Get the free COVID-19: Consumer Loan Forbearance and Other Relief ...

Get, Create, Make and Sign covid-19 consumer loan forbearance

Editing covid-19 consumer loan forbearance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out covid-19 consumer loan forbearance

How to fill out covid-19 consumer loan forbearance

Who needs covid-19 consumer loan forbearance?

Navigating the COVID-19 Consumer Loan Forbearance Form

Understanding the COVID-19 consumer loan forbearance

Loan forbearance refers to an agreement between a borrower and lender to temporarily postpone or reduce payment requirements on a loan. During the COVID-19 pandemic, regions across the globe experienced unprecedented economic disruption. Loan forbearance became a critical tool for individuals and businesses alike, allowing them to manage their financial burdens during a period of uncertainty and income instability.

Forbearance is particularly important as it helps prevent delinquencies and defaults. Many consumers found themselves unable to make regular payments due to job losses, reduced hours, or unexpected expenses. By offering this relief, lenders contributed significantly to retaining household stability and maintaining consumer confidence.

Eligibility criteria for forbearance

To be eligible for COVID-19 loan forbearance, applicants need to demonstrate specific circumstances and conditions. Individuals and small businesses that have faced financial hardship due to the pandemic can seek assistance. Many lenders established straightforward criteria ensuring accessibility for those in need, recognizing the varied impacts of the crisis on consumers.

The primary documentation required generally includes proof of income loss caused by COVID-19, such as pay stubs or unemployment benefit notifications. Additionally, providing loan account details is essential for the application process. Understanding the implications on credit scores is also crucial; while entering forbearance may not negatively impact your credit score, it's vital to stay informed about how forbearance differs from deferment.

