Get the free Credit Cards: Fair Debt Collection Practices Act Could ...

Get, Create, Make and Sign credit cards fair debt

How to edit credit cards fair debt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit cards fair debt

How to fill out credit cards fair debt

Who needs credit cards fair debt?

Credit cards fair debt form - How-to Guide

Understanding credit card debt

Credit card debt refers to money that a consumer owes to credit card companies due to unpaid purchases made using credit cards. This type of debt can quickly spiral out of control due to high-interest rates and fees associated with late payments or missed payments.

Common causes of credit card debt include overspending, unexpected medical expenses, job loss, and inadequate budgeting. Many consumers fall into the trap of relying on credit cards for essential purchases, leading to a cycle of debt that can become difficult to manage.

Accumulating credit card debt has serious implications, including damage to credit scores, higher interest rates on loans, and increased stress which can affect mental and physical health. Taking proactive steps to manage credit card debt is crucial for long-term financial stability.

The importance of fair debt collection practices

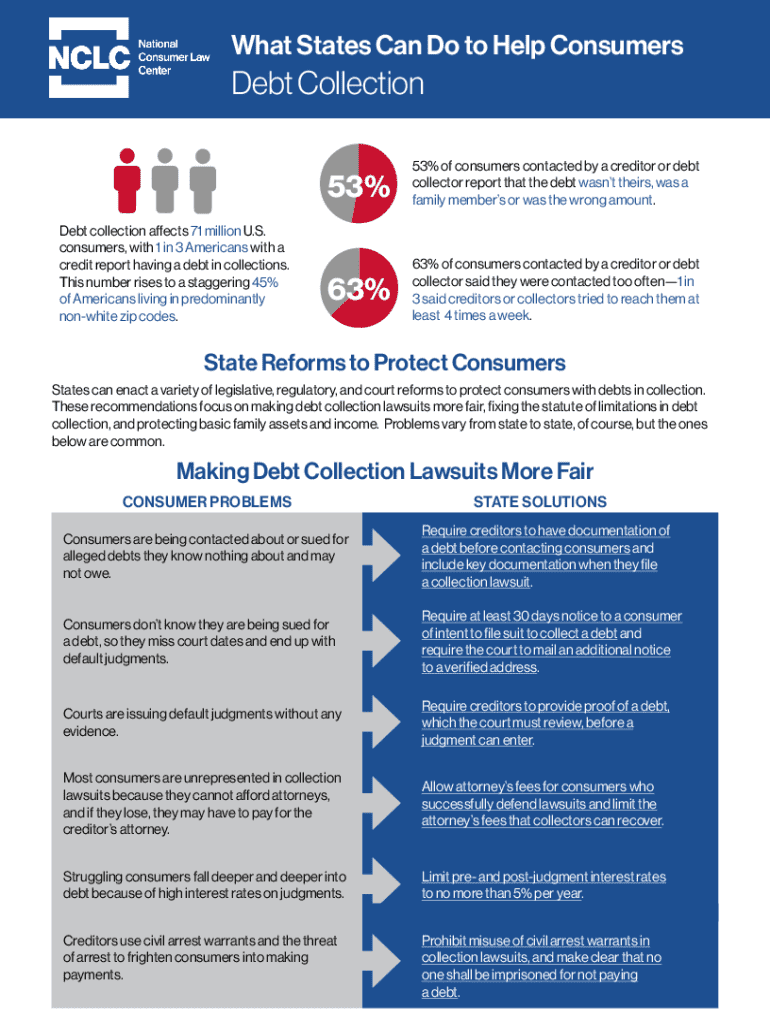

Fair debt collection practices are vital for protecting consumers from harassment and unfair treatment by debt collectors. These practices ensure that consumers have rights that debt collectors must respect, creating a more balanced environment where owed debts can be managed without undue stress or intimidation.

Unfair debt collection can severely impact the mental health and financial situation of consumers. For example, aggressive tactics like repeated phone calls, threats, or abusive language create unnecessary fear and anxiety, often pushing individuals further into debt.

In the United States, the Fair Debt Collection Practices Act (FDCPA) lays out specific regulations concerning what debt collectors can and cannot do. Understanding this legal framework is essential for consumers to navigate debt situations effectively.

