Get the free Corporate Credit Card Personal Expense Reimbursement Form

Get, Create, Make and Sign corporate credit card personal

Editing corporate credit card personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate credit card personal

How to fill out corporate credit card personal

Who needs corporate credit card personal?

Corporate Credit Card Personal Form: A Comprehensive Guide

Understanding corporate credit cards

Corporate credit cards are financial instruments specifically designed for businesses, allowing employees to have access to funds for company-related expenses. These cards serve the dual purpose of convenient transactions and expense tracking, ensuring that companies can efficiently manage their financial operations. Unlike personal credit cards, corporate credit cards often have distinct credit limits, reward programs, and accounting practices that align with organizational policies.

A key difference between personal and corporate credit cards lies in ownership and responsibility. With personal credit cards, individuals are solely responsible for payment, whereas corporate credit cards can distribute financial obligations across the organization. This allows companies to enforce spending limits and track employee expenses. Moreover, corporate cards typically offer benefits like discounts, travel perks, and other rewards tailored for business-related purchases.

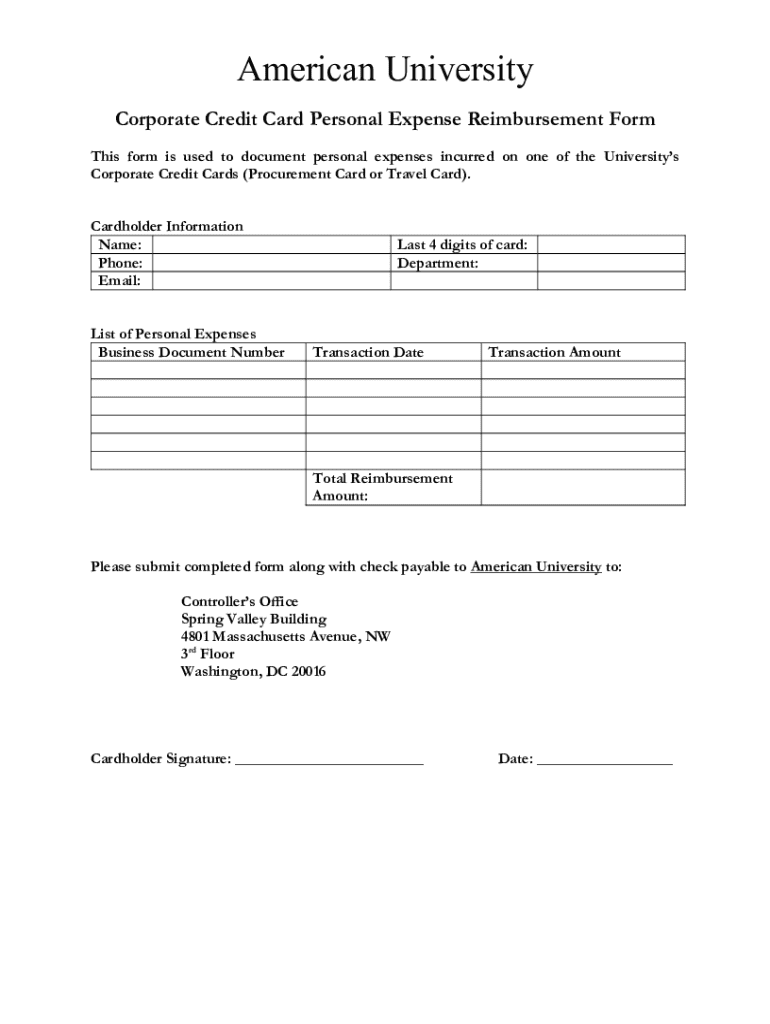

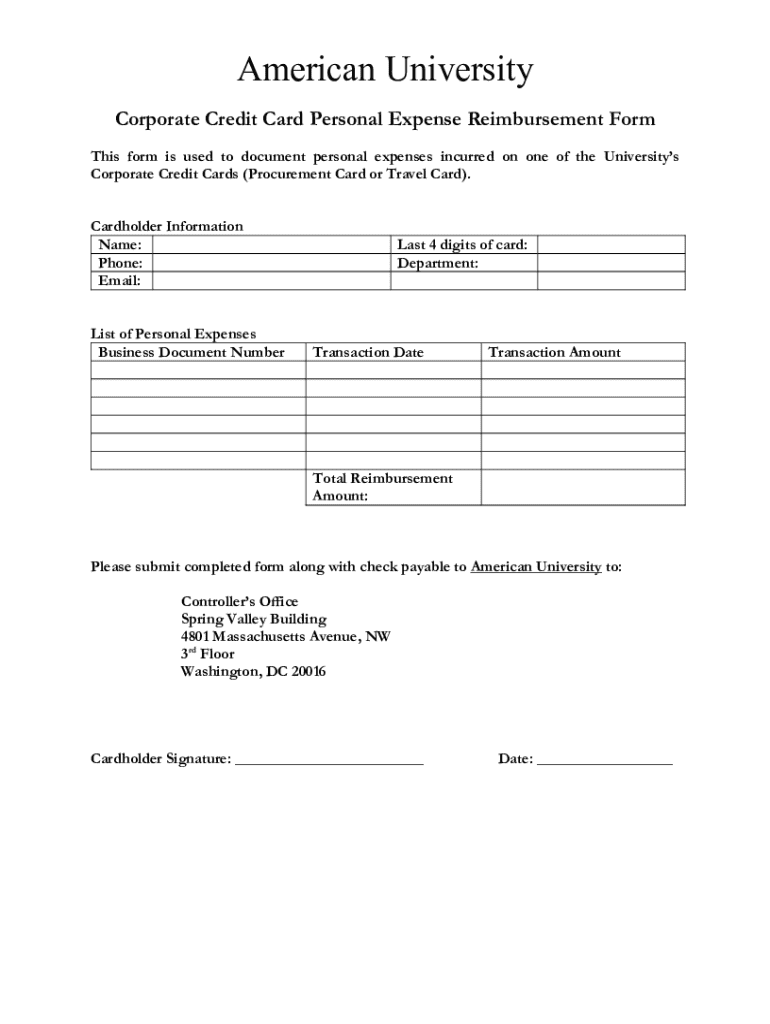

Overview of the corporate credit card personal form

The corporate credit card personal form is a crucial document used by employers to grant employees access to corporate credit cards. This form serves to gather essential information about the individual and assess their suitability for holding a corporate credit card. Filling out the form accurately is paramount, as it directly influences the approval process and subsequent credit allocation.

