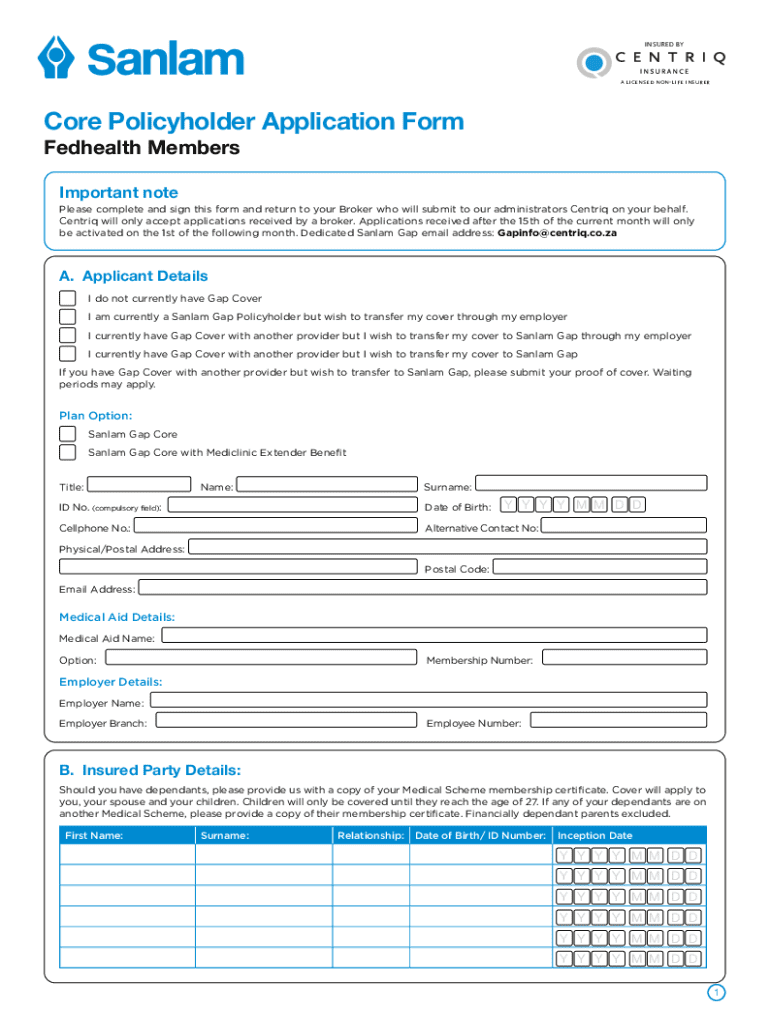

Get the free Core Policyholder Application Form

Get, Create, Make and Sign core policyholder application form

Editing core policyholder application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out core policyholder application form

How to fill out core policyholder application form

Who needs core policyholder application form?

Core Policyholder Application Form: A Comprehensive How-to Guide

Understanding the core policyholder application form

The core policyholder application form serves as the foundation for establishing an insurance policy. This crucial document enables prospective policyholders to provide essential information to the insurance company, facilitating the initiation of coverage. By accurately completing this application, policyholders lay the groundwork for their future relationship with the insurer and ensure their needs are met regarding risk protection.

The significance of this form is multifaceted. For policyholders, it not only confirms their identity but also helps in customizing the coverage to fit their specific circumstances and requirements. Insurance companies benefit from the standardized information that aids in evaluating risk and setting premiums accordingly. In essence, a well-completed application ensures clarity and transparency in the underwriting process.

Preparing to fill out the form

Before you dive into filling out the core policyholder application form, it's imperative to gather all necessary information to streamline the process and minimize errors. Start by collecting your personal identification details, such as your name, address, date of birth, and Social Security number. Additionally, be prepared to provide financial information, including proof of income and any other relevant documentation that the insurance company might require, like previous policies or health records.

Equally important is understanding specific terms and definitions that appear within the application. Familiarizing yourself with common jargon, such as 'underwriting,' 'premium,' and 'deductible,' can simplify the process and reduce the chances of misunderstandings. Policyholders who take the time to educate themselves on these terms will find the application process smoother and more intuitive.

