Get the free Certificate of Insurance Request Form

Get, Create, Make and Sign certificate of insurance request

Editing certificate of insurance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance request

How to fill out certificate of insurance request

Who needs certificate of insurance request?

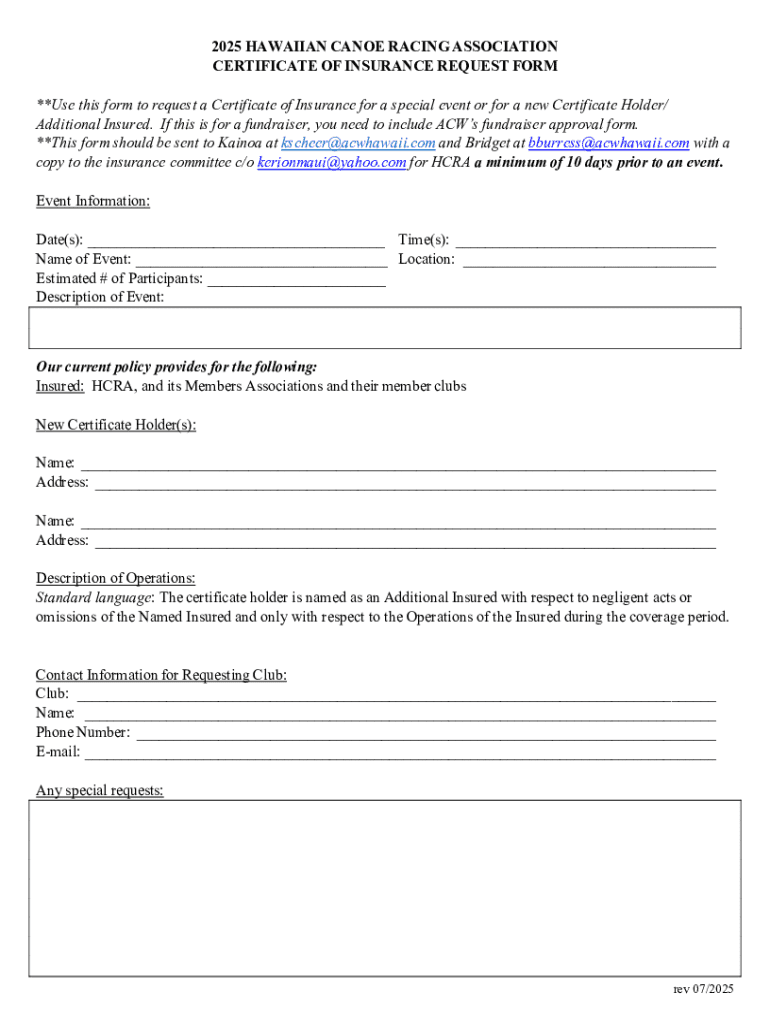

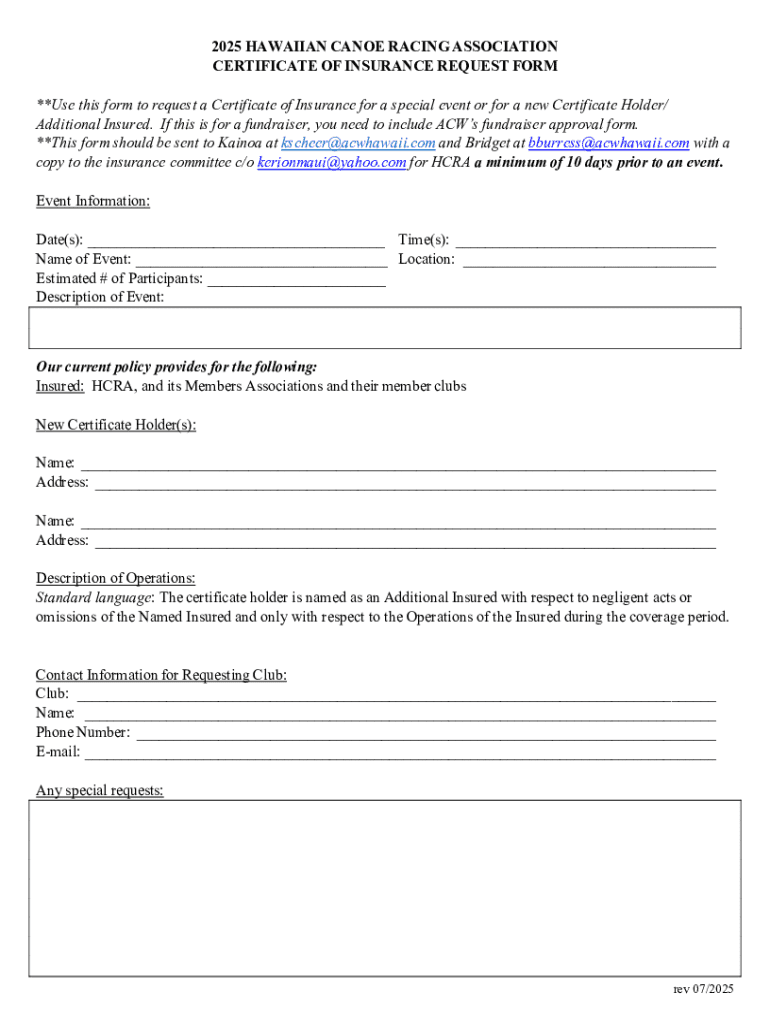

Understanding the Certificate of Insurance Request Form

Understanding the certificate of insurance (COI)

A Certificate of Insurance (COI) serves as a crucial document that provides proof of an individual or entity's insurance coverage. It outlines the specific types and amounts of insurance a policyholder carries, allowing others to verify that adequate coverage is in place.

