Get the free Cboe Futures Exchange Clearing Member Guarantee

Get, Create, Make and Sign cboe futures exchange clearing

How to edit cboe futures exchange clearing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cboe futures exchange clearing

How to fill out cboe futures exchange clearing

Who needs cboe futures exchange clearing?

Cboe Futures Exchange Clearing Form: Your Comprehensive Guide

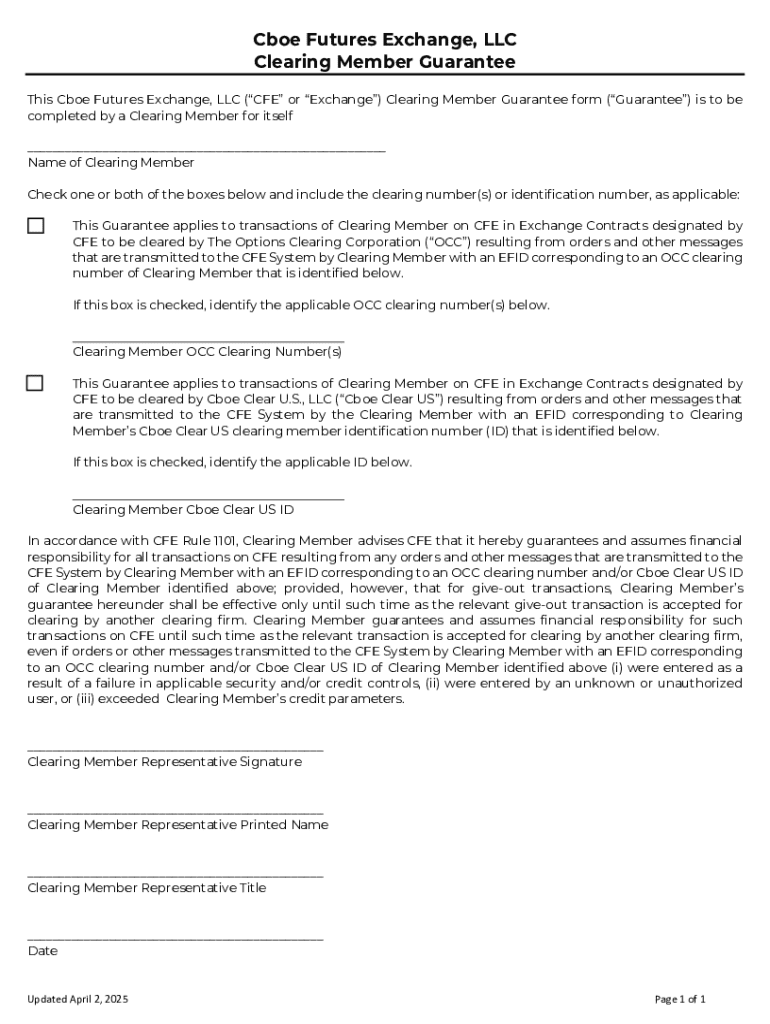

Overview of Cboe Futures Exchange Clearing

The Cboe Futures Exchange (CFE) plays a pivotal role in the operations of futures trading, serving as a primary venue for trading various derivatives. Understanding Cboe's function is essential for anyone looking to participate in futures markets. As trades are executed, proper clearing becomes crucial as it mitigates risk and ensures that both parties fulfill their obligations. A significant aspect of this clearing process is the Cboe Futures Exchange Clearing Form, designed specifically to facilitate and direct essential information crucial for operational success.

Clearing is an integral part of futures transactions. It serves as the intermediary that guarantees the integrity of trade executions and minimizes counterparty risk. By ensuring that trades are settled efficiently, clearing plays a strong role in maintaining market confidence and stability. The Cboe Futures Exchange Clearing Form is designed to capture all relevant data needed to clear trades effectively.

This form is not merely a bureaucratic requirement; it’s a document that holds critical importance for traders. Understanding who needs to complete the Cboe Futures Exchange Clearing Form is also vital. Typically, all participants involved in futures trading on Cboe will need to submit this form as part of their onboarding or account management processes.

