Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form How-to Guide

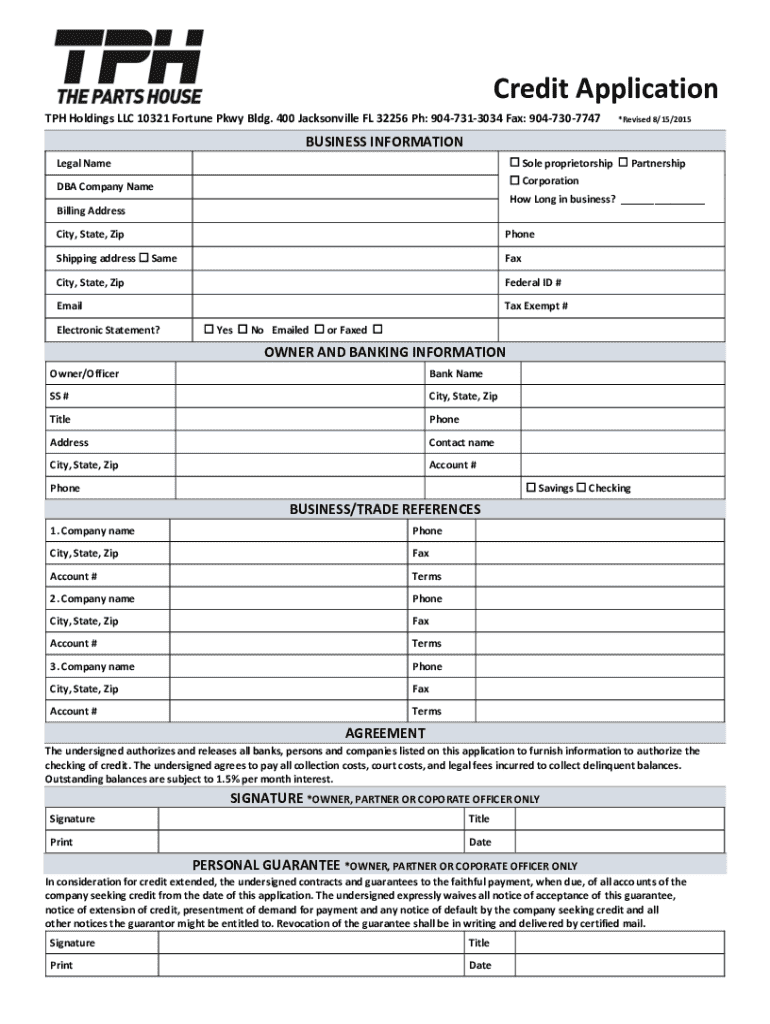

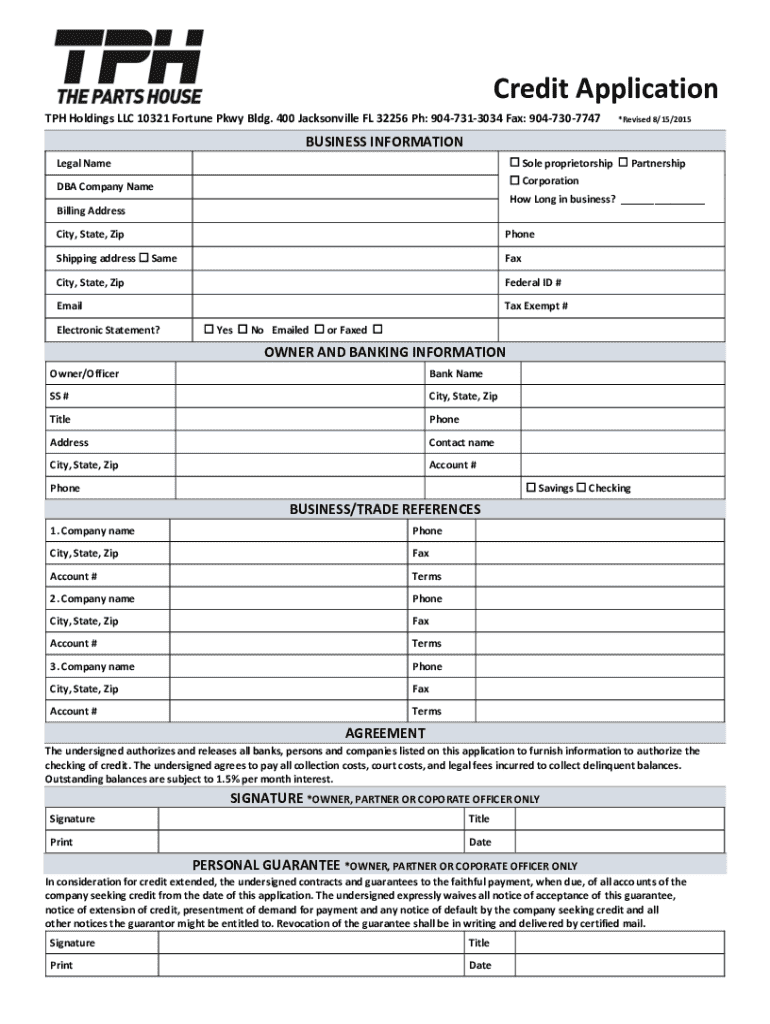

Understanding the credit application form

A credit application form is a document that helps lenders assess the financial health and creditworthiness of a borrower. This form collects personal and financial information to facilitate lending decisions, whether for personal loans, mortgages, or credit cards.

Providing accurate information on your credit application is crucial. Inaccuracies can delay processing or even lead to denial. Lenders base their decisions on the information you provide, making it essential to be honest and thorough.

Key components of a credit application form

Credit application forms typically contain several key sections that gather crucial information about the applicant. Understanding these components will aid in completing the form accurately.

The personal information section collects basic details such as your name, address, and contact details. Additionally, your Social Security number and date of birth are required to verify your identity.

Preparing to fill out the credit application form

Before diving into the credit application form, preparing through document collection ensures a smoother process. This preparation involves gathering essential documentation, which will support your application.

Key documents include identification proof, such as a driver's license or passport, proof of income like pay stubs or tax returns, and if relevant, your credit report. Being aware of your credit score is also beneficial, as it influences lending decisions.

Step-by-step instructions for completing the credit application form

Filling out the credit application form can feel daunting, but a step-by-step approach simplifies the process considerably. Begin by accurately filling in personal information.

Include details such as your full name, current address, and phone number. Ensure that your Social Security number and date of birth are correct, as this information is crucial for identity verification.

Interactive tools and resources

Using online resources simplifies the credit application process significantly. Platforms like pdfFiller provide tools to create, edit, and manage credit application forms effectively.

