Get the free Credit Application

Get, Create, Make and Sign credit application

Editing credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Understanding Credit Application Forms: A Comprehensive Guide

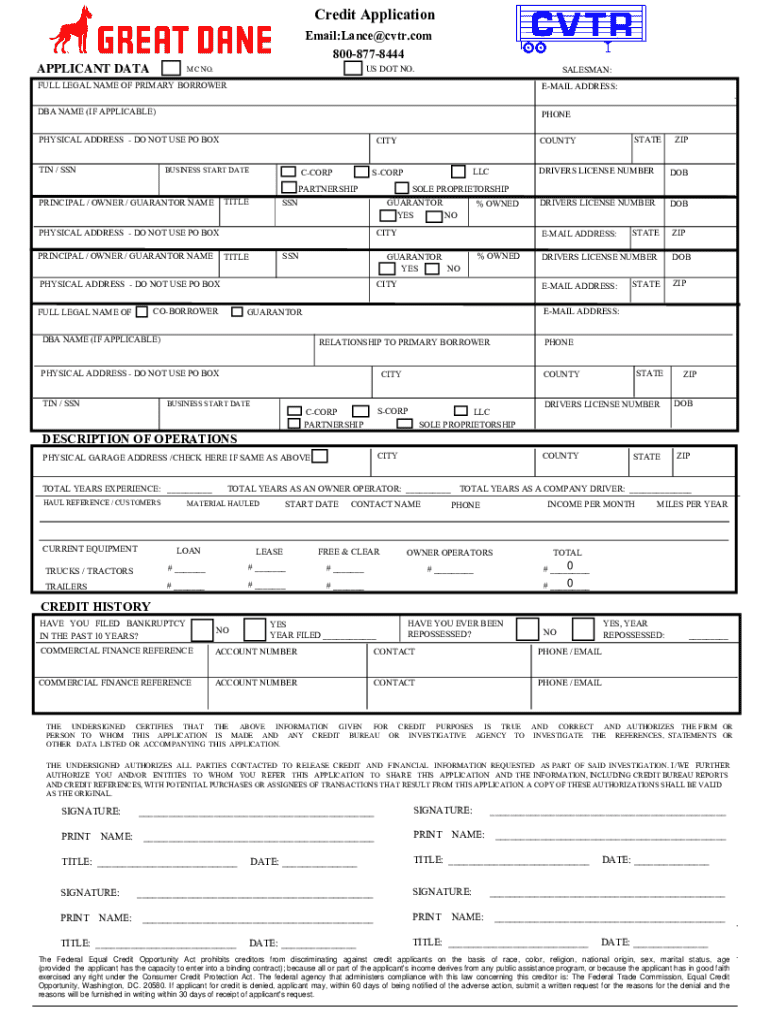

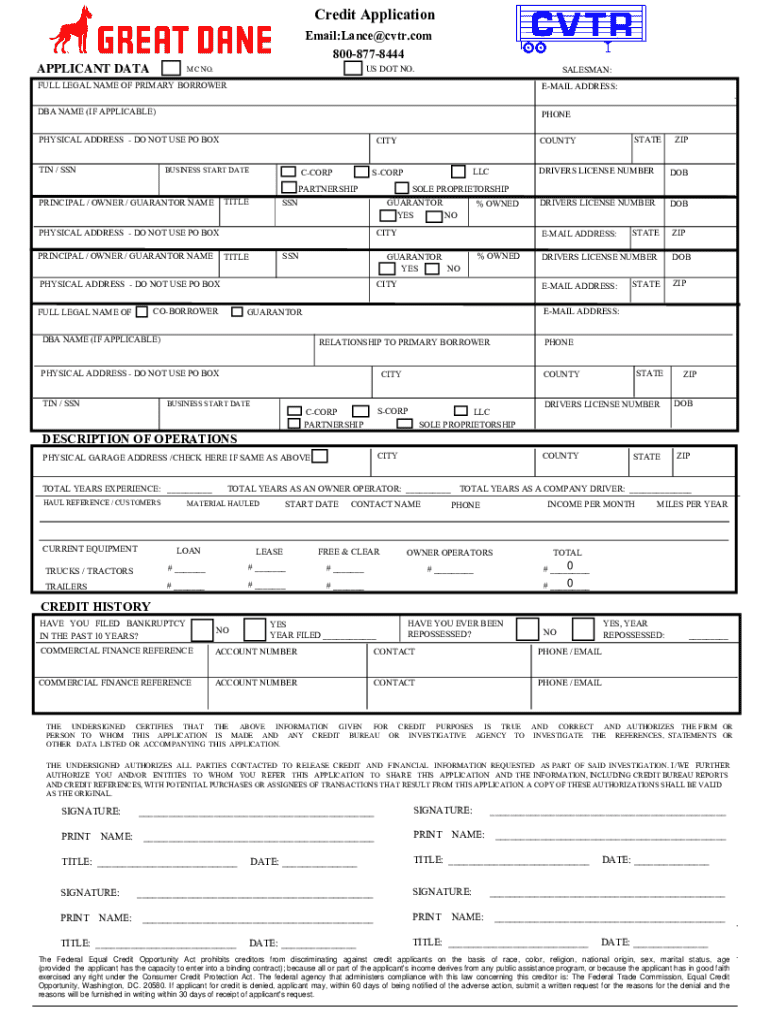

Understanding the credit application form

A credit application form is a standardized document utilized by lenders to collect essential information about prospective borrowers. Primarily designed to evaluate the applicant's creditworthiness, this form plays a crucial role in the lending process. It gathers personal and financial data crucial for lenders to make informed decisions regarding credit approval.

Providing accurate information on a credit application form is vital. An incorrect entry can significantly hinder the likelihood of approval, making it essential to double-check every detail. Common mistakes include typos in personal information and misrepresenting income, which can lead to delays or even denials.

Key components of a credit application form

The credit application form typically comprises several sections, each designed to capture specific details about the applicant. The Personal Information Section requires basic details such as name, address, and contact information. A Social Security number is also requested, as it helps lenders assess the applicant's credit history.

Next, the Employment and Income Information section seeks to document the applicant's employment history and income sources. Accurate reporting of income is essential for determining repayment ability. Additionally, the Financial Information section requests disclosure of assets and liabilities, providing a comprehensive picture of the applicant’s financial situation. Understanding the debt-to-income ratio, which compares total monthly debt payments to gross monthly income, is crucial for evaluating financial health.

Types of credit application forms

Credit application forms come in various types, including personal and business forms. Personal credit applications generally collect individual financial information, while business forms require details about the company's financial history and structure. When comparing online versus paper forms, online applications offer convenience and quicker processing times, although some may prefer the familiarity of paper forms.

Moreover, specialized credit application forms pertain to distinct lending needs like auto loans, mortgages, or credit cards. Each type may request unique information tailored to the specific loan requirements, underscoring the importance of using the appropriate form for the loan one is seeking.

Step-by-step guide to filling out a credit application form

Filling out a credit application form may seem straightforward, yet attention to detail is imperative. Start by gathering required documents such as tax returns, pay stubs, and bank statements. These documents provide the necessary information required to accurately complete the form.

