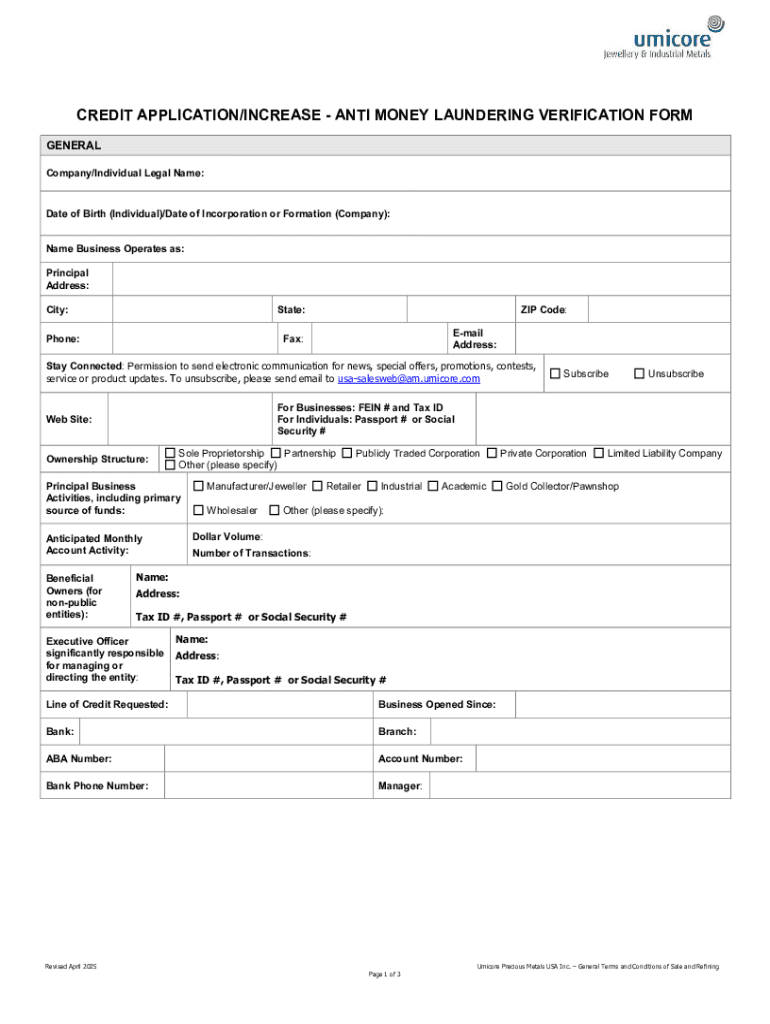

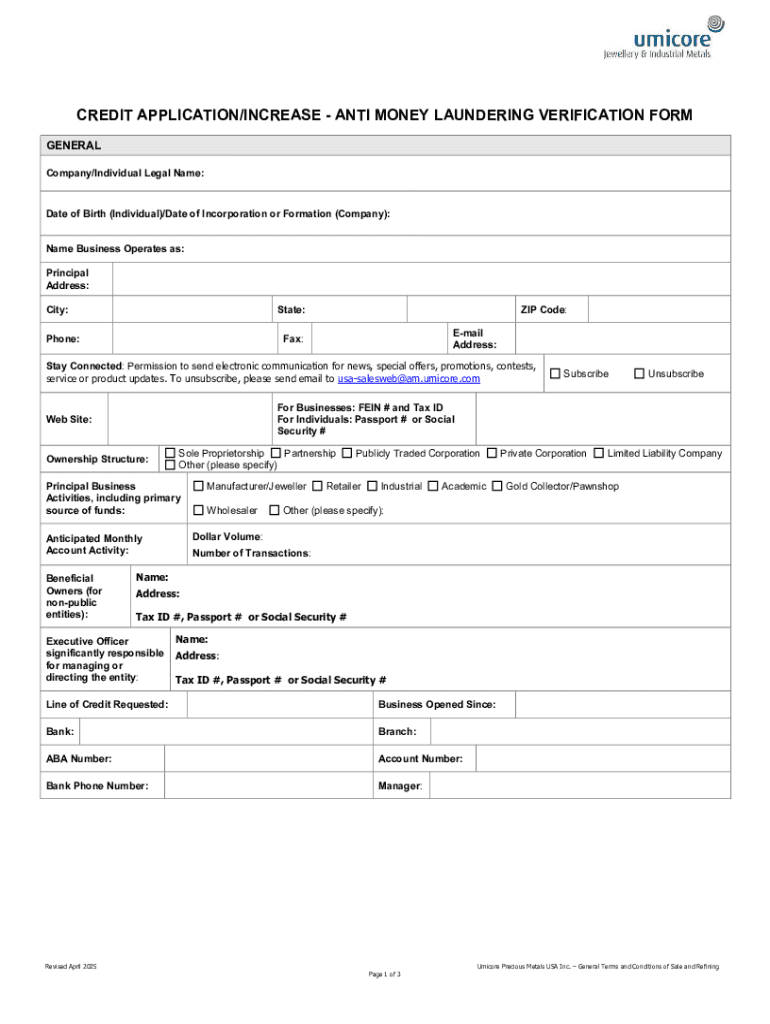

Get the free Credit Application/increase - Anti Money Laundering Verification Form

Get, Create, Make and Sign credit applicationincrease - anti

Editing credit applicationincrease - anti online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit applicationincrease - anti

How to fill out credit applicationincrease - anti

Who needs credit applicationincrease - anti?

