Get the free Consumer Loan Application Checklist

Get, Create, Make and Sign consumer loan application checklist

How to edit consumer loan application checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer loan application checklist

How to fill out consumer loan application checklist

Who needs consumer loan application checklist?

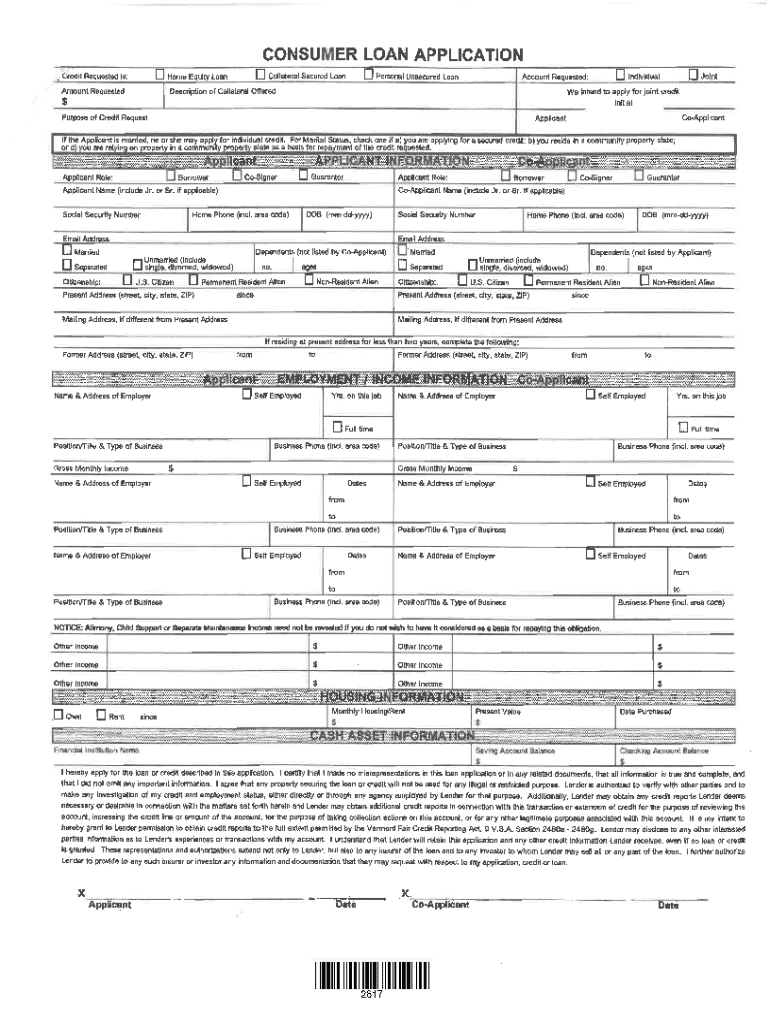

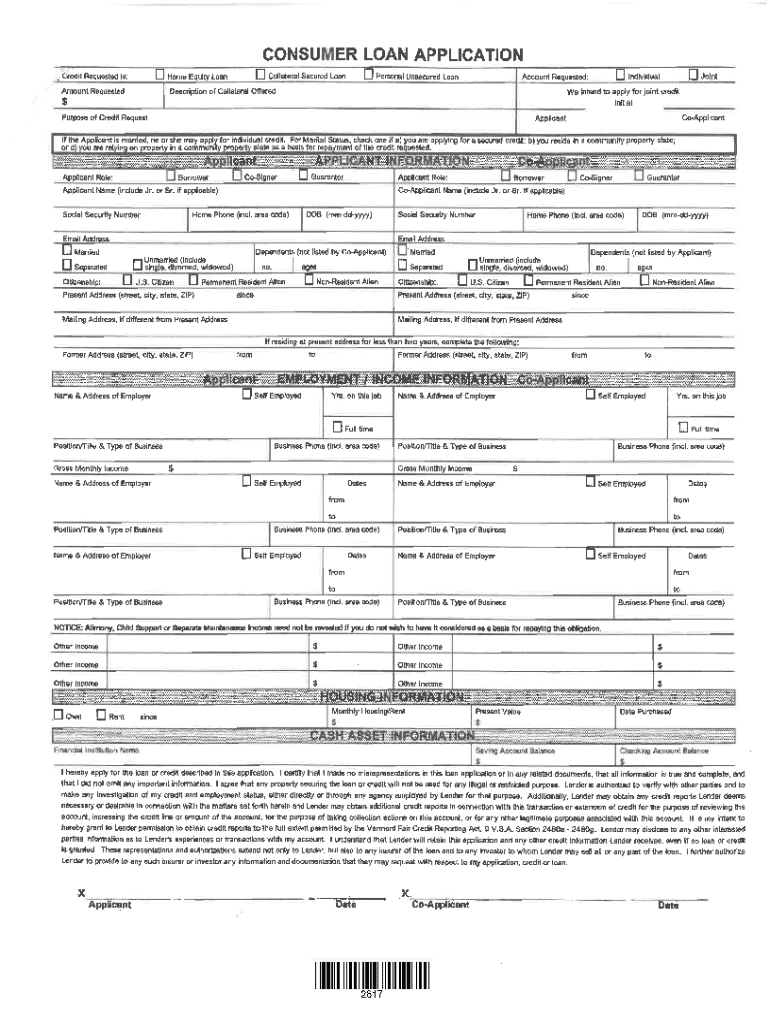

Consumer Loan Application Checklist Form: Detailed Structure

Understanding the consumer loan application process

The consumer loan application process is a fundamental step for individuals seeking financial support for various needs. A consumer loan is a type of borrowing that allows consumers to finance personal expenditures ranging from purchasing a car to consolidating debt. Completing the application correctly is crucial; it not only speeds up the approval process but also increases the chance of being approved. Lenders often evaluate many factors, including creditworthiness and financial history, to make lending decisions.

