Get the free Cash Advance Request

Get, Create, Make and Sign cash advance request

Editing cash advance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash advance request

How to fill out cash advance request

Who needs cash advance request?

Cash Advance Request Form - How-to Guide

Overview of cash advance requests

A cash advance request is a formal procedure where individuals or employees seek preliminary funds, typically for business-related expenses before their actual reimbursement occurs. This process is critical for managing cash flow in various organizational contexts and allows for immediate access to funds for operations or emergencies.

The importance of cash advances in financial management cannot be overstated. They empower businesses to handle unforeseen expenses without disrupting operations. Employees may need to front costs for travel, client meetings, or necessary supplies and equipment. Securely managing these requests facilitates smoother business operations.

Common scenarios for cash advances include travel for business meetings, attending conferences, or making emergency purchases crucial for business continuity. Understanding when and how to request these advances is key to effectively leveraging this financial tool.

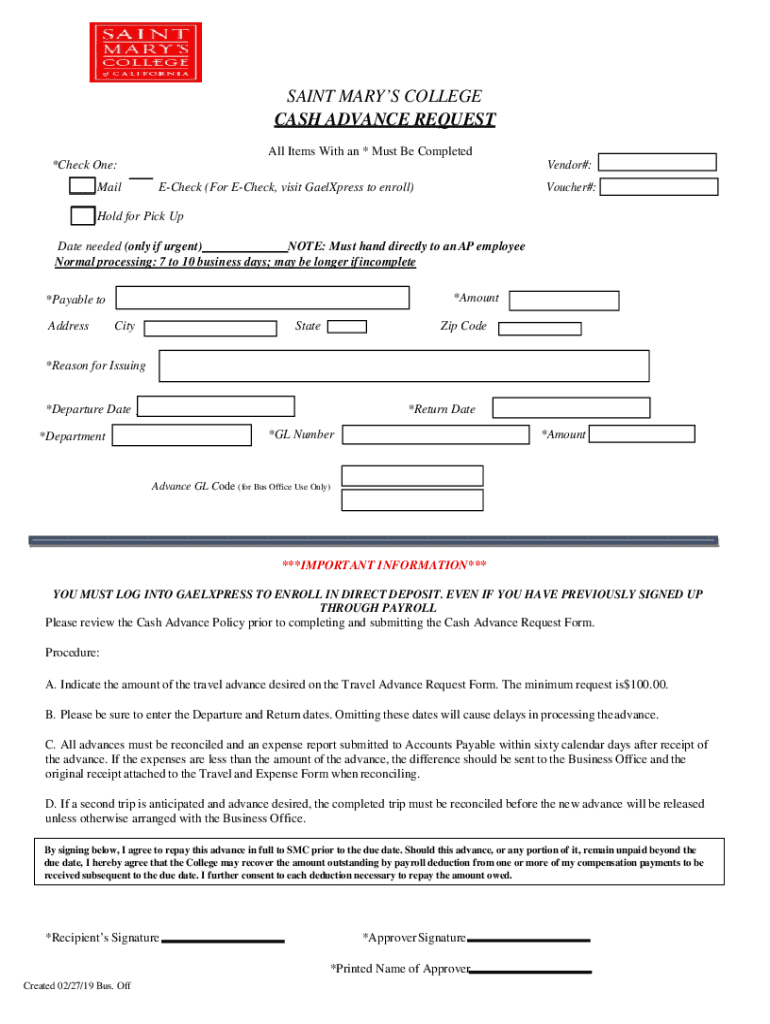

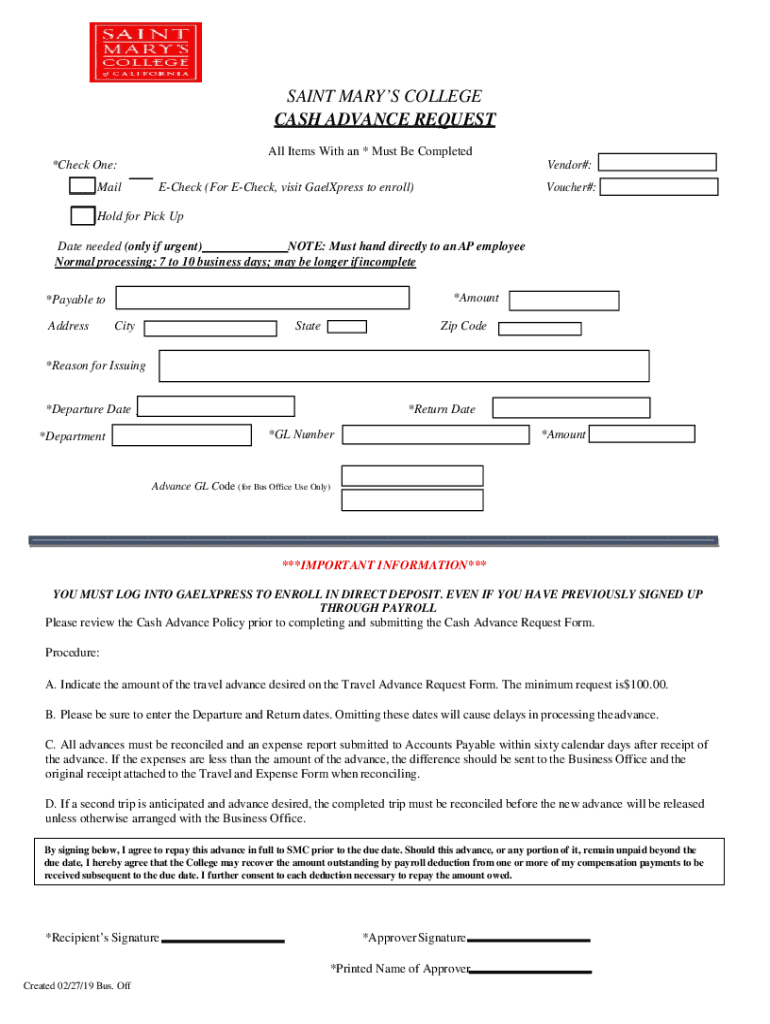

Understanding the cash advance request form

The cash advance request form is a specific document used to formally request funds. Essential for maintaining financial records, this form captures vital information regarding the purpose and amount of the advance requested, which aids in accounting and budgeting.

The form typically includes several key components: a personal information section for the requester; details about the advance requested, including the amount; the purpose for the advance, which should align with business needs; and required signatures or approvals from supervisors or the finance department.

There are various types of cash advance forms available, including electronic versions that can be filled online or PDF formats. Accessing the right form is essential for processing requests efficiently.

Step-by-step instructions for completing the cash advance request form

Completing a cash advance request form involves multiple steps to ensure accuracy and compliance. A clear understanding of the required information is crucial.

Step 1: Gather necessary information

The first step is to gather all necessary documentation. Required documents may include receipts from past expenses, travel itineraries, or even estimates of costs to be incurred. It’s advisable to contact your supervisor or financial manager to get any specific approvals or additional information they might require.

Step 2: Access online form

Next, navigate to pdfFiller’s website to access the specific cash advance request form. You can download it in PDF format or opt to fill it out directly online, depending on your preference.

Step 3: Fill out the form

Carefully fill out the form, starting with your personal details. Make sure to provide accurate information in each section. For best results, stick to clear and concise language, particularly in the purpose section. Remember to include the specific amount requested and justify it in the purpose box.

Step 4: Review and validate data

Before submission, it's critical to review the form meticulously. Common mistakes include typos in the amount requested or missing necessary signatures. Best practices include cross-referencing all figures and ensuring all required signatures are in place, which will streamline processing.

Step 5: Submit the form

Finally, submit the completed form. Check your company’s procedures for submission methods; this may include emailing it to the finance department, uploading it through an internal system, or even submitting a physical copy.