With online PDF tools, you can easily fill out forms, sign them, and manage your documents all in one location. These tools offer various features that enhance the application experience.

Tips for submitting your credit application form

Submission of your credit application form is a critical step that can impact the outcome. Best practices vary depending on whether you're submitting electronically or via paper.

Take care to follow submission guidelines closely. After submission, it's also wise to track your application's status, allowing you to stay informed about the process.

Common pitfalls to avoid

Mistakes during the credit application process can have long-lasting effects. Being aware of common pitfalls can help you navigate the application more effectively.

One of the biggest errors is misrepresenting your information. This can lead to serious consequences, including application denial or even legal ramifications. Additionally, be aware of deadlines and the importance of understanding the terms and conditions associated with your application.

Next steps after submission

Upon submitting your credit application, it's essential to know what comes next. Understanding the approval process can save you time and anxiety.

The timeline for approval can vary widely based on the lender, and factors influencing credit decisions include your credit history, income, and existing debts.

Leveraging pdfFiller for future applications

Once you complete the credit application form, managing and storing it securely is vital. pdfFiller offers benefits of a cloud-based document management system that allows you to store and access your applications anytime.

Utilizing pdfFiller’s features for editing, collaborating, and signing other forms enhances your overall document management experience, making future applications easier.

FAQs about credit application forms

Questions about credit applications are common, particularly among new borrowers. Addressing these concerns can clarify uncertainties and provide additional insight.

For instance, many self-employed individuals wonder how their status affects their applications. Others may question what steps to take if errors are discovered after submission or if changes can be made post-application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit application without leaving Google Drive?

How can I get credit application?

How do I edit credit application straight from my smartphone?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.