Get the free Ct-236

Get, Create, Make and Sign ct-236

Editing ct-236 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-236

How to fill out ct-236

Who needs ct-236?

Comprehensive Guide to the CT-236 Form

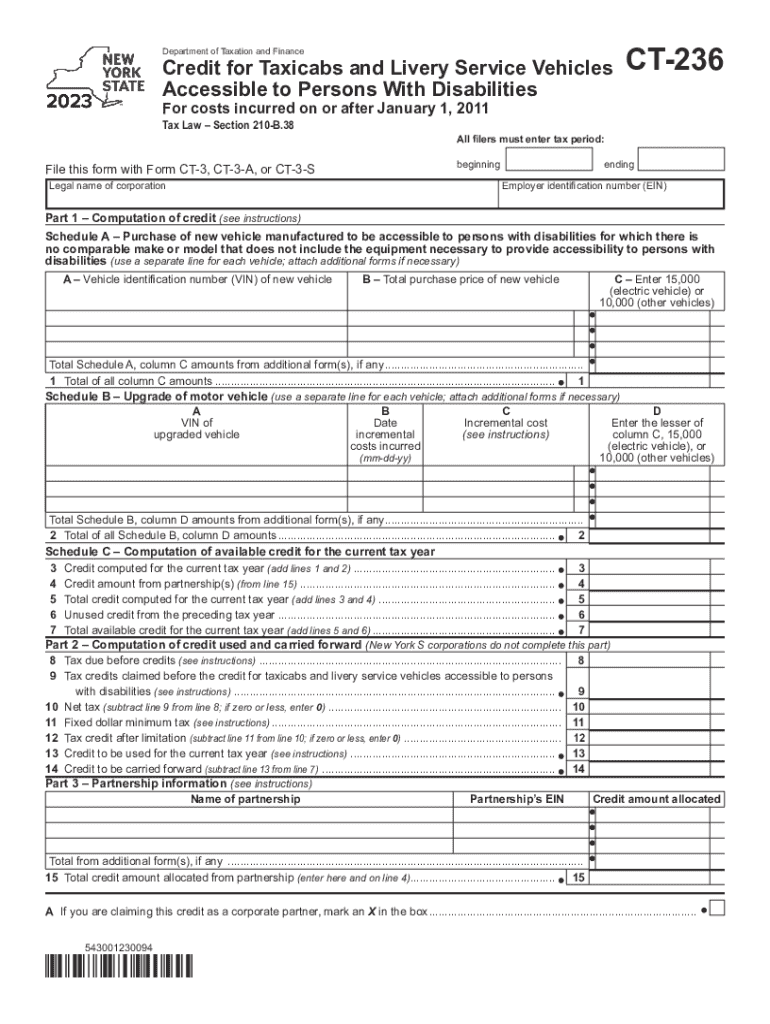

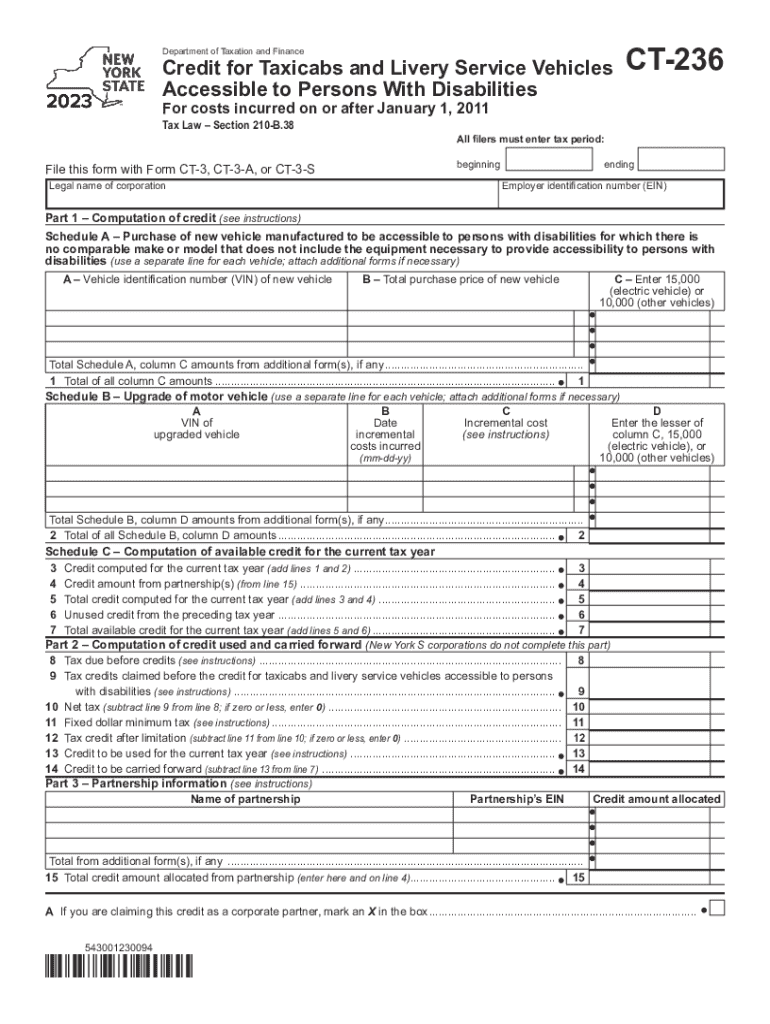

Understanding Form CT-236

Form CT-236 is a critical document utilized for claiming tax credits associated with taxicab and livery service vehicles in states that implement such programs. This form plays an essential role in ensuring that vehicle owners or operators can receive financial relief on the costs incurred for improving, maintaining, or purchasing eligible vehicles. Suffice it to say, the CT-236 form contributes significantly to stimulating the local taxi and livery service industry by providing necessary incentives.

