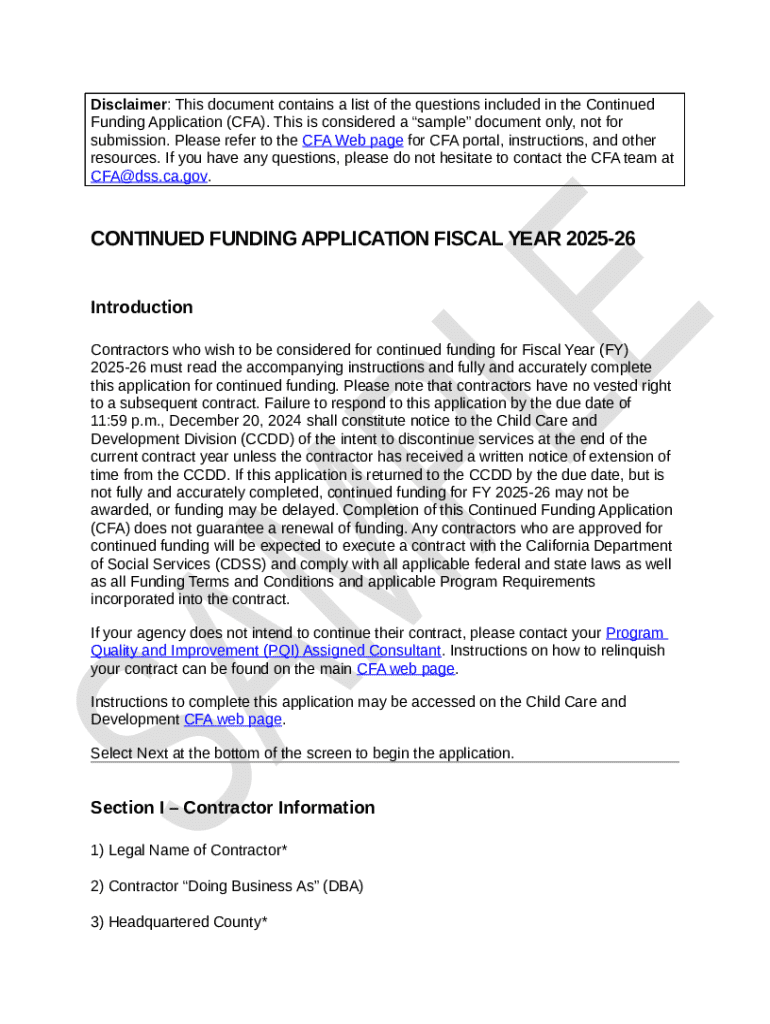

Comprehensive Guide to the Continued Funding Application CFA Form

Understanding the continued funding application (cfa)

A continued funding application (CFA) is an essential document used by organizations to secure ongoing financial support for their projects or programs. This form is crucial for maintaining continuity in funding, especially for initiatives that depend on external sources for their operational budgets. By submitting a CFA, organizations can demonstrate the impact of their projects and justify their need for continued funding. It serves not only as a request for renewed financial support but also as a mechanism to provide funders with updates on progress, outcomes, and any planned adjustments to project implementation.

Eligibility criteria for submitting a CFA can vary significantly depending on the funding organization. Generally, applicants must be in good standing with previous grants and demonstrate that their project has met prior objectives. Most funders will also look for continuity in project management, targeted outcomes, and a transparent budget, ensuring that applicants have effectively utilized previous funding. Understanding these criteria is vital, as it directly influences whether an organization can successfully apply for further financial assistance.

Key components of the cfa form

The CFA form comprises several critical sections, each designed to capture specific information necessary for the evaluation of your application. Here, we break down the fundamental parts of the form:

Project Overview: A concise summary of the project, outlining its goals, target population, and anticipated outcomes.

Financial Information: Details of the budget, including expenses incurred, funds remaining, and a breakdown of how new funding will be allocated.

Supporting Documentation: This includes financial statements, previous funding reports, and any other relevant records that substantiate the application.

Signatures and Submission: A section where authorized representatives must sign and date the form to confirm its authenticity and accuracy.

While filling out the CFA, becoming acquainted with important terminology is also crucial. Understanding terms like 'line-item budget,' 'outcomes assessment,' and 'program sustainability' will help both in drafting your application and in discussions with potential funders.

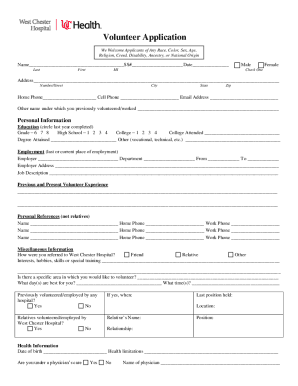

Step-by-step guide to completing the cfa form

Before diving into the actual completion of the CFA form, preparation is crucial. This involves gathering all necessary documents and relevant information that will inform your application. Important materials include:

Financial statements: Recent financial documents that reflect your organization’s current status.

