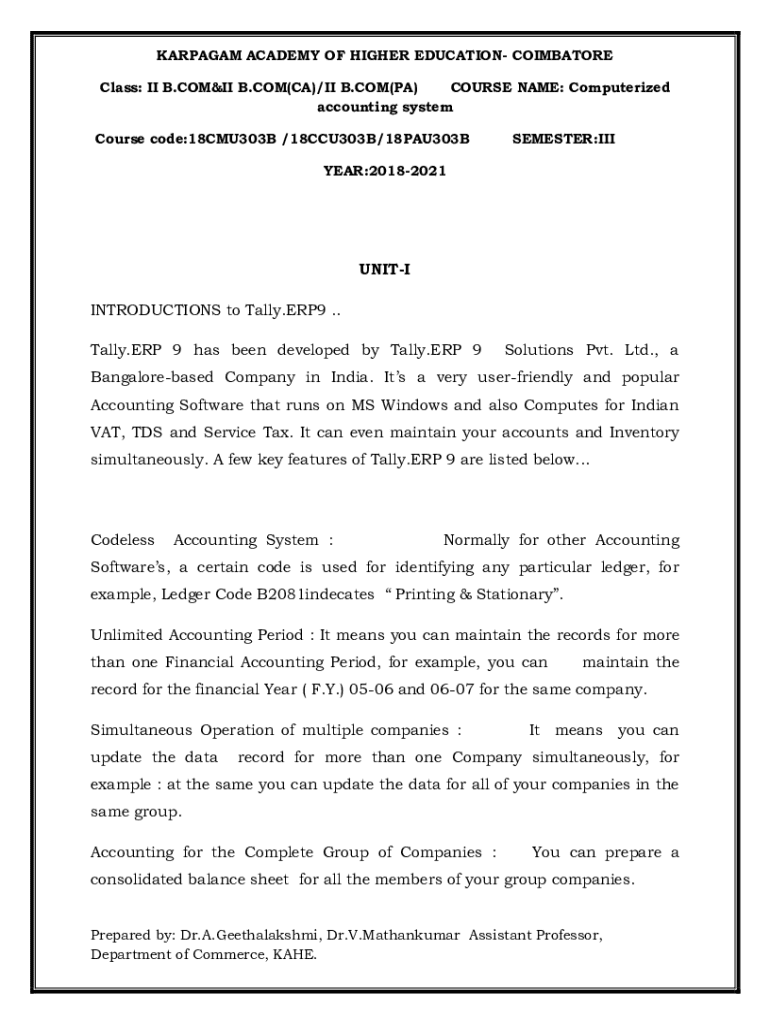

Get the free Computerized Accounting System - kahedu edu

Get, Create, Make and Sign computerized accounting system

How to edit computerized accounting system online

Uncompromising security for your PDF editing and eSignature needs

How to fill out computerized accounting system

How to fill out computerized accounting system

Who needs computerized accounting system?

Computerized Accounting System Form: A Comprehensive How-To Guide

Understanding computerized accounting systems (CAS)

Computerized accounting systems (CAS) leverage technology to manage financial transactions and data, streamlining tasks traditionally done manually. These systems automate processes such as bookkeeping, payroll, and financial reporting, reducing human error and freeing up valuable time for businesses to focus on growth strategies. In an era where accuracy and efficiency are paramount, adopting a CAS can significantly enhance operational capabilities.

The importance of CAS in modern business operations cannot be overstated. By facilitating real-time data access, CAC makes it easier for stakeholders to make informed financial decisions. Moreover, key components of a computerized accounting system, such as ledgers, invoicing, and tax management, ensure that all financial information is recorded accurately and can be retrieved easily when required.

Types of computerized accounting systems

When considering a computerized accounting system, businesses can choose from various types, primarily cloud-based systems and on-premise solutions. Each option has distinct features and benefits tailored to different business needs.

Key features of an effective computerized accounting system

A robust computerized accounting system offers several features that enhance user experience and operational efficiency. Key among them is a user-friendly interface that ensures ease of use, allowing team members with varying levels of expertise to navigate the system effectively. Accessibility also plays a critical role, particularly for remote teams, enabling employees to obtain essential financial data from any location.

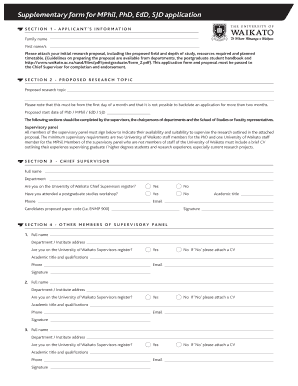

Setting up a computerized accounting system

Implementing a computerized accounting system can dramatically improve financial operations, but a structured approach is vital for successful setup. The process typically involves several key steps. First, businesses must assess their current accounting needs and identify gaps. Following that, a selection of a CAS that aligns with the organization’s operational requirements is crucial, weighing options like user-friendliness, scalability, and industry compatibility.

