Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Everything You Need to Know About Credit Application Forms

Understanding the credit application form

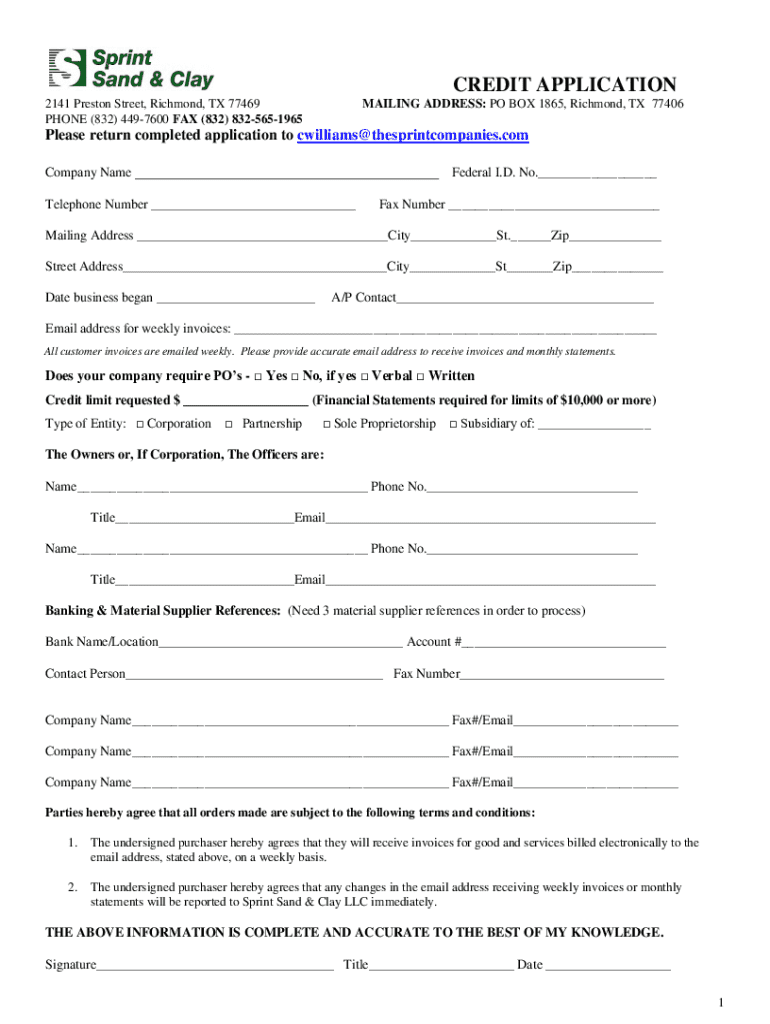

A credit application form is a critical document used by lenders and financial institutions to gather essential information about an individual or a business seeking credit. Its primary purpose is to assess the creditworthiness of applicants, enabling lenders to make informed decisions about whether to extend credit and under what terms.

For individuals, this application can determine their ability to obtain personal loans, credit cards, or mortgages, while businesses use it to secure lines of credit, loans, or trade credit. The importance of these forms cannot be overstated; they serve as the gateway to financial opportunities, highlighting the need for accuracy and honesty in the information provided.

Types of credit application forms

Credit application forms generally fall into two categories: personal and business. Each serves distinct purposes and has unique requirements. Personal credit applications focus on individual borrowers, while business applications require information pertaining to the entire entity.

The differences extend further when comparing Business-to-Business (B2B) and Business-to-Consumer (B2C) applications. B2B applications often require detailed financial statements and credit history of the business, aiming to evaluate the business's overall health and credit behavior. In contrast, B2C applications might focus more on the personal financial details of the applicant, such as employment history and personal credit scores.

Key components of an effective credit application form

Effective credit application forms contain essential information required for a thorough evaluation. For personal applications, this usually includes the applicant’s name, address, and contact details. It also demands financial information, such as income, employment history, and assets.

In business applications, necessary details include the legal name of the business, business type, contact information, identification numbers, and sometimes, a comprehensive overview of financial statements and credit history. Optional information, such as personal references or additional income sources, may also yield helpful insights for lenders.

Steps to complete a credit application form

Completing a credit application form requires careful preparation. Start by gathering all necessary documentation such as identification, proof of income, and relevant financial statements. Organizing these documents beforehand can streamline the process.