Step-by-step guide to completing the form

Completing the core policyholder application form can seem daunting, but breaking it down into manageable steps makes it much easier. Start with the personal information section, where you will fill in vital details such as your full name, address, contact numbers, and Social Security number. Ensure every piece of information is accurate, as discrepancies can delay the processing of your application.

Next is the insurance coverage preferences section, where you will select the types of coverage you wish to apply for. Evaluate your needs carefully, considering factors like your health status, family obligations, and financial situation. This step is critical to establishing the right level of protection tailored to your unique circumstances.

Once those sections are complete, you may be asked for additional information, such as previous insurance coverage details or specific health conditions. It’s vital to provide as much accurate detail as possible, ensuring that any optional information you include enhances your form's comprehensiveness without becoming a burden.

Editing and reviewing the application

Once you’ve completed the application, it's crucial to take a moment to review your work. Best practices for reviewing your application include proofreading each section to identify any typographical errors or inconsistencies. Common mistakes include incorrect information, omitting details, or misunderstanding coverage options, all of which can lead to rejection of your application or complications later on.

Utilizing tools like pdfFiller can significantly ease this process. With pdfFiller, you can edit your form directly after finishing, ensuring that everything is accurate and organized. Their platform also highlights missed fields and offers suggestions to enhance your application. The advantages of cloud-based solutions become particularly apparent when managing multiple forms as you can access and edit your application from anywhere.

E-signing the core policyholder application form

Understanding electronic signatures is paramount before submitting your application. E-signatures are legally recognized in most jurisdictions and hold the same weight as traditional handwritten signatures. The ability to e-sign is essential for a streamlined application process, as it allows for immediate submission without the need for physical documentation.

Using pdfFiller, adding your electronic signature is both simple and secure. Follow their interactive guide to create and place your signature directly on the document. It’s important to ensure that your signature is valid—this can be achieved by verifying your identity through features that pdfFiller provides. When you e-sign, you not only show your commitment but also expedite the submission process.

Submitting the form

Once your core policyholder application form is complete and signed, the next step is submission. There are various methods for submitting the application, with online submission via pdfFiller being the most efficient. This method ensures immediate processing by the insurer. Alternatively, you can submit the application via traditional methods such as mail, fax, or in-person delivery, although these can lead to delays in processing.

After submission, anticipate a review period depending on the insurance company’s processing times. It's beneficial to know what to expect during this phase, such as possible timelines for feedback or requests for further information. Always keep contact points handy in case you need to follow up on your application status.

Managing your policyholder application

After submitting the application, ongoing management is key to ensure everything is on track. Utilizing pdfFiller, you can easily track the progress of your application. Their platform includes tools that help you monitor the status and provide updates regarding any changes or requests from the insurance company.

If you receive a request for additional information from the insurer, respond promptly. Efficient communication can significantly prevent delays. Prepare any extra documentation requested and clarify any misunderstandings that may arise, maintaining a professional dialogue with the insurer.

Collaborating with team members on applications

For teams managing multiple core policyholder application forms, collaboration is key. pdfFiller offers features to share the form for input with others, making it easy to collaborate effectively. Utilize these features to ensure everyone on your team is aligned and informed about the ongoing process.

Collecting feedback efficiently is another vital aspect. Best practices for gathering input include utilizing comments and suggestions directly within the pdfFiller interface, allowing for clearer communication and an organized approach to refining your application. Implementing changes based on team feedback can improve the quality of your application before final submission.

Conclusion: The benefits of using pdfFiller

In conclusion, using pdfFiller for your core policyholder application form not only simplifies the process but also enhances the overall experience of managing your documents. By offering a cloud-based platform, pdfFiller enables users to edit, e-sign, and collaborate on forms seamlessly, eliminating the cumbersome aspects of traditional document handling.

Moreover, pdfFiller empowers users with customizable tools, including templates and various integrations, which further streamline document management. Exploring pdfFiller not only aids in completing your application but provides a versatile solution for other document needs, making it an indispensable tool for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my core policyholder application form directly from Gmail?

How do I edit core policyholder application form straight from my smartphone?

How do I complete core policyholder application form on an iOS device?

What is core policyholder application form?

Who is required to file core policyholder application form?

How to fill out core policyholder application form?

What is the purpose of core policyholder application form?

What information must be reported on core policyholder application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.