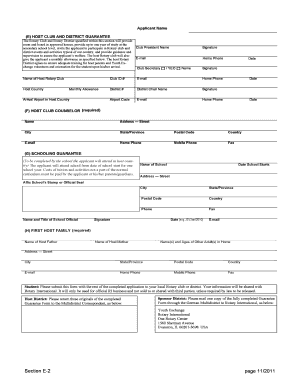

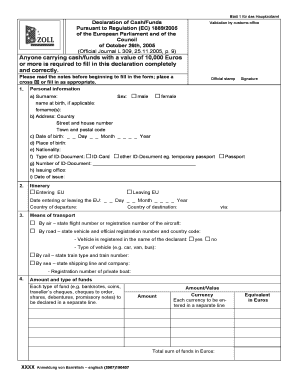

Filling out the computerized accounting system form

Filling out the computerized accounting system form is essential for collecting the necessary information to manage finances accurately. Understanding the required data fields is crucial for ensuring that all financial records are up-to-date and correctly entered. The primary sections of the form include business identification details and comprehensive financial information.

Additionally, custom fields within the form must be filled out carefully. Each field provides vital information essential for generating reports, conducting audits, and meeting compliance requirements. Misentries can lead to serious discrepancies, thus understanding why each field matters is important.

Editing and customizing your computerized accounting system form

Once your computerized accounting system form is filled out, you may need to make adjustments or edits. Utilizing pdfFiller's tools enables easy document editing, allowing you to update information, correct errors, or enhance clarity without hassle. This cloud-based platform simplifies collaboration, enabling multiple team members to contribute to the document simultaneously.

Managing your computerized accounting systems

After setting up your computerized accounting system, effective management is crucial for continued success. A well-organized document management system ensures that all financial records are easily retrievable. Regularly updating software and maintaining compliance is vital to minimize disruptions. Moreover, consistent backups of financial data help prevent data loss in case of unexpected failures.

Security and compliance in computerized accounting

Security and regulatory compliance should be prioritized when using a computerized accounting system. Businesses must adhere to various regulations, such as tax compliance and data protection laws, to avoid penalties and legal ramifications. Implementing best practices for data security, including encryption and secure access protocols, is critical.

Benefits of a computerized accounting system

Numerous benefits accompany the adoption of a computerized accounting system. The most significant advantage is improved accuracy and efficiency in financial reporting. Automated processes significantly reduce the likelihood of errors that could arise from manual entries. Additionally, enhanced accessibility of financial data allows teams to make faster, data-driven decisions.

Challenges with computerized accounting systems

Implementing a computerized accounting system is not without its challenges. Common hurdles include resistance to change from staff accustomed to manual processes. Addressing this resistance requires open communication about the benefits and potential impacts of the new system. Additionally, training needs must be met to ensure all team members are equipped to utilize the system effectively.

Real-world applications of computerized accounting systems

Real-world applications illustrate the transformative impact of computerized accounting systems across various sectors. Small businesses have successfully streamlined their operations through these systems, leading to enhanced productivity and financial health. Case studies emphasize these successes, showcasing how businesses have utilized automated accounting to scale operations effectively.

Exploring various options for computerized accounting systems

Choosing the right computerized accounting system involves comparing features of various providers. Businesses need to evaluate systems based on the size of their operation, specific needs, and anticipated growth. Some systems may offer advanced reporting capabilities, while others might focus on integrations with existing tools.

FAQs about computerized accounting systems

Addressing frequently asked questions can clarify common concerns regarding computerized accounting systems. Understanding the typical timeline for implementation and how small businesses can optimize their accounting processes are essential for prospective users. Additionally, knowing about support options available post-implementation can help ease transition fears.

Next steps for interested businesses

If you’re considering adopting a computerized accounting system, pdfFiller provides a seamless platform for your accounting needs. By leveraging pdfFiller’s capabilities, businesses can efficiently fill out, edit, and manage their accounting forms, ensuring a smooth transition to digital accounting practices. Take the first step by scheduling a demo to explore how pdfFiller can tailor a solution to meet your unique requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find computerized accounting system?

How do I make changes in computerized accounting system?

How do I fill out computerized accounting system on an Android device?

What is computerized accounting system?

Who is required to file computerized accounting system?

How to fill out computerized accounting system?

What is the purpose of computerized accounting system?

What information must be reported on computerized accounting system?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.