Get the free Credit Card Payment Authorization Form

Get, Create, Make and Sign credit card payment authorization

How to edit credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

Credit card payment authorization form: A how-to guide

Understanding credit card payment authorization forms

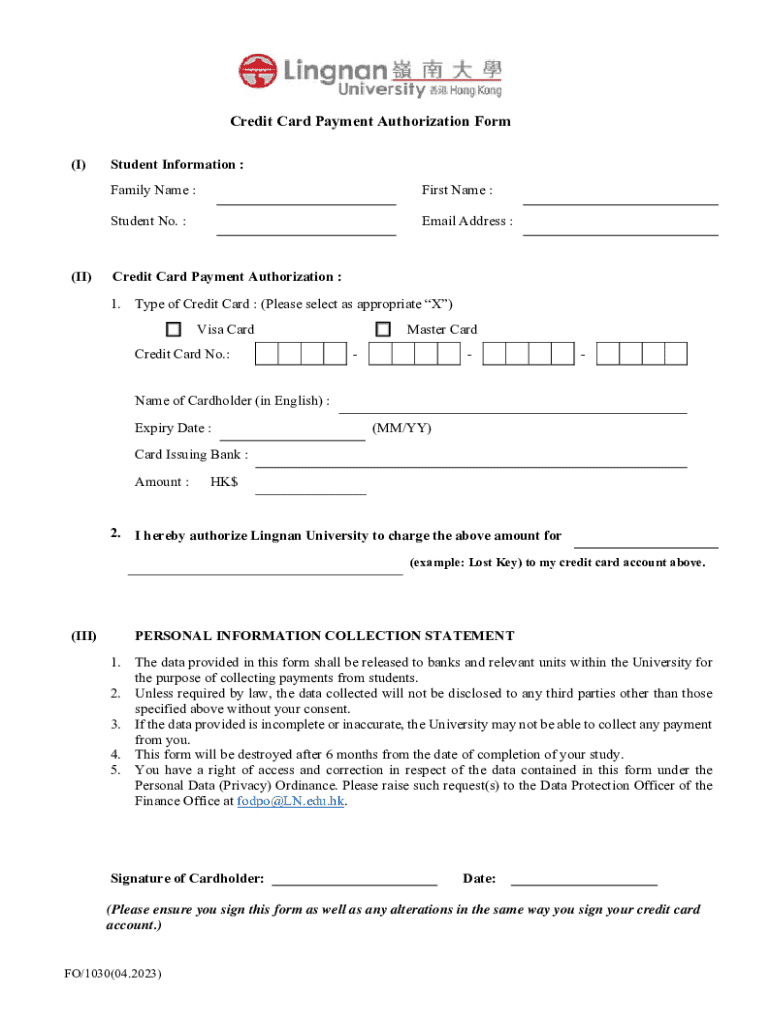

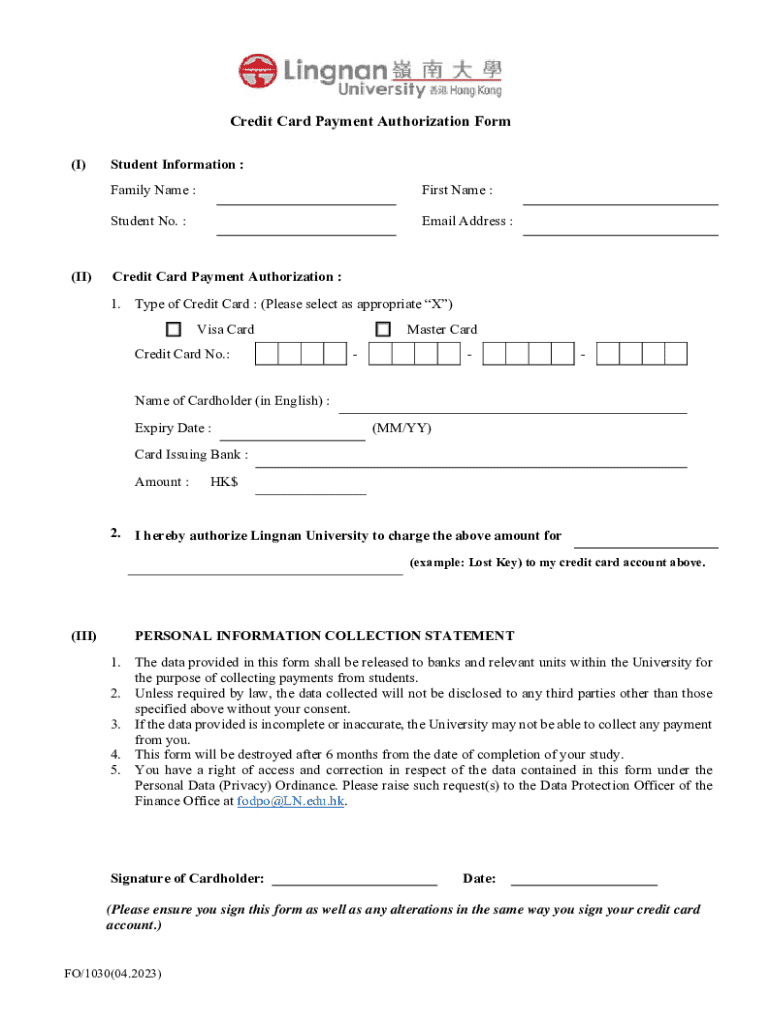

A credit card payment authorization form is a document used to grant permission for a business to charge a customer's credit card. This form is crucial in establishing an agreement between the cardholder and the merchant, ensuring that the payment process is smooth and legitimate.

