Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

A comprehensive guide to credit application forms

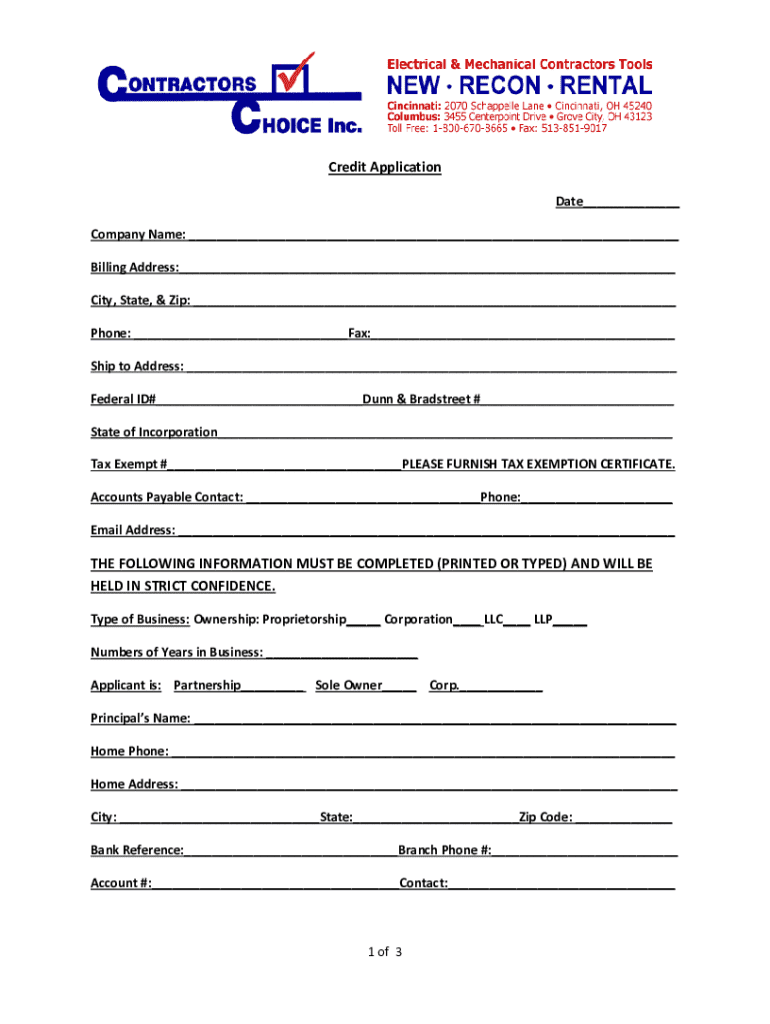

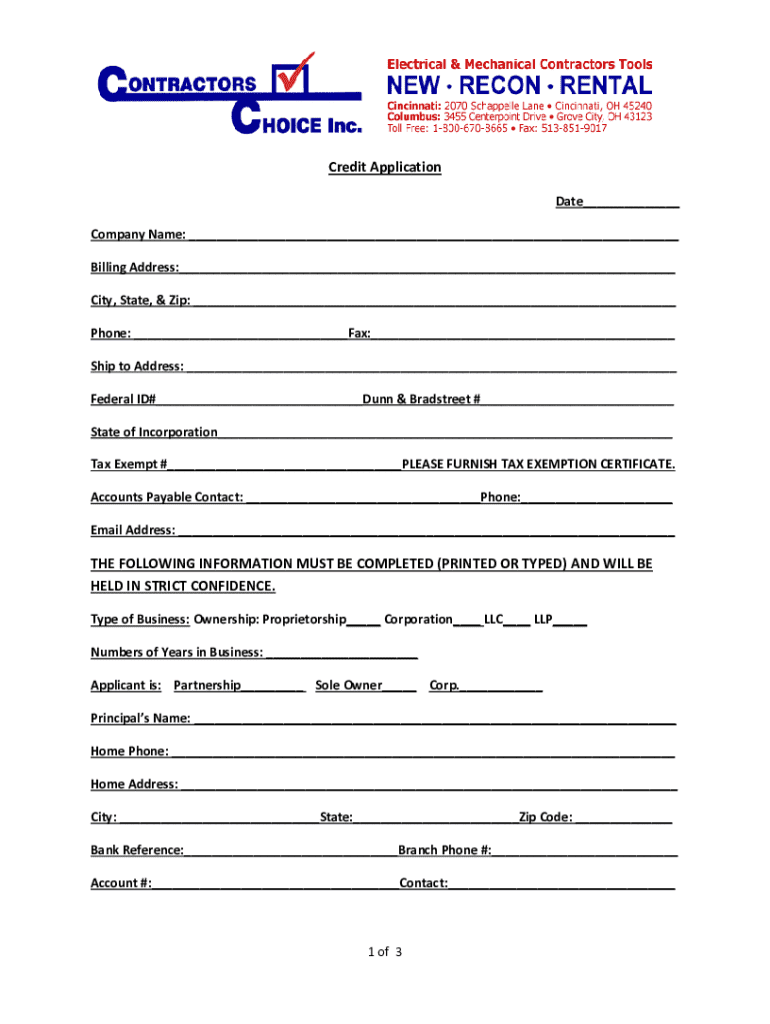

Understanding the credit application form

A credit application form is a crucial document used by lenders to assess the creditworthiness of an individual or a business. This form collects various pieces of information that help lenders determine whether to extend credit and under what terms. When you apply for a credit card, loan, or mortgage, this form is often the first step in the credit approval process.

