Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit application form: How-to guide long-read

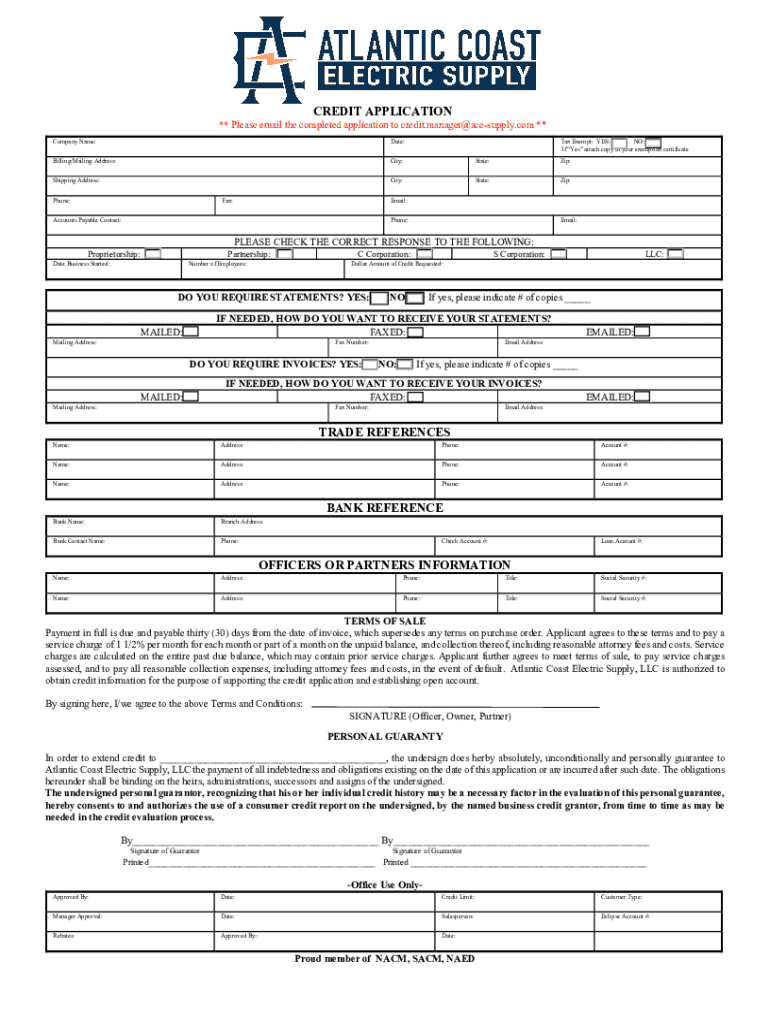

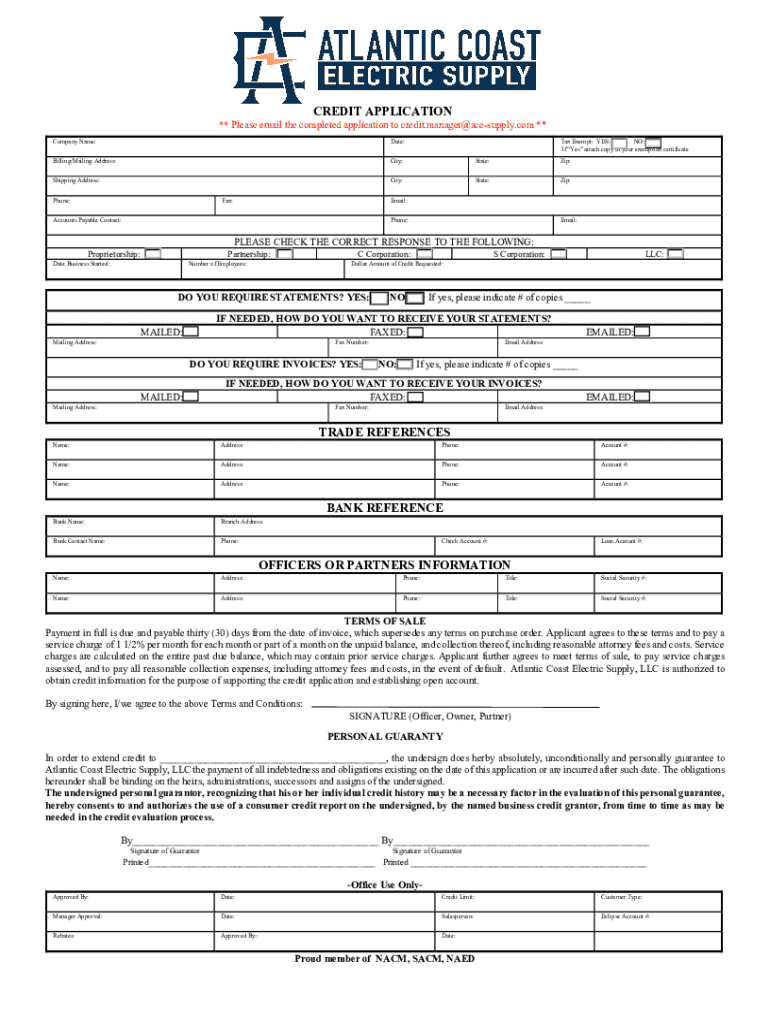

Understanding the credit application form

A credit application form is a document that individuals or businesses submit to lenders to request credit. This form typically requires personal or financial information, enabling lenders to assess the applicant's creditworthiness. The importance of a credit application form extends beyond mere data submission; it often serves as the first step in establishing a financial relationship, whether you are seeking a personal loan, a credit card, or financing for a business.

