Get the free Creditor Matrix

Get, Create, Make and Sign creditor matrix

Editing creditor matrix online

Uncompromising security for your PDF editing and eSignature needs

How to fill out creditor matrix

How to fill out creditor matrix

Who needs creditor matrix?

Creditor Matrix Form: A Comprehensive How-To Guide

Understanding the creditor matrix form

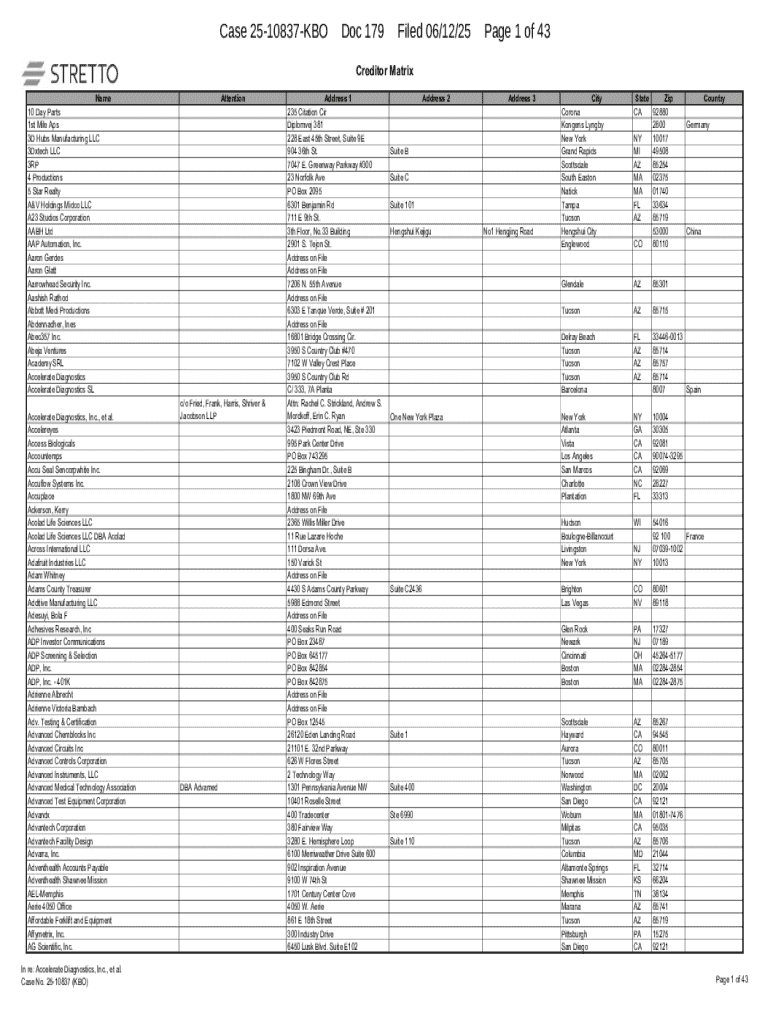

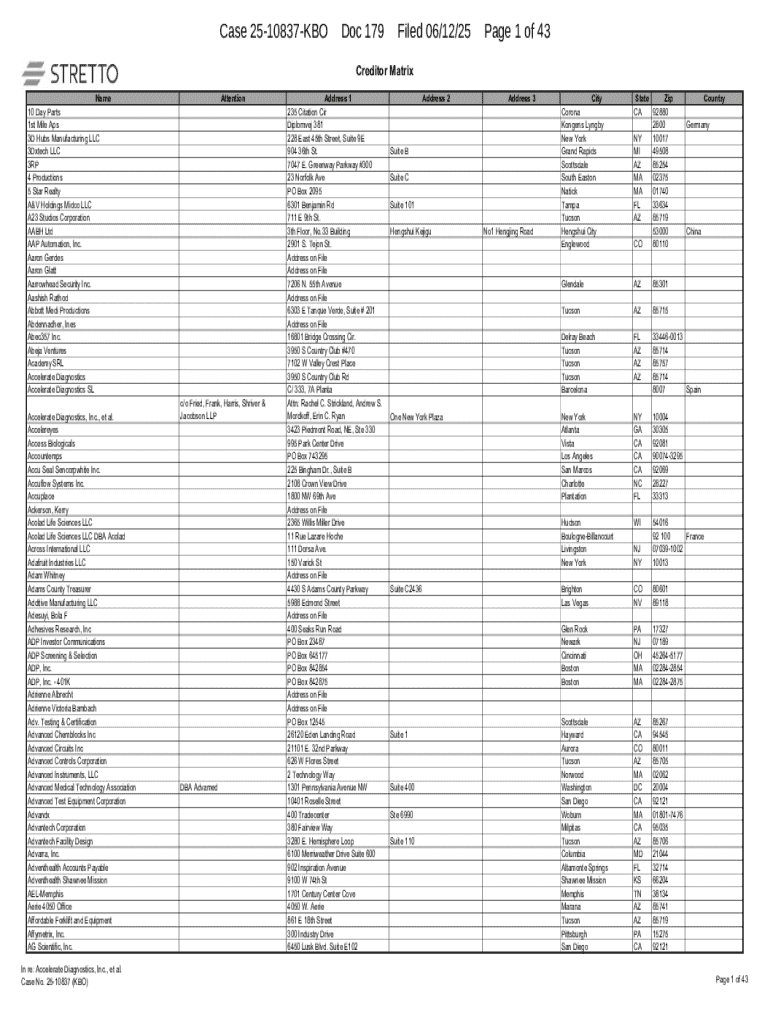

The creditor matrix form is a critical document in bankruptcy proceedings, providing a detailed list of all creditors associated with the debtor. This form captures essential information such as names, addresses, and the nature of claims against the debtor. In bankruptcy filings, especially Chapter 7 and Chapter 13, a well-prepared creditor matrix ensures that all parties are informed and that creditors can participate effectively in the bankruptcy process.

