Get the free Cromwell Funds Coverdell Education Savings Account (cesa) Designated Death Beneficia...

Get, Create, Make and Sign cromwell funds coverdell education

Editing cromwell funds coverdell education online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cromwell funds coverdell education

How to fill out cromwell funds coverdell education

Who needs cromwell funds coverdell education?

Cromwell Funds Coverdell Education Form: A Comprehensive Guide

Understanding the Coverdell Education Savings Account (ESA)

The Coverdell Education Savings Account (ESA) is a tax-advantaged savings plan aimed at helping families save for future educational expenses. This initiative allows you to set aside money in a dedicated account that can grow tax-free, which can then be used for qualified education expenses, including tuition and fees. The Coverdell ESA is particularly favorable for those planning to pay for primary, secondary, or higher education, making it a versatile option for educational savings.

Families can contribute up to $2,000 per year per beneficiary, provided their modified adjusted gross income doesn't exceed certain thresholds. This flexible savings option allows for a variety of investments like stocks, bonds, and mutual funds, giving families the opportunity to choose investments that align with their financial goals.

Cromwell Funds: A deeper dive

Cromwell Funds is a recognized player in the financial services industry, known for its commitment to managing assets responsibly while providing robust investment options tailored for educational savings. Their range of offerings includes funds specifically structured to suit the needs of Coverdell ESAs. Cromwell focuses on long-term growth strategies, helping families maximize their investments allocated for education.

The investment strategies adopted by Cromwell are designed to balance risk and reward, ensuring that the funds remain competitive in the market while aligning with the objectives of education savers. Historically, Cromwell Funds have shown promising performance trends, providing families with confidence in their educational savings plans.