Key components of the Cboe Futures Exchange Clearing Form

The Cboe Futures Exchange Clearing Form consists of several key sections that serve to simplify information entry while ensuring comprehensive data collection. These major sections include personal and business information, trading account details, and an overview of financial information. Each section is designed to gather specific data that is essential for the clearing process.

Filling out each section must be done with care. Common pitfalls include inaccuracies in personal data which can lead to delays or extraneous questions from the clearing team. Traders must also provide adequate trading account details, ensuring that the documentation aligns with the information provided to facilitate verification. Furthermore, financial disclosures should be made transparently, as financial stability is critical for trade approval and smooth operations.

Step-by-step instructions for completing the form

Preparation is crucial when completing the Cboe Futures Exchange Clearing Form. Gather all necessary documents beforehand to ensure a smooth filling experience. Potential documents include identification (passport, driver's license), corporate registration papers, and previous trading records, if applicable. Organizing your information in advance allows you to complete the form more efficiently and accurately.

When filling out the form, navigate through the online interface carefully. The form will contain various prompts guiding you through each section. Ensure to check and double-check each entry before submission. After completing the major sections, review your responses as accuracy is paramount. Consider creating a checklist for validation, noting common errors such as missing signatures or incorrect financial figures that could delay processing.

Editing and managing your Cboe Futures Exchange Clearing Form

Once you have completed the Cboe Futures Exchange Clearing Form, the pdfFiller platform provides you with robust editing tools. If you need to make adjustments after submission, utilizing pdfFiller's features allows you to do so seamlessly. Whether you need to correct a typo or update financial details, these tools facilitate easy edits. Moreover, team collaboration features enable multiple users to review and comment on the submissions before finalizing.

Electronic signatures have become a crucial component of online forms. pdfFiller supports eSigning, which simplifies the authentication of your submissions. This feature not only adds a layer of security but also expedites the form’s processing with Cboe. After signing, saving your form in the cloud is straightforward, allowing you to access it from anywhere with the appropriate credentials.

Submitting the Cboe Futures Exchange Clearing Form

Submission of the Cboe Futures Exchange Clearing Form can be accomplished in various ways. Online submission is the most efficient and highly recommended method, as it allows real-time processing and feedback. Alternatively, traditional methods such as mailing or faxing are still options, but they may lead to longer waiting periods for confirmations and responses.

Once submitted, it is essential to track the status of your form. Cboe may provide tracking options for your submission so you can remain informed about its processing. If any issues arise or further clarifications are needed, having a key contact at the Cboe for assistance can prevent unnecessary delays in your trading operations.

Additional considerations

Several regulatory requirements govern the clearance of futures transactions. Compliance with Cboe's regulations is non-negotiable, ensuring that all trading activities align with established legal and procedural frameworks. Any alterations in trading legislation affecting submission and processing of forms must be monitored closely, as these can impact trading access and operational modalities.

For ongoing documentation needs, exploring other Cboe forms and templates available on pdfFiller can streamline your operational efficiency. The platform offers a variety of solutions, ensuring that you have an effective means of document management for all your trading activities.

Interactive tools and FAQs

Navigating through the digital landscape of document management can be greatly enhanced with interactive tools. pdfFiller provides a range of features designed to support users in managing their forms efficiently. By utilizing these tools, ongoing needs can be fulfilled with the requisite precision and ease.

There are often many questions that arise when dealing with the Cboe Futures Exchange Clearing Form, from submission procedures to compliance concerns. Making use of FAQs can clear up potential misunderstandings and guide traders through the complexities effectively, ensuring that all components are addressed accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cboe futures exchange clearing directly from Gmail?

How can I modify cboe futures exchange clearing without leaving Google Drive?

How do I fill out cboe futures exchange clearing on an Android device?

What is cboe futures exchange clearing?

Who is required to file cboe futures exchange clearing?

How to fill out cboe futures exchange clearing?

What is the purpose of cboe futures exchange clearing?

What information must be reported on cboe futures exchange clearing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.