Beyond just being another tax form, CT-236 represents a lifeline for many individuals and small businesses within the transportation sector, especially as markets evolve and regulatory environments change. The financial benefits derived from this program encourage more persons to operate and maintain compliant and efficient livery services. To maximize the potential benefits, understanding the eligibility requirements is crucial.

Recent revisions and updates

Staying updated with the latest revisions to Form CT-236 is vital for applicants. Recent changes have included updated eligibility criteria, alteration of associated costs, and adjustments to the filing procedure. These alterations are essential to reflect the evolving landscape of vehicle operations and ensure compliance with fiscal legislation. The specific dates of these updates are typically announced annually, with changes often taking effect at the beginning of the calendar year.

The impact of these revisions greatly affects applicants—previously eligible owners may find themselves ineligible or vice versa. Furthermore, improved clarity in sections of the form can help streamline the filing process, making completion more intuitive for users.

Detailed step-by-step instructions for completing Form CT-236

Filling out Form CT-236 might seem daunting, but following a structured approach simplifies the process. Start with Section 1 where you will provide vehicle information. This includes details such as the vehicle make, model, year of manufacture, and Vehicle Identification Number (VIN). Accurate input is essential to avoid discrepancies that could delay processing.

Next, Section 2 requires owner information. You need to supply your name, business name (if applicable), address, and contact details. This information helps tax authorities verify ownership and eligibility. Section 3 delves into cost details; hence, you need to outline all expenses relevant to the cap or livery vehicle. Be meticulous here since documentation will likely be required later.

Finally, you will complete the certification section in Section 4, a critical element assuring that the submitted information is accurate and complete. It is recommended that you review the entire form thoroughly before submission to mitigate any common errors that might hinder your approval.

Utilizing pdfFiller for Form CT-236

pdfFiller provides a robust platform for efficiently managing Form CT-236 through its user-friendly editing tools. Users can easily upload the form, making modifications as needed without the hassle of pen and paper. Whether you need to add details or remove unnecessary ones, the intuitive interface allows for seamless editing.

Moreover, pdfFiller incorporates eSignature functionality. This enables users to electronically sign their submissions, expediting the documentation process while enhancing security. E-signing not only saves time but also provides a trackable audit trail, ensuring that all steps in the submission process can be verified at a later date.

Collaboration on Form CT-236 is made easy with pdfFiller's sharing options. Teams can work together in real time, making adjustments and discussing changes via built-in communication tools. This feature becomes invaluable for businesses or organizations that rely on team input to finalize forms efficiently.

Frequently asked questions (FAQ) about Form CT-236

Understanding the common queries regarding Form CT-236 is essential. Many applicants wonder, 'What happens if I make an error on my submission?' In such cases, it’s crucial to rectify the mistake as soon as it comes to your attention. Some errors allow for corrections to be made on a new submission, while others may require contacting the tax authority directly for guidance.

Another common concern focuses on when and where to submit the form. Generally, submission deadlines align with the tax year, often due by the end of the fiscal year. You can typically file online via the state’s tax website or in person at designated tax offices. Particular situations may arise, such as changes in vehicle ownership impacting eligibility or necessary documentation for claims. Clarity on these points is vital for avoiding complications.

Related documents and linked topics

Form CT-236 is one of several tax documents pertinent to vehicle operation and ownership. Individuals should also be aware of other tax forms related to vehicle deductions or credits. These may include forms for sales tax credits or vehicle use deductions depending on your specific state rules.

Additionally, understanding other pertinent expenses—such as fuel, maintenance, and insurance costs—can provide insights into potential tax deductions. Familiarity with these related expenses enables you to maximize benefits effectively. Access to state resources is also crucial; local tax authority websites often have links to forms, FAQs, and contact information for assistance.

Conclusion and next steps

After completing Form CT-236, the next step is to ensure that you have retained copies for your records and submitted the form within the designated timeframe. Following up with your local tax office can also provide confirmation that your submission has been received and is being processed. This proactive approach can further alleviate stress and uncertainty concerning your application.

Should you have questions or require assistance while filling out Form CT-236, reaching out to a tax professional can provide clarity. Additionally, pdfFiller’s infinite resources offer further guidance through their platform, ensuring that every document you work with meets compliance requirements efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct-236 for eSignature?

How can I get ct-236?

Can I sign the ct-236 electronically in Chrome?

What is ct-236?

Who is required to file ct-236?

How to fill out ct-236?

What is the purpose of ct-236?

What information must be reported on ct-236?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.