There are several common types of consumer loans available, including personal loans, auto loans, and home equity loans. Each of these loans comes with distinct features and terms tailored to different financial needs. For example, personal loans may be unsecured, while auto loans typically require the vehicle as collateral. Understanding these types can help borrowers select the most suitable loan for their situations.

Prepare your documents

Before filling out the consumer loan application checklist form, it's essential to gather all necessary documentation. The first step includes providing essential personal information. Typically, this consists of valid identification, such as a driver's license or passport. Additionally, you will need to provide your Social Security number for verification purposes. These elements establish your identity and help lenders assess your application effectively.

Next, compile financial documentation, including income verification, which can be presented through pay stubs or tax returns. Lenders may also require employment verification to understand your job stability. It's also important to disclose any outstanding debt, such as credit card statements, since this will affect your debt-to-income ratio and loan eligibility.

For those who are self-employed or receive rental income, additional documentation may be necessary. This could include profit and loss statements or rental agreements that confirm income sources, which help establish financial stability.

Interactive tools for document management

Utilizing tools like pdfFiller can significantly simplify the document management process when preparing your consumer loan application checklist form. pdfFiller offers user-friendly editing tools that can help you fill out and refine your document efficiently. Starting with the step-by-step editing guide, you'll find features such as highlighting text fields, adding or deleting sections, and adjusting the layout to ensure all information is accurately captured.

Adding your signature is also a breeze with pdfFiller, as it allows digital signing of documents, streamlining the application process. Moreover, if you're collaborating with a team for the loan application, pdfFiller’s sharing options enable multiple users to access and edit the document, making it a robust solution for group submissions. Real-time collaboration ensures everyone is on the same page, reducing the risk of errors.

Filling out the application form

Completing the application form accurately is vital for a successful loan application. Begin by understanding the form’s layout, which often includes various sections that require specific information. A step-by-step approach can help navigate this process. For instance, start with your personal details, followed by financial information and any additional information that the lender may require.

Avoid common mistakes such as leaving sections blank or providing inconsistent information across your documentation. To reduce errors, consider using pdfFiller's autofill features, which can quickly populate repetitive information based on previously entered data. Always double-check entries to ensure all information is accurate and complete.

Submitting your application

Submitting your loan application is the next critical step. There are various methods to consider, such as online submission or traditional mail-in applications. Online submissions tend to be faster, allowing for immediate processing while mail-in applications may require several days for delivery and processing. Understanding lender-specific requirements is crucial, as different lenders may have unique submission mandates, documentation preferences, or processing times.

Before submission, ensure you have prepared an important checklist that includes application fees, which can vary by lender, and the expected timeframes for submission and processing. Being organized will ease your application journey and prepare you for the next steps after you hit submit.

What to expect after submission

Once your consumer loan application checklist form is submitted, the review process begins. Typically, lenders evaluate applications based on the completeness of the provided information, your credit score, and financial history. This assessment process usually takes a few days, but it can vary significantly between lenders. You may need to follow up if additional information is requested.

Keeping communication lines open with lenders is essential during this period. When reaching out, stick to clear and concise inquiries. It’s advisable to keep a log of any correspondence, including names and times of discussions, which can help streamline any follow-ups that may be required for additional information.

Enhancing your loan application experience

Organizing your application packet can make a significant difference in how smoothly the submission and review processes go. Consider grouping your documents based on the sections of your application checklist and highlight any critical information to catch the lender’s attention. Leveraging technology for document management is another excellent strategy, and tools like pdfFiller allow users to automate document collection, enabling you to focus on the content rather than the logistics.

Monitoring your application status can also boost your experience. Setting up notifications can keep you updated on any changes or requests from your lender, making it easier to respond promptly and fulfill any additional requirements without unnecessary delays.

Maintaining your financial health post-application

Once your loan is approved, understanding its terms and conditions is paramount. Familiarizing yourself with repayment schedules, interest rates, and penalties for late payments can help in budgeting for your loan. Establishing a clear repayment plan is essential to avoid defaulting on your loan, which can adversely affect your credit score.

Moreover, maintaining good credit post-approval involves responsible borrowing and timely payments. Review your credit reports regularly and limit additional debt to safeguard your financial health. This discipline not only fosters a good relationship with lenders but prepares you for future loan applications.

FAQs about consumer loan applications

Many potential borrowers have common concerns regarding consumer loan applications. For instance, what happens if your loan application is denied? Understanding the lender's rationale behind a denial can provide insight into areas that you might need to improve before submitting future applications.

Additionally, potential borrowers often ask how to improve their chances of approval. Strengthening your credit profile, ensuring all information is accurate, and possibly seeking pre-approval are ways that can enhance your prospects of securing a loan.

Important notices

When navigating the consumer loan application process, it’s essential to recognize various important notices. For instance, familiarize yourself with any disclosures regarding external links on lender websites, as they may impact your research process. Moreover, be cautious with email communications, especially regarding sensitive information to avoid phishing attacks. Lastly, it’s advisable to check frequently updated data on loan processing times, as these can fluctuate based on lender policies and market conditions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in consumer loan application checklist without leaving Chrome?

Can I sign the consumer loan application checklist electronically in Chrome?

How do I edit consumer loan application checklist straight from my smartphone?

What is consumer loan application checklist?

Who is required to file consumer loan application checklist?

How to fill out consumer loan application checklist?

What is the purpose of consumer loan application checklist?

What information must be reported on consumer loan application checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.