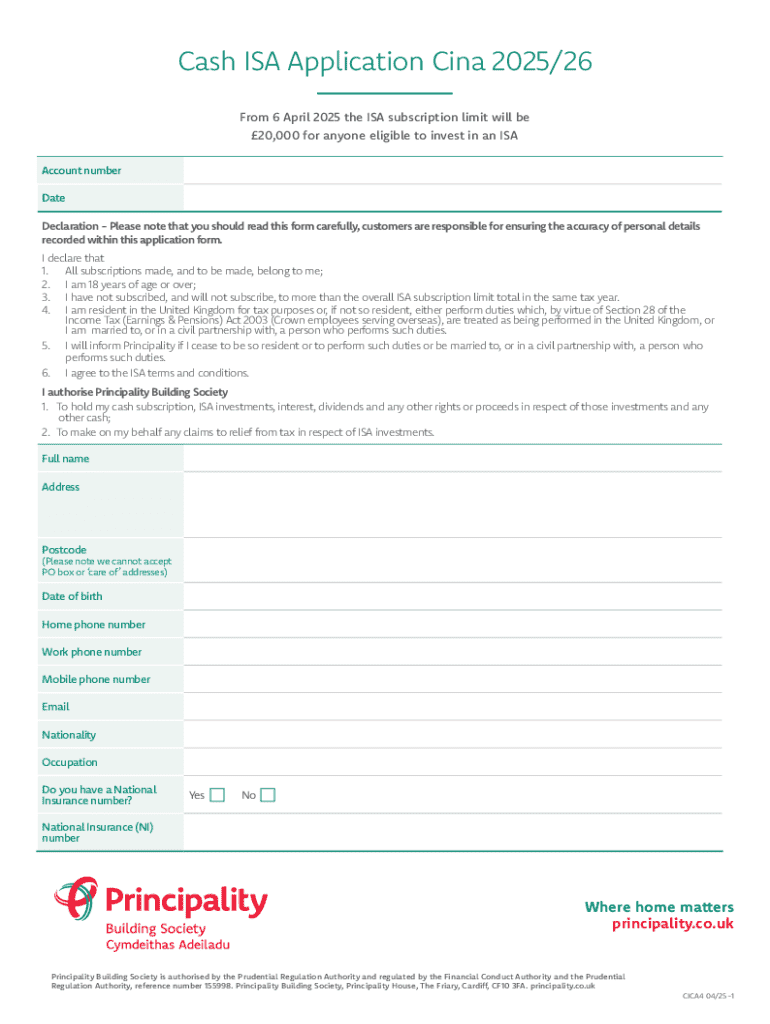

Get the free Cash Isa Application Cina 2025/26

Get, Create, Make and Sign cash isa application cina

How to edit cash isa application cina online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash isa application cina

How to fill out cash isa application cina

Who needs cash isa application cina?

Cash ISA Application CINA Form: A Comprehensive Guide

Overview of cash ISAs

A Cash ISA, or Individual Savings Account, is a tax-efficient savings account available to UK residents, allowing individuals to save money without paying tax on the interest earned. With increasing living costs and financial uncertainty, cash ISAs have become a popular choice for those looking to grow their savings while minimizing tax liabilities.

The importance of Cash ISAs lies in their ability to offer tax-free interest, which can significantly enhance savings outcomes, particularly for those saving for critical life events such as buying a home or planning retirement. Investing within a Cash ISA means any interest accrued remains untaxed, allowing savers to benefit more from their funds.

Understanding the cash ISA application process

The application process for a Cash ISA begins with completing the Cash ISA Application CINA Form. This form is pivotal as it gathers essential personal and financial information needed to establish your account. Understanding the requirements and ensuring you meet the eligibility criteria is crucial to avoid delays.

To qualify for a Cash ISA, applicants must be at least 16 years old and reside in the UK, with some providers requiring you to be a UK citizen or permanent resident. Accurate information in the application is paramount; even minor discrepancies can lead to processing delays or rejection of your application.

Step-by-step guide to completing the cash ISA CINA form

Completing the Cash ISA Application CINA Form can seem daunting, but breaking it down into manageable sections can simplify the process. This section will guide you through each part of the form, ensuring that you know exactly what information to provide.

The form typically consists of several key sections, including personal and contact information, as well as financial details. Ensuring accuracy in these areas is critical as any errors can hinder application processing.

Common mistakes include spelling errors, using incorrect addresses, or failing to provide the necessary identification. Double-checking your application can save time and prevent unnecessary delays.

To ensure your application is complete, consider the following tips: Review the form after filling it out, keep a copy for your records, and verify that you have included all required documentation.

Submitting your cash ISA application

Once you have completed the Cash ISA Application CINA Form, the next step is submitting it. There are typically two methods for submission: online and paper. Utilizing online platforms can streamline this process significantly.

Online submission through platforms like pdfFiller allows for quick completion and easy filing. Simply upload, fill out, and submit your form digitally, which can save time and ensure accuracy. Alternatively, if you choose a paper submission, follow your provider’s instructions for mailing or delivering your application.

After submission, you will typically receive a confirmation of your application. This may take a few days, depending on the provider's processing times. It’s advisable to keep an eye on your email for a confirmation message, which will provide insight on your application’s progress.

Managing your cash ISA post-application

After successfully opening a Cash ISA, managing your account becomes essential to ensure you maximize your savings. Accessing your account can often be done through the pdfFiller platform, which allows you to manage documents effortlessly.

Understanding the features and benefits of your Cash ISA will help you take full advantage of the savings potential. Most Cash ISAs offer options for flexible withdrawals and transfers, which can further enhance your financial strategies.

Frequently asked questions (FAQs)

When applying for a Cash ISA, many questions may arise, especially regarding the application process. Here are answers to common queries about the Cash ISA Application CINA Form to help clarify doubts.

Additional information on cash ISA types

Knowing the different types of Cash ISAs can enhance your savings strategy. There are primarily two forms: fixed-rate and variable-rate ISAs. Each has unique features suited for different financial goals.

Fixed-rate Cash ISAs generally offer a higher interest rate locked over a specific term, while variable-rate ISAs may fluctuate based on underlying interest trends. Consider your financial situation and future needs when selecting the type of Cash ISA that suits you.

Resources for further guidance

Utilizing available resources can help you navigate the Cash ISA landscape more efficiently. Interactive tools specifically designed to calculate potential savings can provide you insights into how much you can grow with a Cash ISA.

Additionally, customer support for application-related queries is invaluable. Do not hesitate to reach out for assistance when filling out the Cash ISA Application CINA Form through resources like pdfFiller, which offers document templates and comprehensive tools to ensure your experience is seamless.

Conclusion

In summary, a Cash ISA provides a fantastic way to save money tax-free, making it an essential tool for anyone looking to enhance their savings. The Cash ISA Application CINA Form is your gateway to this financial advantage, and through careful completion and management, individuals can reap substantial benefits.

Take the first step towards achieving your savings goals by gathering your information and filling out your Cash ISA Application CINA Form today. Remember, using platforms like pdfFiller can simplify the process and ensure accuracy, allowing you to focus on what truly matters — your financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cash isa application cina without leaving Google Drive?

How can I send cash isa application cina to be eSigned by others?

Can I create an electronic signature for signing my cash isa application cina in Gmail?

What is cash isa application cina?

Who is required to file cash isa application cina?

How to fill out cash isa application cina?

What is the purpose of cash isa application cina?

What information must be reported on cash isa application cina?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.