Using a credit card authorization form in transactions is vital for several reasons, including enhancing security and protecting against fraudulent charges. When you collect these forms, you build a paper trail that can be referenced in case disputes arise. This protects both the merchant and the customer from potential misunderstandings.

Common scenarios that require a credit card authorization form include but are not limited to: online services, subscription-based businesses, and situations where the cardholder is not physically present to swipe their card, known as Card-Not-Present (CNP) transactions. Utilizing these forms helps ensure that the payment process remains transparent.

Benefits of utilizing credit card authorization forms

Implementing credit card authorization forms offers numerous advantages for both merchants and customers. One of the primary benefits is the prevention of chargeback abuse. Chargebacks can lead to significant financial losses for businesses, especially if they occur frequently due to malicious intent by customers. Having a signed authorization form can serve as evidence to contest these chargebacks.

Enhanced security for transactions is another key benefit. By gathering detailed information from customers, businesses create a layer of verification before processing payments. This reduces the likelihood of unauthorized charges and increases customer confidence in transacting with your company.

Streamlined payment processing is also a major advantage. With a clear document in place that outlines the payment amount and authorization, businesses can quickly and effectively process charges on a customer's credit card, especially beneficial for repeat customers who frequently make purchases.

Key components of a credit card authorization form

A well-structured credit card authorization form should contain essential information that ensures the payment can be processed without obstacles. The vital components include the cardholder's name, card details such as card number and expiration date, and the amount authorized for charge. Collecting this information helps in identifying the cardholder and validating the payment.

In addition to these essential details, optional information such as the CVV number can also help enhance security. While not always included, capturing the billing address and contact information can provide greater assurance against unauthorized transactions. However, one must also be aware of legal considerations and compliance factors, as improper handling of personal data could lead to regulatory issues.

How to create a credit card payment authorization form

Creating a credit card payment authorization form can be straightforward with the right approach. Follow these step-by-step instructions to ensure that your form is functional and user-friendly.

If you opt for pdfFiller, its user-friendly tools can also simplify the editing and creation process, allowing you to fine-tune your forms to your specific business needs.

Best practices for handling credit card authorization forms

Handling credit card authorization forms with care is crucial for maintaining customer trust and compliance with financial regulations. One of the best practices includes ensuring the safekeeping of signed forms. These documents must be stored securely to prevent unauthorized access, thus protecting sensitive cardholder information.

Additionally, businesses should establish a clear duration for retaining signed authorizations. Retaining these forms for a reasonable time frame is key—a typical period is up to two years, which allows you to address any disputes or chargebacks that may arise. It's also important to manage authorization limits for repeat customers effectively, to avoid exceeding customer-allowed payment limits which could lead to disputes.

Frequently asked questions (FAQ)

1. What happens if a payment fails after authorization? If a payment fails after authorization, it's important to communicate with the customer promptly to resolve the issue, whether it’s updating payment information or verifying funds available.

2. Am I legally obligated to use a credit card authorization form? While not legally required in all scenarios, utilizing a credit card authorization form offers protection against fraud and chargebacks, making it a best practice in most transactions.

3. Why is there no space for CVV on some forms? Some forms may not include a dedicated section for the CVV in order to comply with PCI regulations that discourage storing CVV data post-authorization.

4. How to deal with unauthorized charges? In the event of unauthorized charges, both merchants and customers should reach out to their respective banks immediately to dispute the transaction and analyze the trend of processing activity to prevent similar instances.

Downloadable resources

pdfFiller offers a variety of templates for credit card authorization forms, which can be easily customized to suit your business needs. Additionally, examples of best practices and common mistakes are available to guide you as you implement these forms.

Related topics and further reading

Understanding the importance of Card-Not-Present (CNP) transactions can be particularly useful for those in e-commerce or service industries. Additionally, learning how to handle subscription-based payments effectively is crucial for businesses relying on recurring revenue.

Studying best strategies for accepting online payments securely will also enhance your payment processing practices, ensuring customer satisfaction and trust.

Interactive tools and features on pdfFiller

pdfFiller provides a suite of interactive tools that can enhance collaboration and document management. With digital signing capabilities, users can sign documents electronically, eliminating the need for paper-based processes.

Moreover, collaborative features allow teams to work on documents together, which fosters efficient communication and workflow. Accessing your documents from anywhere through the cloud ensures that your important forms are always at your fingertips.

Join our community and stay updated

By subscribing to our newsletter at pdfFiller, you can receive the latest tips on document management, including insights on credit card payment authorization forms. Engage with our network of online resources for business solutions that cater specifically to your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card payment authorization in Gmail?

How can I send credit card payment authorization for eSignature?

How do I complete credit card payment authorization on an Android device?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.