The primary purpose of a COI is to serve as a quick reference for any party requiring evidence of insurance during transactions or contracts. Common uses of a COI include providing assurance to landlords, clients, or contractors that appropriate insurance coverage exists.

Key components of a certificate of insurance

A standard COI includes several essential components that outline coverage details. These typically encompass the name of the insurance holder, the issuing insurance company, policy numbers, coverage types, and coverage limits.

Coverage types commonly featured in a COI include general liability, which protects against claims of bodily injury and property damage, and workers' compensation, essential for safeguarding employees against workplace injuries. Understanding these components helps businesses make informed decisions about engaging with vendors.

Importance of COIs for vendors

Requesting a Certificate of Insurance from a vendor is a vital practice for mitigating risks and ensuring legal protection. COIs lessen the liability exposure of businesses by confirming that their vendors hold sufficient insurance coverage to handle potential claims arising from their services.

Moreover, requiring a COI builds trust and assures compliance with contractual obligations, creating a professional standard among parties involved in transactions. This protective layer fosters a more secure working relationship.

Certificate of insurance for businesses

COIs significantly safeguard businesses in various transaction scenarios. For instance, in high-risk industries such as construction, a COI can prevent major financial loss following an incident by ensuring that the contractor has liability and workers’ compensation coverage.

In events management, clients often ask for COIs to guarantee that vendors handling food, equipment, or entertainment hold the coverage necessary to protect against liabilities, further emphasizing the need for COIs in a wide range of service-based businesses.

Requesting a certificate of insurance

The process of requesting a Certificate of Insurance from a vendor requires systematic steps to ensure that the request is constructed properly and yields a timely response.

Begin by identifying the necessity for a COI, such as when hiring a contractor or setting up an event. Next, determine who to contact, whether it's the vendor directly or their insurance provider.

Best practices for requesting a COI

Communication with vendors during the COI request process is paramount. Ensure your communications are formal yet friendly, indicating professionalism while still being approachable. Be clear about the reasons for your request and the timeline in which you need the COI.

Consider using reminders if you don’t receive a response within your specified timeframe. Clearly outline your expectations for the COI to ensure the vendor understands what is required.

Filling out the certificate of insurance request form

Successfully completing a Certificate of Insurance request form is essential for efficient documentation and ensures that no critical information is overlooked.

The request form should include necessary information such as your contact details and specifics about the requested coverage. Clearly detail the purpose and intended use of the COI to avoid misunderstandings.

Pay attention to what to avoid while filling out the form. For instance, don't leave fields blank or provide vague descriptions. Inaccurate or incomplete information may lead to delays in processing your request.

COI management and compliance

Properly managing your Certificates of Insurance is critical to maintain readiness for audits and compliance checks. Using solutions such as pdfFiller can streamline this process.

pdfFiller allows users to upload and securely store COIs digitally. This environment enhances accessibility and supports effective document management through interactive tools, making it easier to retrieve COIs as needed.

Staying compliant with certificate requirements

Understanding and adhering to state-specific COI requirements is essential for any organization. Certain industries may have unique stipulations that must be strictly followed to avoid legal complications.

Be vigilant about common issues that may arise with COIs, such as discrepancies in coverage or lapses in coverage periods. Addressing these obstacles proactively ensures smoother business operations.

Troubleshooting common COI issues

Despite thorough preparation, occasional issues with Certificates of Insurance may arise. It is crucial to know how to address frequent questions and concerns effectively. For example, if a vendor fails to provide a COI, it's important to escalate the request firmly yet diplomatically to ensure compliance.

Additionally, if discrepancies in coverage details occur, promptly communicate with the vendor to clarify misunderstandings, ensuring you have the correct documentation for your records.

Resolving disputes over COIs

In cases where disputes arise regarding the COIs—for example, what constitutes adequate coverage—legal advice may be required. It is advisable to have detailed discussions with the vendor about the specific risks and requirements to mitigate such conflicts.

Sample certificate of insurance forms

Having access to sample Certificate of Insurance forms can significantly expedite the request process. Various templates exist that can be tailored to fit different situations and industries.

By utilizing pdfFiller features, users can seamlessly customize these templates, ensuring all necessary components are included. This flexibility is invaluable for significantly reducing repetitive tasks.

Common scenarios requiring specific COI templates

Different sectors have varying needs for specific Certificate of Insurance forms. For instance, construction projects frequently require extensive liability coverage information, whereas event planning often emphasizes vendors' insurance against damages during occasions.

Identifying these requirements allows businesses to tailor their COI templates accordingly, ensuring compliance while addressing their unique risks.

Legal considerations and risks

When it comes to Certificates of Insurance, not having the appropriate COIs can lead to significant contractual risks. Failing to obtain valid insurance documentation puts businesses in jeopardy and could result in costly litigation or liability claims.

Local governments, in particular, cannot afford missteps in ensuring all COIs are valid and compliant with regulations. Understanding state laws and ensuring adherence to specific requirements protects against avoidable pitfalls.

State laws & regulations regarding COIs

Each state has specific laws governing insurance coverage that can affect COI requirements. Organizations should conduct due diligence to ensure their forms meet any state mandates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in certificate of insurance request without leaving Chrome?

Can I sign the certificate of insurance request electronically in Chrome?

How do I fill out certificate of insurance request on an Android device?

What is certificate of insurance request?

Who is required to file certificate of insurance request?

How to fill out certificate of insurance request?

What is the purpose of certificate of insurance request?

What information must be reported on certificate of insurance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.