Get the free Calamity Tax Relief Guide: Save on Property Taxes After ...

Get, Create, Make and Sign calamity tax relief guide

Editing calamity tax relief guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calamity tax relief guide

How to fill out calamity tax relief guide

Who needs calamity tax relief guide?

Calamity Tax Relief Guide Form: Your Comprehensive Guide

Overview of calamity tax relief

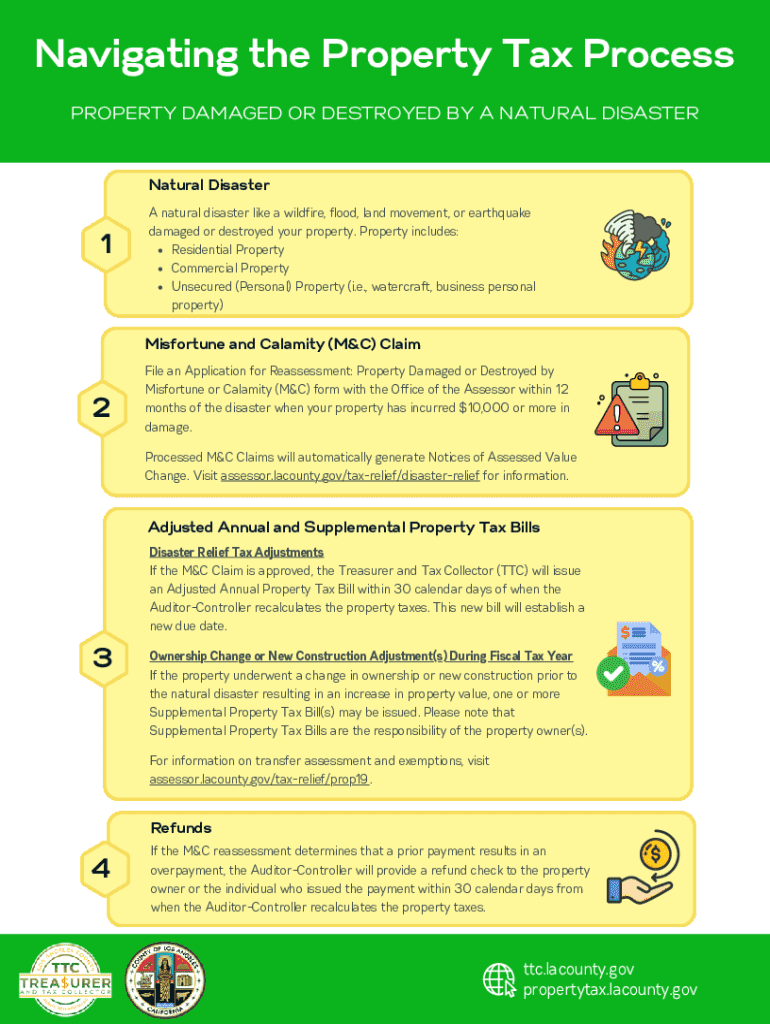

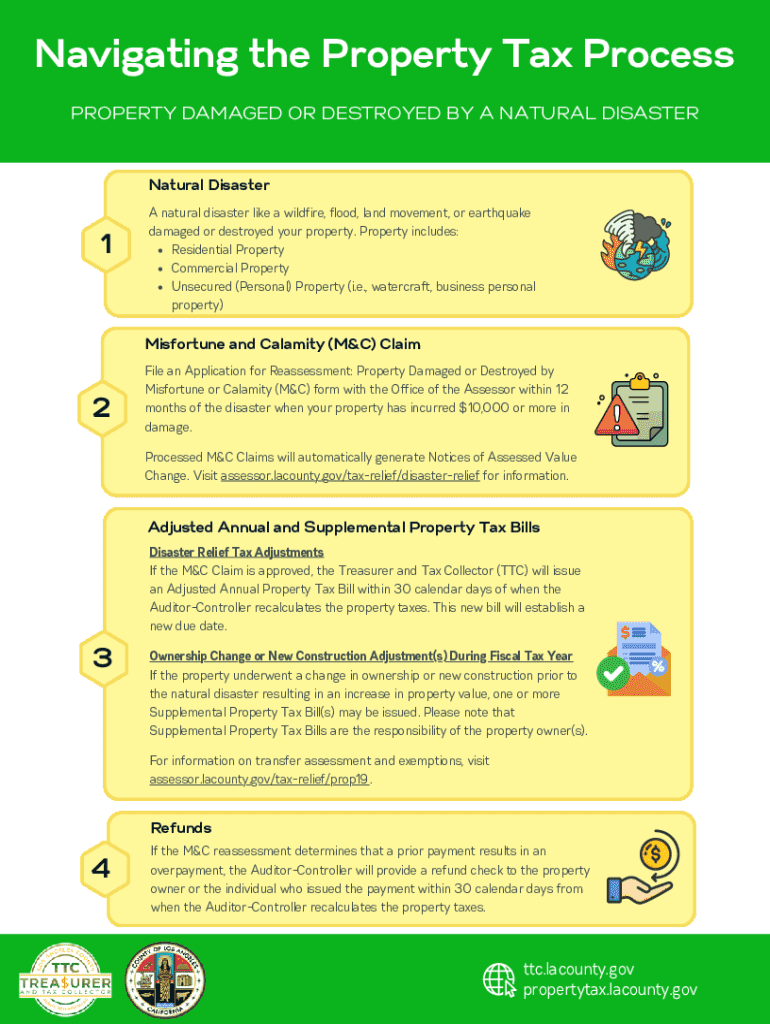

Calamity tax relief is a mechanism that provides financial assistance to property owners who have suffered from significant damage due to disasters such as floods, earthquakes, and wildfires. This relief is crucial in the aftermath of a disaster, as it helps ease the financial burden on families and businesses trying to rebuild their lives. Knowing how to navigate the calamity tax relief process can make a substantial difference in your recovery efforts.

Understanding calamity tax reassessment

Calamity tax reassessment involves reviewing and potentially lowering the assessed value of properties that have suffered significant damage due to a disaster. This reassessment can significantly benefit homeowners by reducing their property tax obligations during a difficult recovery period. Most jurisdictions recognize various types of disasters, enabling homeowners impacted by events like hurricanes, tornadoes, or major floods to seek relief.

Eligibility requirements for tax relief

To qualify for calamity tax relief, homeowners must meet specific eligibility criteria. Typically, these criteria include being the property owner at the time of the disaster and demonstrating that the property suffered damage exceeding a certain threshold, often defined as a percentage of its market value. It's crucial to check with your local jurisdiction for exact requirements, as they can differ from one locality to another.

Preparing for your application

Preparing to apply for calamity tax relief involves thorough documentation of the damage. Essential documents include photographs of the property pre- and post-disaster, repair estimates, and any inspection reports. Accurate documentation not only supports your application but can also expedite the approval process.

Step-by-step guide to filing the calamity tax relief application

Filing the calamity tax relief application involves careful adherence to procedure. Start by completing the calamity tax relief guide form, ensuring all sections are filled out accurately. This form often requires detailed information about the property and the damages sustained.

