Get the free Check Request Form

Get, Create, Make and Sign check request form

How to edit check request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check request form

How to fill out check request form

Who needs check request form?

A Comprehensive Guide to Check Request Forms

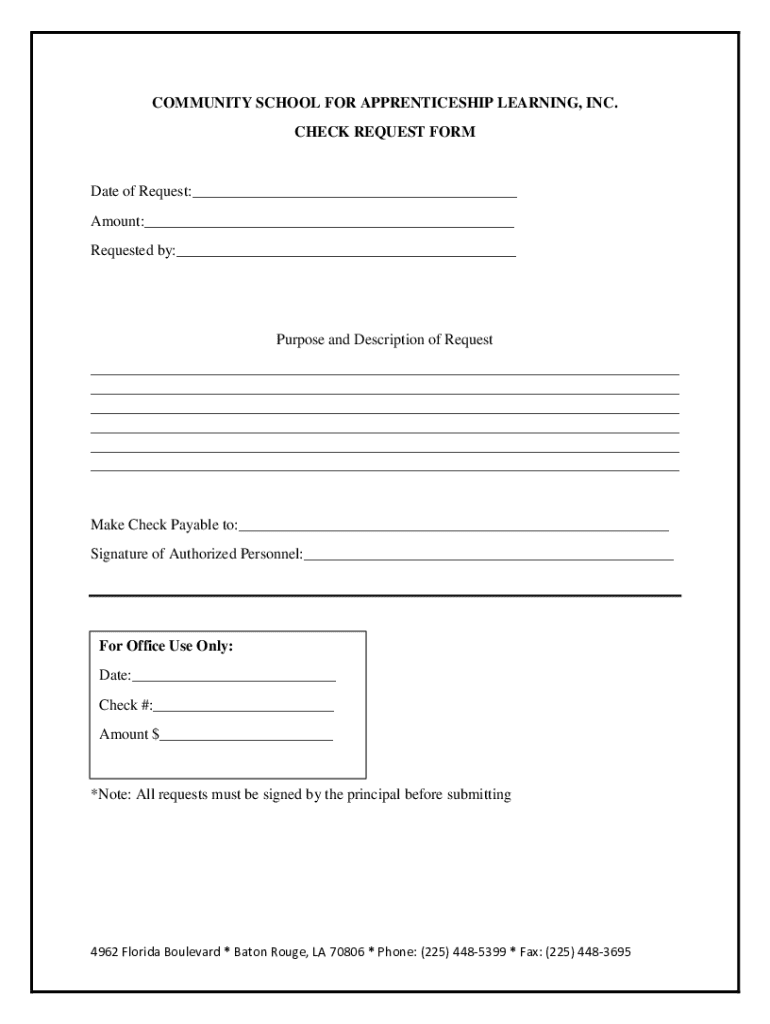

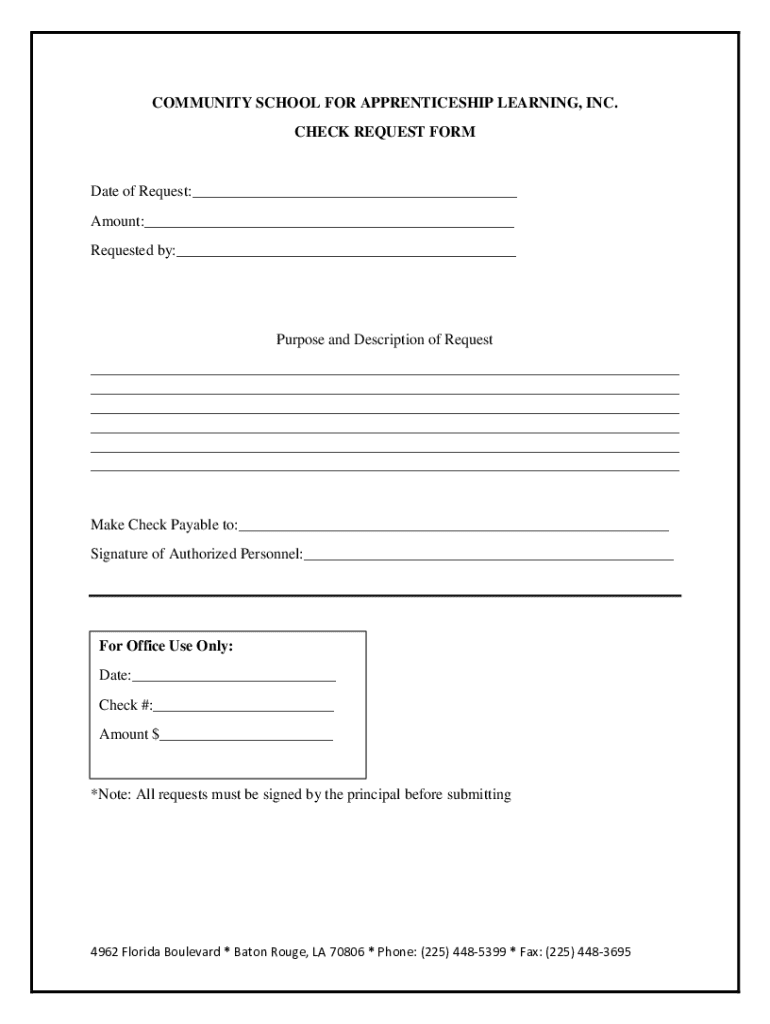

Overview of the check request form

A check request form is a financial document used by organizations to request payment for a specific expense. It is crucial for maintaining accurate financial records by formalizing payment requests, ensuring that all expenditures are documented and approved before disbursal. This process not only fosters financial transparency but also aids in creating a structured approach to budgeting.