Legal requirements for debt collections

The Fair Debt Collection Practices Act (FDCPA) is a federal law that dictates how debt collectors may operate. It prohibits them from engaging in any deceptive or unfair practices when collecting debts. This legislation covers a wide range of activities, ensuring that consumers are treated with respect throughout the process.

Key consumer rights under fair debt laws include receiving a written notice of the debt, the right to dispute the debt, and protections against harassment. Debt collectors are required to provide accurate information and must cease contact upon request by the consumer.

Debt collectors themselves have specific responsibilities to adhere to, such as avoiding contact during inconvenient times or locations and not using abusive language. These regulations empower consumers and encourage fair treatment in debt collection processes.

Introduction to credit cards fair debt form

The credit cards fair debt form is a vital document designed to assist consumers in managing their credit card debts responsibly. This form serves to officially communicate concerns regarding unfair debt collection practices, providing a structured means for consumers to assert their rights.

It is essential to use this form when you are experiencing harassment from a debt collector or when you dispute a debt's validity. Proper use of the credit cards fair debt form helps ensure that your rights are respected and that further collection actions are halted.

Benefits of using the credit cards fair debt form include creating a documented record of your concerns, enhancing communication with debt collectors, and ensuring that you assert your rights within the legal framework established by the Fair Debt Collection Practices Act.

Step-by-step guide to completing the credit cards fair debt form

Completing the credit cards fair debt form involves specific steps to ensure that all necessary information is accurately conveyed. Here’s a detailed guide to navigating this process:

Editing and customizing the credit cards fair debt form

Utilizing pdfFiller to edit your credit cards fair debt form provides a user-friendly approach to making necessary changes. The platform allows you to tailor the form to your unique situation while maintaining the integrity of the document.

To edit your form, simply upload it to pdfFiller, and follow these steps: First, select the area you want to change, or add new information. Online document editing offers the advantage of easy adjustments on the go, making it convenient to collaborate with others for input on your submissions.

eSigning your credit cards fair debt form

Signing your credit cards fair debt form is a crucial step in ensuring its validity. Whether you choose to sign electronically or traditionally, providing a signature confirms that the information you have submitted is accurate and that you have asserted your rights regarding the debt collection process.

Using pdfFiller, you can easily eSign your document. This method is not only convenient but also legally valid in most jurisdictions. Electronic signatures streamline the process and help eliminate unnecessary delays in the submission of your form.

Managing your credit cards fair debt form

Once your credit cards fair debt form is completed, managing it efficiently is key to accessing it when needed. Storing your form securely in the cloud with pdfFiller ensures that you can retrieve it from anywhere and at any time.

Employing version control strategies allows you to keep track of amendments or changes made to your document. This is particularly useful for maintaining accurate records over time, ensuring that your credit cards fair debt inquiries remain organized and easily accessible.

Addressing potential disputes

If your debt is disputed, it is essential to take immediate action. Start by documenting all communications and interactions with the debt collector. This documentation will be invaluable should you need to escalate the situation or seek legal advice.

Consider consulting a legal professional when you feel overwhelmed or threatened. Utilizing your consumer rights effectively can help protect you from unfair treatment. Keep in mind that knowledge is power when negotiating debt situations.

Interactive tools available on pdfFiller

pdfFiller offers various interactive tools that enhance document management and streamline processes associated with the credit cards fair debt form. These include form templates, automatic calculations for financial totals, and other features designed to facilitate better organization.

Utilizing these interactive resources allows users to create forms quickly and efficiently while integrating essential financial management tools to make informed decisions regarding credit card debts.

FAQs about credit cards fair debt

Understanding the common questions surrounding the credit cards fair debt form can help clear up confusion. For instance, after submission, you may wonder what the next steps are and how long it typically takes to receive a response.

Contact information for further assistance

For help with your credit cards fair debt queries or to seek further assistance, pdfFiller provides multiple customer support channels. Users can reach out through email, live chat, or the help center located on the website.

It’s essential to take advantage of these resources when managing your document-related needs, ensuring that you are informed and empowered throughout your credit card debt resolution journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit cards fair debt from Google Drive?

Can I edit credit cards fair debt on an Android device?

How do I fill out credit cards fair debt on an Android device?

What is credit cards fair debt?

Who is required to file credit cards fair debt?

How to fill out credit cards fair debt?

What is the purpose of credit cards fair debt?

What information must be reported on credit cards fair debt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.