Get the free Credit Card Transaction Report

Get, Create, Make and Sign credit card transaction report

Editing credit card transaction report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card transaction report

How to fill out credit card transaction report

Who needs credit card transaction report?

Your Complete Guide to Credit Card Transaction Report Form

Understanding the credit card transaction report form

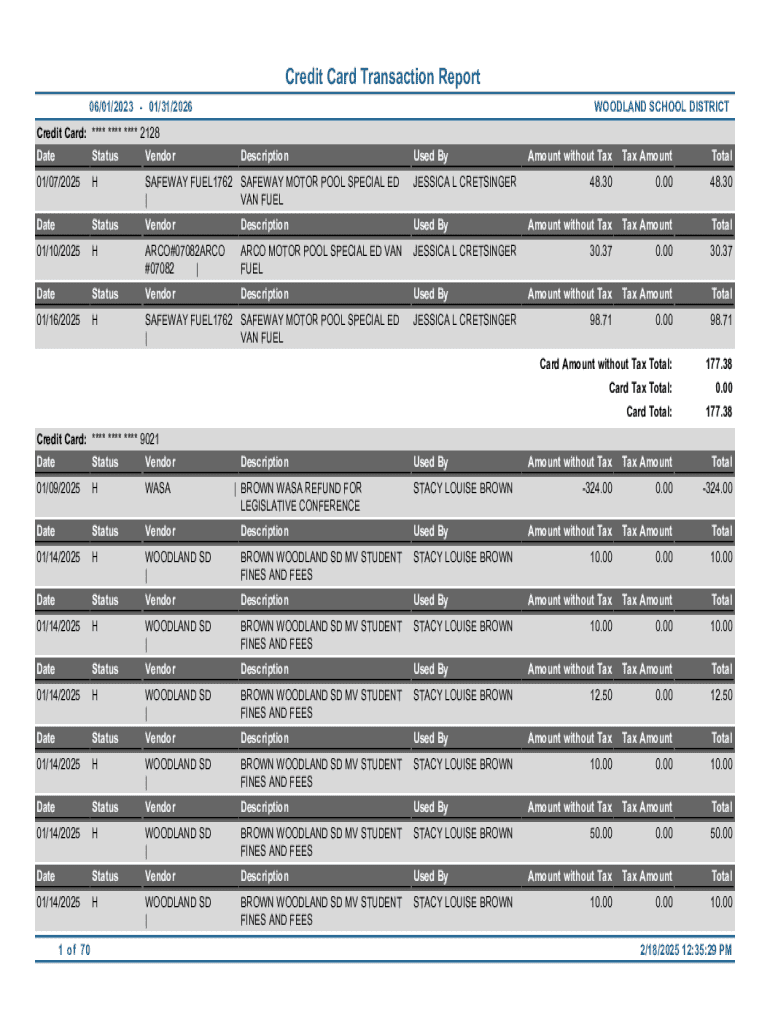

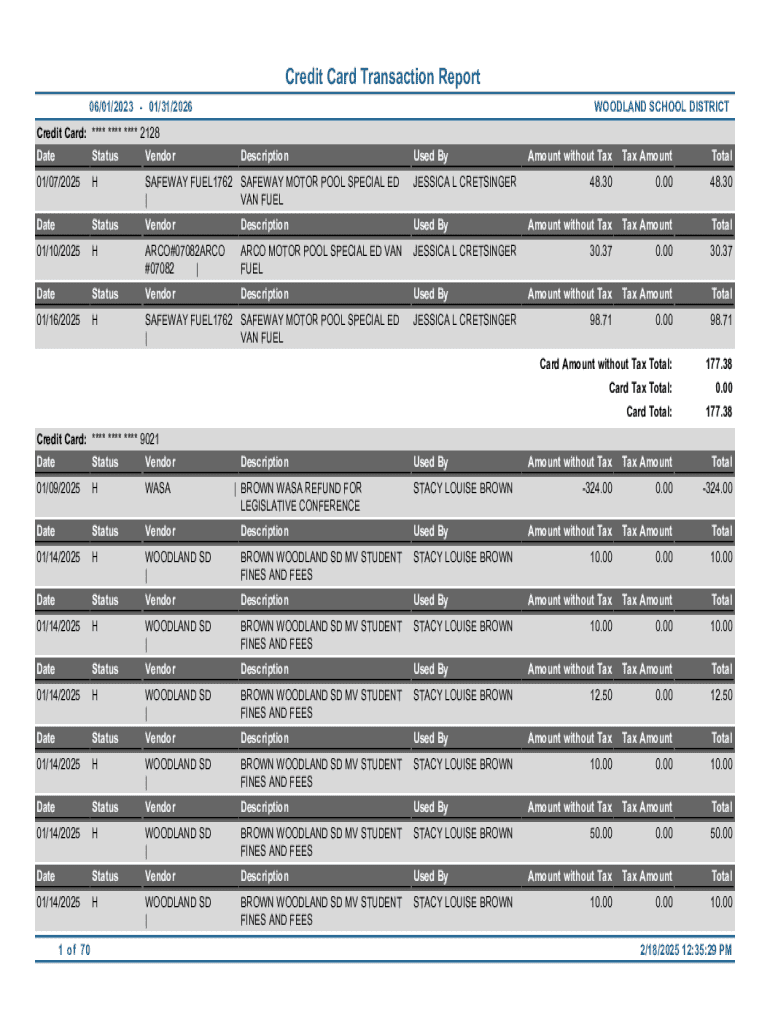

The credit card transaction report form is a vital tool for tracking and organizing financial transactions made through a credit card. This form records essential data concerning credit card purchases, making it easier for users to monitor their spending, facilitate budgeting, and assist in tax reporting or organizational audits.

Accurate transaction records are crucial, not only for personal budgeting but also for businesses aiming to manage expenses and prepare for tax obligations. Moreover, this form serves as a reference point in resolving discrepancies or disputes with financial institutions. Both individuals and businesses utilize credit card transaction report forms, each tailored to meet specific financial management needs.

Key components of the credit card transaction report form

A detailed credit card transaction report form typically consists of several key components that ensure all the necessary information is captured. Understanding these components is crucial for accurate completion.

Accessing and using the credit card transaction report form

To efficiently manage your credit card transactions, obtaining the credit card transaction report form is easy. You can access it online through dedicated financial or tax preparation websites. Here’s a step-by-step guide on how to do this:

Filling out the credit card transaction report form

Accurate completion of the credit card transaction report form is vital. Make sure each field is filled correctly to avoid issues later. Here are some key instructions for filling out the form:

Editing the credit card transaction report form

Editing your credit card transaction report form has never been more straightforward, especially with the tools available through pdfFiller. Users can easily modify or add information post-completion. You can also convert hard copy forms into editable PDFs seamlessly. Here’s how:

