Get the free Credit Card Payment Authorization Consent Form

Get, Create, Make and Sign credit card payment authorization

Editing credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

Credit card payment authorization form: A comprehensive how-to guide

Understanding credit card payment authorization forms

A credit card payment authorization form serves as a formal agreement between a cardholder and a merchant that allows the business to charge the specified credit card for specific transactions. This form becomes particularly essential in scenarios such as high-value purchases, subscriptions, or instances where a card is not physically present, also known as card-not-present transactions.

The significance of credit card authorization is multifaceted. Not only does it help in preventing fraud, but it also secures the merchant against chargeback claims. Utilizing such a form ensures both parties are aware of the conditions under which the card is being used, fostering transparency and trust.

Businesses, regardless of their size or industry, leverage these forms to streamline transactions, especially when dealing with repeat customers who may prefer to keep their card on file. It simplifies the payment process while ensuring compliance with industry regulations.

Benefits of using a credit card payment authorization form

One of the most significant benefits of employing a credit card payment authorization form is its capability to prevent chargeback abuse. Chargebacks can occur when a customer disputes a transaction, and without proper documentation, merchants can face hefty penalties and financial losses. Having this form on file offers substantial proof that a transaction was authorized.

Furthermore, these forms enhance security for both merchants and customers. Merchants can verify that they have permission to charge the card, while customers enjoy peace of mind knowing their payment details are being handled appropriately. The form can also facilitate smoother transactions for repeat customers by allowing businesses to keep their payment information securely on file, thus expediting future purchases.

