Get the free Crawford County Small Business Assistance Loan Program

Get, Create, Make and Sign crawford county small business

Editing crawford county small business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crawford county small business

How to fill out crawford county small business

Who needs crawford county small business?

Crawford County Small Business Form: Your Essential Guide

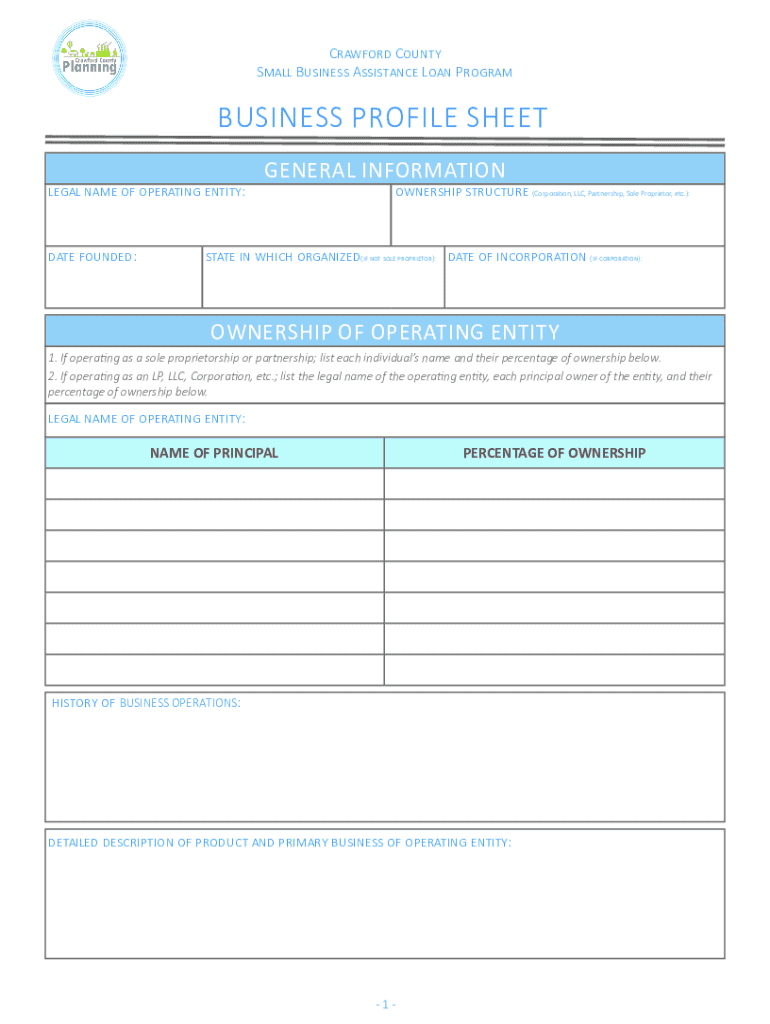

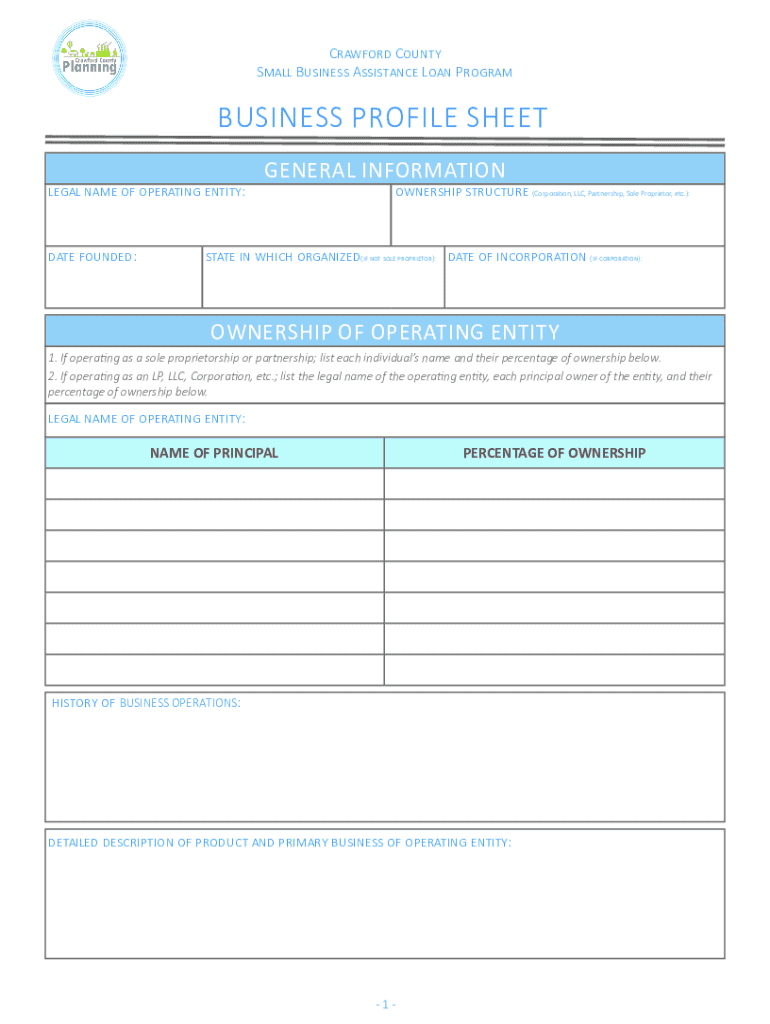

Overview of Crawford County Small Business Form

The Crawford County Small Business Form holds significant importance for local entrepreneurs aiming to establish and develop their business ventures. Designed to streamline the application process, this form acts as a cornerstone for business registration and compliance within the area. Using this form allows business owners to more effectively navigate the regulatory landscape, access local resources, and tap into potential financial support.