Tips for maximizing your tax relief

Maximizing your tax relief potential may involve exploring additional benefits specific to your jurisdiction. Local property tax professionals can offer valuable insights and ensure your application is robust. Be prepared to address potential challenges by understanding common reasons for application denials, which can include incomplete documentation or missing deadlines.

Long-term financial benefits of filing for calamity tax relief

By successfully filing for calamity tax relief, homeowners can experience immediate savings on their property taxes, allowing for reinvestment into recovery efforts. Moreover, the long-term financial stability that comes from tax relief helps create a sense of peace of mind during recovery, making it easier to plan for the future without the weight of overwhelming tax liabilities.

Interactive tools and resources

Utilizing online tools can simplify the process of filing your calamity tax relief application. Platforms like pdfFiller provide resources for document creation, collaboration, and management. Utilizing these interactive tools can streamline your tax relief application process, helping you focus on recovery.

FAQs about calamity tax relief

Many homeowners have questions regarding calamity tax relief. Common concerns involve eligibility criteria, the types of documentation required, and the timeline for relief. Understanding these components can significantly aid in a smoother application process and alleviate concerns during an already stressful recovery period.

Have questions?

For further inquiries regarding the calamity tax relief guide form, reaching out to local tax offices or utilizing resources provided by pdfFiller can assist in clarifying any uncertainties you may have. Our platform is designed to support you through each step of your documentation requirements, ensuring that you find the assistance you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send calamity tax relief guide to be eSigned by others?

How do I fill out the calamity tax relief guide form on my smartphone?

Can I edit calamity tax relief guide on an iOS device?

What is calamity tax relief guide?

Who is required to file calamity tax relief guide?

How to fill out calamity tax relief guide?

What is the purpose of calamity tax relief guide?

What information must be reported on calamity tax relief guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.