Get the free Cardholder Agreement / Terms & Conditions

Get, Create, Make and Sign cardholder agreement terms conditions

How to edit cardholder agreement terms conditions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cardholder agreement terms conditions

How to fill out cardholder agreement terms conditions

Who needs cardholder agreement terms conditions?

Comprehensive Guide to Cardholder Agreement Terms Conditions Form

Understanding the cardholder agreement

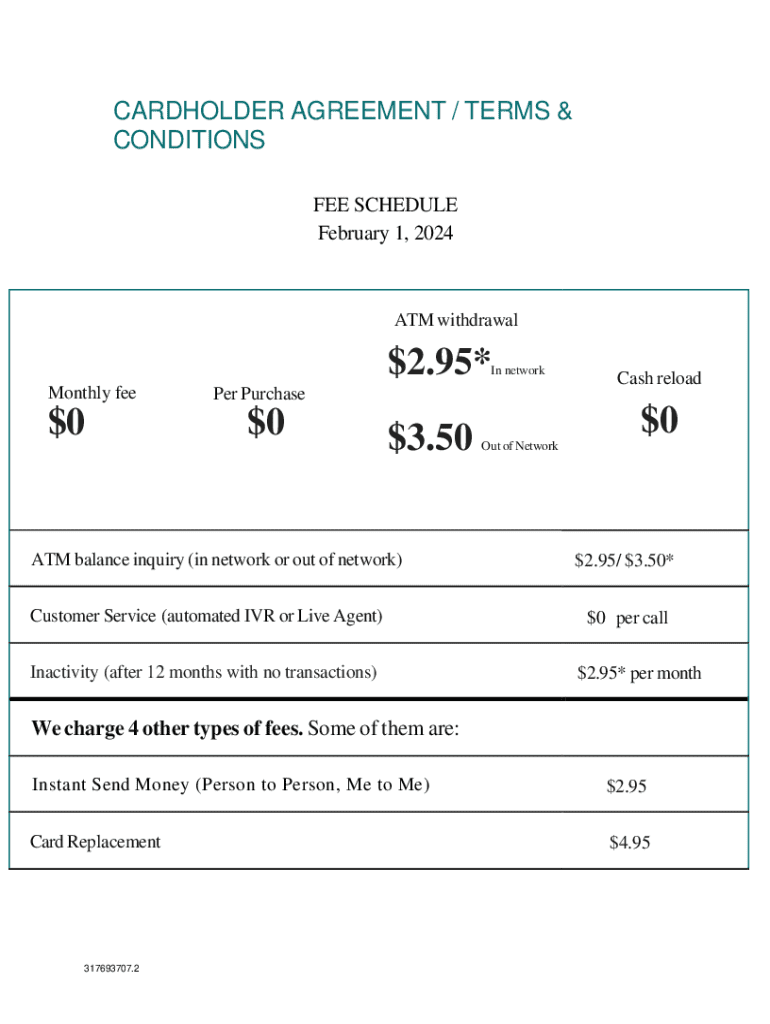

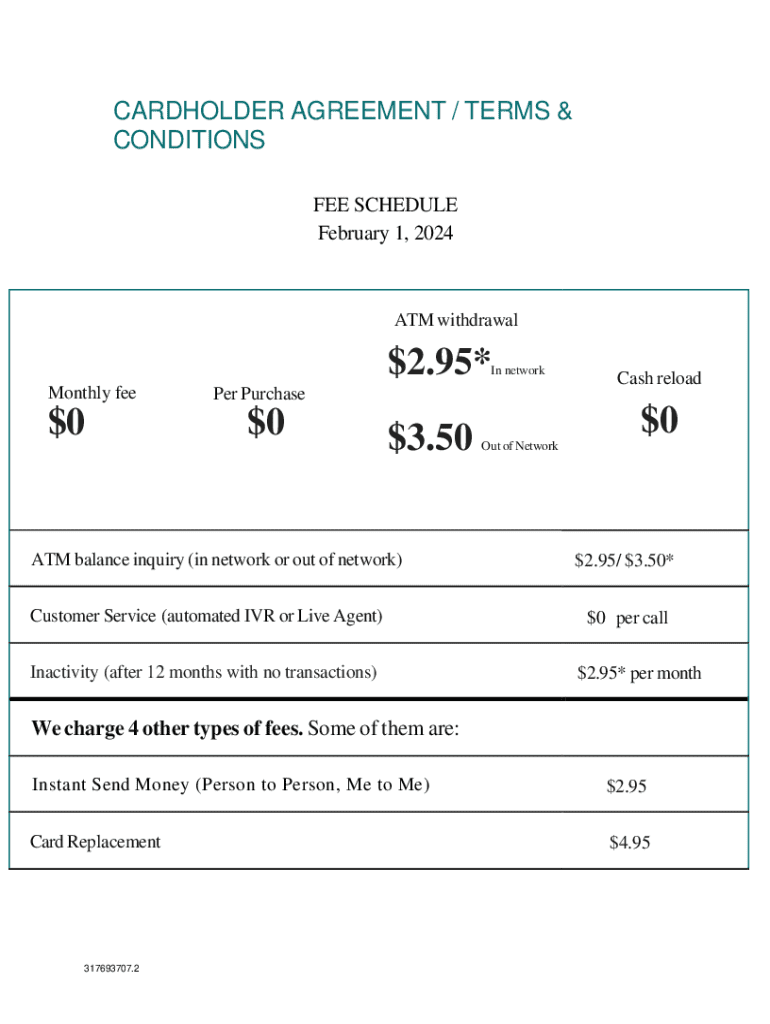

A cardholder agreement is a crucial document that outlines the terms and conditions between a cardholder and their financial institution. This agreement not only defines the rights and responsibilities of both parties but also serves as a guideline for card usage, payments, and fees. The importance of this document cannot be overstated; it plays a pivotal role in protecting the interests of consumers while establishing clear expectations for financial institutions.