Key benefits of utilizing the Crawford County Small Business Form include improved organization of required information, faster processing of applications, and enhanced assistance from local business development partners. Entrepreneurs in various fields such as retail, service, and tech can find the form essential for their operations.

Understanding the requirements

To successfully complete the Crawford County Small Business Form, it is crucial to understand the eligibility criteria and required documentation. A small business in Crawford County is typically defined as an independently owned and operated entity with fewer than 500 employees. Businesses looking to apply should gather documentation that showcases their operational plans and financial status.

Additionally, applicants will need to outline their business history, including any licenses and permits if applicable. Demonstrating a comprehensive understanding of these requirements can significantly affect the success of your application.

Step-by-step guide to completing the form

Completing the Crawford County Small Business Form involves several critical sections. Each part requires careful attention to detail to ensure accuracy and compliance with local regulations. Here's how to navigate each section:

Section 1: Basic Information

Start with your business name, address, and primary contact information. Make sure that all entries are accurate and up-to-date, as discrepancies may lead to processing delays.

Section 2: Business Structure and Ownership

Identify the structure of your business—whether it's an LLC, Corporation, or Sole Proprietorship. This information is crucial as it affects your tax obligations and liability. Clearly list all owners and their roles within the business, as this will facilitate communication with local authorities.

Section 3: Business Financials

This section requires a detailed account of your start-up costs, projected revenues, and anticipated expenses. Use realistic figures and if possible, back them with market research to strengthen your application. Proper documentation will enhance the credibility of your financial claims.

Section 4: Additional Details

Provide information about any required business permits and licenses specific to Crawford County. Compliance with local regulations is non-negotiable. Without the appropriate permits, your business could face shutdowns or fines.

Editing and customizing your form

Leveraging tools such as pdfFiller will significantly ease the process of editing and customizing your Crawford County Small Business Form. This platform offers user-friendly editing tools that allow for seamless correction of errors and formatting enhancements, ensuring a polished final submission.

Enhancing your form with eSignatures

eSignatures are crucial in today’s digital filing processes. They not only speed up the signing process but also enhance the security of your documents. With pdfFiller, adding a secure eSignature to your small business form is straightforward. Follow the prompts within the pdfFiller platform to ensure your documents are legally binding and ready for submission.

Submission process explained

Once your form is complete, the next step is submission. Business owners in Crawford County can typically submit their small business form through various methods: online, via mail, or in person. It’s important to choose the method that best suits your needs, ensuring that you have trackable proof of submission.

For potential follow-ups, keep a record of your submission date and refer to the Crawford County Small Business Office for estimated processing times and updates on your application’s status.

Collaboration and managing your documents

Working as a team while preparing the Crawford County Small Business Form can enhance the input quality and accuracy. pdfFiller provides features that support team collaboration, where members can share the document and provide feedback easily. Use sharing options available on the platform to ensure that all contributors are aligned and informed.

Organizing and storing your forms

Keeping your documents organized is crucial for ongoing business operations. With pdfFiller, establishing a digital document management system becomes less daunting. Implement tools that allow easy retrieval of your forms and ensure a clear structure for your files.

Insights on local resources for small businesses

Crawford County offers a wealth of resources for small businesses, enhancing their potential for success. Local business associations, such as the Chambers of Commerce, serve as invaluable partners in facilitating connection and support within the business community.

Engaging with these organizations can open doors to myriad networking and event opportunities that can enhance your business’s growth and visibility in Crawford County.

Frequently asked questions about the Crawford County small business form

Many potential applicants have questions regarding the Crawford County Small Business Form. Some common queries encompass the necessary documentation and troubleshooting tips for successful submissions.

Providing clear answers to these queries not only aids in simplifying the process but also fosters confidence in submitting your form accurately.

Final tips for success

Achieving success in completing the Crawford County Small Business Form hinges on attention to detail and knowledge of best practices. Errors can lead to unnecessary delays and complications, so ensure that you double-check all entries before submission.

In this competitive environment, being well-prepared will enable your business to thrive from the outset.

Resources for ongoing business support

As your business evolves, staying aware of supplementary resources is critical. pdfFiller provides access to related documents and forms that may assist in various business transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my crawford county small business in Gmail?

Where do I find crawford county small business?

How do I fill out crawford county small business on an Android device?

What is crawford county small business?

Who is required to file crawford county small business?

How to fill out crawford county small business?

What is the purpose of crawford county small business?

What information must be reported on crawford county small business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.