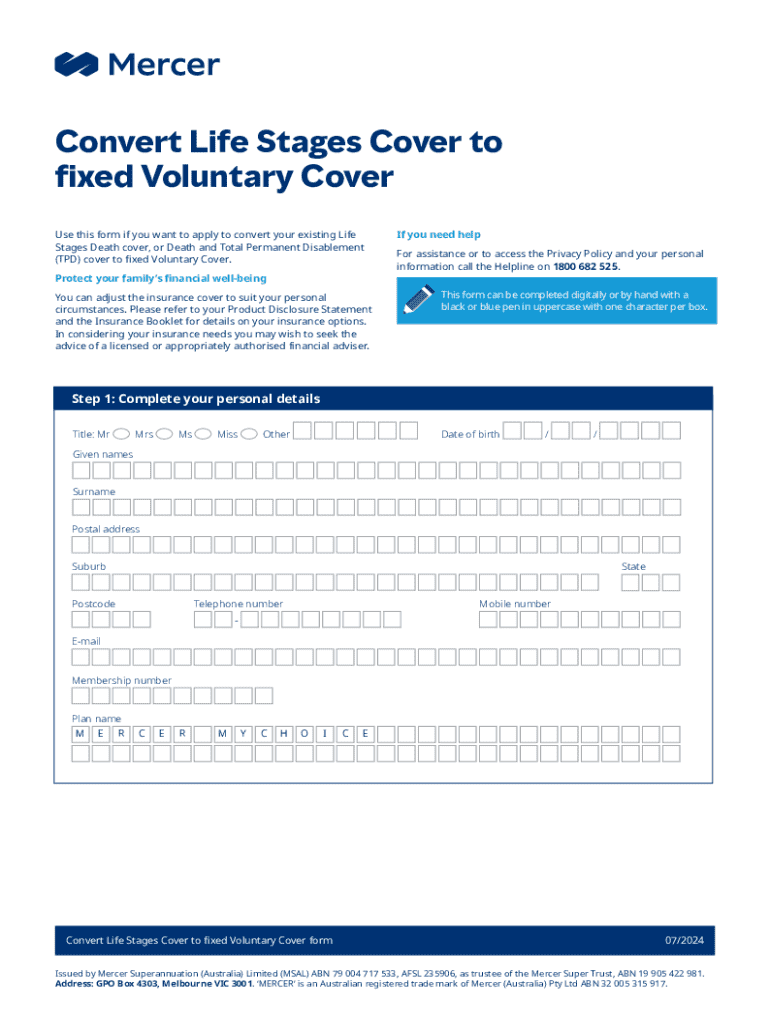

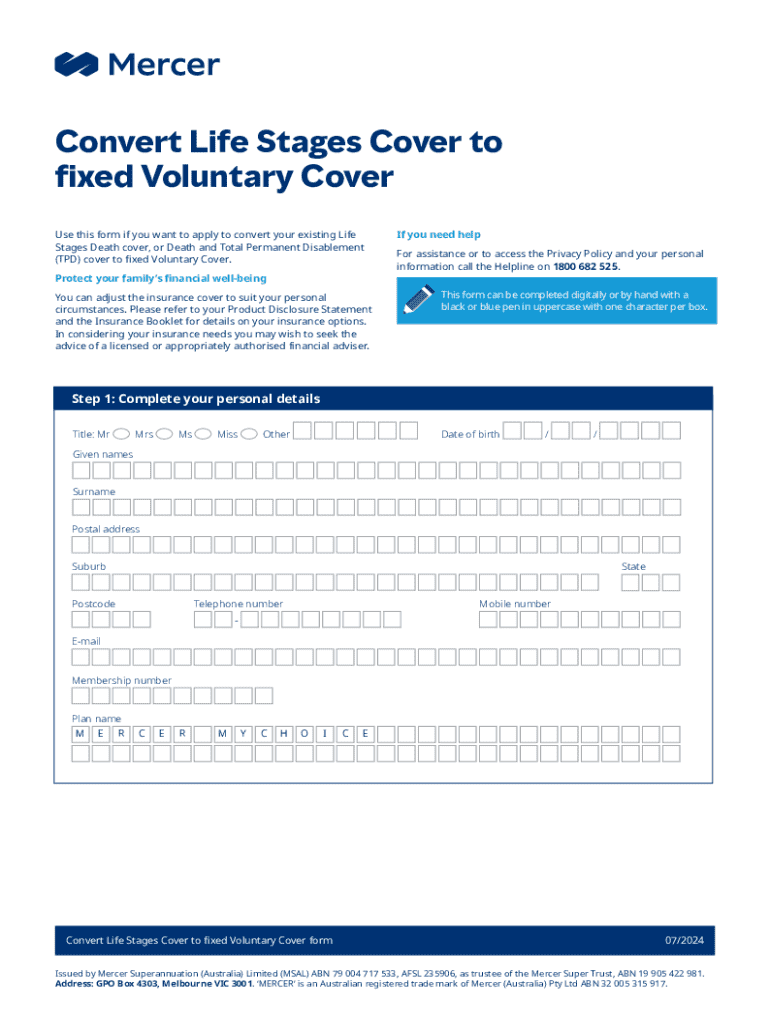

Get the free Convert Life Stages Cover to Fixed Voluntary Cover Form

Get, Create, Make and Sign convert life stages cover

Editing convert life stages cover online

Uncompromising security for your PDF editing and eSignature needs

How to fill out convert life stages cover

How to fill out convert life stages cover

Who needs convert life stages cover?

Convert Life Stages Cover Form: A Comprehensive Guide

Understanding life stages cover

Life Stages Cover is a tailored insurance solution designed to adjust your coverage as you progress through various significant phases in life. Its primary purpose is to ensure that both your personal and financial needs are met with appropriate coverage at each life stage, offering protection and peace of mind during major transitions.