When completing each section, be meticulous. For personal information, ensure spelling and accuracy; for employment details, provide the correct employer address and job title. Financial information requires specific figures, so refer to your documents for accuracy. Utilize a clear format, and if using an online application, check for required fields highlighted during the application process.

Editing and signing your credit application

Once completed, reviewing the credit application is essential. Utilizing platforms like pdfFiller allows users to edit scanned forms or templates effortlessly. With pdfFiller, applicants can incorporate digital signatures, streamlining the submission process.

Moreover, pdfFiller offers collaborative features that permit sharing the application with trusted parties for feedback before final submission. This ability helps catch any potential errors and ensures that all perspectives are considered.

Common mistakes to avoid when filling out the credit application form

Several common pitfalls can derail a credit application. One major mistake is overlooking required fields, such as financial disclosures or personal identifiers, frequently leading to delays in processing. Misrepresenting financial information, whether intentionally or accidentally, can also result in application denials. Accurately reporting income and debt is critical, as lenders perform rigorous checks.

Additionally, ignoring provided instructions can have detrimental effects. Each credit application form comes with specific guidelines that are essential to follow. Therefore, reading all instructions ensures that applicants avoid overlooked nuances that could compromise their submission.

Frequently asked questions about credit application forms

Understanding the credit application process generates a slew of questions. A common inquiry is, 'How long does the approval process typically take?' The answer varies by lender, but many provide responses within a few business days.

Beyond the application: managing your credit after submission

Once a credit application has been submitted, understanding credit reports becomes crucial. Granting the lender insight into your credit behavior, credit reports also reveal how multiple applications can impact your credit score.

Additionally, keeping track of your application status is beneficial. Following up with lenders post-submission demonstrates initiative and can provide clarity on processing timelines. Once approved, practicing responsible credit management is vital. This includes making timely payments and avoiding excessive borrowing, which enhances your credit health.

Conclusion

Completing a credit application form accurately is essential for a smooth lending process. By being thorough, utilizing tools like pdfFiller can make the application workflow seamless, allowing for easy editing and signing of forms. Prioritize accuracy and clarity to improve your chances of credit approval while avoiding common pitfalls.

Engagement with pdfFiller resources offers additional support; users can access templates and tools tailored to navigating the credit application process effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit application?

How do I edit credit application online?

Can I sign the credit application electronically in Chrome?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.