Get the free Crs Self Certification Form – Individual

Get, Create, Make and Sign crs self certification form

Editing crs self certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self certification form

How to fill out crs self certification form

Who needs crs self certification form?

CRS Self Certification Form: A Comprehensive How-to Guide

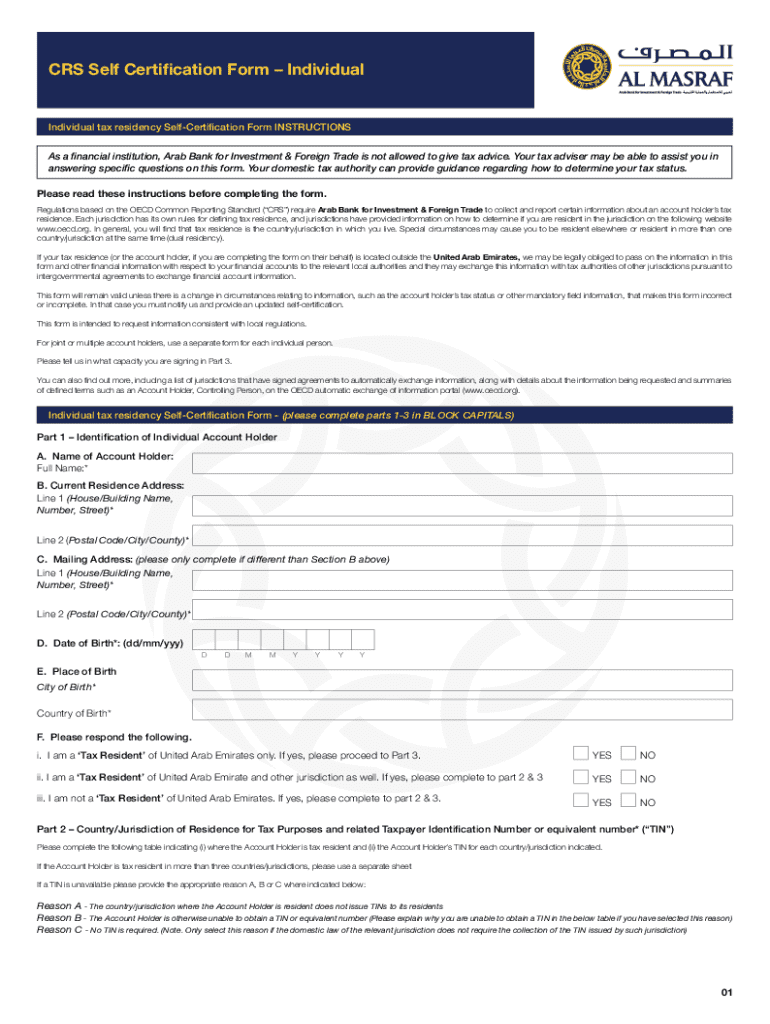

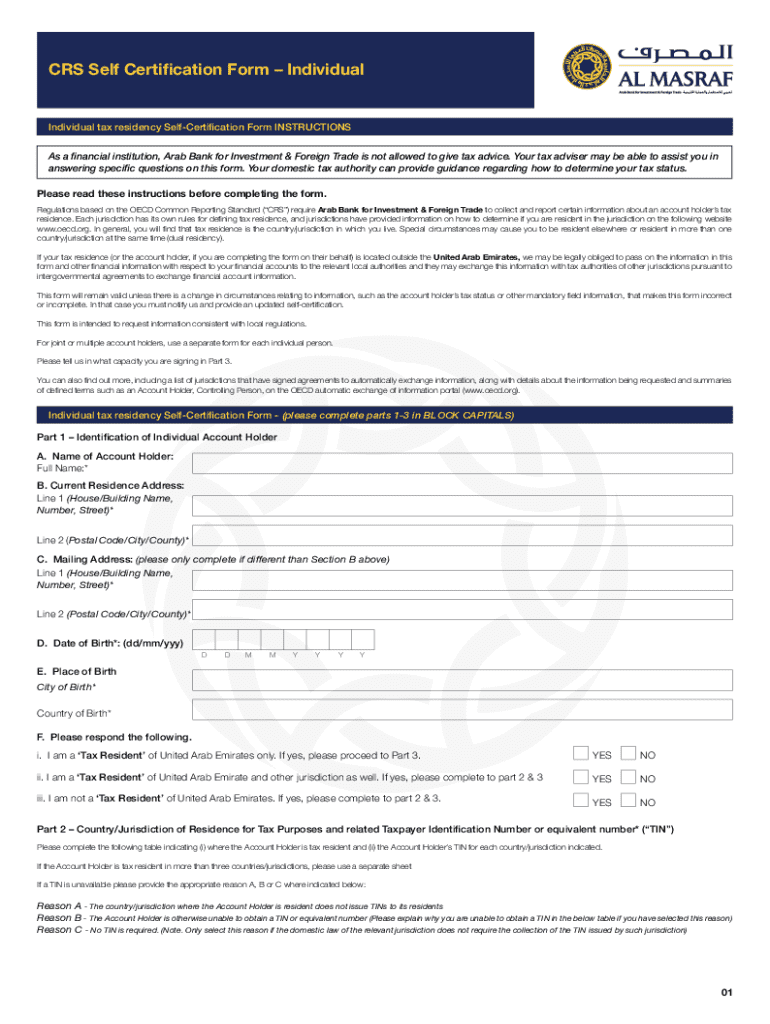

Understanding the CRS Self Certification Form

The Common Reporting Standard (CRS) is an international standard for the automatic exchange of financial account information between governments. Developed by the Organisation for Economic Co-operation and Development (OECD), it aims to combat tax evasion globally. The CRS Self Certification Form is a document used by financial institutions to collect information from account holders to comply with tax reporting obligations.

Filling out the CRS Self Certification Form is essential for maintaining tax compliance, as it enables governments to identify and report foreign financial accounts held by their residents. This self-certification helps ensure that individuals provide accurate information about their tax residency, which in turn aids in international efforts to combat tax evasion.

Key components of the CRS Self Certification Form

The CRS Self Certification Form consists of multiple sections aimed at collecting comprehensive information on the account holder. Understanding each component is critical for accurate completion.

Detailed breakdown of form sections

Common terms such as 'tax residence' and 'account holder' are defined within the form. Understanding these definitions is paramount to avoid mistakes in the submission process.

Accuracy in providing this information is essential; errors can lead to compliance issues or delays. Therefore, guidelines on submitting accurate details are generally included with the form.

Filling out the CRS Self Certification Form

Completing the CRS Self Certification Form is straightforward if approached methodically. Here’s a step-by-step guide to assist you.

Step-by-step instructions for completing the form

Common errors to avoid

Tools and resources for filling out the form