The importance of a check request form cannot be understated. By requiring detailed documentation of expenses, organizations can better assess their spending patterns and financial obligations. This transparency cultivates accountability among employees, ensuring that funds are allocated appropriately and in alignment with the organization's budget.

Key components of a check request form typically include details such as: the name of the requestor, date of the request, recipient information (usually the vendor), description of the product or service, invoice number, total amount requested, and account codes. Common formats for these forms can include Excel templates, PDF documents, or even integrated digital solutions offered by platforms like pdfFiller.

Benefits of using a check request form

Utilizing a check request form streamlines the entire request process. Documentation aids in reducing administrative bottlenecks by providing a clear structure for requests. By having all pertinent information compiled into one form, processing becomes more efficient, thus shortening approval times and reducing the workload for finance departments.

In terms of budgeting and tracking, a well-maintained check request process contributes significantly to an organization's overall financial health. Each request serves as a building block for an accurate financial picture, allowing organizations to make informed decisions when it comes to future expenditures.

Moreover, a structured check request process is an effective means of preventing theft and fraud. Essential security features can be incorporated into the request process, such as requiring approvals from multiple levels of management before a check is issued, helping to safeguard against unauthorized payments.

How to fill out a check request form

Filling out a check request form correctly is paramount to ensuring compliance and approval. Start by gathering all necessary information prior to beginning the process. Common requirements include vendor details, invoice numbers, descriptions of goods/services, and account specifics. Having everything at hand will streamline the filling process.

Next, select the appropriate form template. Platforms such as pdfFiller provide a range of options, from simple Excel sheets to more sophisticated digital documents, making it easier to find one that suits specific needs.

When you begin to complete the form, ensure each required field is filled with accurate data. Pay particular attention to the numbers, as discrepancies can lead to delays or rejections. After filling out the request, take the time to review the form carefully. Double-checking for compliance and correctness maintains the integrity of your request and fosters a culture of accuracy.

Common scenarios for check request forms

There are several scenarios when a check request form may be necessary. Requesting funds before a purchase is standard practice, especially for budget planning. Here, it is critical to provide a detailed description of the anticipated expense, along with supporting documentation such as preliminary invoices or estimates.

On the other hand, if the funds are requested after a purchase has been made, it’s vital to include all relevant receipts and documentation to substantiate the request. This post-purchase scenario may slightly alter the required fields to ensure clarity on expenses already incurred.

Additionally, departments within organizations may need to customize check request forms based on their unique needs. For example, student organizations might have different requirements compared to faculty or administrative staff. Adapting check request forms is essential to meet varying operational demands within any organization.

Check request form templates

For organizations looking to implement an efficient check request process, utilizing templates available on pdfFiller can save time and reduce errors. Various template options are available in both Excel and PDF formats, allowing for flexibility in how requests can be handled.

To use these templates effectively, start by downloading the relevant form type that meets your organization’s requirements. Customize the fields according to your needs, ensuring that each section aligns with your financial protocols. The intuitive interface provided by pdfFiller makes it simple to edit and adapt these templates before submission.

Managing your check request forms

Managing check request forms is significantly made easier with cloud-based solutions like pdfFiller. Users can store and track submissions for easy access, creating a central repository for all financial requests. This not only organizes the workflow but also enhances accountability by maintaining a clear record of all transactions.

Collaboration features available on pdfFiller allow team members to work together in approving and managing requests. By providing a platform for discussion and review, organizations can ensure that no requests are overlooked, facilitating a more cohesive approach to financial management.

Additional insights and best practices

As organizations create or improve upon their check request processes, several best practices can emerge. Frequently asked questions often center around how to address discrepancies or what to do in case of rejected requests. Organizations can benefit from providing detailed guidance on their internal processes to mitigate confusion.

Key takeaways for effective use of check request forms include ensuring that all requests are substantiated with proper documentation, promoting transparency among departments, and utilizing available technologies to enhance workflow efficiency. Maintaining a clear line of communication within the organization reduces potential misunderstandings and ensures a more fluid financial operation.

Real-world examples and use cases

To illustrate the importance of properly filled check request forms, consider sample completed forms that highlight common inaccuracies or mistakes. Visual examples are helpful in demonstrating what a well-structured form looks like versus one that lacks essential details. Such insights can prevent costly rejections and streamline processing times.

Case studies showcasing organizations that improved their financial flow through effective check request management can further highlight best practices. By analyzing how certain organizations revamped their processes, others can better understand the direct impact that a proactive approach to check requests can have on overall operational efficiency.

Using interactive tools on pdfFiller

Interactive PDFs bring several advantages to the check request process. These include editable fields, automatic calculations, and user-friendly interfaces, streamlining the inputting of data. Utilizing such digital tools ensures that forms are not only accurate but also help in reducing time spent on manual processes.

In addition, pdfFiller provides a guide for users to eSign their check request documents securely. This step-by-step process for electronic signatures enhances the efficiency of approvals while maintaining compliance with digital standards, making it a seamless addition to the financial workflow.

Continuous improvement in the check request process

Adapting to modern practices in financial documentation is essential for ongoing organizational success. The landscape of financial management is always evolving, and organizations must stay ahead of trends that can enhance compliance and efficiency in their operations.

pdfFiller supports users with evolving needs through ongoing support and a range of resources, enabling them to keep pace with changes in financial documentation practices. By fostering a culture of continuous improvement, organizations can maintain effective check request processes that adapt to new hurdles and opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit check request form from Google Drive?

How do I execute check request form online?

How do I complete check request form on an iOS device?

What is check request form?

Who is required to file check request form?

How to fill out check request form?

What is the purpose of check request form?

What information must be reported on check request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.