Get the free Ct-3.1-i

Get, Create, Make and Sign ct-31-i

How to edit ct-31-i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-31-i

How to fill out ct-31-i

Who needs ct-31-i?

Navigating the CT-31- Form: A Complete Guide for Effective Filing

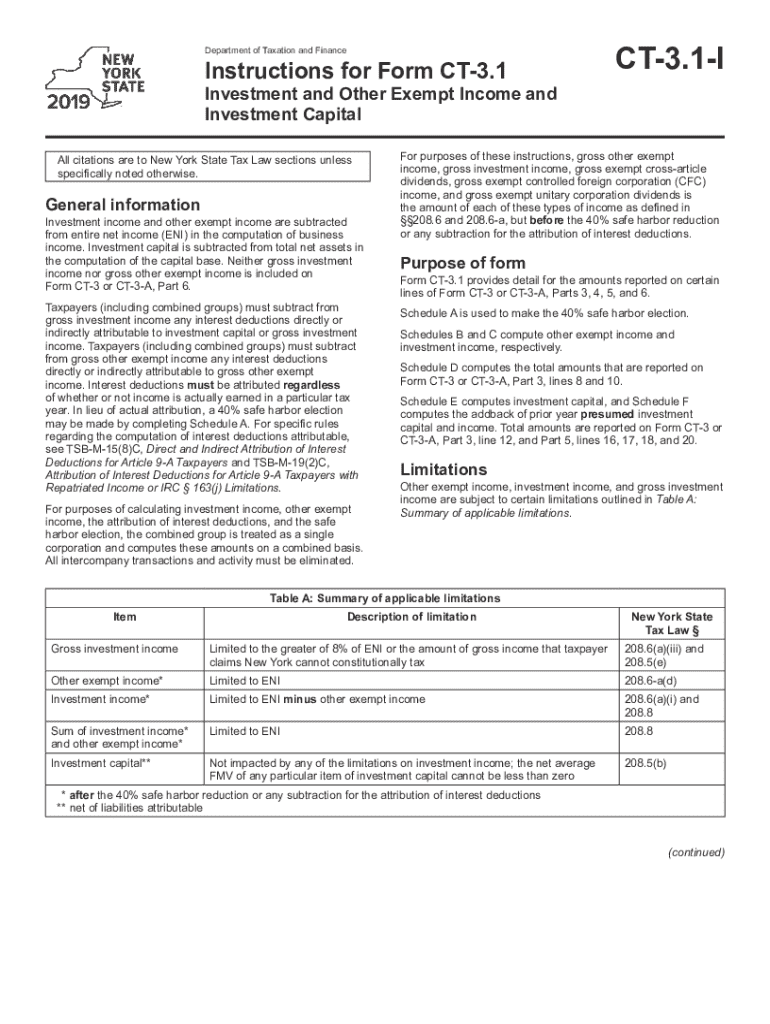

Overview of the CT-31- Form

The CT-31-I Form, known as the New York State Credit for Qualifying Environmental Initiatives, specifically serves a crucial role in facilitating tax credits for eligible businesses engaging in environmental sustainability projects. This form allows organizations to apply for credits that can offset various state tax liabilities, making it vital for those who qualify.

Unlike other tax forms such as the CT-3 (General Business Corporation Franchise Tax Return), the CT-31-I focuses exclusively on the environmental credits. As a result, it's tailored to businesses that are actively striving to implement eco-friendly practices, thus distinguishing it from more general tax filings.

Understanding who needs to file the CT-31-I is equally critical. Primarily, this form is designed for corporations engaged in or contributing to environmentally beneficial initiatives that meet state-defined criteria. Thus, businesses aiming to take advantage of these credits must ensure they have the necessary documentation and eligibility before filing.

Key features of the CT-31- Form

The CT-31-I Form, when utilized through pdfFiller, offers numerous interactive features that enrich the user experience. Functionality such as autofill capabilities, automatic error-checking, and instant calculations significantly streamline the process of form completion.

Accessibility is a key aspect of the CT-31-I Form on pdfFiller, allowing users to access the form online, fill it out at their convenience, and save their progress in the cloud. The platform's cloud-based nature ensures that individuals and teams can collaborate efficiently, no matter where they are based.

Ultimately, using pdfFiller's platform for the CT-31-I Form enhances user experience and empowers businesses in their journey toward ecological responsibility.

Step-by-step instructions on filling out the CT-31- Form

Filling out the CT-31-I Form begins with detailing your basic information. In Section 1, you should provide your business's name, address, and entity type. An accurate representation of your business structure—be it corporation or partnership—is essential for proper tax credit evaluation.

In Section 2, the focus shifts to tax information. Here, you will report your income and available deductions within the scope of the environmental initiatives. Understanding tax rates and the calculation methods applicable to your situation is crucial to maximize your credits.

