Get the free County CodesDepartment of Revenue

Get, Create, Make and Sign county codesdepartment of revenue

Editing county codesdepartment of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out county codesdepartment of revenue

How to fill out county codesdepartment of revenue

Who needs county codesdepartment of revenue?

Comprehensive Guide to County Codes Department of Revenue Form

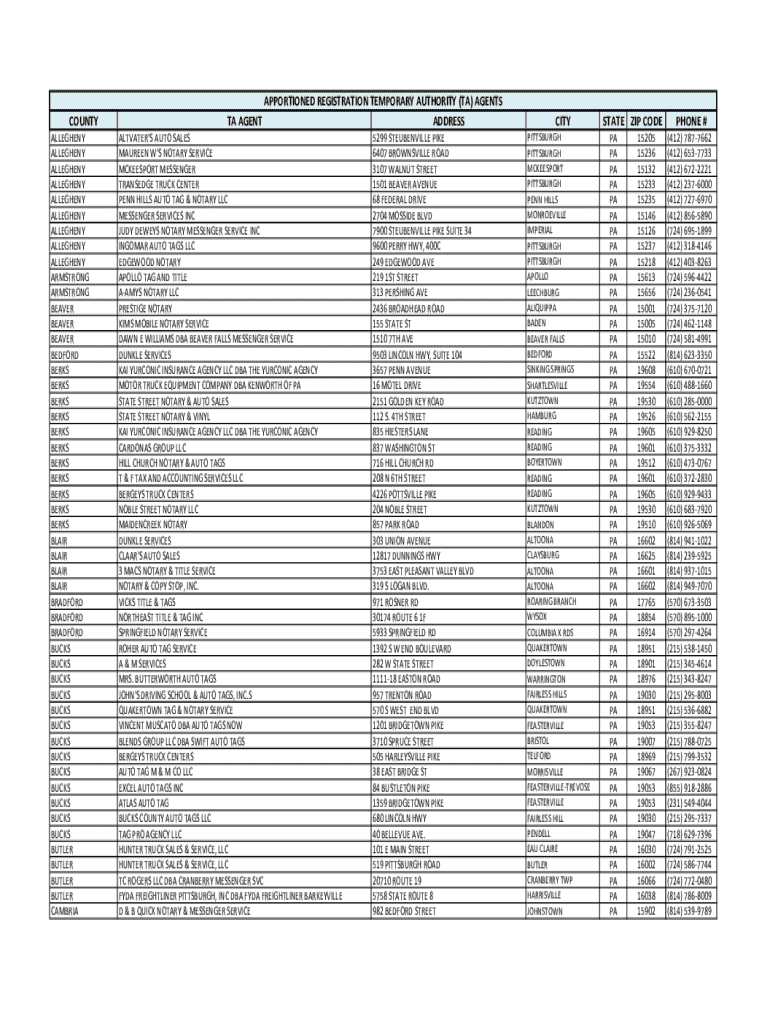

Understanding county codes

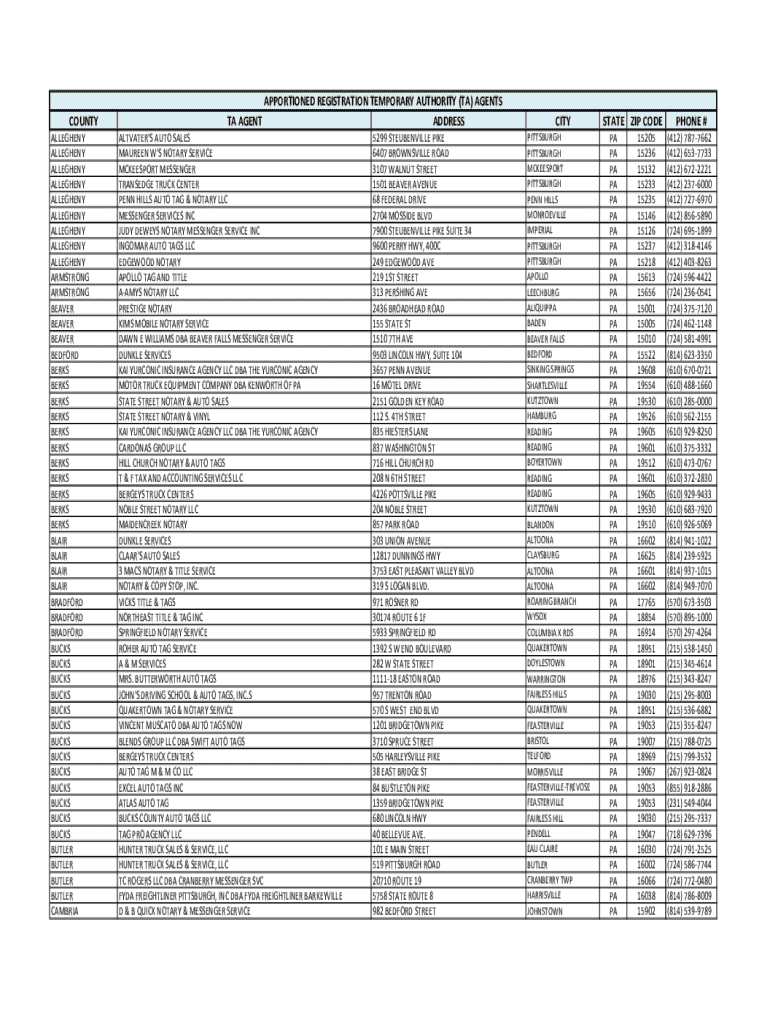

County codes are unique identifiers assigned to specific counties or jurisdictions within a state. They play a crucial role in how local governments manage and collect revenue, significantly impacting taxation policies and regulations. These codes are essential for local tax assessments, as they help determine applicable tax rates and ensure proper allocation of funds for public services such as education, infrastructure, and emergency services.