For cardholders, understanding this agreement is essential as it directly affects their financial decisions. Financial institutions rely on these agreements to ensure compliance with regulatory requirements and to maintain healthy customer relationships. Thus, both parties benefit from clear terms that mitigate misunderstandings and legal disputes.

Key components of the cardholder agreement

Importance of reviewing cardholder agreement terms

Understanding the specifics of your cardholder agreement is essential. By reviewing the terms and conditions, cardholders can better understand their obligations and the potential costs associated with their credit usage. This proactive approach helps avoid unexpected charges and ensures that they remain in good standing with their credit issuer.

Furthermore, knowing your rights as a cardholder can empower you to make informed decisions and take appropriate action if discrepancies arise. A thorough review of the agreement can unearth crucial information such as fees, penalties, and even changes in terms that may affect usage.

Common terms to look out for

Navigating the cardholder agreement terms and conditions form

Accessing the cardholder agreement terms and conditions form is straightforward on the pdfFiller platform. Users can easily find the form by using the search feature in the main navigation. This user-friendly platform allows you to filter results, making the form retrieval process efficient. Once you locate the form, you can view, edit, or download it based on your needs.

When filling out the form, you will encounter specific sections that require your attention. Every part of the form facilitates accurate documentation of your agreement and preferences.

Filling out the form

Editing and customizing your cardholder agreement

pdfFiller’s editing tools offer remarkable flexibility when it comes to customizing your cardholder agreement. Users can easily modify the document to suit their requirements, whether it's adding personal notes or adjusting terms based on their preferences. The platform’s features allow you to add text, comments, and signature fields, ensuring the agreement accurately reflects your situation.

Ensuring that your form complies with legal standards is vital. This involves continually reviewing for accuracy and relevancy, particularly if laws governing credit and financial transactions shift. Taking advantage of pdfFiller’s collaborative tools allows you to invite team members or advisors into the editing process, improving the overall quality and compliance of your document.

Collaborating on your cardholder agreement

Signing and managing your cardholder agreement

Once your cardholder agreement is complete, signing it can be done electronically through pdfFiller. eSigning provides a quick and secure way to finalize the document, ensuring that both parties acknowledge and accept the terms. It’s crucial to understand the legal implications of eSigning, especially when it comes to financial documents, as many jurisdictions recognize electronic signatures as legally binding.

Managing your signed cardholder agreement effectively involves proper storage and retrieval. The advantage of cloud storage on pdfFiller’s platform allows users to access their agreements anytime, anywhere. It’s recommended to categorize your documents efficiently for easy retrieval in case of future disputes or reference requirements.

Benefits of cloud storage for your cardholder agreement

Frequently asked questions (FAQs)

Cardholders frequently have questions about their agreements. Understanding what to do if you disagree with the terms is crucial. Most agreements include a clause that allows for negotiation in some cases, but it’s essential to approach this gracefully. Disputing charges can also be addressed within the framework of the terms outlined in the agreement, typically requiring documentation and a formal process.

If you find yourself needing to change credit card providers, knowing the specifics of how to initiate this process is fundamental. Check for any early termination fees or penalties outlined in your agreement, as these can heavily influence your decision to switch.

Common queries regarding cardholder agreements

Additional considerations for cardholders

Staying informed about updates to your cardholder agreement is vital. Financial institutions have the right to amend their agreements periodically, but they are typically required to notify cardholders in advance. This vigilance can help you avoid sudden changes to fees and terms that may negatively impact you.

Equipping yourself with further knowledge about financial literacy is invaluable. There are numerous resources available online, such as consumer advocacy groups and financial education platforms, designed to help individuals understand credit Terms.

Empowering yourself with knowledge

Conclusion

Understanding the terms outlined in your cardholder agreement is a vital step in becoming a responsible cardholder. The principles established within the agreement govern how you can utilize credit, the fees you may incur, and what rewards you can obtain. By maintaining awareness of your rights and obligations as articulated in the agreement, you can avoid pitfalls and manage your finances with confidence.

Ultimately, ensuring compliance with these guidelines not only supports your financial health but also fosters a positive relationship with your credit issuer. Using platforms like pdfFiller can help streamline the management of your cardholder agreement, allowing you to focus on your goals without getting bogged down by paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in cardholder agreement terms conditions without leaving Chrome?

Can I edit cardholder agreement terms conditions on an Android device?

How do I fill out cardholder agreement terms conditions on an Android device?

What is cardholder agreement terms conditions?

Who is required to file cardholder agreement terms conditions?

How to fill out cardholder agreement terms conditions?

What is the purpose of cardholder agreement terms conditions?

What information must be reported on cardholder agreement terms conditions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.