Get the free Central Kyc Registry

Get, Create, Make and Sign central kyc registry

How to edit central kyc registry online

Uncompromising security for your PDF editing and eSignature needs

How to fill out central kyc registry

How to fill out central kyc registry

Who needs central kyc registry?

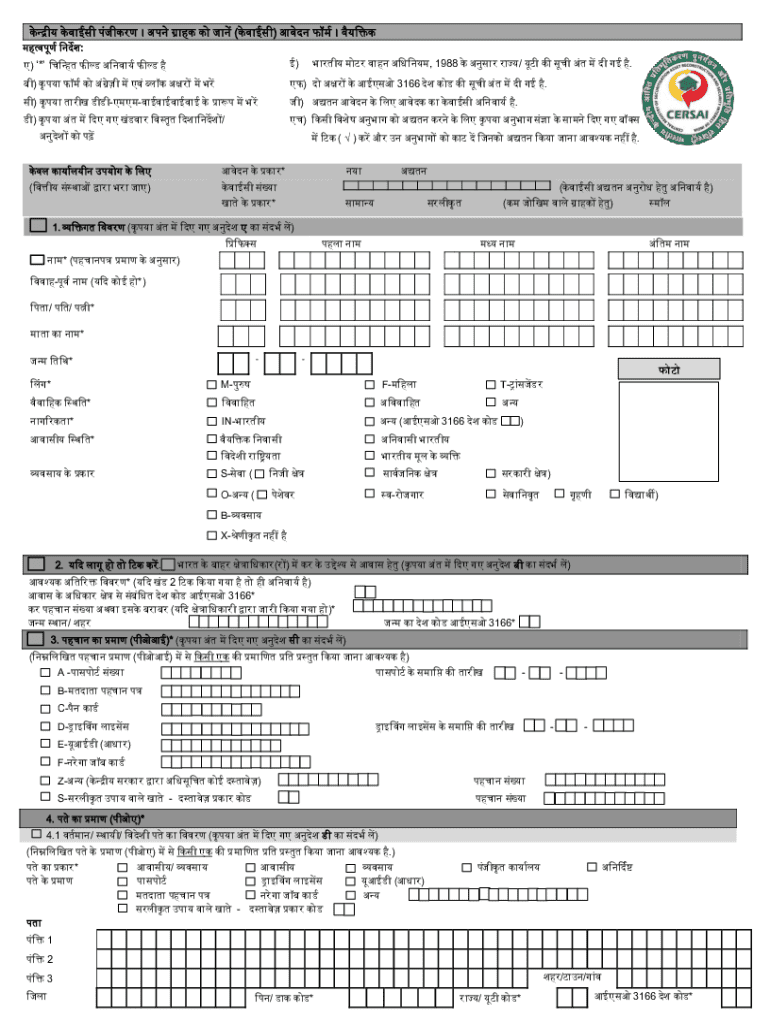

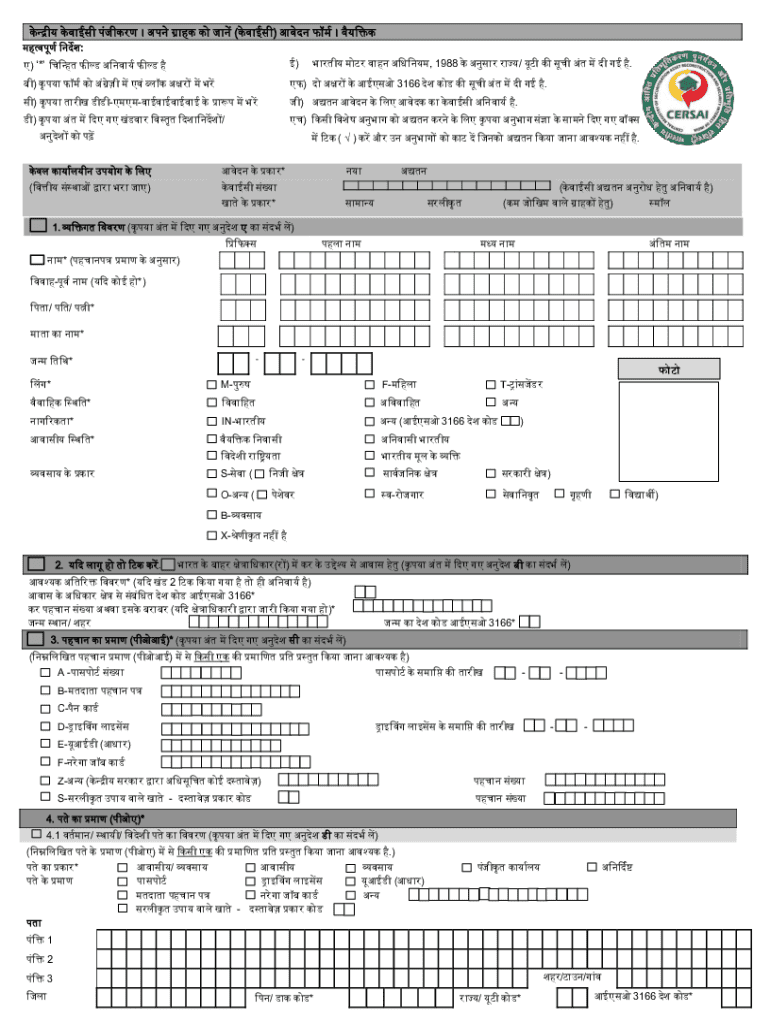

A Comprehensive How-to Guide for the Central KYC Registry Form

Understanding the Central KYC Registry Form

The Central KYC (Know Your Customer) Registry is a vital component in the financial services ecosystem, primarily aimed at verifying the identity of customers. KYC is essential for mitigating risks related to fraud and money laundering and ensures compliance with various regulatory requirements. Financial institutions must adhere to stringent guidelines that involve collecting and maintaining accurate customer information, making KYC not just a best practice but a regulatory necessity.

The Central KYC Registry acts as a centralized repository for KYC records, aiming to simplify the process and enhance efficiency among financial institutions. Its primary purpose is to collate and store KYC data securely while improving accessibility across different stakeholders, including banks, non-banking financial companies (NBFCs), and regulatory authorities.

The importance of the Central KYC Registry Form

Utilizing the Central KYC Registry Form significantly streamlines the KYC process for both customers and financial institutions. By having a single point of access for KYC information, institutions can expedite customer verification. This has proven advantageous especially in sectors where customer onboarding is time-sensitive, such as real estate or fintech companies.

A centralized registry also significantly enhances compliance and security measures. By reducing the chances of fraud and ensuring that customers are thoroughly vetted, financial institutions can better protect themselves and their clients from potential financial crimes. The registry allows institutions to verify customer identities swiftly while conforming to the necessary legal and regulatory frameworks.

Essential information required for the Central KYC Registry Form

Filling out the Central KYC Registry Form requires specific personal identification information essential for effective verification. Basic details such as your full name, contact numbers, and email address are foundational entries. Additionally, providing date of birth and nationality helps establish your identity and differentiate you from other clients.

Verification documents play a critical role in the submission process. For individuals, mandatory documents usually include a government-issued ID, proof of address, and a recent passport-sized photograph. If representing a business, additional documentation such as certificates of incorporation or partnership agreements might be required to represent the entity accurately. Data privacy is crucial, so understanding how personal information is stored and managed by the registry is also vital.

Step-by-step guide to filling out the Central KYC Registry Form

Accessing the Central KYC Registry Form is the first step in your process. You can find it online through official financial regulatory websites or the specific bank’s portal you are transacting with. Make sure to check for the correct URL to ensure you are not on a fraudulent website.

