Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form: A Comprehensive How-To Guide

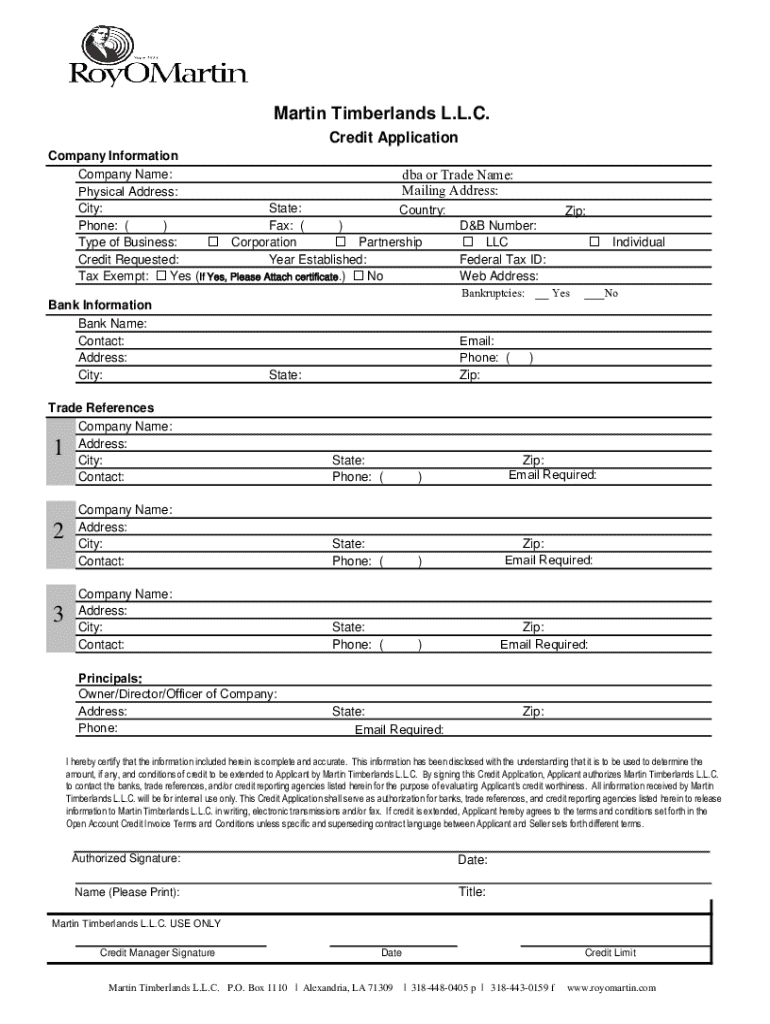

Understanding the credit application form

A credit application form is a crucial document used by financial institutions to evaluate an individual's eligibility for various credit products, such as personal loans, credit cards, and mortgages. This form collects essential information regarding the applicant's personal details, financial status, and credit history. Accurately filling out a credit application form is important, as inaccuracies can delay processing time or even lead to denial. Whether you are purchasing your first home, applying for a credit card, or seeking a loan, a correctly filled credit application form can significantly enhance your chances of approval.

Key components of a credit application form

Every credit application form typically consists of three key sections: personal information, financial information, and credit history. The personal information section asks for basic details such as your full name, Social Security Number (SSN), and contact information to help lenders identify and reach you. The financial information section is crucial for determining your repayment capabilities, requiring details like your employment status, income sources, and a comprehensive overview of your assets and liabilities. Lastly, the credit history information section provides the lender insight into your past financial behavior, including any previous loans, current credit cards, and payment history.

Step-by-step guide to filling out a credit application form

Filling out a credit application form can seem daunting, but breaking it down into manageable steps can simplify the process. Follow this comprehensive guide to ensure clarity and completeness in your application.

Editing and formatting your credit application form

Ensuring your credit application form is polished can enhance your chances of approval. Utilize pdfFiller’s editing tools for seamless modifications, allowing you to correct errors or update information easily. Clear formatting plays a crucial role in making your application readable. Use headings and bullet points to highlight important sections and ensure all required fields are clearly marked. Utilizing professional format standards can create a positive impression on potential lenders.

Electronic signing and submission process

E-signing your credit application presents several advantages, such as increased speed and convenience. With pdfFiller, the process of eSigning is straightforward. Just follow a few simple steps to electronically sign your document, ensuring it's legally binding. Once signed, consider various submission methods, keeping in mind any specific preferences or requirements set by the lender.

Common mistakes to avoid when submitting a credit application

Avoiding common pitfalls can enhance your application’s chances of approval. Financial discrepancies can lead to immediate rejections, so ensure accuracy in reporting income and debt. Leaving sections incomplete can raise red flags for lenders. Additionally, poor organization of supporting documents can delay the review process. Streamline your documentation and ensure all necessary papers are scanned and attached before submission.

Understanding the review process for credit applications

After submitting your credit application, it enters a structured review process. Generally, lenders assess the completeness of your application, verify the information provided, and check your credit report. Typical timelines for credit approval may vary from days to weeks, depending on the institution. Familiarizing yourself with common reasons for application denial, such as insufficient credit history or high debt-to-income ratios, can prepare you to address these issues in future applications.

Managing your credit application post-submission

Once your credit application has been submitted, staying proactive is key. You can track the status of your application using pdfFiller, allowing you to stay informed about any correspondence from lenders. Maintaining clear communication with lenders is also important; be prepared to answer any questions or provide additional documentation. If your application is denied, consider evaluating your credit score and reapplying only after addressing any highlighted weaknesses.

Frequently asked questions (FAQs) about credit applications

Addressing common queries can demystify the credit application process. Applicants often ask how long a credit application takes to process; typically, lenders provide feedback within a few days but can take longer during peak times. Another frequent question relates to the difference between hard and soft inquiries, with the former potentially lowering your credit score while the latter does not affect it. Additionally, many wonder if they can modify their application after submission; the answer generally depends on the lender's policies.

Additional tips for a successful credit application experience

Preparing for lender questions and knowing your credit rights can significantly bolster your application. Understanding the kinds of queries lenders may pose—such as those regarding employment history, major purchases, or debt obligations—can put you at an advantage. Prior to applying, employ strategies for improving your credit score, like paying down existing debts, ensuring timely payments, and correcting any errors in your credit report. These efforts can pave the way for more favorable loan terms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit application from Google Drive?

How can I edit credit application on a smartphone?

How do I fill out credit application using my mobile device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.