The importance of the credit application form cannot be overstated; it serves as the foundation for your credit assessment. Lenders rely on the details provided to evaluate your financial health, your reliability as a borrower, and the level of risk associated with lending to you. Accurately completed forms facilitate quicker decisions and may improve your chances of approval.

Types of credit application forms

There are generally two main categories of credit application forms: personal and business. A personal credit application is used by individuals to request credit for personal means, such as credit cards or auto loans. These applications are often straightforward, requiring personal and financial information.

On the other hand, a business credit application may involve more extensive documentation, especially if the business is seeking significant credit to facilitate operations. These applications usually require additional details such as tax identification numbers, business structure information, and sometimes personal guarantees from owners or partners.

Another consideration is the format of the application. Online applications offer convenience and instant processing, while paper applications may require mailing time. Each format has its benefits and drawbacks, depending on the user's access to technology and personal preferences.

Preparing to fill out your credit application form

Before filling out a credit application form, it is essential to gather all necessary documentation. Start by collecting proof of income, such as pay stubs or tax returns, and any details regarding existing debts. This preparation helps ensure your application reflects an accurate financial picture, which can accelerate the approval process.

Additionally, understanding your credit score is vital, as it can significantly impact your application. Major lenders often perform a credit check as part of the approval process. Knowing your score ahead of time allows you to address any inaccuracies or issues that may hinder your application.

Step-by-step guide to completing your credit application form

Completing a credit application form involves several sections, each requiring careful attention to detail. Start with the 'Personal Information' section; accurately fill in your name, address, and social security number. Review each entry for completeness to avoid delays in processing.

Next, the 'Financial Information' section requires details about your income and any debts you hold. Provide precise figures to prevent discrepancies. The 'Employment Details' section will ask for your employer's name, your job title, and how long you have been employed there. Be honest and thorough as lenders may verify this information.

Before submission, it is crucial to review your application thoroughly. Cross-check all the information as minor errors can lead to denial. Prepare a checklist to confirm that all sections are filled and that supporting documents are attached.

Editing and managing your credit application form

Once your credit application form is completed, you may want to utilize tools for editing to ensure it reflects all necessary and accurate information. pdfFiller offers a plethora of editing features that allow users to adjust content, formatting, and layout in PDF documents. This capability is especially useful if you realize something needs to be amended after noticing it during the review.

The submission process is simplified with pdfFiller's eSignature feature. By digitally signing your application, you expedite the submission without the need for printing and mailing. Collaborating with advisors or co-applicants is also straightforward; you can easily share the form, allowing others to contribute comments or notes that enhance your application.

Tracking your credit application status

After submission, understanding the review process is crucial for managing expectations. Lenders typically provide a timeline for approval, and it can vary widely—from a few hours to several days, depending on the complexity of your application. During this review, the lender may contact you to clarify certain details or request additional documentation.

In the unfortunate event your application is denied, don’t despair. This outcome is not the end of the road. Contact the lender to understand the reasons behind the denial, as this feedback can be invaluable for improving your creditworthiness in future applications. Whether it involves addressing credit score issues or gathering more information, taking proactive steps can help ensure better results next time.

Advanced tips and tricks for credit application success

A critical strategy in managing credit applications is how to handle multiple applications simultaneously. While it may be tempting to apply for multiple credit options, this can backfire if not managed carefully. Each application triggers a hard inquiry on your credit report, which can temporarily lower your credit score. A well-thought-out strategy involves limiting applications to only those that truly match your needs and financial status.

Timing can also play a critical role in application success. Certain periods, such as post-holiday seasons or when financial products are heavily marketed, may yield better results. Preparing your credit profile ahead of significant financial decisions, such as applying for a mortgage, can provide a distinct advantage.

Common FAQs related to credit application forms

A common question arises regarding changes to information after submission. If you realize you need to correct or update something after you've sent in your form, contact the lender immediately to inform them. Clear communication is crucial in these situations.

Another frequent concern centers around correcting errors on a submitted application. If a mistake is caught early, reach out directly to the lender to rectify the issue. Remember that accuracy in your application can significantly influence the response from lenders.

Exploring alternative options

For those who may encounter difficulties with traditional credit applications, alternative options exist. Peer-to-peer lending platforms offer a unique avenue where individuals can borrow money from other people instead of traditional financial institutions. Another option includes secured credit cards, which require a cash deposit; these can improve your credit score when used responsibly.

Additionally, seeking professional guidance through credit counseling can offer strategies and resources that help improve overall credit management. These services guide individuals on budgeting, credit repair, and how to enhance your financial standing before a new credit application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute credit application online?

How do I complete credit application on an iOS device?

How do I edit credit application on an Android device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.