eSigning the credit card transaction report form

eSigning is a feature available on pdfFiller that enhances the submission process for your credit card transaction report form. This method ensures that your forms are legally binding and secure. When eSigning, consider the following:

Submitting the credit card transaction report form

Once completed, the next step is submission. Knowing your options can save time and hassle. There are several methods to submit your credit card transaction report form, including:

It's also advisable to keep a digital copy of any submissions sent for record-keeping. This serves as a backup in case there are queries or issues later.

Managing and storing your credit card transaction records

Effective management and storage of transaction records not only help in personal finance but are also crucial for businesses during audits and tax filing. Here are some best practices to consider:

Handling discrepancies and fraudulent transactions

Occasionally, users may find discrepancies within their reported transactions, or they may even face fraudulent charges. Addressing these issues promptly is crucial. Here are steps to follow when discrepancies arise:

Frequently asked questions about credit card transaction reports

As you navigate the nuances of the credit card transaction report form, you might have some common questions. Here are answers to some frequently asked questions:

Customer support and help

Navigating through the process of filling out and submitting a credit card transaction report form can raise questions. Luckily, pdfFiller offers robust customer support to assist.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute credit card transaction report online?

Can I create an electronic signature for the credit card transaction report in Chrome?

How do I fill out credit card transaction report on an Android device?

What is credit card transaction report?

Who is required to file credit card transaction report?

How to fill out credit card transaction report?

What is the purpose of credit card transaction report?

What information must be reported on credit card transaction report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.