Navigating Credit Application Increases: Understanding Anti Forms

Understanding credit applications

A credit application is a formal request made to a lender or financial institution for credit, which can range from loans, credit cards, to lines of credit. It plays a crucial role in assessing the creditworthiness of an individual or business. Credit applications contain information about the applicant's financial history, income, employment, and other relevant details which inform the lender's decision on whether to grant credit and at what terms.

The importance of credit applications cannot be overstated; they are the gateway to financial transactions that can help build or enhance your financial future. In an increasingly credit-driven society, having a well-prepared credit application is vital. Common reasons for increasing credit applications include improving homeownership opportunities, gaining better rates on loans, or simply consolidating existing debt.

Recognizing anti form issues

Anti forms in credit applications refer to instances where applicants submit false, misleading, or incomplete information either knowingly or unknowingly. Identification of anti forms is critical because they can lead to severe consequences such as credit application denial, negative impacts on credit scores, and even potential legal repercussions.

Understanding why anti forms are detrimental to financial wellness is essential. When misinformation or inaccurate details are present in your application, it can undermine your credibility, complicate future credit pursuits, and jeopardize legitimate loan requests. Signs of an anti form might include discrepancies in reported income, unexplained gaps in employment history, and mismatched personal data.

Strategies to enhance credit application processes

Setting clear objectives is the first step in increasing credit applications effectively. Before submitting an application, define what you want to achieve—whether it's to secure a higher credit limit, obtain a loan with lower interest, or internal funding for a personal project. By having a clear strategy, the completion of credit applications becomes more focused and purposeful.

Building a robust documentation process is vital. The necessary documentation could include your social security number, proof of income, credit history, and bank statements. Organizing these documents effectively, perhaps using tools like pdfFiller, makes the overall process seamless. pdfFiller helps not just in editing PDFs, but also in organizing the documents needed for smooth credit application submissions.

How to fill out a credit application form correctly

A well-filled credit application is essential. Begin by gathering initial information such as your personal identification—name, address, and contact details. The next step involves detailing your financial background, including credit history and monthly expenses. Providing accurate employment and income details will be vital as lenders heavily rely on this information to assess your payment capability.

Providing truthful information ensures integrity in your application process. Common mistakes to avoid include misreporting income or omitting previous loans. It's prudent to double-check your application for accuracy before submission, as one simple error can lead to application denial.

Utilizing pdfFiller tools for credit applications

pdfFiller offers an array of tools specifically designed to improve your credit application experience. Editing PDF forms allows you to make real-time adjustments before submission, ensuring your application is polished and professional. The benefit of eSigning your credit application cannot be overlooked; it streamlines the submission process, allowing for a quicker response from lenders.

Collaboration features also exist for teams working on credit requests. Shared access ensures all team members can stay updated with any necessary changes. Furthermore, pdfFiller’s cloud storage allows you to manage all your application documents securely and access them anywhere, anytime, eliminating the hassle of physical paperwork.

Handling rejections and appeals

Understanding why credit applications get denied is important for improving your future submissions. Common reasons may include insufficient credit history, low credit scores, or inconsistencies in your application. It's essential to assess these aspects before submitting your next application.

If your application is denied, don't be discouraged. Steps to appeal include requesting the reason for denial, correcting any errors, and submitting additional documentation to bolster your application. Resubmitting with improved documentation could significantly enhance your chances of success.

Frequently asked questions

If you suspect an anti form, the first step is to review your application closely and address any discrepancies you find. It’s also wise to follow up with the lender for clarification. To verify the status of your credit application, contact the financial institution where you applied; they should provide you with updates on the process.

Regarding the impact of anti forms on your credit score, submitting inaccurate information can lead to a poor credit evaluation, which, in turn, can affect your credit score negatively, making it essential to be diligent in your applications.

Best practices for future credit applications

Creating a credit application checklist can streamline the preparation process. Ensure all necessary documents are gathered in advance, including proof of income and employment verification. Regularly updating your financial documents ensures they're always accurate and ready to go. Utilizing pdfFiller enhances this process by allowing easy editing and management of all your documents.

Keeping your documents accessible and up-to-date will not only make your application process smoother but also help in mitigating the risks associated with anti forms.

Risks of not addressing anti forms

Ignoring the presence of anti forms can lead to long-term financial consequences, including a decline in your credit score and the potential for future loans being denied. The legal implications of submitting fraudulent forms can also be significant, resulting in penalties or legal action against you.

In addition, building and maintaining a good credit score requires diligence. Ensuring all your applications are accurate and truthful helps you build credibility with lenders over time.

Leveraging technology to prevent anti forms

Digital platforms like pdfFiller play an essential role in credit applications. With advanced editing tools, users can minimize errors and effectively present their financial information. The security features provided by pdfFiller ensure that sensitive information is kept safe while remaining easily accessible.

Utilizing such technology not only reduces the potential for inaccuracies in applications but also allows applicants to focus more on completing quality submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit applicationincrease - anti for eSignature?

Can I create an electronic signature for the credit applicationincrease - anti in Chrome?

How do I fill out credit applicationincrease - anti on an Android device?

What is credit applicationincrease - anti?

Who is required to file credit applicationincrease - anti?

How to fill out credit applicationincrease - anti?

What is the purpose of credit applicationincrease - anti?

What information must be reported on credit applicationincrease - anti?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.