Get the free Customer Account Application

Get, Create, Make and Sign customer account application

Editing customer account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer account application

How to fill out customer account application

Who needs customer account application?

Complete Guide to the Customer Account Application Form

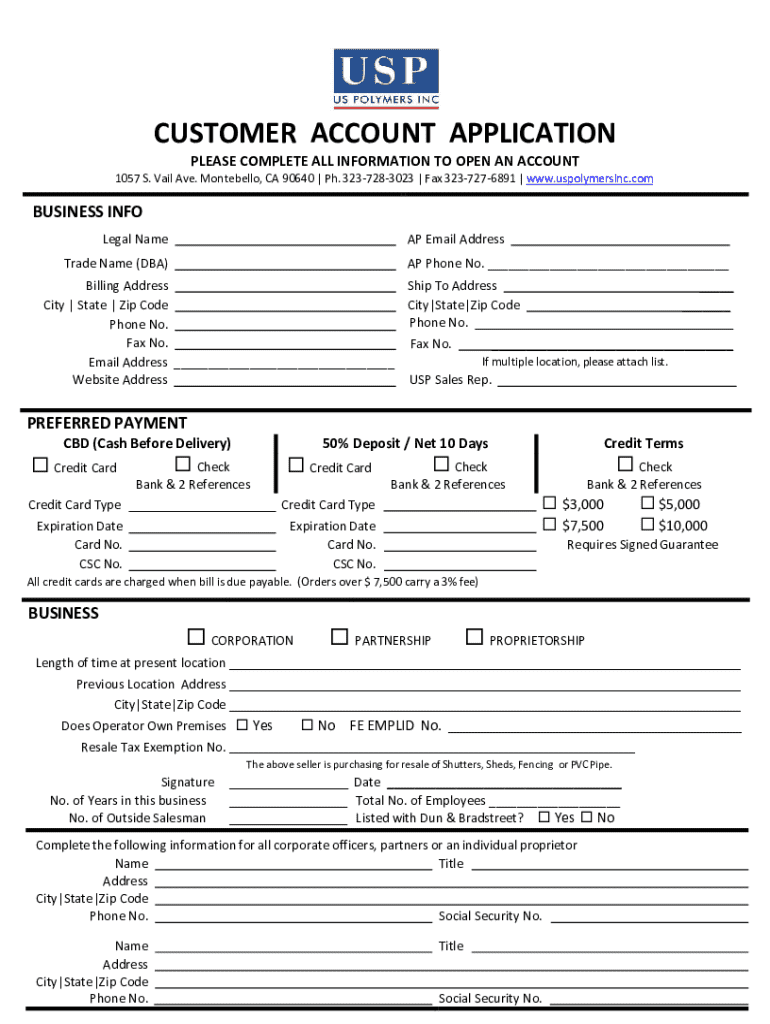

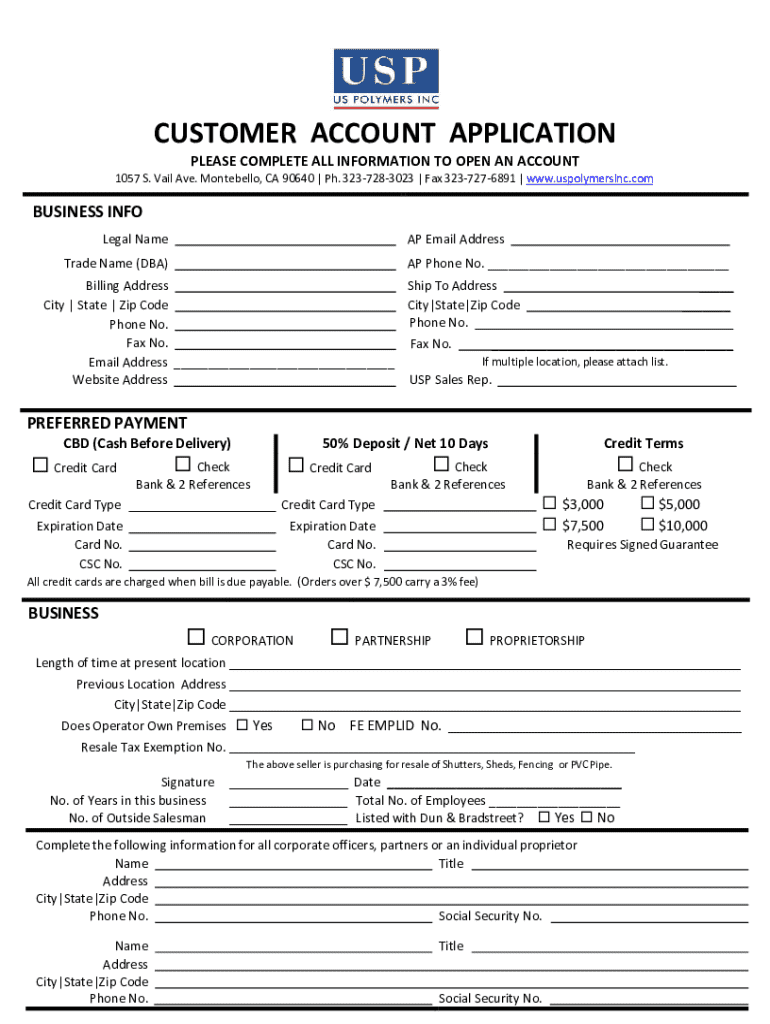

Understanding the customer account application form

The customer account application form is a crucial document used by individuals and businesses to initiate a relationship with service providers, especially in financial services, insurance, and membership organizations. This form collects essential information that enables companies to assess eligibility and tailor services to meet the needs of their clients. A well-structured application form saves time for both the applicant and the company by facilitating smooth processing.

The importance of the customer account application form cannot be overstated. It acts as the first point of contact, establishing the foundation for customer relationships. Without accurate information, companies may struggle to offer appropriate services, handle inquiries, or resolve issues. Across various industries, from banks opening new accounts to gyms managing memberships, the application form is the standardized means of gathering necessary client information.

Key components of the customer account application form

Every customer account application form generally contains several mandatory fields that standardize the data collection process. The most common components include:

In addition to mandatory fields, many companies include optional fields to gather further information that may enhance personalization. Different types of accounts may have specific requirements; for instance, a business account application might ask for tax ID numbers or business licenses, whereas an individual account might not.

Interactive tools for efficient completion

Utilizing tools like pdfFiller's interactive editing features can significantly simplify the completion of the customer account application form. Its drag-and-drop functionality allows users to easily manipulate the form fields, ensuring a personalized experience. It's especially beneficial for teams working on the same application, as real-time collaboration features make it easy to share edits and feedback immediately.

Moreover, choosing the right template on pdfFiller hits two birds with one stone—efficiency and customization. Users can select a template that aligns with their specific needs, whether an individual or business account, streamlining their application process while maintaining clarity and consistency.

Step-by-step guide on filling out the customer account application form

Filling out a customer account application form might seem daunting at first, but following a clear step-by-step guide makes it manageable.

Customizing your customer account application form

Customization can make a standard customer account application form align better with your brand’s identity. Tailoring the design can significantly enhance user experience. Consider incorporating your branding elements, such as logos and colors, to foster familiarity.

Additionally, know that you have the option to add fields for acquiring more detailed information. Modifying the language used in the form can also clarify requests, reducing ambiguity for applicants and streamlining the overall process.