Finally, Section 3 addresses signature requirements. Utilizing eSignature options through pdfFiller not only expedites the process but also enhances the legitimacy of your submission. Ensure that you certify the accuracy of the information provided, as inaccuracies can lead to penalties or credit denial.

Editing and modifying the CT-31- Form

Once you’ve filled out the CT-31-I Form, the ability to edit and modify is crucial. pdfFiller’s editing tools offer users flexibility by allowing changes to be made quickly and easily. Users can adjust data, fix typos, or add necessary attachments without needing to start over.

Common mistakes include leaving out required fields or incorrectly reporting figures. Avoiding these pitfalls is essential to ensure your credits are not jeopardized due to simple errors. Regularly reviewing the form before submission can help underscore any discrepancies.

For amendments made after submission, users often have queries regarding the next steps. Refining your form accurately ensures compliance with both state laws and internal regulations, and proper protocols can facilitate amendments effectively.

Submitting the CT-31- Form

Filing deadlines for the CT-31-I Form are clearly stipulated by the New York State tax authorities. Missing the submission date can result in penalties, emphasizing the need for timely compliance. The ability to choose between digital versus physical submission allows flexibility based on your business needs.

Submitting your completed form through pdfFiller provides an additional layer of convenience; you can confirm successful submission instantly within the platform. This instant feedback is essential for maintaining records and ensuring that you've satisfied all filing obligations.

Confirming your submission is vital, and using pdfFiller simplifies this task. By utilizing the platform, you ensure a seamless experience from preparation to submission.

Managing your CT-31- Form using pdfFiller

One of the standout advantages offered by pdfFiller is the ability to manage your CT-31-I Form anytime, anywhere. The platform enables you to save your forms securely in the cloud, making them accessible from various devices. This flexibility is ideal for teams that need to collaborate on submissions or track progress.

Collaboration tools are also built into pdfFiller, allowing multiple team members to edit, comment, and finalize forms together. This streamlines the workflow, ensuring that all necessary input is considered before submission. Moreover, history tracking and version control features ensure that all changes are monitored, providing a clear view of your form’s status at all times.

By utilizing pdfFiller’s capabilities, businesses can enhance their filing process, ensuring nothing falls through the cracks in their CT-31-I management.

New updates for the CT-31- Form in 2024

Every year, the CT-31-I Form may undergo crucial updates to reflect changing regulations and best practices. In 2024, important changes include refined definitions for qualifying projects and adjustments to tax credit calculations. Staying informed about these updates is essential to maximize available benefits.

pdfFiller is committed to adapting to these new regulatory requirements, ensuring that all users have access to the most current form versions. This ensures compliance and proper strategy when filing the CT-31-I Form, leveraging the latest insights to optimize your submissions.

Understanding these updates allows businesses to strategize their tax credit applications effectively, ensuring they are not leaving potential savings on the table.

Understanding related forms and filings

When dealing with the CT-31-I Form, it's also beneficial to understand its context within the broader spectrum of related forms. Other relevant forms include the CT-3 for general tax filings and the CT-5 for exemption claims. Knowing when to use each form can save time and ensure all necessary credits are claimed.

Resources are available to help users navigate multi-form filings. This entails understanding how different forms interact with each other, ensuring that businesses can maximize their filings while maintaining compliance with state regulations.

By harnessing this information, businesses can create robust filing strategies that ensure thorough compliance and maximize potential credits.

Common concerns and queries

Post-submission, users often find themselves grappling with concerns about errors discovered after the CT-31-I Form has been filed. Knowing the steps to rectify such issues is critical in maintaining compliance and ensuring that credit applications do not fall through due to oversights.

A frequently asked question is regarding the process of appealing denials or rectifying mistakes after submission. Engaging with customer support from pdfFiller can provide tailored assistance, guiding users through the necessary procedures to correct any issues.

Being proactive about these common issues can save time and frustration in the long run, helping businesses stay ahead of filing responsibilities.

Best practices for filing the CT-31- Form

Filing the CT-31-I Form correctly requires adherence to best practices that maximize efficiency and ensure compliance. Proper document management is key; using pdfFiller’s tools can help in creating organized filing systems, ensuring easy retrieval and editing capabilities.

Additionally, staying informed on New York State tax regulations ensures that businesses aren’t inadvertently non-compliant. Regularly reviewing form instructions and engaging with state resources enhances knowledge and application.

Incorporating these best practices into your filing routine sets your business up for success in claiming the credits available through the CT-31-I Form, enhancing both compliance and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ct-31-i in Gmail?

Where do I find ct-31-i?

How do I edit ct-31-i on an Android device?

What is ct-31-i?

Who is required to file ct-31-i?

How to fill out ct-31-i?

What is the purpose of ct-31-i?

What information must be reported on ct-31-i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.