When filling out the form, begin with personal or business identification information. Follow up by entering financial details, being as thorough as possible. Include any additional required documents that substantiate your financial situation, as these can bolster your application's credibility.

Ensure that all details are accurate and double-check for completeness before submission to avoid unnecessary delays.

Common mistakes to avoid

When filling out a credit application form, it's crucial to avoid common pitfalls that can lead to automatic denial or delays. One of the most frequent mistakes is submitting incomplete information. Ensure that all sections are filled in without leaving blanks unless clearly specified.

Misleading or false information is another significant error that can result in fraud accusations or complete denial. Providing documents that don’t match the information given in the application can also raise eyebrows. Always be transparent and consistencies across all submitted documentation.

How to submit your credit application

Once your credit application form is complete, it's time to submit it. Various methods are available, including online submission, mailing a physical copy, or visiting a branch in person. Choose the one that aligns best with your schedule and the lender’s preferences.

Processing times can vary significantly between lenders, so inquire about this when submitting your application. Ensure you follow up after submission to confirm receipt and address any questions or issues that may arise.

The creditworthiness assessment process

After submitting a credit application form, the next step is the creditworthiness assessment. Lenders will analyze the provided information, evaluating aspects like income stability, previous borrowing history, and current debt levels.

The lender's objectives are to minimize risk, and applicants with higher credit scores typically have a better chance of receiving a favorable response. Understanding what factors contribute to your credit score can help enhance your financial profile prior to submission.

Red flags to watch for in credit applications

While applicants strive for approval, lenders also remain vigilant for potential red flags that may indicate fraud. Signs such as inconsistencies in personal data across different submitted documents or applicant information can raise suspicions.

High debt-to-income ratios may also project risk to lenders, making it essential for applicants to be mindful of their financial obligations when applying. Preparing comprehensive details and ensuring all data corroborate improves chances for all parties involved.

Benefits of using pdfFiller for credit application forms

pdfFiller streamlines the credit application process, allowing users to easily edit and fill out forms digitally. Users can leverage its e-signature capabilities to expedite approvals, eliminating the need for mailing or in-person visits.

Moreover, its collaboration features enable teams to work on applications simultaneously, ensuring that all essential documents are in one accessible location. This not only enhances productivity but also reduces the likelihood of errors during the submission process.

Automation in credit application processing

The automation of credit application processing delivers significant advantages, such as faster turnarounds and improved accuracy. By using software tools to evaluate and sort applications, lenders can minimize human error while ensuring that data is securely processed.

Technologies like AI and machine learning are reshaping how institutions assess credit applications, leveraging algorithms to identify reliable patterns and forecast trends based on historical data. Many organizations have reported increased efficiency and a reduction in risky lending through these advancements.

FAQs about credit application forms

Questions surrounding credit application forms are common among applicants. A frequent concern is, 'What happens if my application is denied?' Generally, you will receive a notice detailing the reason for denial and sometimes options for reapplication or improvement.

Many seek guidance on enhancing their chances, which often entails maintaining good credit scores and providing comprehensive, well-organized information in applications. Typical turnaround times for approvals range from a few hours to several days, depending on the lender's processing methods and workload.

Best practices for managing your credit applications

Managing your credit applications effectively is just as crucial as filling them out accurately. Begin by organizing all your credit documentation systematically, ensuring easy access when needed. Establish alerts for application status updates, which can help you remain proactive and informed.

Once your applications are submitted, regularly reviewing your credit reports can also provide insights into how they impact your credit score, especially after successful loans or credit extensions. Understanding this may empower you to make financial decisions that align with your goals.

Related topics and suggestions

Exploring related topics can enhance your understanding of financially sound habits. For instance, cash flow management significantly impacts creditworthiness, and learning how to handle it can lead to better borrowing options in the future.

Guides on personal loans and credit lines also provide practical strategies for effective credit use, helping users capitalize on opportunities. Moreover, insights on maintaining good credit health can ensure continual access to favorable financial products.

Interactive tools and resources

Utilizing interactive tools can significantly ease the process of creating and managing credit application forms. Downloadable credit application templates available on pdfFiller enable users to customize documents to their needs and preferences.

Furthermore, resources like credit score checklists and educational webinars focused on managing credit applications provide valuable knowledge that can guide your financial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out credit application using my mobile device?

Can I edit credit application on an iOS device?

How can I fill out credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.