Get the free Ct-120

Get, Create, Make and Sign ct-120

Editing ct-120 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-120

How to fill out ct-120

Who needs ct-120?

A comprehensive guide to the CT-120 form

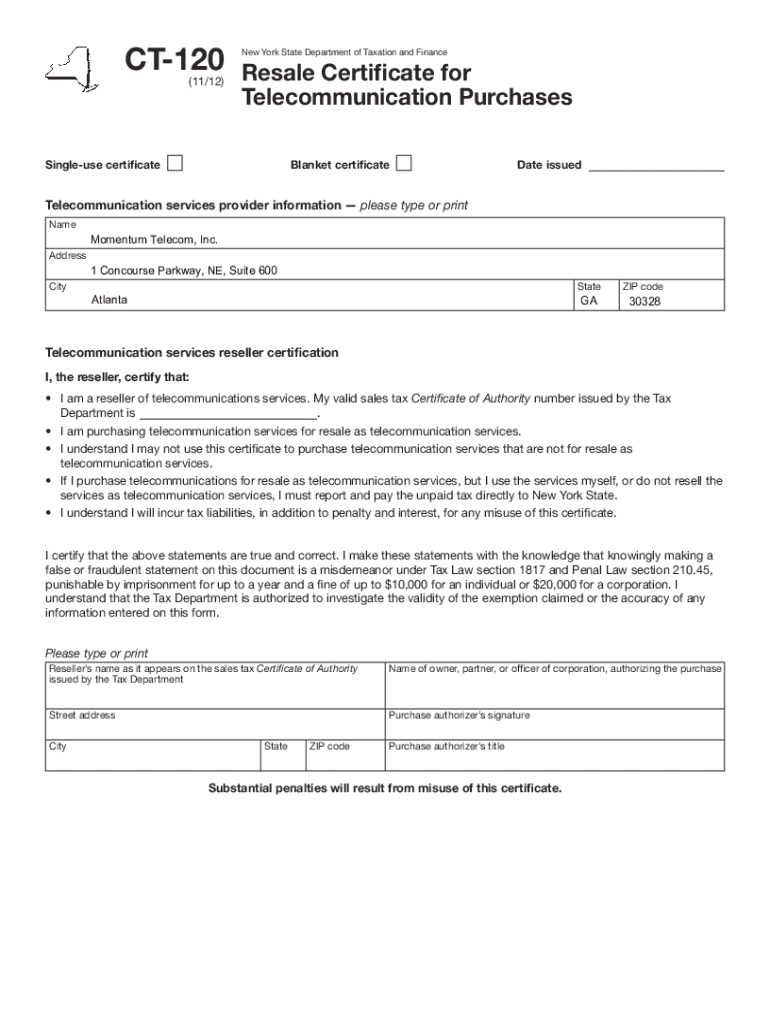

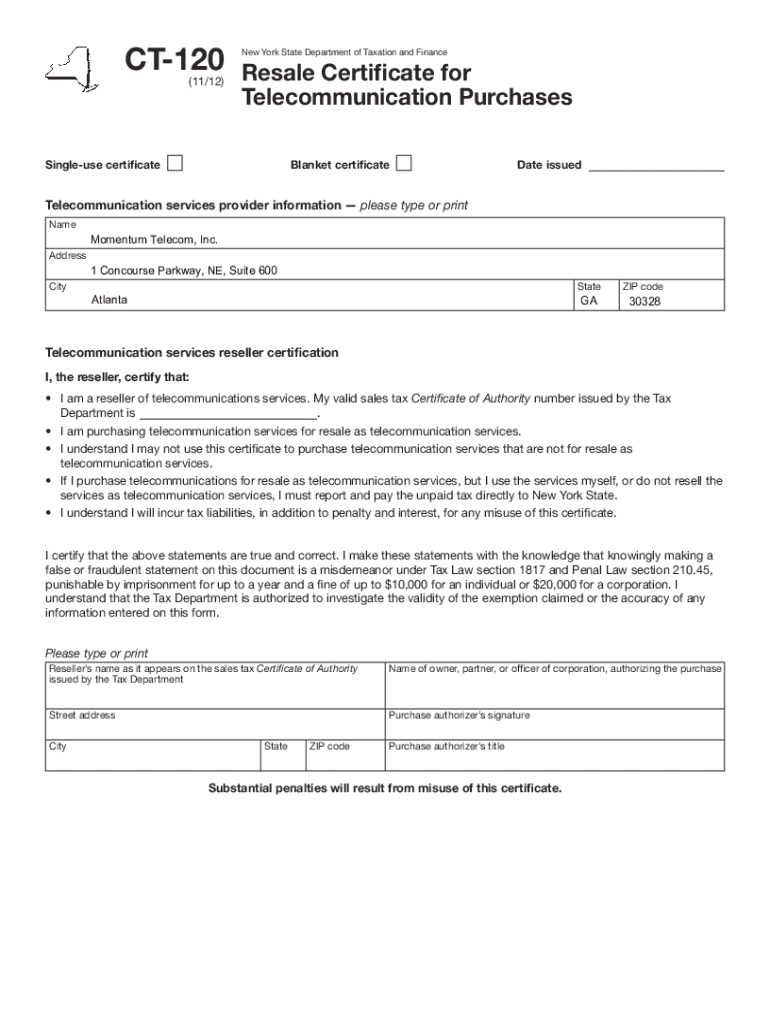

Understanding the CT-120 form

The CT-120 form is a pivotal document required for certain businesses operating in New York State, specifically those taxed as corporations. Its primary purpose is to report the corporation's entire income, allowing for the calculation of the tax owed to the state. Accurate filing is paramount, not just for compliance but also for avoiding penalties that can arise from misreporting income or expenses.

