Get the free Certificate of Independent Coverage for Colorado Real Estate Brokers

Get, Create, Make and Sign certificate of independent coverage

Editing certificate of independent coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of independent coverage

How to fill out certificate of independent coverage

Who needs certificate of independent coverage?

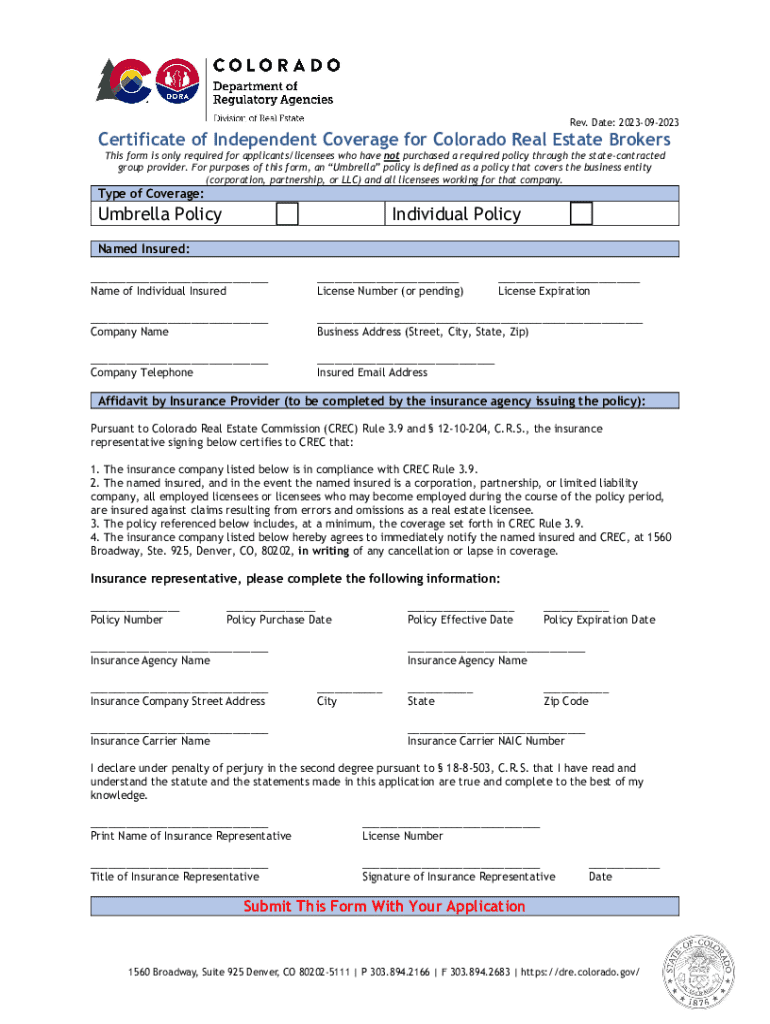

Understanding the Certificate of Independent Coverage Form

Understanding the Certificate of Independent Coverage Form

A Certificate of Independent Coverage Form serves as a crucial document for many professionals, particularly independent contractors and freelancers. It indicates that a person has sustained insurance coverage independently, separate from the organizations or companies they may contract with. This form not only provides proof of coverage but also establishes the contractor’s professional approach to managing risk in their work.

Independent coverage is vital because it assures clients that you, as a professional, are taking the necessary steps to protect yourself and others in the event of an unexpected incident. This is essential in building trust and ensuring smooth business operations. Key features of the form often include details about the amount of coverage, types of risks included, and the insurance provider engaged.

Who needs a Certificate of Independent Coverage?

Several types of professionals may find the Certificate of Independent Coverage Form essential, especially those who operate independently, such as independent contractors, freelancers, and small business owners. For instance, if you are an independent web developer, having this certificate assures your clients that you have sufficient liability coverage when they hire your services.

Certain scenarios necessitate this form. Contractual obligations often require proof of insurance before any work can commence, protecting the client against potential losses due to your actions. Additionally, some businesses may require it to verify coverage when engaging in partnerships or contracts, ensuring that all parties maintain appropriate insurance levels.

Why is the Certificate of Independent Coverage essential?

The Certificate of Independent Coverage Form provides legal protections by safeguarding against liability that may arise during your work. If a project goes awry and a client pursues damages, having your independent coverage can ensure that the financial burden does not fall upon you personally, protecting your assets and livelihood.

Furthermore, this form enhances your credibility and professionalism in the eyes of your clients. By demonstrating that you are insured, you establish a more reliable image, making it easier to attract and retain clients. It showcases that you prioritize the safety and security of your business and their interests, establishing a foundation of trust.

Additionally, many industries require proof of insurance coverage to comply with regulations. Fulfilling these compliance requirements is vital to avoid any legal repercussions and maintain your business's good standing.

Key components of the Certificate of Independent Coverage Form

The Certificate of Independent Coverage typically includes several important sections, which break down the information needed clearly. Common areas include policyholder information, coverage details, and signatory requirements. Each component serves a specific purpose and ensures all necessary information is captured.

Being meticulous when filling out each section is crucial. Common mistakes to avoid include providing inaccurate or incomplete information, failing to sign the document, or neglecting to update the form as your coverage changes.

Steps to obtain your Certificate of Independent Coverage

Acquiring a Certificate of Independent Coverage may seem daunting, but it can be broken down into manageable steps. Start with determining your coverage needs based on the type of work you perform and any requirements set by potential clients.

Next, selecting the right insurance provider is crucial — shop around to find a reputable provider who suits your specific needs. After settling on an insurance company, complete the necessary documentation they require.

How to fill out the Certificate of Independent Coverage Form using pdfFiller

Utilizing pdfFiller can streamline the process of filling out your Certificate of Independent Coverage Form. To begin, access the pdfFiller platform, which offers convenient tools for editing. Start by uploading the document to your account.

After uploading, you can utilize predefined fields designed for easy completion, which saves time and minimizes errors. Additionally, pdfFiller enables you to add your eSignature and collaborate with others on the document seamlessly, which is especially helpful if you're working with an insurance agent or client who requires specific details.

Managing your Certificate of Independent Coverage

Once you have obtained your Certificate of Independent Coverage, managing it effectively is equally important. Keeping track of renewal dates is crucial, as many policies have expiration periods that require you to update your coverage regularly.

Further, any time you have a significant change in your business activities or the scope of your work, it’s wise to update your certificate to ensure that you remain adequately protected. Storing the document within a secure and accessible location allows you to retrieve it easily when needed, especially during client meetings or contract negotiations.

Frequently asked questions (FAQs)

Many potential clients have queries regarding the Certificate of Independent Coverage Form. Common inquiries include what actions to take if their client requires additional coverage, guidance on how often certificates should be updated, and whether the same form can be used for multiple projects. Understanding these nuances can help clarify your obligations and how to best serve your clients.

Conclusion

In summary, the Certificate of Independent Coverage Form is a vital tool for freelancers, independent contractors, and small business owners to protect themselves and instill confidence in their clients. By securing these documents and keeping them updated, you demonstrate professionalism and compliance in your field.

Consider utilizing pdfFiller to simplify the process of creating, editing, and managing your documents. Their platform empowers you to streamline your workflow, ensuring all necessary forms are at your fingertips, ready to support your independent business ventures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find certificate of independent coverage?

Can I create an electronic signature for the certificate of independent coverage in Chrome?

How do I complete certificate of independent coverage on an Android device?

What is certificate of independent coverage?

Who is required to file certificate of independent coverage?

How to fill out certificate of independent coverage?

What is the purpose of certificate of independent coverage?

What information must be reported on certificate of independent coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.