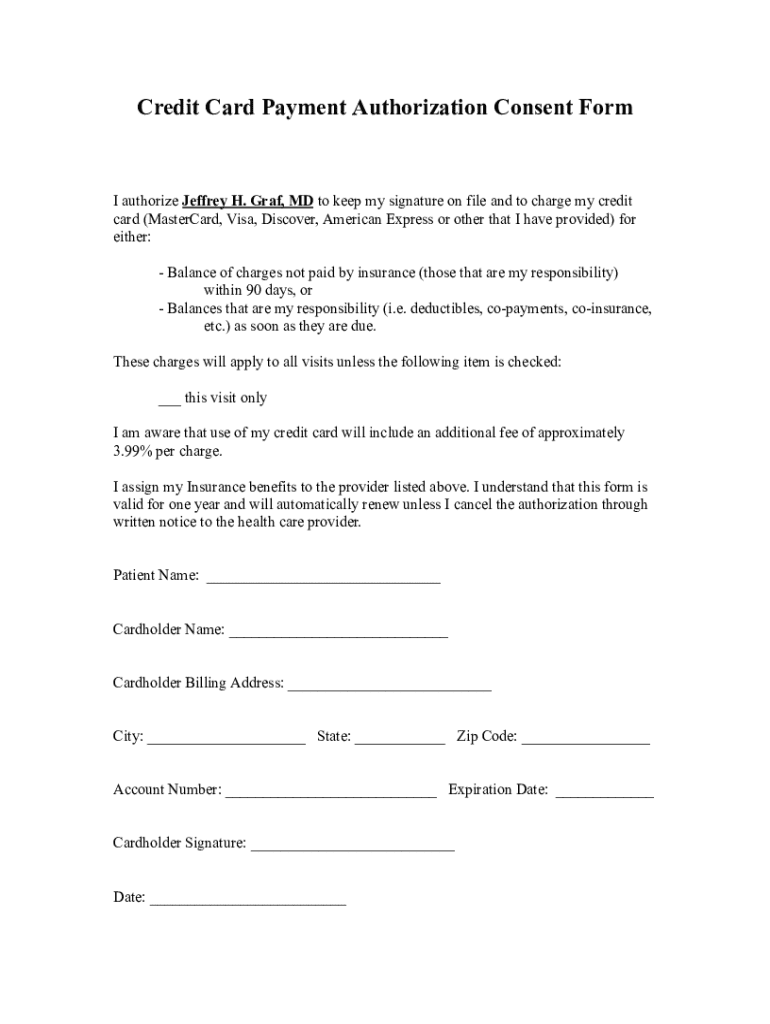

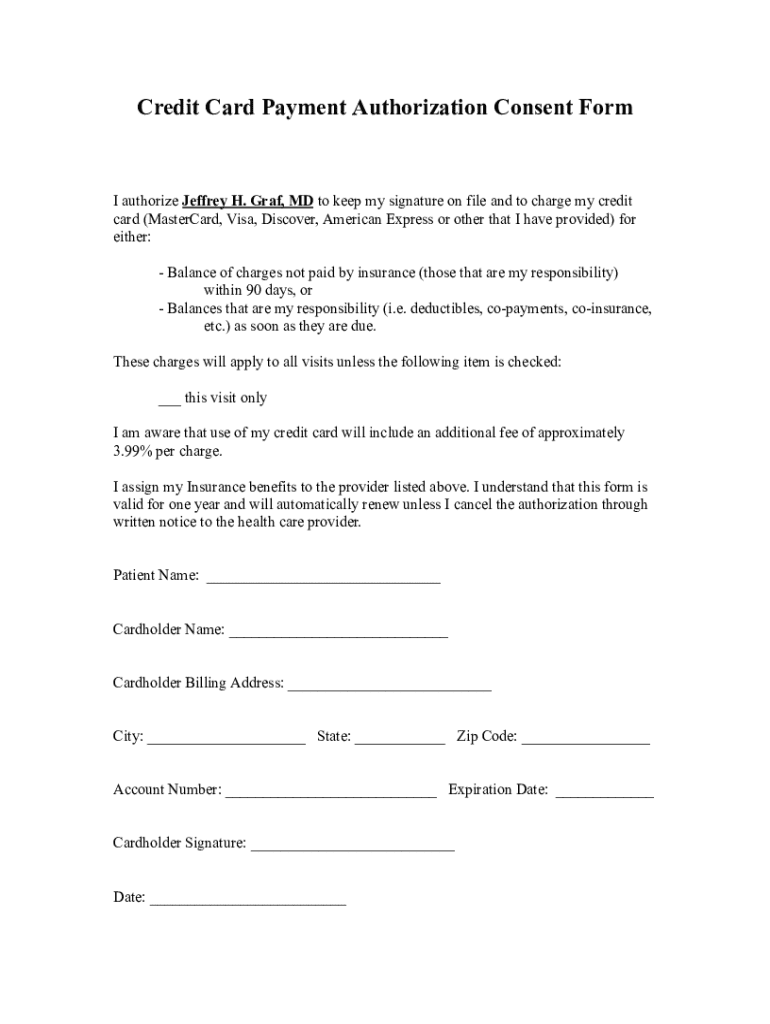

Key components of a credit card payment authorization form

To create an effective credit card payment authorization form, there are several essential fields that must be included. The payment form should collect the cardholder's name, card number, expiration date, and CVV, if applicable, to ensure that the merchant has all relevant information needed for processing the payment. Additionally, the billing address should be collected to verify the transaction.

Obtaining clear consent from the cardholder is imperative. This consent not only confirms that the cardholder agrees to the charges but also establishes a legal safeguard for the merchant. Optional fields like the reason for payment or invoice number can enhance the form, helping both the vendor and customer to keep track of transactions easily.

When to use a credit card payment authorization form

A credit card payment authorization form becomes crucial in specific situations, such as when managing subscriptions, high-value transactions, or for recurring payments. If a customer is purchasing an item at a retail store, having them sign a form may not be necessary; however, for service-based businesses or e-commerce transactions, it is highly recommended.

Analyzing risk factors is an essential part of determining when to use this form. For example, businesses with higher chargeback rates or those selling products that are easy to return may need to implement this form more rigorously. Legally speaking, it’s important for sellers to understand regional regulations regarding customer consent and privacy laws, to ensure all practices comply with applicable standards.

How to fill out a credit card payment authorization form

Filling out a credit card payment authorization form accurately is essential for avoiding payment discrepancies and potential disputes. To complete the form, start with entering the cardholder’s details including their name and billing address. Next, specify the payment details such as the card number, expiration date, and CVV (if applicable).

Concluding the form requires the cardholder's consent through a signature, often in a designated area to avoid any confusion. Be mindful of common mistakes; for instance, ensure the card number and expiration date are entered without any typos. Omitting a signature can render the authorization invalid, leading to potential issues with processing payments in the future.

Best practices for storing credit card authorization forms

Proper storage of credit card authorization forms is critical for protecting sensitive information. Firstly, ensure that all physical copies are stored in a secure location, such as a locked filing cabinet or a safe. For digital forms, using encrypted cloud storage solutions is advisable to safeguard against unauthorized access.

It is also prudent to establish a recommended storage duration for signed forms, typically aligned with the statute of limitations for credit card transactions in your jurisdiction. Regularly audit your records to dispose of expired forms in a secure manner. Understanding the balance between physical and digital storage is essential: while digital can offer convenience and space savings, physical copies may sometimes be necessary for oversight or compliance.

Frequently asked questions about credit card payment authorization forms

A common question that arises is whether a credit card authorization form is necessary if the customer is physically present. While it is not always required, best practices suggest having a form signed for higher risk transactions to protect both parties. Another query relates to disputes: if a transaction is challenged after an authorization, having the form can serve as pivotal proof of consent.

Additionally, businesses often wonder about the validity of a form that does not have space for the CVV. While it's better to include the CVV for added security, the absence of this field does not invalidate the form itself. Handling expired authorization forms requires diligence; ensure they are marked for destruction or review to comply with both customer privacy and financial security standards.

Download our credit card payment authorization form template

For those looking to save time and ensure compliance, pdfFiller offers a customizable credit card payment authorization form template. Downloading our template is straightforward: simply navigate to our website, choose the appropriate form, and follow the prompts to fill it out. This helps tailor the form to meet specific business needs, ensuring all critical fields are included.

Our users have reported increased satisfaction and efficiency in managing transactions with the aid of our templates. Utilizing these forms provides peace of mind, allowing businesses to focus on growth rather than paperwork.

Additional resources and tools

For businesses interested in broadening their range of financial document management, pdfFiller also offers access to various related forms and tools. From invoices to receipts, having a comprehensive suite can simplify your operations tremendously. Explore our collection that includes payment processing tools, billing templates, and systems designed to secure sensitive financial information.

Additionally, diving into our blog posts related to payment processing, business finance, and document management can keep you informed of the latest trends and best practices in the industry.

Case studies: Successful implementation of credit card authorization forms

Many businesses have witnessed significant improvements in transaction security and customer trust through the effective use of credit card authorization forms. For instance, a subscription-based service reported a 30% decrease in chargebacks after implementing a robust authorization form process, as customers felt more secure about transactions.

Another case study from a high-end retail store illustrates how having customers authorize payment upfront increased their repeat business, as shoppers appreciated the streamlined process for future purchases.

Stay informed

For ongoing insights into document management and payment processing trends, subscribe to our newsletter. This ensures you remain on the forefront of best practices, documented management techniques, and industry tips that can enhance your operations. Also, follow pdfFiller on social media to stay connected for regular updates and professional guidance.

Related topics that might interest you

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card payment authorization directly from Gmail?

Can I edit credit card payment authorization on an iOS device?

How can I fill out credit card payment authorization on an iOS device?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.