Previous funding details: Information on prior applications and fund allocations.

Project outcomes and milestones: Data evidencing the success of your initiative thus far.

Once prepared, you can begin filling out the CFA form. Here’s a breakdown of what to include in each section:

Personal and Organizational Information: Include key details such as your organization's name, address, contact information, and tax ID number.

Project Details: Clearly articulate your ongoing project, its objectives, the target population, and its anticipated impact. Be specific and compelling.

Budget Justifications: This section should outline your financial request with justifications for each line item in your budget. Explain how these funds will contribute to achieving project goals.

Documentation Upload: Compile and attach necessary supporting documents as specified by the funding agency. Make sure to follow their guidelines regarding file formats and limits.

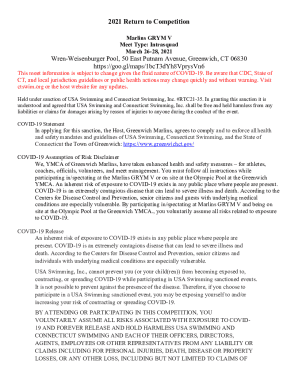

Tips for a successful application

When submitting a CFA, avoiding common mistakes can significantly improve your chances of success. Pay close attention to these pitfalls:

Incomplete forms: Ensure all sections are filled out entirely, including required signatures.

Lack of clarity: Avoid using jargon or overly complex language. Write in a straightforward manner that communicates your project effectively.

Missing documentation: Verify that all requested supporting documents are included and properly formatted.

Best practices for crafting your CFA narrative involve effectively communicating project goals and measurable outcomes. Use concrete data and quotes from beneficiaries if applicable. When discussing anticipated future impacts, be optimistic yet realistic.

Utilizing online tools, such as pdfFiller, can streamline your application process. With interactive editing features and eSignature options, you can not only edit your CFA form easily but also expedite approvals through digital signatures.

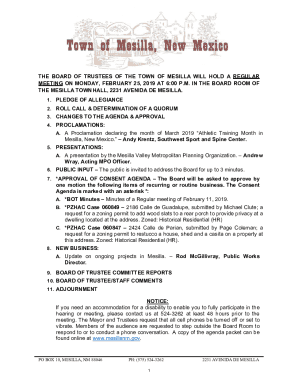

Managing your cfa submission

Once your CFA is submitted, tracking its status is vital to understand the follow-up process. Most funding organizations provide a way to check application status, which can save time and reduce uncertainty.

After submission, expect a specific timeline for review, which is typically communicated through acknowledgment emails. Depending on the organization’s workload, the review process can vary greatly, but preparing for potential outcomes — approvals, requests for additional information, or rejections — is essential.

If your application requires revisions or faces rejection, do not be discouraged. Carefully follow up on any feedback provided and make the necessary adjustments to improve your submission. Many funders allow resubmission of revised applications.

Resources for further guidance

Navigating the CFA process can raise numerous questions. A frequently asked questions (FAQ) section on your funding agency’s website can be invaluable. Addressing commonly posed queries can significantly clarify uncertainties.

Additionally, it is beneficial to have contact information for support readily available. Reach out directly to correspondent representatives for any specific inquiries regarding your application.

Access to relevant documentation and templates is also crucial. Various organizations provide sample CFAs and additional forms that may assist in your application.

Community and networking opportunities

Connecting with fellow applicants can provide invaluable insights and support. Consider joining forums or groups where individuals discuss their CFA experiences. Sharing stories, tips, and resources can enhance your understanding and approach to submitting your application.

Attending webinars and workshops dedicated to the CFA process is another effective way to hone your skills. These events often feature seasoned professionals who share best practices and answer participant questions, making them invaluable for prospective applicants.

Conclusion

In summary, the continued funding application CFA form is a pivotal component for organizations seeking ongoing financial support. Thoroughness and clarity are crucial when filling out the form, and understanding the requirements can enhance your chances of success significantly.

Embrace the resources available, be open to feedback, and take advantage of tools like pdfFiller to facilitate your CFA journey. By doing so, you’ll be well-positioned to secure the funding necessary to continue your valuable projects.

About pdfFiller

At pdfFiller, our mission is to empower users by providing seamless document management solutions. We understand the complexities of the application process and aim to simplify forms like the CFA, helping users to efficiently edit, eSign, collaborate, and manage various documents from a single cloud-based platform.