In personal financial planning, Life Stages Cover plays a crucial role, addressing the dynamic nature of life’s circumstances—from starting a family to planning for retirement. The importance of this coverage can’t be overstated as it reflects not only individual life events but also the collective risk management strategy for families and individuals alike.

Different life stages: what you need at each stage

Every phase of life brings unique challenges and requirements. Understanding these aspects is essential when converting your Life Stages Cover Form.

During early adulthood, typically from ages 18 to 30, the focus is on laying a solid foundation. This includes the need for basic health insurance, life insurance for debt coverage, and possibly starting to save for retirement. Key documents at this stage often include student loan agreements and rental agreements.

In midlife (ages 31 to 60), emphasis shifts to protecting one’s legacy. This may require enhanced life and long-term disability insurance, as the responsibility for dependents increases. Important documents could comprise mortgage agreements, will drafts, and college savings plans for children.

Later life (ages 61 and beyond) demands a focus on ensuring financial stability and security. Health insurance, life insurance, and estate planning become paramount at this stage to cater to potential medical costs and to provide for heirs. Critical documents encompass updated wills and medical directives.

Preparing to convert your life stages cover form

Converting your Life Stages Cover Form is not simply a matter of filling in new information; it’s a crucial step in aligning your coverage with your current circumstances. Changes in life circumstances—such as marriage, the arrival of children, or retirement—are key triggers for this conversion.

As your life evolves, so do your coverage requirements. A well-timed conversion not only gives you peace of mind but also ensures that you’re not under-insured or paying for unnecessary coverage.

To begin the process, you'll need to gather essential information that brings accuracy and specificity to your conversion.

Step-by-step guide to converting your life stages cover form

The following guide provides practical steps for converting your Life Stages Cover Form using pdfFiller effectively. Accessing the form is the first step.

To access the Life Stages Cover Form on pdfFiller, navigate to the pdfFiller landing page. The site features an intuitive layout allowing users to search for specific forms quickly.

Utilize the search function by typing 'Life Stages Cover Form' to locate the document you need among the myriad of other resources available.

Once located, filling out the form should be systematic. Each section is designated for specific information:

To ensure accuracy, double-check all information before proceeding, paying particular attention to numbers and specific terms.

After filling out, pdfFiller offers advanced editing tools to modify your document, add or remove unnecessary information, and help you comply with state regulations. Verification ensures that all is in order for the subsequent steps.

Next, addressing the signing process: this is straightforward within pdfFiller. The platform supports eSigning, which is legally valid in most jurisdictions, enhancing the convenience and speed of document execution. If notarization is required, ensure you follow the necessary guidelines as that varies by state.

To finish, manage and save your Life Stages Cover Form effectively. Utilizing pdfFiller's cloud storage ensures easy access in the future and organizes your documents efficiently.

Advanced features for enhanced document management

To take your documentation process further, pdfFiller's advanced features offer additional benefits. Collaborating on your Life Stages Cover Form can streamline communication and feedback.

You can invite team members, such as partners or advisors, to review the document, allowing real-time input and edits. This not only improves accuracy but can also lead to healthy discussions about your coverage needs.

And with the ability to track changes and comments, you’ll know exactly who made adjustments, making oversight easier.

Interactive tools, like calculators for estimating your coverage needs, further enhance decision-making. Integration with personal finance management tools allows for a holistic view of your financial landscape.

Moreover, being on a cloud-based system grants you access from anywhere, which is a significant advantage for those with busy lifestyles. The enhanced security features offered by pdfFiller also ensure that your sensitive information remains protected.

Tips for maintaining your life stages cover

Once you have successfully converted your Life Stages Cover Form, maintaining it is equally vital. Regular reviews of your life stages cover are essential to ensure your insurance meets your current needs.

Life events, such as marriage, childbirth, purchasing property, or retiring, warrant an immediate reassessment of your coverage. A recommended timeline for routine checks is annually, allowing for incremental adjustments and avoiding major lapses in coverage.

Avoid common pitfalls during the conversion process to ensure maximum benefit from your insurance. Misunderstanding coverage requirements and failing to update beneficiary information are common mistakes that can lead to undesirable outcomes.

FAQs about life stages cover and conversion process

Understanding the nuances surrounding life stages cover and the conversion process is crucial. Users often have questions about the implications of their coverage decisions and the conversion process.

Success stories & testimonials

Real-life examples illuminate the important impacts that converting life stages cover can have on personal finance management. Many users have seamlessly transitioned their coverage to better fit their lives.

For instance, one couple successfully adapted their life stages cover after having children, ensuring that their new responsibilities were met with comprehensive coverage. Others have found peace of mind after transitioning their plans into retirement frameworks.

Financial advisors emphasize the security and foresight brought to families who engage in regular reviews and conversions. They highlight ongoing trends in life stages cover, noting that modern policies are becoming increasingly flexible to cater to the evolving needs of individuals and families.

Key takeaways on life stages cover conversion

Converting your Life Stages Cover Form is a significant step in the ongoing management of your personal finances. It ensures your coverage is relevant and effective amidst life’s many changes.

Key best practices for conversion include thoroughness in data entry, proper use of the pdfFiller platform features, and regular reviews of your cover to align with life events. Having clear documentation and understanding your responsibilities improve both confidence and effectiveness in securing your family’s future.

Taking these steps not only provides peace of mind but also empowers you and your loved ones for a confident financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in convert life stages cover?

Can I sign the convert life stages cover electronically in Chrome?

How do I edit convert life stages cover on an Android device?

What is convert life stages cover?

Who is required to file convert life stages cover?

How to fill out convert life stages cover?

What is the purpose of convert life stages cover?

What information must be reported on convert life stages cover?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.