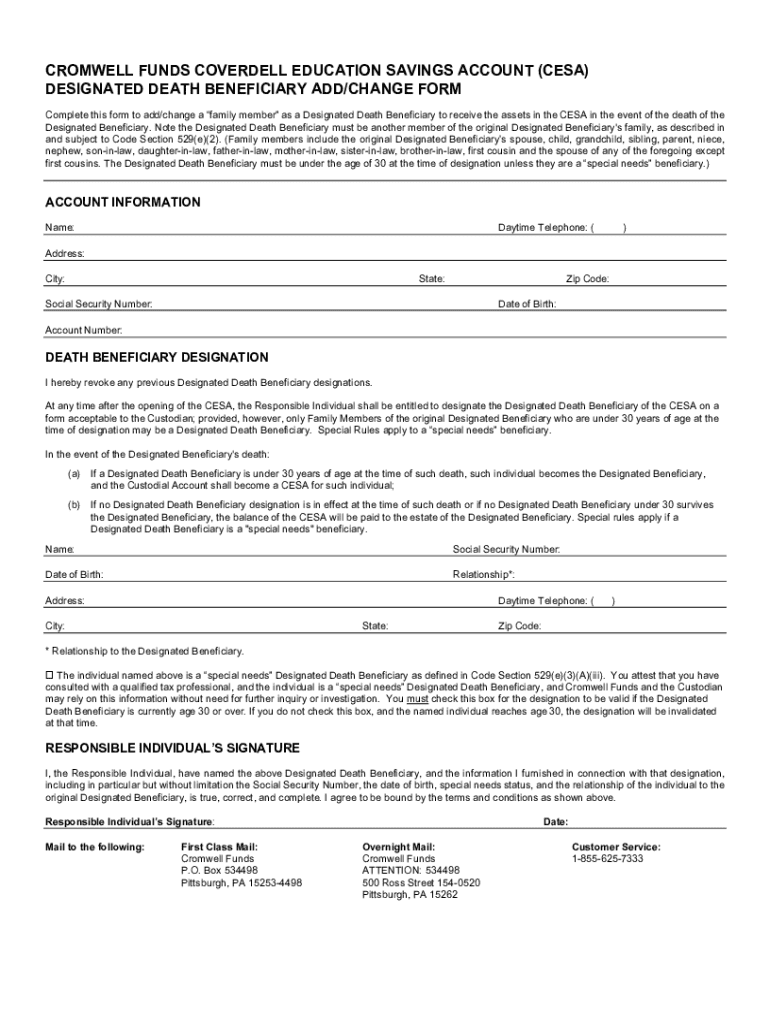

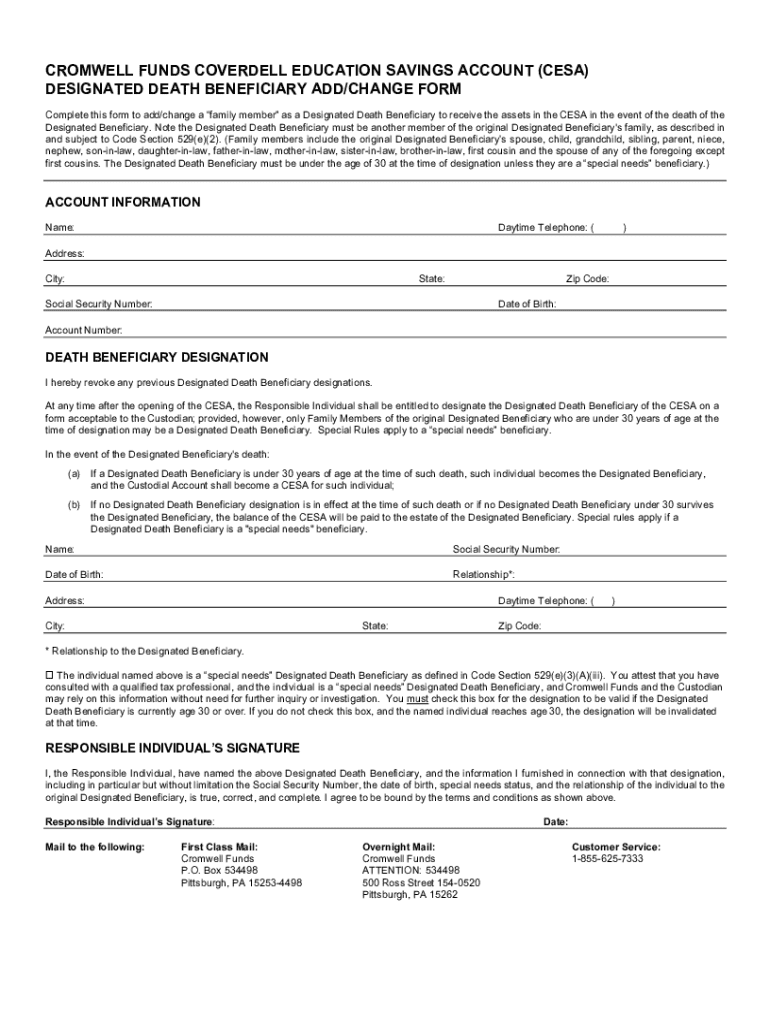

Navigating the Cromwell Funds Coverdell Education Form

Filling out the Cromwell Funds Coverdell Education form is a crucial step in managing your educational investments correctly. Ensuring accuracy in this form helps in the smooth administration of your funds. To start, here's how to access the Cromwell Funds Coverdell form through pdfFiller, a trusted platform for document management.

Follow these simple steps to find and download the form required for your Coverdell Education Savings Account:

Filling out the Coverdell Education Form

Once you've obtained the Cromwell Funds Coverdell Education form, the next step involves filling it out accurately. This ensures that your account is established correctly and that investments can start growing towards educational expenses. Below are detailed instructions on how to fill the form out effectively.

Begin with personal information, including names, addresses, and Social Security numbers, ensuring all data is current and correct. Next, designate beneficiaries and contributors clearly, as these details determine who will benefit from the savings. It's crucial to double-check the information entered in these sections for accuracy.

Lastly, carefully choose your investment options within Cromwell Funds. Each option comes with its set of risks and rewards, so a clear understanding of these facets will aid in making informed decisions that align with your educational savings goals.

Editing and managing your Coverdell form with pdfFiller

pdfFiller offers robust tools for editing your Cromwell Funds Coverdell Education form, making it easier to manage your documents effectively. If you need to make changes after your initial entry, pdfFiller provides various editing features that allow seamless adjustments.

You can utilize pdfFiller’s editing tools to modify text, add notes, or make other necessary alterations without starting over. Additionally, the platform allows users to add digital signatures, making forms legally binding and efficient. This feature is particularly valuable for collaborative efforts, as multiple users can work on a single document.

Once your form is complete and accurate, you can save and securely store it in the cloud. This access means that you can retrieve it from anywhere, making efficient document management a breeze.

Filing and submitting the Coverdell Education form

After ensuring your Coverdell Education form is filled out correctly, the next step is to file and submit it properly. This is crucial to ensure that your account is established without any hindrance. It's recommended to follow best practices during this process to avoid unnecessary delays.

Submissions are typically made to your financial institution or through the designated Cromwell Funds channels. Be sure to familiarize yourself with the intended submission method for the form. Also, note any deadlines or timelines associated with submission to ensure compliance.

Tracking the status of your submitted form is advisable; many financial institutions offer online portals or customer service lines to keep you updated on your application progress.

Frequently asked questions about the Coverdell Education form

It’s common to have questions as you navigate the Cromwell Funds Coverdell Education form. Here are some of the most frequently asked questions to assist you in the process:

Maximizing the benefits of your Coverdell ESA

To truly optimize the benefits of your Coverdell Education Savings Account, adopt long-term strategies that factor in market fluctuations and educational requirements. Understanding how to grow your savings efficiently is crucial for families aiming to provide for their children's education.

Keep in mind key strategies for effective withdrawals as well, ensuring that any expenses incurred are qualified and align with the plan's rules. Regularly reviewing your account will allow you to make necessary adjustments, whether adjusting contributions, changing investment strategies, or reallocating funds based on your evolving financial situation.

Have a question? We are here to help

If you still have questions while navigating the Cromwell Funds Coverdell Education form, pdfFiller provides a plethora of support options. Whether you prefer real-time assistance via online chat or perusing help forums, various resources are available to ensure you receive the help you need.

Additionally, Cromwell Funds' customer service is equipped to address inquiries related to your account or specific fund options. Having quick access to proper support not only enhances your experience but also ensures that you make informed decisions regarding your educational investments.

Stay informed: Read our timely investment insights

To remain updated regarding Cromwell Funds' performance and the intricacies of education savings, consider subscribing to their newsletter. Receiving the latest investment insights as well as educational articles will keep you informed about emerging trends, regulatory changes, and optimal investment practices.

Incorporating a consistent learning approach into your financial strategy will ultimately empower you with the knowledge necessary to make impactful decisions regarding your Coverdell ESA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cromwell funds coverdell education directly from Gmail?

How can I edit cromwell funds coverdell education from Google Drive?

How do I complete cromwell funds coverdell education on an iOS device?

What is cromwell funds coverdell education?

Who is required to file cromwell funds coverdell education?

How to fill out cromwell funds coverdell education?

What is the purpose of cromwell funds coverdell education?

What information must be reported on cromwell funds coverdell education?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.