Managing your cash advance request

Once you’ve submitted your cash advance request, tracking its status is vital. You should be able to check the approval status through your company's financial system or follow up with the finance department. Keep a holding period in mind, as processing timelines can vary significantly based on your organization’s policies.

In case your request is denied, it's crucial to understand the reasons behind it. Common reasons include insufficient justification for the amount requested or failing to follow submission protocols. Consider seeking feedback from your supervisor and making any necessary adjustments before resubmitting.

Keeping records of all cash advance requests is also important for your personal documentation and future budgeting. Retaining copies of all submitted forms and any correspondence regarding them is recommended for your reference.

Editing and collaborating on the cash advance request form

Utilizing the tools provided by pdfFiller enhances your ability to edit and collaborate on cash advance request forms efficiently. Editing PDFs is straightforward with their user-friendly interface, allowing you to make necessary changes without hassle.

Moreover, you can add annotations and comments, facilitating collaboration with team members. This process is invaluable for gathering input on complex forms or ensuring that everyone is on the same page regarding the requests being made.

Sharing the form with team members

Sharing the completed form with colleagues is simple; you can send it via email or directly annotate within the pdfFiller platform. Receiving feedback is a breeze with integrated tools, making it easier to collaborate and finalize submissions efficiently.

Frequently asked questions (FAQs)

As you navigate the cash advance request process, you may encounter various questions. Here are some common inquiries.

Best practices for using cash advances responsibly

Employing best practices when handling cash advances is crucial for responsible financial management. Always plan your finances carefully and understand when cash advances can prevent disruptions in operations but never create financial strain on yourself or the organization.

Transparency and communication in your cash advance requests foster trust and facilitate smoother approval processes. Always be upfront about why funds are needed and maintain clarity in your communications.

Consider the long-term implications of cash advances on your personal and organizational finances. Use them judiciously and always keep records for future reference, as this helps in maintaining an accountable financial framework.

Conclusion on the importance of a cash advance in workflow

The cash advance request process is an integral component of smooth financial management, offering numerous benefits when utilized correctly. Ensuring you follow proper protocols can lead to timely processing and approval of requests, minimizing disruptions.

pdfFiller stands out as an invaluable resource for managing forms like the cash advance request form efficiently. With features allowing for easy editing, collaboration, and document management, it empowers users to maintain streamlined workflows and effectively manage their financial documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cash advance request directly from Gmail?

How do I execute cash advance request online?

How do I fill out cash advance request using my mobile device?

What is cash advance request?

Who is required to file cash advance request?

How to fill out cash advance request?

What is the purpose of cash advance request?

What information must be reported on cash advance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.