraft limits and expenses, while evaluating the costs of maintaining an overdraft line compared to other financial solutions.

Conclusion on the importance of a cash reserve overdraft line

In summary, a cash reserve overdraft line is a powerful tool for managing finances, providing access to funds when needed and offering security against unexpected expenses. The benefits of having this service extend beyond just immediate cash access; it also aids in maintaining a sound financial standing.

Keep track of your overdraft line usage effectively, set personal limits, and regularly review your financial situation to maximize the advantages this service offers.

Customer support and resources for overdraft line queries

For individuals seeking help with their cash reserve overdraft line form, reaching out to customer support can be instrumental. Many banks and institutions have dedicated teams to assist during the application process.

Additionally, pdfFiller provides a suite of document management resources to assist users in navigating their forms, making the entire interaction straightforward and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cash reserve overdraft line?

Can I create an electronic signature for the cash reserve overdraft line in Chrome?

How do I edit cash reserve overdraft line straight from my smartphone?

What is cash reserve overdraft line?

Who is required to file cash reserve overdraft line?

How to fill out cash reserve overdraft line?

What is the purpose of cash reserve overdraft line?

What information must be reported on cash reserve overdraft line?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.