Get the free Cd-516

Get, Create, Make and Sign cd-516

How to edit cd-516 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cd-516

How to fill out cd-516

Who needs cd-516?

A Comprehensive Guide to the -516 Form

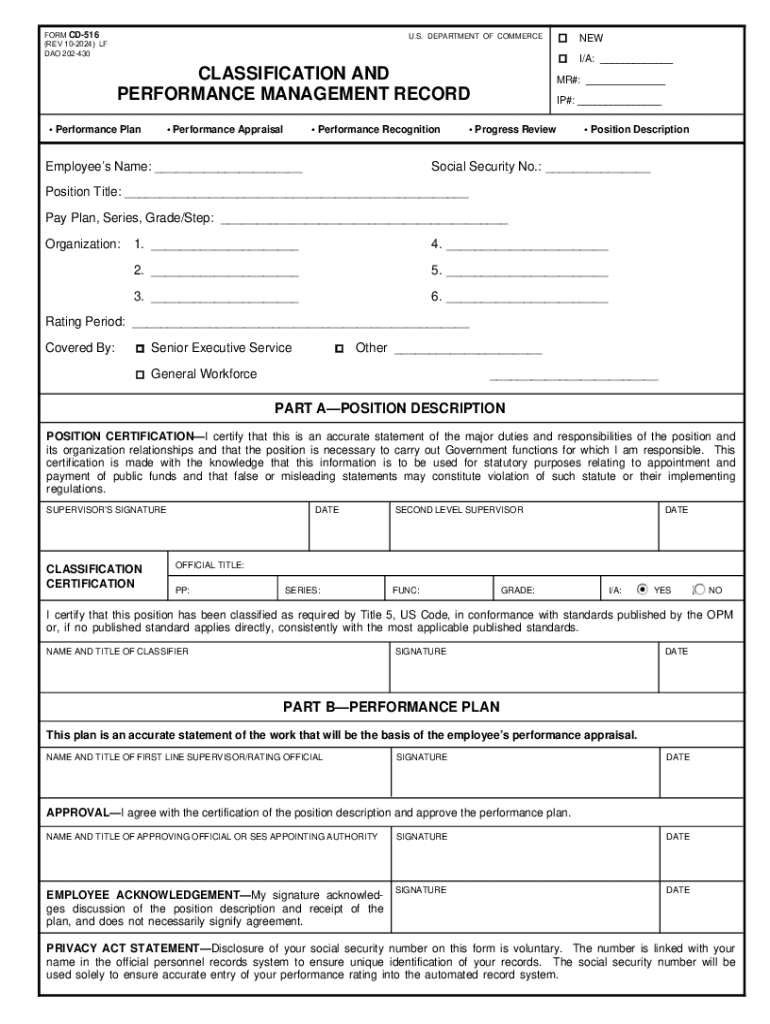

1. Understanding the -516 form

The cd-516 form serves as a vital document in various administrative processes, primarily related to financial and legal reporting. Its primary purpose is to collect specific information that helps organizations and governmental entities evaluate financial statuses, eligibility for benefits, or compliance with certain regulations. This makes the cd-516 form a critical tool for both individuals and businesses.

Typically, the cd-516 form is utilized in situations that necessitate detailed insights into personal or organizational financial situations. Those involved in applications for social services, tax returns, or loan processes may find themselves needing to tackle this form. Its versatility makes it applicable across various domains, ensuring diverse user engagement.

Who exactly needs to complete the cd-516 form? The answer is broad; anyone applying for benefits or services requiring financial disclosure may need this form. This includes individuals applying for government assistance, business owners seeking loans, or organizations undergoing audits.

Utilizing the cd-516 form effectively has key benefits. This includes clarity in financial disclosures, streamlined application processes for necessary services, and improved communication with governmental or oversight bodies. By ensuring accurate reporting through this form, individuals and entities can enhance their chances of favorable outcomes in their applications.

2. Key components of the -516 form

A thorough understanding of the cd-516 form hinges on knowledge of its essential components. Each section of the form is designed to capture specific data, aiding in the overall accuracy of information collected. The personal information section lays the groundwork, requiring basic details such as name, address, and contact information.

Next, the income and employment details section requires users to provide insights into their financial situation, detailing sources of income, employment status, and potentially relevant financial obligations. Lastly, additional information requirements might ask for unique circumstances or specifics that could impact the evaluation process.

Understanding common terms within the cd-516 form can also enhance user comprehension. Terms such as 'gross income,' 'net income,' and 'dependents' are frequently used and deserve clarity to avoid misinterpretation. Users are encouraged to familiarize themselves with these terms to streamline their form-filling process.