Typically, the form is required for employees who are expected to manage expenses on behalf of the organization. Different companies might have particular criteria for who should complete this form, often including sales personnel, project managers, and team leads. The process usually occurs when starting a new role, when financial responsibilities change, or when the company implements new financial controls.

Essential components of the corporate credit card personal form

The corporate credit card personal form consists of several key sections to capture the necessary information adequately. Each component plays a role in ensuring the applicant is trustworthy and capable of managing organizational funds responsibly.

The personal information section collects basic identification details, like the employee's name, contact information, and sometimes Social Security Number, to verify identity. The employment information section requires data about the employer, including the company's name, job title, and the duration in the current position, which helps assess the applicant's stability within their role.

Furthermore, the financial information section is critical. It typically covers income details, previous credit history, if applicable, and any significant financial obligations. Finally, corporate affiliation asks for the company name and the specific role of the individual within the organization to evaluate their necessity for the card.

Interactive tools for completing the form

To facilitate the completion of the corporate credit card personal form, pdfFiller offers a range of interactive tools. Users can benefit from a step-by-step guide to assist them through the various sections of the form, ensuring that essential information is correctly filled out. These guides are designed to simplify the process and help avoid errors that may delay approval.

Highlights of key fields are also essential as they guide users on what to prioritize while filling out the form. For example, emphasizing the importance of accurate employment and financial information ensures that the application aligns with company expectations. Moreover, pdfFiller includes interactive features like autofill options and suggestions, streamlining the form filling experience.