The importance of county codes extends beyond mere identification; they help in maintaining order in local tax regulations and compliance. By understanding how these codes function, taxpayers can better navigate the tax landscape in their locales, ensuring they meet obligations and avoid penalties.

Accessing the Department of Revenue form

Finding the correct Department of Revenue form is essential for accurate submission of county codes. pdfFiller offers an efficient platform for accessing these forms digitally. Users can visit the website and utilize the search functionality to locate the right document based on their specific needs.

Navigating the pdfFiller site is intuitive; interested individuals can explore categories or use the search bar to find forms related to their county codes. Once located, the forms are available in a downloadable format, making it simple to fill out and submit.

Detailed insights on completing the county codes form

Completing the county codes form involves precise attention to detail. The form generally consists of several sections that must be filled out correctly to avoid issues down the line. One of the first sections requires personal information, including name, address, and sometimes Social Security numbers or Tax Identification Numbers. You should ensure all required fields are filled accurately to avoid delays or rejections.

Next comes the county code identification. You must accurately enter your county's specific code. This can typically be found through state or county websites, or even directly on the pdfFiller platform through embedded tools. Lastly, tax rate information is crucial; you will need to check the latest local tax rates, applying them correctly to the form for your area.

Common mistakes to avoid

When filling out the county codes form, certain mistakes can frequently occur and should be avoided. One of the most significant errors is not verifying the county code. Using an incorrect code can lead to delayed processing and potential fines, ultimately affecting your tax assessment. Always double-check the code against the state resources.

Another common pitfall involves calculating tax rates incorrectly. Ensure to reference the most current tax rates relevant to your county and apply them accurately to avoid underassessment or overassessment. Keeping clear records of your calculations simplifies this process and acts as a safety net in case of disputes.

Interactive tools for form completion

Utilizing pdfFiller's editing features can dramatically simplify the completion of the county codes form. The platform provides various tools to fill out, edit, and annotate documents seamlessly. You can access interactive fields that let you type directly onto the PDF, which can save time and ensure greater accuracy.

Moreover, pdfFiller enables users to save their progress. This feature is particularly helpful if you need to gather additional information before finalizing the form. Collaboration is another highlight; multiple users can work on the same document, allowing for streamlined input and review processes.

eSignature solutions

Incorporating electronic signatures into your form management is crucial for a seamless process. pdfFiller's eSignature solutions allow you to sign documents digitally, eliminating the need for printing, signing, and scanning. This not only saves time but also enhances security and compliance, as digital signatures offer a verifiable way to authenticate documents.

The process of signing a document digitally on pdfFiller is straightforward. Once your county codes form is filled out, you simply click on the signature field, follow the prompts to create or insert your digital signature, and then finalize the document. This ensures a swift and professional completion of all requisite paperwork.

Managing your completed county codes form

Successfully submitting your county codes form is only the beginning. Understanding how to submit the document correctly is paramount. pdfFiller provides users with various submission options, including online submission through the state’s portal, mailing a hard copy, or visiting local offices in person. Each method has its benefits depending on your situation.

After submission, it's vital to keep track of your form's status. pdfFiller allows users to maintain a record of submitted forms, and you can follow up with the department of revenue if needed. Keeping copies of all submitted forms enables you to have a reference point in case of any questions or investigations about your tax obligations.

Frequently asked questions (FAQs) about county codes

County codes can be confusing, especially when it comes to updates and corrections. A common question is, 'How do I update my county code?' Typically, you will need to contact your local Department of Revenue or follow the specific protocols laid out on their website. This may involve filling out an additional form or submitting a request form to make any changes.

Another frequent inquiry is, 'What do I do if I make a mistake on the form?' It’s important to address any errors promptly, often by filling out a corrected form. Documentation of your original submission may be required to adjust your tax records properly.

Additional tools and resources

For a broader understanding of how county codes affect taxes, accessing the state's Geographic Information System (GIS) can be invaluable. GIS provides vital data on property taxes, land use, and county boundaries which further clarifies taxation responsibilities based on county codes.

Additionally, government websites often host important links that lead to county-specific tax information and support resources. Being informed about your local tax landscape will empower you to manage your responsibilities more effectively and engage with local government when needed.

Tax implications and compliance

Understanding the tax implications associated with county codes is essential for accurate compliance. Typically, counties impose various taxes such as sales and use tax, property tax rates, and additional local taxes or surtaxes. Each county may have different regulations and rates, which makes it critical for individuals and businesses to familiarize themselves with local codes.

Moreover, changes in county codes and tax rates may occur due to legislative updates or economic circumstances. It's advisable to regularly consult your local Department of Revenue or dedicated online resources to stay updated on any changes affecting your community.

Contact information for support

For personalized assistance regarding the county codes department of revenue form, you can reach out to your local Department of Revenue directly. Available channels include phone, email, and often online chat options for immediate inquiries. Their expertise can guide you through nuances regarding taxes, regulations, and compliance.

Additionally, for any issues related to using pdfFiller, their customer support is readily available to assist with form-related questions or technical support regarding the platform. Utilizing these resources will enhance your document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in county codesdepartment of revenue without leaving Chrome?

How do I fill out the county codesdepartment of revenue form on my smartphone?

How can I fill out county codesdepartment of revenue on an iOS device?

What is county codesdepartment of revenue?

Who is required to file county codesdepartment of revenue?

How to fill out county codesdepartment of revenue?

What is the purpose of county codesdepartment of revenue?

What information must be reported on county codesdepartment of revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.