Failure to complete the CT-120 form correctly can lead to discrepancies in tax liabilities, which could result in audits. Individuals and teams responsible for filing this form must pay close attention to the guidelines outlined by the New York State Department of Taxation and Finance to ensure that all necessary information is included.

Preparing to complete the CT-120 form

Before diving into filling out the CT-120 form, it’s crucial to prepare adequately. The first step involves gathering required information. This includes personal identification details, such as the taxpayer ID number, and comprehensive financial data including revenue and expenses related to the business operations.

Additionally, businesses should compile documentation that can substantiate their financial figures, such as profit and loss statements, balance sheets, and any pertinent tax records. Tools like pdfFiller serve as excellent resources, allowing users to streamline the preparation of their CT-120 form with intuitive functionalities.

Moreover, timelines are critical; ensuring the CT-120 form is filed timely can prevent unnecessary penalties. The deadline for submission generally aligns with the corporation's fiscal year-end.

Step-by-step instructions for filling out the CT-120 form

Understanding the structure of the CT-120 form is vital. Here’s a breakdown of each section and the essential information required:

Interactive tools for completing the CT-120 form

pdfFiller’s suite of form-filling tools enhances the completion experience significantly. Users can easily access the CT-120 form through the platform, making use of various interactive features designed to assist with entry and improve accuracy.

For example, the capability to save progress ensures that you can stop and return to your form without losing critical information. This flexibility is beneficial, especially for teams working collaboratively on document preparation.

Editing and customizing your CT-120 form

Once you have filled out the CT-120 form, reviewing and editing is the next essential step. pdfFiller offers users the ability to make changes easily, whether it’s correcting numbers or adding new sections as needed.

Collaborative functionality allows team members to work in real-time, ensuring that any updates to the document are immediately visible. This feature fosters transparency and reduces the chances of errors that can arise from multiple versions of the same document.

Finalizing your CT-120 form submission

Thoroughly reviewing your CT-120 form before submission is critical. It's advisable to double-check all entries for accuracy and completeness of required attachments, as any delays or inaccuracies can lead to processing issues.

Methods for submitting the form electronically vary, but using pdfFiller allows for seamless submission directly through the platform, making the filing process more efficient.

Tracking your CT-120 submission status

After submitting your CT-120 form, keeping track of the submission status is advisable. Users can verify whether their submissions have been processed either by checking their submission history within pdfFiller or contacting the New York State Department of Taxation and Finance directly.

Developing a habit of following up will help address any issues proactively, ensuring a smoother filing experience.

Common questions and troubleshooting

Often, individuals filing the CT-120 form have similar questions that pertain to errors encountered during filing and how to amend submissions efficiently. If errors are discovered post-filing, individuals should immediately investigate the proper procedures for correction based on the type of issue.

pdfFiller's Help Center can be a valuable resource for addressing specific problems and finding answers quickly.

Related forms and filing requirements

In addition to the CT-120 form, businesses may encounter several other corporation-related forms that could be essential for different tax scenarios. Form CT-100 and CT-3 are significant examples that serve varied purposes in terms of corporate reporting within New York State.

Understanding the distinctions between these forms is crucial for effective filing and ensuring compliance with state tax laws.

Additional insights on tax compliance

Accurate tax filing is the backbone of sound financial management for any business. Ensuring that filings are comprehensive and precise not only fosters trust with tax authorities but minimizes the risk of audits or penalties.

Resources for tax exemption forms and FAQs can be particularly useful for those navigating the tax landscape. Each jurisdiction may impose distinct requirements, making localized knowledge invaluable.

Language assistance and accessibility

For individuals who are non-English speakers, it’s vital to have access to resources that ensure understanding and compliance. pdfFiller provides a variety of language options and assistance tools that make document creation accessible for diverse audiences.

Additionally, accessibility features on the pdfFiller platform cater to users with differing needs, making it easier for everyone to manage their documentation effectively.

Contact information for further assistance

If challenges arise during the completion of the CT-120 form or subsequent filings, contacting professionals at the Department of Taxation and Finance can provide clarity. Furthermore, pdfFiller’s dedicated support team is always ready to help users navigate the form completion process.

Utilizing these resources ensures that individuals and businesses can confidently manage their tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct-120 on an iOS device?

How can I fill out ct-120 on an iOS device?

Can I edit ct-120 on an Android device?

What is ct-120?

Who is required to file ct-120?

How to fill out ct-120?

What is the purpose of ct-120?

What information must be reported on ct-120?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.