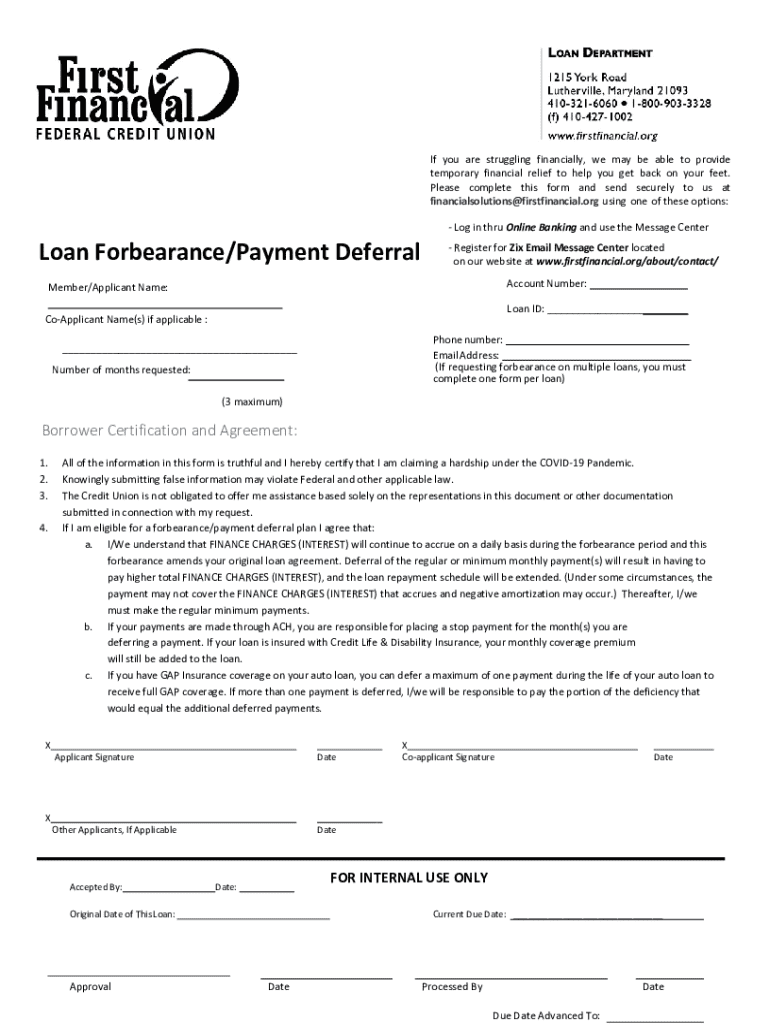

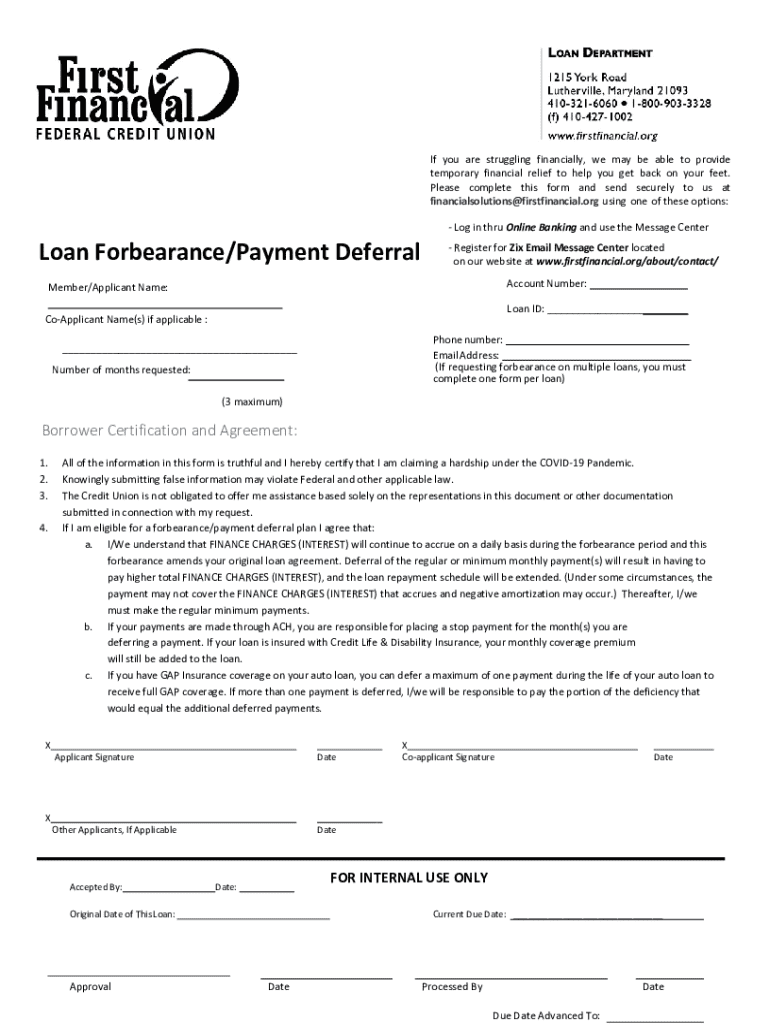

The COVID-19 consumer loan forbearance form explained

The COVID-19 consumer loan forbearance form is essential for anyone seeking to apply for payment relief. This form outlines the borrower's current financial situation and requests the lender to accept reduced payment terms or temporarily suspend payments. Without this form, there is no official record of the borrower's request, and the oversight may result in missed opportunities for relief.

Finding the right form is made easier through various online resources. Most lenders and financial institutions provide downloadable forms directly on their websites, making access straightforward. For added convenience, the pdfFiller platform allows users to access the form directly, providing customization for individual needs.

Step-by-step guide to completing the forbearance form

Before completing the forbearance form, prepare by gathering all necessary documents, including your loan details, proof of income changes, and any correspondence from your lender regarding relief options. Being organized will make filling out the form smoother and more efficient.

Once you’re prepared, follow this detailed walkthrough of each section on the loan forbearance form:

Be cautious of common mistakes, such as failing to include all necessary information or not clearly articulating the reasons for your financial hardship.

Editing and signing the forbearance form on pdfFiller

Editing the COVID-19 consumer loan forbearance form is simplified with pdfFiller’s robust tools. Users can enhance the form by utilizing interactive features that allow them to add notes, comments, or additional documentation.

Once the form is complete, signing it digitally is straightforward. The electronic signature process offered by pdfFiller is legally recognized and streamlines the submission process. Digital signatures eliminate the need for printing, thereby saving time and reducing paper waste.

Submitting the completed form

After completing the forbearance form, the next step is submission. Ensure that you review the submission instructions, as different lenders may have varied methods for receiving forms. Many lenders have online portals while others accept forms via email or traditional mail. Familiarize yourself with the deadlines to avoid delays in processing your request.

Monitoring the application status is crucial once submitted. Keep track of any confirmation emails and follow up with your lender if you do not receive an acknowledgment within a reasonable timeframe. Knowing what to expect in terms of timelines can alleviate anxiety and keep you informed.

Managing your loan during forbearance

After receiving approval for forbearance, understanding the terms is vital. Depending on the agreements set forth by your lender, borrowers may have options for managing any missed payments during the forbearance period. Some may require a repayment plan, while others offer flexibility to extend relief.

It's important to maintain open communication with your lender throughout this process. Establishing a rapport with your lender and having written documentation of all conversations can be beneficial in case any issues arise later.

Alternatives to forbearance

For borrowers who may not find forbearance to be the best option, exploring alternatives can be a valuable avenue. Understanding the differences between loan deferment and forbearance is essential. Unlike forbearance, which pauses payment obligations, deferment allows postponed payment without accruing interest.

Moreover, other options may include structured payment plans or modifications that allow borrowers to pay off their loan more gradually. Government assistance programs and local resources can also provide additional support during challenging financial times.

Frequently asked questions (FAQs)

Many borrowers have common questions about COVID-19 loan forbearance. One of the most frequent inquiries concerns the duration of forbearance. Generally, the length can vary based on the lender’s policies and the type of loan.

Other concerns include whether forbearance can be extended if circumstances change and how to proceed if your financial situation worsens. It’s essential to proactively engage with your lender to address any fresh challenges as they arise.

Tools and resources for further assistance

Various tools are available to help borrowers manage their loans effectively. For example, loan repayment calculators on pdfFiller allow users to visualize their repayment journey, providing insights into potential payment structures.

For more personalized support, individuals can seek assistance from financial advisors who can offer expert advice tailored to their unique situations. Additionally, consumer advocacy organizations often provide resources and guidance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify covid-19 consumer loan forbearance without leaving Google Drive?

How do I edit covid-19 consumer loan forbearance online?

Can I create an electronic signature for the covid-19 consumer loan forbearance in Chrome?

What is covid-19 consumer loan forbearance?

Who is required to file covid-19 consumer loan forbearance?

How to fill out covid-19 consumer loan forbearance?

What is the purpose of covid-19 consumer loan forbearance?

What information must be reported on covid-19 consumer loan forbearance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.