The importance of the creditor matrix cannot be overstated. It serves as the backbone of communication between the debtor and creditors during the bankruptcy process. Without it, relevant entities may remain uninformed about the proceedings, leading to delays and complications. Key components of the form include accurate creditor information and a clear structure that adheres to court standards.

Step-by-step guide to creating a creditor matrix

Creating a creditor matrix involves several essential steps to ensure that all necessary information is captured accurately. Begin by gathering all the required data on your creditors. This includes their names, mailing addresses, and the amounts they are owed. It’s crucial to understand the classifications of your creditors as well — secured creditors have rights to specific assets, while unsecured creditors do not.

Once you have collected all relevant details, you can move on to formatting the matrix. A clean, organized layout is vital; commonly, this is done in rows and columns in a spreadsheet format, which allows for easy manipulation and adjustments. Software such as Excel or Google Sheets can be particularly helpful in this process.

Editing and finalizing your creditor matrix

After filling out the creditor matrix, the next phase is editing and finalizing the document. pdfFiller offers a range of features that facilitate this process. The platform is user-friendly and allows easy editing of PDF documents, which is crucial in ensuring that all details are correct before submission. Users can also take advantage of the collaboration tools provided by pdfFiller, allowing team members to contribute to revisions if the matrix is created as a team effort.

Checking for accuracy is vital when working on your creditor matrix. Any errors can lead to complications later in the filing process. A good strategy involves going over the matrix multiple times, and if possible, enlisting a second pair of eyes to review the document. This can help in catching common mistakes such as typos or incorrect addresses.

Submitting the creditor matrix form

Once your creditor matrix form is finalized, the next step is submission. Each jurisdiction may have specific requirements regarding where to send the form, such as the clerk's office or online portals. Make sure to be aware of any submission deadlines, as these can vary widely depending on the type of bankruptcy you are filing and the rules in your state.

After submitting the creditor matrix, confirming receipt with the court is an essential follow-up action. Keeping a record of this confirmation is crucial should any issues arise later. Make sure to understand the follow-up procedures in place and stay compliant with any additional requests from the court.

Managing your creditor matrix post-submission

After the submission of your creditor matrix, it's vital to continue managing the document properly. There may be instances where updates or modifications are needed due to changes in circumstances, such as new creditors or changes in claim amounts. Knowing how to amend the matrix is just as essential as preparing the original; with pdfFiller, making these edits is straightforward and efficient.

Communication with creditors post-filing is equally important. Maintaining transparent communication helps in managing claims and fostering relationships. Keeping creditors informed of the bankruptcy progress and any potential impacts on their claims reflects professionalism and responsibility.

FAQ: Common questions about the creditor matrix form

Individuals filing for bankruptcy often have questions about the creditor matrix form. One common concern is what happens if a creditor is accidentally omitted from the list. Omitting a creditor can lead to complications, as they may not receive notification of the bankruptcy, potentially affecting the validity of some claims. It’s advisable to include all known creditors to avoid any issues.

Another question pertains to how to handle invalid creditor claims. If a claim is deemed invalid, it can be contested through the bankruptcy court. Lastly, many are curious about electronic filing options for their creditor matrix. Many jurisdictions now allow electronic filing, making it easier to submit your document efficiently.

Related forms and resources

When preparing your creditor matrix form, it's also essential to be aware of related documents that may be required in the bankruptcy process. This includes forms like the bankruptcy petition, schedules of assets and liabilities, and the Statement of Financial Affairs. Understanding these related forms can further streamline your bankruptcy filing experience.

Additionally, keep in mind that regulations may vary from state to state. Being informed about state-specific rules and variations on the creditor matrix can save time and avoid potential errors in your filing. Utilizing resources like the bankruptcy court website in your jurisdiction can provide valuable guidance.

Interactive tools and features on pdfFiller

With pdfFiller, users benefit from interactive document templates designed to simplify the creation and management of the creditor matrix form. These templates can save both time and effort, ensuring accuracy in every submission. The cloud-based solution enhances accessibility, allowing users to edit, collaborate, and finalize documents from anywhere, which is particularly beneficial for teams working remotely.

Getting started with pdfFiller is straightforward. Users can sign up for an account and immediately take advantage of the platform's array of tools for document management. Integrations with other software and platforms further extend the functionality, making it a robust option for managing various forms, including your creditor matrix.

Visuals and examples

Visual aids can significantly enhance understanding when working with the creditor matrix form. For instance, a sample creditor matrix with annotations can guide users in understanding how to correctly fill out each section. Additionally, screenshots of the pdfFiller platform can showcase the ease of editing features, providing a visual representation of the functionalities available.

Using visuals aids not only helps in providing clarity but also ensures a more engaging experience for users. Familiarizing oneself with these visuals can increase confidence when completing the creditor matrix form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my creditor matrix directly from Gmail?

How do I complete creditor matrix online?

How do I complete creditor matrix on an Android device?

What is creditor matrix?

Who is required to file creditor matrix?

How to fill out creditor matrix?

What is the purpose of creditor matrix?

What information must be reported on creditor matrix?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.