Utilizing tools and resources can simplify the process of completing the CRS Self Certification Form. pdfFiller offers various features that enhance the experience.

Interactive tools provided by pdfFiller

Accessibility across devices

Managing your CRS Self Certification Form

Once you’ve completed your CRS Self Certification Form, managing it effectively is crucial for personal compliance and future reference.

How to ensure compliance with local regulations

Stay informed about local tax regulations and updates related to CRS self-certification requirements. This can vary by jurisdiction and impact your compliance obligations.

Keeping meticulous records is not just beneficial for tax reasons; it can also help you in cases where you are audited or need to provide proof of tax residency.

Frequently asked questions about the CRS Self Certification Form

Several common questions arise concerning the CRS Self Certification Form that can provide clarity for individuals filling it out.

Best practices for ensuring successful submission

Implementing best practices when filling out and submitting the CRS Self Certification Form can streamline the entire process.

Examples of completed CRS Self Certification Forms

Understanding various scenarios can help clarify the nuances of filling out the CRS Self Certification Form.

Sample scenarios for different tax residents

Highlighting common annotations and clarifications in examples can also prevent confusion among filers, ensuring the completion of the CRS Self Certification Form is both effective and compliant.

Tips for navigating CRS compliance

Engaging with tax advisors or financial institutions can prove beneficial for individuals navigating CRS compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit crs self certification form on a smartphone?

Can I edit crs self certification form on an iOS device?

How do I complete crs self certification form on an iOS device?

What is crs self certification form?

Who is required to file crs self certification form?

How to fill out crs self certification form?

What is the purpose of crs self certification form?

What information must be reported on crs self certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.