Get the free Customer Credit Information

Get, Create, Make and Sign customer credit information

Editing customer credit information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer credit information

How to fill out customer credit information

Who needs customer credit information?

Comprehensive Guide to Customer Credit Information Forms

Understanding customer credit information forms

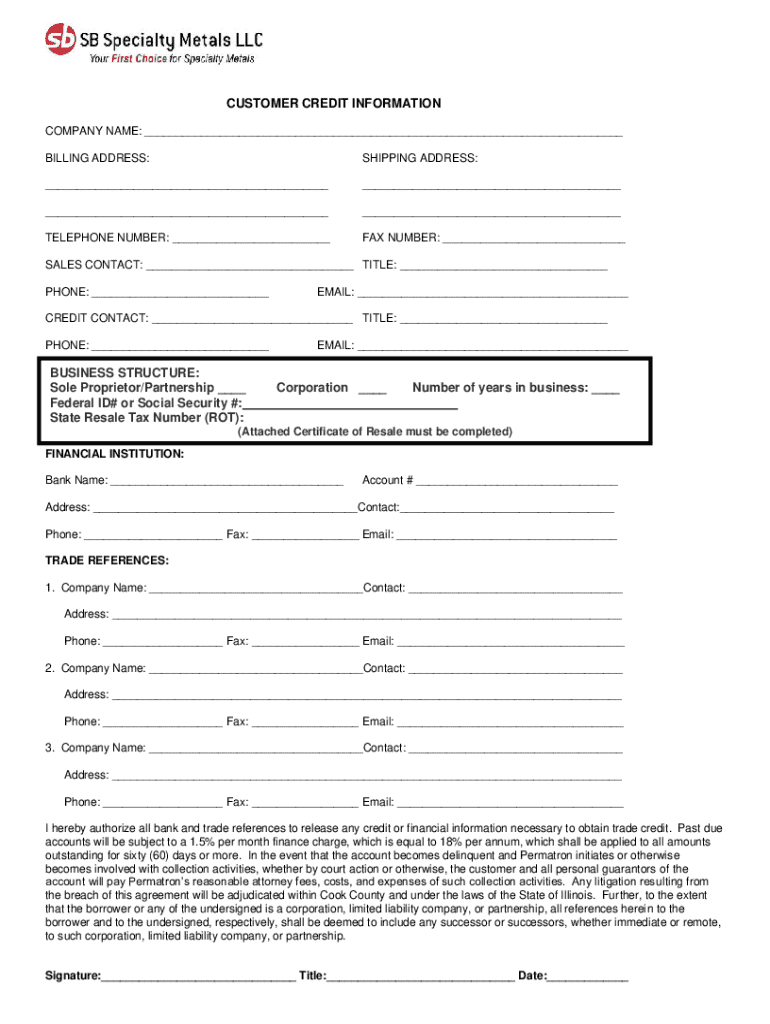

A customer credit information form is a crucial document that provides lenders with the necessary insights to assess the creditworthiness of individuals or businesses. These forms are used across various financial transactions, including loans, credit cards, and even rental agreements. By gathering comprehensive information about a borrower’s financial status, creditors can make informed decisions regarding the approval of credit applications.

The importance of this form cannot be overstated. It not only assists lenders in evaluating risks but also protects the interests of both borrowers and lenders by ensuring that the credit extension is appropriate based on financial circumstances. In essence, a customer credit information form serves as a bridge between the applicant's financial history and the lender's ability to provide loans or other credit services responsibly.

The components of a customer credit information form

To effectively utilize a customer credit information form, understanding its key components is crucial. The primary sections typically include personal information, financial data, and an authorization section. Each plays a vital role in sharing a comprehensive overview of the applicant's financial landscape.

The personal information section requires details such as the applicant's name, address, and contact information, which are essential for identification and communication purposes. The financial information section encompasses various aspects like income sources, existing debts, and assets. Finally, the authorization and consent section outlines how the gathered data will be used, ensuring compliance with data protection regulations.

How to fill out a customer credit information form

Filling out a customer credit information form accurately is imperative. Here's a step-by-step guide that walks you through the process to ensure all information is reported correctly.

Digital tools for efficient form management

In today's digital age, managing customer credit information forms can be streamlined using online tools. Platforms like pdfFiller provide users with the ability to upload, edit, and manage their credit information forms efficiently and securely.

One of the standout features of pdfFiller is its e-signature capability, allowing users to sign documents without the need for printing. Additionally, it offers easy sharing options with stakeholders, ensuring that everyone involved can access the documents needed for a thorough assessment. With these features, users can enjoy a significant reduction in the time and complexity traditionally associated with paper forms.

Understanding your rights and obligations

When submitting a customer credit information form, it’s essential to be aware of your rights and obligations. Under various consumer protection laws, individuals have the right to accurate credit reporting and to be informed about how their data is used.

Furthermore, applicants are obligated to provide true and accurate information. Failure to comply can result in significant consequences, such as denied applications or legal repercussions for fraud. It’s important to understand that providing false information undermines the purpose of the form and can impact future credit applications.

Remediation: What to do if your credit application is denied

A denied credit application can be disheartening. Understanding common reasons for denial, such as insufficient income or poor credit history, is crucial for moving forward.

If your application is denied, the first step is to request a review or explanation from the lender. This helps in identifying specific deficiencies in your application. Moving forward, focus on improving your creditworthiness by minimizing debts, ensuring timely payments, and regularly monitoring your credit report.

Frequently asked questions (FAQs)

After submitting a customer credit information form, applicants often have several questions regarding the next steps. It is common to wonder what to expect, including how long the approval process will take.

Typically, lenders may take anywhere from a few hours to several days to process applications, depending on their policies. If you find an error in your submitted form, most institutions allow corrections as long as you notify them promptly.

Best practices for maintaining strong credit health

The foundation of maintaining strong credit health lies in diligent financial practices. Regularly monitoring your credit report allows you to stay on top of your credit status and catch any discrepancies early.

Additionally, implement strategies for improving your credit score, which include timely payments, managing debts effectively, and creating a budget. These practices not only protect your credit health but also contribute to your overall financial well-being.

Related links and resources

For further support related to consumer credit, many agencies provide valuable resources. Websites dedicated to consumer protection offer relevant information on maintenance of credit health, reporting fraud, and understanding credit laws.

Additionally, numerous articles and guides are available online, providing in-depth insights into credit management and financial practices. Utilizing these resources can lead to a deeper understanding of credit and its implications on your financial journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my customer credit information directly from Gmail?

Can I create an electronic signature for the customer credit information in Chrome?

How can I fill out customer credit information on an iOS device?

What is customer credit information?

Who is required to file customer credit information?

How to fill out customer credit information?

What is the purpose of customer credit information?

What information must be reported on customer credit information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.