Once you access the form, start filling in your personal details. Be meticulous in entering your information, as discrepancies can lead to delays. After filling in your details, the next step involves uploading the required verification documents. It's crucial to adhere to the format and size requirements specified for documents to avoid rejection. Ensure all uploaded documents are clear and easily readable.

Editing and finalizing your submission

Utilizing tools such as pdfFiller can vastly improve your experience in editing the Central KYC Registry Form. pdfFiller offers intuitive features allowing you to make adjustments to your form swiftly and collaboratively. If you're part of a team submitting a form, you can easily share drafts and amendments with team members before finalizing.

Once your form is accurately filled out and edited, the signing process follows. eSigning options available via pdfFiller ensure that your signature is legally binding, offering convenience without compromising legal integrity. Understanding the legal implications of electronic signatures is crucial, particularly in compliance-heavy environments like finance.

Submitting the Central KYC Registry Form

Submitting the Central KYC Registry Form can be done through both online and offline channels, depending on the institution’s preferences. Online submission is usually faster, allowing for quicker processing times. Be aware of the specific submission guidelines outlined by your financial institution, as adherence is key to ensuring a smooth process.

Once you have submitted your application, keeping track of its status is important. Most financial institutions provide tracking features, either through a dedicated portal or via customer service. Knowing what to expect following your submission can help manage any potential issues that may arise during processing.

Common issues and troubleshooting tips

While filling out the Central KYC Registry Form might seem straightforward, many applicants encounter common issues. One frequent problem is form submission errors, often stemming from incomplete fields or document mismatches. Ensuring all required entries are filled and documents correspond to the information provided is crucial in avoiding rejection.

Document rejection is another prevalent issue for applicants. It could occur due to insufficient clarity, format discrepancies, or an outdated ID. For personalized assistance, most institutions provide support resources. It’s advisable to contact their customer service for guidance tailored to your unique situation.

Maintaining your KYC information

Maintaining accurate and up-to-date information in the Central KYC Registry is essential for ongoing compliance and security. Institutions often require regular updates in response to changes in your personal or business circumstances, making it crucial for customers to remain vigilant about their KYC data.

The process of updating your KYC details is generally simple but must be executed with precision. Contact your financial institution to obtain the proper channels for amendment requests, ensuring the right documentation supports your updated information. Ignoring this might lead to compliance issues with your bank, so proactive management is recommended.

Case studies: Successful implementation of the Central KYC Registry

Numerous financial institutions have successfully implemented the Central KYC Registry to streamline their processes and enhance customer experiences. For instance, a regional bank reported a 30% decrease in customer onboarding time after integrating the registry into their systems. This not only improved customer satisfaction but also increased the bank's ability to attract new clients.

Another example involves a non-banking financial company (NBFC) that leveraged the Central KYC Registry to enhance its security protocols. By utilizing the centralized data for robust identity verification, the company substantially reduced its exposure to fraudulent transactions, thereby gaining trust among its clientele. Such case studies highlight the transformative effect of the Central KYC Registry in financial services.

Maximizing the benefits of pdfFiller with your KYC forms

pdfFiller is designed to enhance your experience in dealing with the Central KYC Registry Form and beyond. Features like real-time collaboration mean that you can work on forms simultaneously with your team, ensuring everyone is on the same page. eSignatures offered by pdfFiller simplify the signing process, enabling you to finalize documents quickly.

Moreover, utilizing cloud storage allows easy access to all your forms and documents from anywhere, making it convenient for team members to manage their KYC-related paperwork without bottlenecks. By optimizing your form templates for future use, you're not only saving time but also fostering a more efficient workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my central kyc registry in Gmail?

How can I send central kyc registry for eSignature?

How do I complete central kyc registry online?

What is central kyc registry?

Who is required to file central kyc registry?

How to fill out central kyc registry?

What is the purpose of central kyc registry?

What information must be reported on central kyc registry?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.