3. Step-by-step instructions for filling out the -516 form

Before diving into filling out the cd-516 form, taking time to gather necessary documents is crucial. Users should prepare documents that validate their income, employment details, and any additional information required by the form. Essential items may include pay stubs, tax returns, and identification documentation.

Once documents are ready, users can begin the detailed filling process. Starting with the personal information section, fill in all requested details accurately—double-check spelling and numbers to avoid errors. When providing income and employment details, be honest and precise, as discrepancies can lead to delays or denials.

Completing the additional information section requires careful thought. Here, users should provide context or clarifications that might influence their application's outcome. After filling out the form, review all sections for accuracy and completeness to ensure no essential data is omitted.

To ensure completion accuracy, take the time to review guidelines or even seek assistance where necessary. Clarity is vital when completing the cd-516 form, and ensuring the captured information is 100% correct can significantly enhance the user's experience with subsequent processes.

4. Editing and customizing your -516 form

With pdfFiller, users can easily edit their cd-516 form as needed. Through intuitive tools, one can not only adjust text but also add insightful annotations that enhance clarity. This is particularly useful when additional context must be provided or when needing to emphasize specific information.

Customizing formatting and design elements can also make the form more appealing and easier to read. By adjusting font sizes, colors, or styles, users can create a document that stands out while still meeting necessary requirements.

Collaboration is enhanced through pdfFiller’s features. Team members can work on a single document simultaneously, inputting their details or comments directly, which streamlines the process and mitigates the potential for confusion.

5. Signing the -516 form: E-signature process

E-signatures have gained momentum due to their legal validity and acceptance across numerous jurisdictions. Integrating an e-signature into your cd-516 form can simplify the submission process significantly, making it quicker and more efficient.

Using pdfFiller, users can add their e-signatures seamlessly. Begin by navigating to the designated signing area of the form, ensuring all previous sections have been correctly completed. Follow the straightforward instructions to insert your signature—this can often be accomplished in just a few clicks.

However, while signing, be cautious of common mistakes. Failing to sign in the correct area or neglecting to date the signature can lead to delays and necessitate re-submission, which can be avoided with attention to detail.

6. Managing and storing your -516 form

Once the cd-516 form is completed, managing and storing the document securely is crucial. PdfFiller provides cloud storage solutions that ensure completed forms are accessible anytime and from anywhere, fostering convenience and safety in document management.

Best practices for storing completed forms include organizing files using a systematic naming convention that reflects the content and date, allowing for easy retrieval when needed. Within pdfFiller’s cloud storage, creating folders for different types of documents can further enhance organization.

Sharing completed forms is another critical aspect of document management. Ensure you utilize secure sharing options that prevent unauthorized access to sensitive information. Utilize pdfFiller's sharing features to control who sees your document and in what context.

7. Troubleshooting common issues with the -516 form

Even experienced users may encounter issues while filling out the cd-516 form. Frequent mistakes include omitting required fields or miscalculating numerical entries. Being aware of these common pitfalls can drastically reduce frustrations during the submission process.

If errors occur after submission, it’s essential to know the proper procedures for addressing them. Familiarize yourself with the form submission processes and follow up diligently to rectify inaccuracies quickly. Additionally, having a list of frequently asked questions can allow users to troubleshoot effectively.

8. Related forms and resources

Navigating through administrative or legal processes may involve more than just the cd-516 form. Other related forms could be necessary depending on specific circumstances, including applications for grants or tax-related documents. Understanding these alternatives can make the process smoother.

For further assistance, links to additional resources, including government websites and legal aid, can be highly useful. Engaging with these resources can offer guidance and clarity in the complex world of documentation and compliance.

9. Additional interactive tools

Utilizing interactive tools can enhance the experience of working with the cd-516 form. A form filling calculator can help users understand requirements better, providing insights on what data is necessary based on specific situations.

Additionally, creating a checklist for cd-516 form submissions ensures every required step is covered, promoting thoroughness. An interactive Q&A section can allow for real-time assistance, enabling users to get immediate answers to their specific questions.

10. Final thoughts on the -516 form

Accurate documentation is paramount when dealing with administrative or legal applications. The cd-516 form embodies the need for precision and clarity in financial reporting, making accuracy essential to better outcomes.

By utilizing pdfFiller, users can streamline the complex process of managing forms like the cd-516 efficiently. The ability to edit, e-sign, and collaborate seamlessly from a cloud-based platform enhances user experience significantly.

Feedback from users about their experiences with the cd-516 form will contribute to improving the resources further and refining the help provided. Engaging with these forms helps users become more confident in handling their documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cd-516 from Google Drive?

Can I create an eSignature for the cd-516 in Gmail?

How do I complete cd-516 on an iOS device?

What is cd-516?

Who is required to file cd-516?

How to fill out cd-516?

What is the purpose of cd-516?

What information must be reported on cd-516?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.