There are various types of credit application forms tailored to specific needs. Personal credit applications often include details about the applicant's employment, income, and expenses, whereas business credit applications may require information about company revenue, business plans, and existing debts. Understanding these nuances helps applicants choose the right form and approach lenders effectively.

Essential components of a credit application form

A well-structured credit application form typically contains several essential components. The first section focuses on personal information, where applicants must provide details such as their full name, residential address, and contact information. Accuracy in this section is critical; even minor mistakes could lead to delays or misunderstandings in the application process. It’s advisable to double-check this information before submitting.

Following personal information, applicants enter the financial information section. This area demands thorough disclosure of income, monthly expenses, assets, and liabilities. Transparency in this section is paramount because lenders use these details to determine your financial stability and ability to repay the credit requested. Finally, the credit history and consent section is vital, where applicants usually grant permission for lenders to check their credit report and declare any previous credit accounts.

Step-by-step guide to filling out a credit application form

Completing a credit application form is a straightforward process when approached methodically. Step 1 involves gathering necessary documentation. Typical documents include an identification proof (like a driver’s license), income verification (such as pay stubs or tax returns), and financial statements showing assets and liabilities.

In Step 2, it's essential to accurately fill out the personal information section. Ensure your name is spelled correctly, and provide current contact details. Step 3 requires entering financial information. When reporting your income and liabilities, aim for clarity. Listing your sources of income separately and accurately detailing monthly expenses can enhance your application. Step 4 involves reviewing your credit history before submitting the application. Use free credit report services to check for errors or outstanding debts, addressing these issues beforehand can strengthen your application. Finally, in Step 5, sign and submit the application. Whether electronically or in paper format, ensure you’ve included all the required information to avoid delays.

Interactive tools for credit application management

Utilizing tools like pdfFiller can greatly streamline the process of managing credit application forms. With pdfFiller, users can access a range of features that simplify the form filling and editing process. The platform allows users to fill out forms digitally, eliminating the hassle of handwritten applications and enhancing clarity. Additionally, cloud-based access means you can manage your documents from anywhere, a significant advantage for busy individuals or teams.

Collaboration options are another significant benefit of using pdfFiller. If multiple parties are applying for credit together, they can easily share the application and collaborate on necessary edits. The eSigning feature ensures that all parties can sign the document securely and swiftly, streamlining the submission process. This functionality is particularly useful in business scenarios, where multiple stakeholders are involved in financing decisions.

Common mistakes to avoid with credit application forms

When filling out credit application forms, several common pitfalls can jeopardize your application’s success. One of the most significant mistakes is providing inaccurate information. Simple typos or misinformation can raise red flags for lenders and may result in application denial. It is crucial to provide precise information to avoid complications.

Another frequent error is omitting key sections or failing to disclose relevant financial details. Incomplete applications can lead to significant delays or outright denials, so ensure that each section is fully addressed. Lastly, neglecting to review the entire application before submission can be detrimental. A final thorough review allows you to catch any overlooked inaccuracies and provides a last chance to ensure your application meets all requirements.

Understanding the approval process for credit applications

Once submitted, credit applications typically undergo a review and approval process that varies by lender. Upon receiving your application, the lender will assess it against their approval criteria, which often includes evaluating your credit score, debt-to-income ratio, and overall financial health. The timeline for this process can range from a few hours to a few weeks, depending on the lender’s workload and complexity of the application.

Various factors influence approval decisions—most importantly, your credit score and financial history. A higher credit score typically enhances your chances of approval. If your application is denied, it's vital to ascertain the reasons. Many lenders will provide specific feedback, enabling you to understand areas for improvement before attempting to apply again.

Maintaining your credit after application approval

Once your credit application is approved, managing your new credit responsibly becomes crucial. Timely repayments are essential for maintaining a healthy credit score. Set reminders for payment due dates and consider automating payments to avoid late fees, which can negatively impact your credit.

Monitoring your credit score after obtaining new credit is also important. Regularly checking your credit reports for discrepancies and understanding how your new debt impacts your overall credit health will aid in future financial decisions. There are many online resources and tools available that provide insights into your credit status, helping you stay informed and educated about managing your finances.

Frequently asked questions about credit application forms

Questions often arise when submitting a credit application form. For instance, if you're unsure about certain terms, many lenders offer customer support or FAQs on their websites to clarify common concerns. If you discover mistakes post-submission, promptly contacting the lender can sometimes rectify the situation, though it’s crucial to act quickly.

Another question often posed is whether it's possible to apply for multiple credits simultaneously. While it is allowed, keep in mind that multiple applications may negatively impact your credit score if done in a short timeframe, as it signals risk to lenders. Strategically timing your applications and understanding the repercussions will help you manage your credit journey effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit application?

How do I complete credit application online?

Can I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.