Detailed instructions for editing and signing the form

Once the corporate credit card personal form is filled out, accessing and editing it through pdfFiller is straightforward. Users simply need to locate the document in their saved files or the pdfFiller platform and select it for editing. The cloud-based nature of pdfFiller allows users to secure their data and access it from anywhere.

Adding necessary signatures is another critical aspect of the process. PdfFiller provides easy-to-use eSignature technology, enabling users to sign documents electronically, which complies with legal standards. This feature eliminates the need for printing or scanning, streamlining the entire workflow from completion to submission.

Managing your corporate credit card application

Once the corporate credit card personal form has been submitted, managing the application process becomes vital. Employees should keep track of their application status, as many organizations provide online portals where applicants can monitor progress. This transparency helps prevent surprises and allows for timely follow-ups when necessary.

Common issues might arise during application processing, such as insufficient information or delays in approval. Troubleshooting tips, like double-checking the form for accuracy and completeness, can help mitigate these challenges. Keeping contact information updated is crucial, as this ensures that applicants receive all necessary communications regarding their application status.

Understanding terms and conditions

Before finalizing the corporate credit card personal form, it is critical to understand the terms and conditions associated with corporate credit cards. These agreements outline key terms related to fees, interest rates, card usage, and company policies. Being well-acquainted with these agreements can help cardholders navigate their responsibilities.

Responsibilities as a cardholder include adhering to spending limits, properly reporting expenses, and ensuring that purchases are made for legitimate corporate purposes. In return, cardholders enjoy benefits such as the ability to manage work-related expenses without personal liability and potential rewards that may arise from responsible usage.

Addressing privacy and security concerns

In today’s world, ensuring the privacy and security of personal information is paramount, especially when it comes to financial documents like the corporate credit card personal form. Companies often implement robust data protection measures, including encryption and secure storage options, to shield sensitive information from unauthorized access.

Understanding data privacy policies is crucial for employees filling out the form. They should be aware of how their information will be used and the measures in place to protect it. Compliance with corporate policies surrounding data security ensures that individuals can respectfully manage their information while minimizing the risk of data breaches.

FAQs about corporate credit cards and the personal form

There are several common questions regarding the corporate credit card personal form and the implications of using a corporate credit card. For example, individuals often wonder what to do if their application is denied. In such cases, applicants can usually seek clarification from their HR department about the reasons for denial, which may provide insights for a future application.

Additionally, questions regarding the use of the corporate card for personal expenses frequently arise. Generally, corporate cards are strictly for business purposes, and using them for personal expenses can lead to penalties or termination of card privileges. Moreover, understanding the interest rates and fees associated with corporate cards is fundamental, as misuse or late payments can have financial consequences.

Further resources available on pdfFiller

For those looking to explore more about corporate credit card personal forms and related financial documents, pdfFiller offers a wealth of resources. Users can access links to various related forms and templates that can assist them in financial documentation, whether for personal or corporate use.

Furthermore, pdfFiller provides additional tools for document management that can enhance the overall user experience. Whether it’s templates for expense reports or forms necessary for budget approvals, pdfFiller is equipped to support users in their efficiency. Finally, customer support is readily available for any guidance, ensuring that users can navigate the document management landscape with ease.

User testimonials: real-life experiences

Real-life experiences from users of the corporate credit card personal form can provide invaluable insights. Many users share success stories about their applications and highlight the ease with which they navigated the pdfFiller platform. Testimonials often focus on the intuitive interface and its role in ensuring that their forms were completed correctly and efficiently.

Moreover, users frequently convey tips about how to best fill out the form, emphasizing the importance of accuracy and verifying details before submission. Many also credit pdfFiller for significantly enhancing their document management processes, noting how it has allowed for smoother operations in corporate environments by reducing paperwork and unnecessary delays.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify corporate credit card personal without leaving Google Drive?

How do I fill out corporate credit card personal using my mobile device?

How do I edit corporate credit card personal on an iOS device?

What is corporate credit card personal?

Who is required to file corporate credit card personal?

How to fill out corporate credit card personal?

What is the purpose of corporate credit card personal?

What information must be reported on corporate credit card personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.