Where can you use a customer account application form?

The customer account application form can be employed in various scenarios across different platforms. Some common use cases include:

Frequently asked questions about customer account application forms

Applicants often have questions and face challenges when filling out the customer account application form. Common inquiries frequently revolve around the terminology used and what to do if their application gets denied. To clarify, give applicants a brief explanation of terms—like 'net income,' 'credit score,' or 'reference checks'—to ensure that they fully understand the requirements.

If an application is denied, it is crucial for applicants to know the next steps. They should reach out to the company for clarification, understand the reasons for rejection, and gather necessary documentation for a potential re-application.

Making the process efficient with pdfFiller

pdfFiller offers unique features that make the customer account application process more efficient. Recommendations for maximizing these features include utilizing the platform's advanced collaborative tools, which allows multiple team members to work on the same application simultaneously. This fosters a quicker completion time and allows for shared input across departments, ensuring that all voices are heard.

Storing and managing completed forms is another benefit of using pdfFiller. With cloud storage capabilities, users can access their applications anywhere, ensuring that they can follow up or make amendments when necessary without hassle.

Best practices for managing your customer account application form

To ensure smooth operations regarding customer account applications, keeping meticulous records of submitted applications is imperative. This practice allows companies to maintain transparency and effectively monitor application statuses. As such, knowing how to follow up on an application and also maintaining adherence to data security and confidentiality standards is critical.

Moreover, educating teams on data protection protocols is essential, especially in industries where sensitive information is involved. Implementing strict access controls and regularly reviewing data management practices can enhance security.

Enhancing your application experience with pdfFiller

To further improve the customer account application experience, pdfFiller offers additional features, such as document sharing and tracking capabilities. These tools simplify the process of sending applications to other departments for review or approval, while tracking ensures transparency about the application's journey.

Furthermore, pdfFiller’s mobile capabilities empower users to submit applications remotely, providing flexibility that traditional paper forms cannot offer. The constant support from pdfFiller’s customer service team also adds an extra layer of reliability, making the overall experience seamless and user-friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send customer account application to be eSigned by others?

How do I edit customer account application in Chrome?

How can I edit customer account application on a smartphone?

What is customer account application?

Who is required to file customer account application?

How to fill out customer account application?

What is the purpose of customer account application?

What information must be reported on customer account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.